Mexico Electric Substation Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Mexico Electric Substation Market Overview:

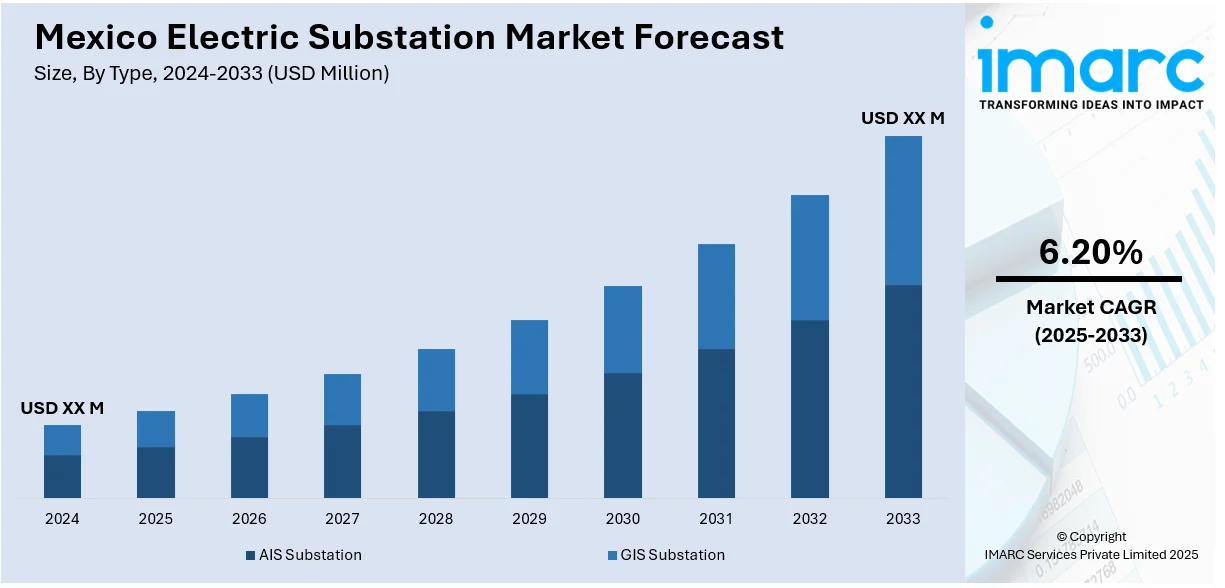

The Mexico electric substation market size is projected to exhibit a growth rate (CAGR) of 6.20% during 2025-2033. The market includes rapid urbanization, growing electricity demand, and the country’s commitment to renewable energy integration. Modernization of aging infrastructure, the push for grid reliability, and adoption of smart technologies like digital substations are accelerating development. Compact solutions like gas-insulated substations are favored in space-constrained urban areas. Additionally, government support for clean energy and smart grid initiatives is fostering investment in advanced substation technologies to meet evolving energy needs and ensure efficient power transmission thus impelling the Mexico electric substation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 6.20% |

Mexico Electric Substation Market Trends:

The Shift to Digital Substations

Mexico is transitioning from conventional to digital substations as part of its commitment to smarter, more resilient energy infrastructure. These advanced substations use intelligent devices and communication technologies to enable real-time monitoring, automation, and faster fault response, enhancing grid reliability and supporting renewable energy integration. Despite challenges like technical complexity and the need for skilled personnel, their long-term benefits drive adoption. This change is in line with the National Strategy for the Electricity Sector 2024–2030, which calls for a USD 23 billion investment to improve energy availability, fortify grid design, and guarantee dependability. Digital substation development is a key component of this strategy, helping Mexico manage growing energy demands and urbanization while creating a more interconnected and efficient power network.

Reliable Grid Expansion Through Gas Insulated Substations

As Mexican cities grow and space becomes more scarce, gas-insulated substations (GIS) are becoming more popular. In contrast to the more common air-insulated designs, GIS take up much less space and provide increased safety and reliability. These are the perfect choice for urban environments where land is scarce or costly. GIS also perform better in extreme weather and contaminated environments because their enclosed construction shields internal equipment. GIS is a popular option for long-term infrastructure construction due to its extended lifespan, low maintenance requirements, and compact size, despite its initial higher cost. Its growing popularity coincides with utilities' efforts to upgrade the electrical system and satisfy the growing demand for electricity in cities and industrial hubs. GIS technology is allowing utilities to overcome spatial and environmental constraints while providing uninterruptible and secure power supply, particularly in areas where conventional substation designs are no longer practical.

