Mexico Electric Truck Market Size, Share, Trends and Forecast by Vehicle Type, Propulsion, Range, Application, and Region, 2025-2033

Mexico Electric Truck Market Overview:

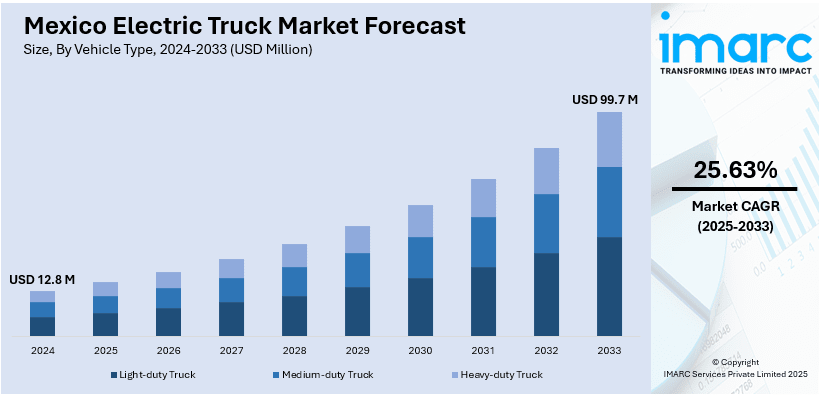

The Mexico electric truck market size reached USD 12.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 99.7 Million by 2033, exhibiting a growth rate (CAGR) of 25.63% during 2025-2033. The market is witnessing significant growth, driven by the growth of sustainable logistics and fleet electrification and the advancements in changing infrastructure and battery technology.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 12.8 Million |

| Market Forecast in 2033 | USD 99.7 Million |

| Market Growth Rate 2025-2033 | 25.63% |

Mexico Electric Truck Market Trends:

Growth of Sustainable Logistics and Fleet Electrification

The Mexico electric truck market is experiencing significant expansion, driven by the growing emphasis on sustainable logistics and fleet electrification across industries. As companies seek to reduce their carbon footprint and comply with stricter environmental regulations, electric trucks have emerged as a viable solution for reducing greenhouse gas emissions and lowering long-term operational costs. For instance, in October 2024, Yutong Mexico introduced the T5 electric truck for last-mile logistics, expanding its EV lineup with a van in March 2025 and a T7 truck. The T5 offers a 250-kilometer range per charge. Also, e-commerce and urban deliveries continue to increase the need for zero-emission transportation solutions, as logistics and retail companies in their fleets turned to electric trucks. Moreover, electric trucks are increasingly seen as the way forward by businesses as battery technologies have come a long way in improving range and charging efficiency, thus making them more sustainable and economically viable alternatives to traditional diesel-powered vehicles. Besides this, the trend toward fleet electrification is further reinforced by commitments to corporate sustainability and increasing investor pressure toward greener supply chain practices. Further improvements in infrastructure and greater competitiveness of electric trucks' total cost of ownership are highly likely to ensure a gradual increase in their adoption rates in Mexico, forecasting the country to be a key player in the sustainable transportation transition that is taking place across Latin America.

Advancements in Charging Infrastructure and Battery Technology

The expansion of Mexico’s electric truck market is closely tied to advancements in charging infrastructure and battery technology, both of which are critical to overcoming adoption barriers and enhancing operational feasibility. The Mexican government, along with private sector stakeholders, is investing in the development of a robust electric vehicle (EV) charging network to support commercial fleets. These initiatives include the installation of high-capacity fast-charging stations along key transportation routes and urban delivery hubs, reducing downtime and increasing efficiency for fleet operators. For instance, in January 2025, Mexico’s Sheinbaum administration unveiled Olinia, the nation’s first domestic EV, debuting at the 2026 World Cup. With a $1.2 million budget, models include city-friendly mini-vehicles and a final-mile delivery truck. Additionally, improvements in battery technology are enhancing vehicle range, charging speed, and energy density, making electric trucks more practical for long-haul and heavy-duty applications. The emergence of lithium-ion battery advancements, including solid-state batteries, is further improving durability and performance, addressing concerns regarding range limitations and battery lifespan. Moreover, innovations in battery recycling and second-life applications are contributing to cost reductions and sustainability efforts within the market. As infrastructure and battery performance continue to improve, the total cost of ownership for electric trucks is expected to decrease, making them a more attractive investment for businesses. These advancements are set to accelerate the adoption of electric trucks in Mexico, fostering a more efficient and environmentally friendly transportation sector.

