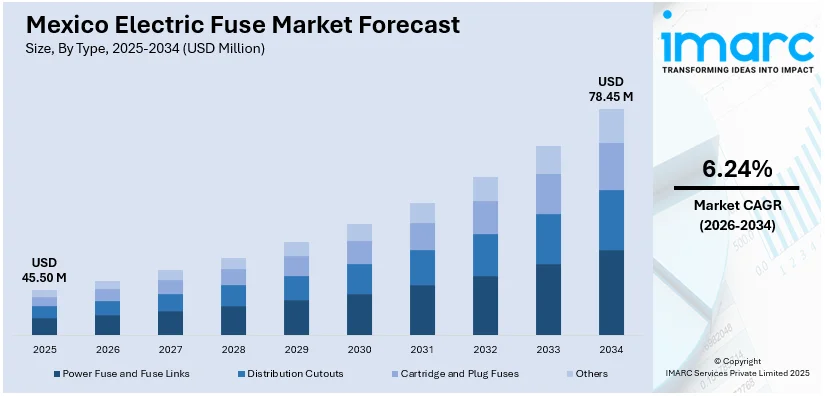

Mexico Electric Fuse Market Size, Share, Trends and Forecast by Type, Voltage, End Use, and Region, 2026-2034

Mexico Electric Fuse Market Size and Share:

The Mexico electric fuse market size was valued at USD 45.50 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 78.45 Million by 2034, exhibiting a CAGR of 6.24% from 2026-2034. The Mexico electric fuse market includes protective devices that are designed to protect electrical circuits from overcurrent conditions in residential, commercial, and industrial settings. These safety components are part of the country's vast electrical infrastructure, serving manufacturing facilities and household installations. Increasing urbanization and expansion of industrial operations raise consistent demand for reliable circuit protection solutions. Different product configurations, which have varying voltage needs and application requirements, are found in the market; manufacturers of these products have targeted technology enhancement and compliance with safety standards in order to increase Mexico electric fuse market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 45.50 Million |

| Market Forecast in 2034 | USD 78.45 Million |

| Market Growth Rate 2026-2034 | 6.24% |

Access the full market insights report Request Sample

The main driver for electric fuse adoption is the expansion of Mexico's manufacturing sector. With the country positioning itself as a manufacturing hub, especially in the automotive, electronics, and aerospace industries, demand for strong electrical infrastructure increases significantly. Large industrial plants require advanced circuit protection systems to ensure operational continuity and prevent electrical surges that could damage expensive equipment. Setting up new production plants and modernization of facilities at regular intervals create ongoing demand for high-quality fuses at various voltage ratings and current capacities. This industrial momentum translates into increased consumption of protective devices as manufacturers look to ensure the safety of equipment while meeting regulatory requirements.

To get more information on this market Request Sample

Infrastructure development in residential and commercial sectors significantly drives the market growth. Urbanization in Mexico leads to ongoing building construction of housing complexes, office buildings, shopping centers, and public facilities, all of which require heavy installations of electrical protection systems. In addition, new building codes stress the need to increase safety, thus demanding the installation of certified protective devices along the whole electrical network. The housing projects cover the residential segment in order to accommodate the urban population, while commercial developments account for the enlarging retail and service sectors. Renewal and upgrading of obsolete electrical infrastructure in the already developed urban areas lead to replacement demand, thus sustaining market activity due to property owners renewing those systems to meet the demand of current safety standards and electrical load conditions.

Mexico Electric Fuse Market Trends:

Smart Grid Integration and Advanced Protection Technologies

The integration of intelligent electrical protection systems is a paradigm shift in how circuit protection is approached in modern electrical networks. Advanced fuses now provide real-time monitoring of electrical parameters, enabling predictive maintenance and enhanced system reliability. These sophisticated devices have the potential to communicate with building management systems and smart grid infrastructure for information on power consumption patterns and potential circuit anomalies before failures occur. The evolution toward connected protection devices aligns with broader digitalization trends affecting Mexico's electrical infrastructure, with utilities and facility managers seeking granular control over power distribution networks. This technological progress allows for more efficient energy management while still providing the basic function that fuses serve, marking a significant evolution in the landscape of Mexico electric fuse market trends.

Sustainability and Eco-Friendly Manufacturing Practices

The environmental consciousness increasingly influences product development and manufacturing processes in the realm of protective devices. There is an increasing demand from manufacturers for materials and production techniques that minimize environmental impact without sacrificing performance standards necessary for reliable circuit protection. Examples include designing fuses from recyclable materials, minimizing hazardous substances in their construction, and facilitating easier end-of-life recycling. This increasing focus on sustainability stretches from product composition right through to energy-efficient manufacturing facilities and reduced packaging waste. With Mexican industries under increasing pressure to prove environmental responsibility, demand for electrical components that will help fulfill corporate sustainability objectives continues to spur innovation in eco-friendly fuse technologies that provide the protection needed while supporting greater environmental aspirations.