Modernizing the Grid for Renewable Energy Expansion

Expansion of renewable power in Mexico is driving dramatic change in electric substation planning and operation. With increasing solar and wind power injection into the grid, substations need to be upgraded to manage intermittent power input and provide a stable and balanced output. This has driven investment in automation, real-time control systems, and flexible grid infrastructure. Substations are increasingly playing a key role in managing energy delivery from decentralized and variable sources, enabling efficient transmission and improved grid stability. These innovations are critical to achieving national energy objectives and a low-carbon economy. This change, requiring technical coordination and investment, is transforming the energy sector by making it more sustainable and resilient. Substations are no longer merely a point of transmission they are becoming smart hubs that facilitate cleaner and smarter energy distribution further bolstering the Mexico electric substation market growth.

Mexico Electric Substation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- AIS Substation

- GIS Substation

The report has provided a detailed breakup and analysis of the market based on the type. This includes AIS substation and GIS substation.

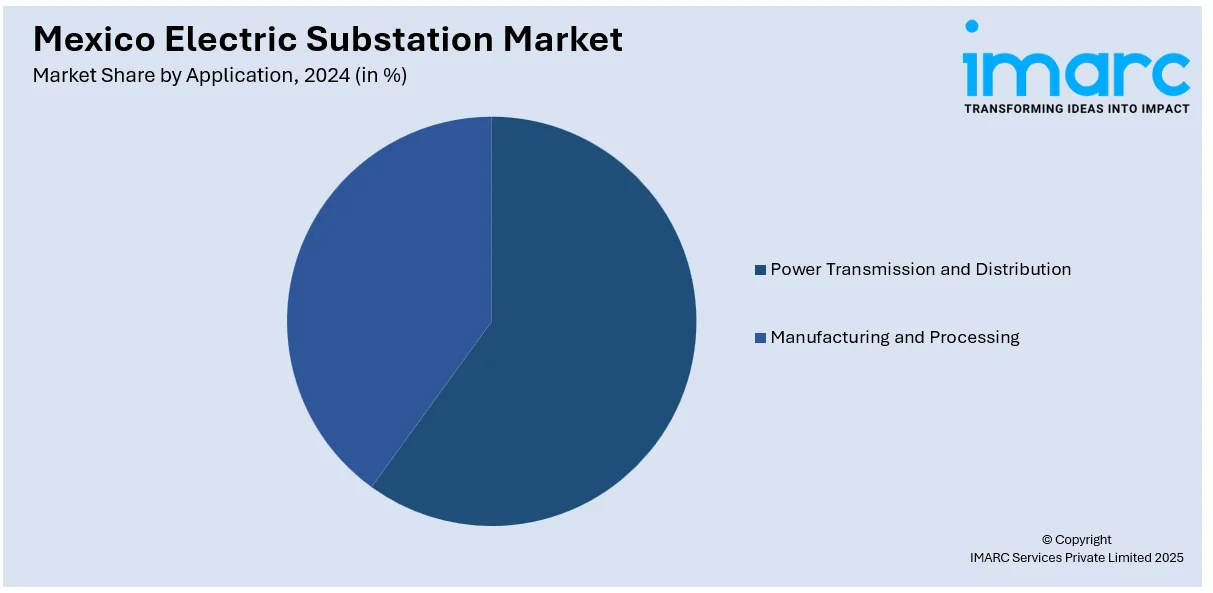

Application Insights:

- Power Transmission and Distribution

- Manufacturing and Processing

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes power transmission and distribution and manufacturing and processing.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern, Central, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Electric Substation Market News:

- In April 2025, Mexico unveiled an ambitious electric expansion plan involving over 620 billion pesos in public investment and additional private sector participation. The strategy aims to modernize generation, transmission, and distribution while prioritizing clean energy. By 2030, 29,074 MW of capacity will be added. Eleven projects will launch in 2025, with seven more in bidding, including combined cycle, internal combustion, and photovoltaic plants across multiple states.

- In March 2025, The Federal Electricity Commission (CFE) approved a US $2.5 billion investment to build five new power plants across Mexico. The move aims to strengthen the national grid, particularly in the Yucatán Peninsula, ahead of peak summer demand. This upgrade follows widespread blackouts in 2024 that affected major tourist areas and prompted emergency declarations. The new plants will support grid stability and help prevent future outages in key regions.

Mexico Electric Substation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | AIS Substation, GIS Substation |

| Applications Covered | Power Transmission and Distribution, Manufacturing and Processing |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico electric substation market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico electric substation market on the basis of type?

- What is the breakup of the Mexico electric substation market on the basis of application?

- What is the breakup of the Mexico electric substation market on the basis of region?

- What are the various stages in the value chain of the Mexico electric substation market?

- What are the key driving factors and challenges in the Mexico electric substation market?

- What is the structure of the Mexico electric substation market and who are the key players?

- What is the degree of competition in the Mexico electric substation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico electric substation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico electric substation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico electric substation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)