Mexico Electric Commercial Vehicles Market Size, Share, Trends and Forecast by Vehicle Type, Propulsion Type, Battery Capacity, End User, and Region, 2025-2033

Mexico Electric Commercial Vehicles Market Overview:

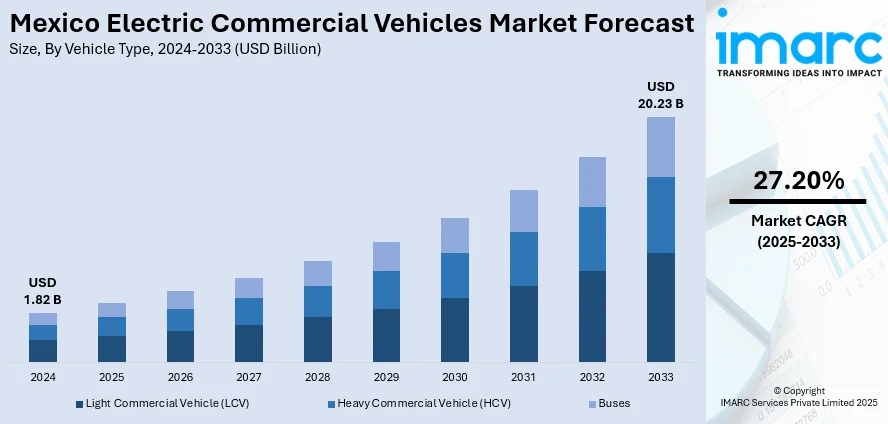

The Mexico electric commercial vehicles market size reached USD 1.82 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 20.23 Billion by 2033, exhibiting a growth rate (CAGR) of 27.20% during 2025-2033. The increasing environmental pressures and strong government backing for green transport is impelling the growth of the market. Moreover, companies are constantly enhancing battery efficiency, lowering charging times, and expanding the range of electric vehicles (EVs), making them more appealing to fleet operators. This trend, along with the rising costs of fuel, is expanding the Mexico electric commercial vehicles market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.82 Billion |

| Market Forecast in 2033 | USD 20.23 Billion |

| Market Growth Rate 2025-2033 | 27.20% |

Mexico Electric Commercial Vehicles Market Trends:

Increasing Environmental Concerns and Government Support

The Mexico electric commercial vehicles sector is driven by increasing environmental pressures and strong government backing for green transport. Government authorities of Mexico is enforcing strict emission standards and granting incentives like tax exemptions and subsidies in support of electric vehicles (EVs). The incentives are making electric commercial vehicles more economically viable for companies, which are increasingly looking towards environment friendly transport solutions to achieve sustainability targets. Furthermore, as world consciousness regarding climate change increases, Mexico is not only reducing its greenhouse gas emissions but also encouraging a switch to zero-emission commercial fleets. There are low-emission zones in urban centers being implemented by local administrations, which are further driving the demand for EVs. Moreover, the National Institute of Statistics and Geography (INEGI) reported that around 200,000 hybrid, plug-in hybrid, and fully EVs were sold in Mexico in 2024, representing a 70.2% rise compared to the prior year. These initiatives are contributing to a rapid increase in the adoption of electric commercial vehicles, with businesses recognizing the long-term financial benefits of transitioning to electric alternatives.

Technological Advancements in Electric Vehicle Batteries

Advances in battery technology are impelling the Mexico electric commercial vehicle market growth. Companies are constantly enhancing battery efficiency, lowering charging times, and expanding the range of electric commercial vehicles, making them more appealing to fleet operators. These technologies are relieving fears of limited driving range and lengthy charging times that originally held back the use of electric vehicles. Furthermore, the declining price of batteries is bringing electric commercial vehicles within reach, resulting in increased usage across industries such as logistics, delivery, and public transportation. As battery technologies improve, they are making electric commercial vehicles for long-distance use increasingly viable, further propelling the market growth. These developments are inspiring companies to replace their fleets with electric models as part of their sustainability and cost-saving initiatives. In 2024, the BMW Group initiated the construction of an 80,000 sq.m battery manufacturing facility to supply for Neue Klasse in Mexico.

Rising Fuel Prices and Operational Costs

The rising prices of traditional fuels, such as diesel and gasoline, are significantly driving the demand for electric commercial vehicles in Mexico. Fleet operators are increasingly seeking alternatives to mitigate the financial burden of high fuel costs, which are impacting profit margins and operational efficiency. EVs offer substantial cost savings in terms of fuel expenses, with electricity being a much cheaper alternative to fossil fuels. Furthermore, ECVs have lower maintenance costs compared to their internal combustion engine counterparts, as electric motors have fewer moving parts and require less frequent servicing. As fuel prices continue to rise and the economic pressure on businesses increases, the long-term cost savings associated with electric commercial vehicles are becoming an attractive proposition. This shift toward EVs is further supported by the increasing availability of charging infrastructure, allowing businesses to efficiently operate electric fleets without worrying about fueling logistics.

Mexico Electric Commercial Vehicles Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on vehicle type, propulsion type, battery capacity, and end user.

Vehicle Type Insights:

- Light Commercial Vehicle (LCV)

- Heavy Commercial Vehicle (HCV)

- Buses

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes light commercial vehicle (LCV), heavy commercial vehicle (HCV), and buses.

Propulsion Type Insights:

- Battery Electric Vehicle (BEV)

- Plug in Hybrid Vehicle (PHEV)

- Fuel Cell Electric Vehicle (FCEV)

The report has provided a detailed breakup and analysis of the market based on the propulsion type. This includes battery electric vehicle (BEV), plug in hybrid vehicle (PHEV), and fuel cell electric vehicle (FCEV).

Battery Capacity Insights:

- <50kwh

- 50-150 kwh

- >150kwh

The report has provided a detailed breakup and analysis of the market based on the battery capacity. This includes <50kwh, 50-150 kwh, and >150kwh.

End User Insights:

- Logistics

- Last Mile Delivery

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes logistics and last mile delivery.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Electric Commercial Vehicles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Light Commercial Vehicle (LCV), Heavy Commercial Vehicle (HCV), Buses |

| Propulsion Types Covered | Battery Electric Vehicle (BEV), Plug in Hybrid Vehicle (PHEV), Fuel Cell Electric Vehicle (FCEV) |

| Battery Capacities Covered | <50kwh, 50-150 kwh, >150kwh |

| End Users Covered | Logistics, Last Mile Delivery |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico electric commercial vehicles market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico electric commercial vehicles market on the basis of vehicle type?

- What is the breakup of the Mexico electric commercial vehicles market on the basis of propulsion type?

- What is the breakup of the Mexico electric commercial vehicles market on the basis of battery capacity?

- What is the breakup of the Mexico electric commercial vehicles market on the basis of end user?

- What is the breakup of the Mexico electric commercial vehicles market on the basis of region?

- What are the various stages in the value chain of the Mexico electric commercial vehicles market?

- What are the key driving factors and challenges in the Mexico electric commercial vehicles market?

- What is the structure of the Mexico electric commercial vehicles market and who are the key players?

- What is the degree of competition in the Mexico electric commercial vehicles market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico electric commercial vehicles market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico electric commercial vehicles market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico electric commercial vehicles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)