Customization for Specialized Industrial Applications

In this regard, the diversified industrial landscape of Mexico has increased the demand for more specialized forms of circuit protection, tailored to very specific operational needs. Different industries have introduced different electrical challenges, ranging from the high-temperature environments of basic metallurgical operations to sensitive electronics manufacturing with very precise protection parameters. Accordingly, manufacturers have developed application-specific fuses that provide appropriate current ratings, response characteristics, and physical configurations for each application. The trend toward more specialization enables industrial operators to devise optimal protection strategies for their equipment and process, minimizing nuisance tripping while ensuring adequate fault protection. Reflecting this trend, in September 2024, Eaton Corporation announced the opening of a new state‑of‑the‑art facility in Ciudad Juárez, México, expanding its manufacturing of electrical solutions for utilities, mining, oil & gas, and industrial markets. The company noted that the new 110,000 sq ft facility represents a “strategic expansion increasing its manufacturing capacity to better serve the Mexican and Latin American markets.” Such technical collaboration between fuse manufacturers and users drives the innovation in the design of protective devices, with solutions that not only improve operational efficiency but also maintain stringent safety standards across diverse industrial applications.

Mexico Electric Fuse Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Mexico electric fuse market, along with forecast at the regional, and country levels from 2026-2034. The market has been categorized based on type, voltage, and end use.

Analysis by Type:

- Power Fuse and Fuse Links

- Distribution Cutouts

- Cartridge and Plug Fuses

- Others

Cartridge and plug fuses are the dominating types, with around 35% market distribution because of their versatile uses in residential and light commercial installations. These fuses provide simple replacement procedures and reliable overcurrent protection for moderately powered circuits. Their standardized design guarantees easy availability and compatibility with existing electrical panels, making these types ideal for household applications and small business installations. Their operation is simple and thus favored not only by electricians but also by property owners because it is easily determined, by mere observation, whether the fuse has blown out. Their cost-effectiveness and proven reliability ensure sustained demand in both residential construction and retrofit projects of Mexico's older electrical systems needing protection upgrades without necessarily overhauling the infrastructure.

Analysis by Voltage:

- Low Voltage

- Medium Voltage

Low voltage fuses represent the dominant voltage category, accounting for about 70% share in Mexico electric fuse market outlook, because these protective devices have wide applications in residential, commercial, and light industrial sectors. This category includes most electrical installations in buildings in Mexico for service below the standard voltage supply of power. The reason for this omnipresence lies in low voltage distribution networks at both the urban and rural levels. Low voltage fuse installation protects everything, from home appliances to commercial lighting systems. It indicates the very basic and intrinsic low voltage electrical installation that is part of day-to-day life, which faces continuous demand in new construction, maintenance needs, and ongoing replacement requirements of aging protection devices installed across all types of properties.

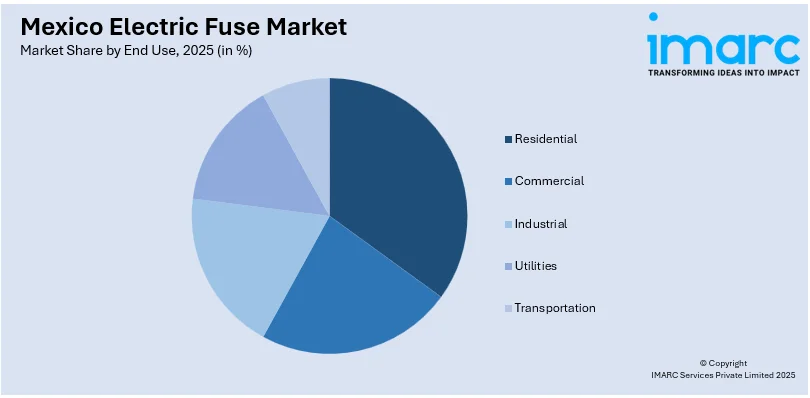

Analysis by End Use:

To get detailed segment analysis of this market Request Sample

- Residential

- Commercial

- Industrial

- Utilities

- Transportation

Industrial applications constitute about 35% of the end-use distribution, showing how important reliable circuit protection is in places of manufacture and production. Industrial facilities require more robust protective devices with higher current load carrying and more demanding operating conditions compared to residential and commercial installations. Protection reliability is a significant issue in such installations to ensure minimum production disruptions and protection of expensive machinery from electrical faults. The segment includes various industries like automotive manufacturing, food processing, chemical production, and electronics assembly, all requiring specific protection solutions. Mexico electric fuse market growth within industrial applications would correspond with the expansion of the manufacturing sector and the continuous need to maintain electrical safety standards within production settings, since equipment reliability has a direct bearing on operational efficiency and the safety of workers.