Mexico Electric Truck Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on vehicle type, propulsion, range, and application.

Vehicle Type Insights:

- Light-duty Truck

- Medium-duty Truck

- Heavy-duty Truck

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes light-duty truck, medium-duty truck, and heavy-duty truck.

Propulsion Insights:

- Battery Electric Truck

- Hybrid Electric Truck

- Plug-in Hybrid Electric Truck

- Fuel Cell Electric Truck

A detailed breakup and analysis of the market based on the propulsion have also been provided in the report. This includes battery electric truck, hybrid electric truck, plug-in hybrid electric truck, and fuel cell electric truck.

Range Insights:

- 0-150 Miles

- 151-300 Miles

- Above 300 Miles

A detailed breakup and analysis of the market based on the range have also been provided in the report. This includes 0-150 miles, 151-300 miles, and above 300 miles.

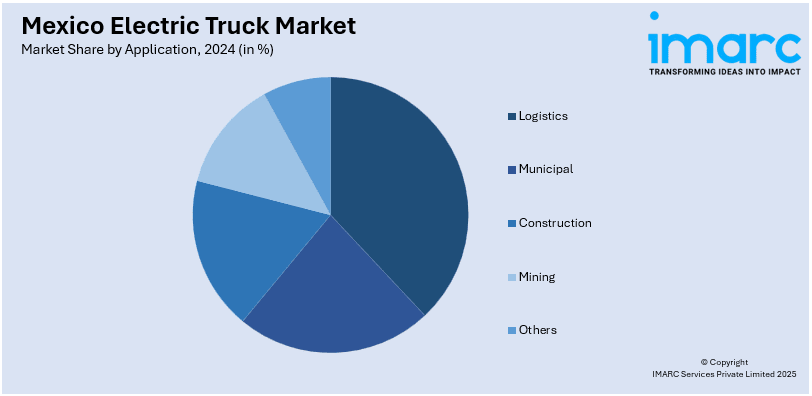

Application Insights:

- Logistics

- Municipal

- Construction

- Mining

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes logistics, municipal, construction, mining, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Electric Truck Market News:

- In February 2025, Transportes Marva will deploy its fleet of 120 electric semi-trailers for cargo shipments between Monterrey and Texas. Partnering with subsidiary BY Deléctrico, a BYD distributor, Marva is piloting electric routes of 250-300 km. The initiative reduces CO2 emissions, enhances road safety, and expands Mexico’s electric trucking infrastructure and logistics capabilities.

- In April 2023, Scania's electric revolution reaches Mexico with Grupo Bimbo’s purchase of seven 25P B4x2 electric trucks. Designed for urban routes, these 11.5-ton trucks feature ADAS 2.0 and Scania maintenance contracts, marking Latin America’s first Scania electric truck fleet and advancing sustainable transportation in the region.

Mexico Electric Truck Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Light-duty Truck, Medium-duty Truck, Heavy-duty Truck |

| Propulsions Covered | Battery Electric Truck, Hybrid Electric Truck, Plug-in Hybrid Electric Truck, Fuel Cell Electric Truck |

| Ranges Covered | 0-150 Miles, 151-300 Miles, Above 300 Miles |

| Applications Covered | Logistics, Municipal, Construction, Mining, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico electric truck market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico electric truck market on the basis of vehicle type?

- What is the breakup of the Mexico electric truck market on the basis of propulsion?

- What is the breakup of the Mexico electric truck market on the basis of range?

- What is the breakup of the Mexico electric truck market on the basis of application?

- What is the breakup of the Mexico electric truck market on the basis of region?

- What are the various stages in the value chain of the Mexico electric truck market?

- What are the key driving factors and challenges in the Mexico electric truck?

- What is the structure of the Mexico electric truck market and who are the key players?

- What is the degree of competition in the Mexico electric truck market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico electric truck market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico electric truck market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico electric truck industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)