Regional Analysis:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

A large share of electric fuse consumption comes from Northern Mexico, since there is concentrated industrial activity combined with proximity to international trade routes. The various automotive and electronic manufacturing operations in this region also create a significant amount of demand for industrial-grade protective devices. This would also include maquiladora operations in several major cities along the border, which entail vast electrical infrastructure requirements in support of production activities. With such a proper industrial base, there exists both new installation and continuous maintenance requirements for circuit protection systems across the region.

Central Mexico is the demographic and economic center of the country, featuring several major metropolitan areas and a variety of different electrical infrastructure needs. The combination of dense residential populations, intensive commercial activity, and varied industrial operations found in the region makes demand for protective devices multifaceted for all product categories. The capital city and surrounding municipalities drive strong consumption through ongoing construction efforts, infrastructure modernization, and maintenance of existing electrical systems.

Emerging opportunities in southern Mexico are being presented with infrastructure development, particularly in areas of the region that historically have been underserved. Demand for basic circuit protection solutions in residential and small commercial applications is driven by ongoing regional electrification efforts and the expansion of modern housing stock. Industrial activity is also less concentrated versus northern regions, but agricultural processing facilities and tourism-related infrastructure still contribute to protective device consumption. The outlook for the electric fuse market in southern Mexico reflects incremental infrastructure improvement and access to reliable electrical service.

Other regions, comprising coastal areas with smaller urban centers, add to market diversity due to special application needs and various demand patterns located in the area. These include tourism infrastructures, fishing industries, and agricultural support facilities that also have their own various circuit protection needs. The dispersed nature of electrical infrastructure across these regions ensures that steady replacement demand exists when existing protective devices reach end-of-life or require upgrading to meet evolving safety standards.

Competitive Landscape:

The competitive environment is heterogeneous, with participants ranging from well-established international manufacturers to regional suppliers competing across various segments and price points. International companies leverage technological expertise and wide product portfolios to serve customers in the industrial and commercial sectors who need sophisticated protection solutions with proven reliability. Established players underline quality certifications and technical support capabilities to maintain market position among professional customers with high demands. Regional manufacturers compete effectively in price-sensitive segments through cost-competitive alternatives suitable for residential applications and budget-sensitive projects. The market structure reflects a variation in priorities among customers, with some buyers willing to pay more for a superior performance and others for affordability. Distribution networks play a critical role in market access; product availability through electrical wholesalers and retail channels significantly influences purchasing decisions. The Mexico electric fuse market forecast continues its competitive dynamics as participants balance innovation, pricing strategies, and effectiveness in distribution in pursuit of opportunities created by expanding electrical infrastructure across the country.

The report provides a comprehensive analysis of the competitive landscape in the Mexico electric fuse market with detailed profiles of all major companies.

Latest News and Developments:

- May 2024: Littelfuse opened a new manufacturing facility in Piedras Negras, Coahuila, enhancing production capacity for industrial circuit protection. The plant features advanced automation, sustainable technologies, and customized solutions for sectors including renewable energy, data centers, HVAC, and OEMs, while supporting workforce development and community engagement.

Mexico Electric Fuse Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Power Fuse and Fuse Links, Distribution Cutouts, Cartridge and Plug Fuses, Others |

| Voltages Covered | Low Voltage, Medium Voltage |

| End Uses Covered | Residential, Commercial, Industrial, Utilities, Transportation |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico electric fuse market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico electric fuse market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico electric fuse industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The electric fuse market in Mexico was valued at USD 45.50 Million in 2025.

The electric fuse market in Mexico is projected to exhibit a CAGR of 6.24% during 2026-2034, reaching a value of USD 78.45 Million by 2034.

Large-scale industrial expansion, especially in manufacturing industries, propels high demand for advanced circuit protection solutions within their facilities. Infrastructure development related to residential and commercial sectors means constant demand for electrical safety equipment. Renovation of old electrical installations in cities also replaces demand, while the introduction of changing safety standards calls for higher protection levels. Increasing urbanization favors an overall rise in electrical infrastructure demand, which continues to drive market performance across various application fields and geographical markets in Mexico.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)