Mexico Electric Two-Wheeler Batteries Market Size, Share, Trends and Forecast by Battery Type, Vehicle Type, and Region, 2025-2033

Mexico Electric Two-Wheeler Batteries Market Overview:

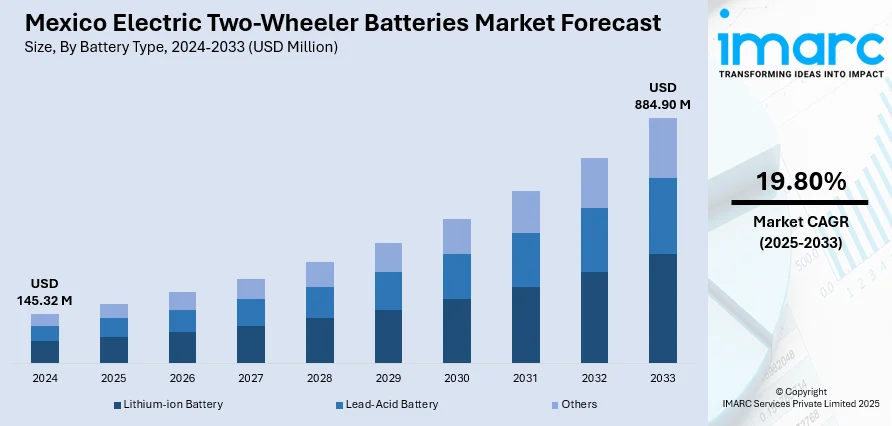

The Mexico electric two-wheeler batteries market size reached USD 145.32 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 884.90 Million by 2033, exhibiting a growth rate (CAGR) of 19.80% during 2025-2033. The market is driven by increasing demand for eco-friendly transportation, government incentives promoting clean energy solutions, and rising fuel prices. Additionally, urban congestion and the need for efficient last-mile delivery solutions contribute to Mexico electric two-wheeler batteries market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 145.32 Million |

| Market Forecast in 2033 | USD 884.90 Million |

| Market Growth Rate 2025-2033 | 19.80% |

Mexico Electric Two-Wheeler Batteries Market Trends:

Expansion of Charging Infrastructure

A critical factor propelling the Mexico electric two-wheeler batteries market growth is the expansion of charging infrastructure across the country. As the adoption of electric two-wheelers increases, the demand for accessible and efficient charging stations is growing. This development is particularly important in urban areas where electric two-wheelers are becoming popular for short-distance travel. Both public and private sectors are investing in the establishment of widespread charging networks to ensure that riders can charge their vehicles conveniently. For instance, according to industry reports, Mexico currently hosts 2,089 public electric vehicle (EV) charging stations, with plans to expand that number to approximately 38,000 by 2041. This growth aligns with projections that the national EV fleet will increase from 43,000 to 700,000 units. Supporting this transition, Evergo has pledged a USD 400 million investment to deploy 15,000 charging points over the next ten years, reinforcing the country’s commitment to electric mobility. Additionally, advancements in fast-charging technology are improving the charging experience by reducing the time required to charge electric two-wheeler batteries. With enhanced infrastructure, consumers feel more confident in making the transition to electric mobility, which is helping to drive the growth of the Mexico electric two-wheeler batteries market.

Government Incentives and Policy Support

Government incentives and policies are pivotal in driving the Mexico electric two-wheeler batteries market growth. Mexico’s government has set ambitious targets for reducing carbon emissions and promoting clean energy technologies. As part of this commitment, the government has introduced policies that encourage the purchase and use of electric vehicles, including two-wheelers. These policies include tax reductions, rebates, and import duty exemptions for electric vehicles and their components, such as batteries. For instance, Mexico’s “Olinia” project plans to launch affordable, domestically manufactured electric vehicles (EVs) by 2026. With a price range of 90,000 to 150,000 pesos (roughly $4,400–$7,400), these compact EVs are designed for urban households and young city residents. The initiative aims to lessen dependence on imported EVs from brands like BYD and Chery, while boosting local automotive production. Additionally, state-level incentives and programs supporting the installation of charging infrastructure are further bolstering the market. Such government-led initiatives create a favorable environment for electric two-wheeler manufacturers and consumers, making it easier and more affordable to switch to electric mobility. Consequently, the growing policy support is contributing significantly to the expansion of the Mexico electric two-wheeler batteries market.

Mexico Electric Two-Wheeler Batteries Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecast at the country/regional level for 2025-2033. Our report has categorized the market based on battery type and vehicle type.

Battery Type Insights:

- Lithium-ion Battery

- Lead-Acid Battery

- Others

The report has provided a detailed breakup and analysis of the market based on the battery type. This includes lithium-ion battery, lead-acid battery, and others.

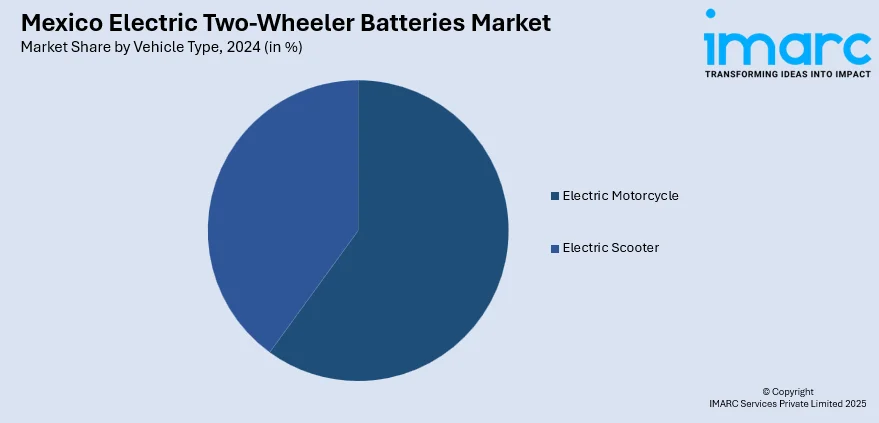

Vehicle Type Insights:

- Electric Motorcycle

- Electric Scooter

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes electric motorcycle and electric scooter.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Electric Two-Wheeler Batteries Market News:

- In September 2024, Yadea launched its premium intelligent electric motorcycle, the Kemper, in Mexico, showcasing its commitment to green transportation. At the 2024 SIMM Exhibition in Mexico, Yadea presented its flagship models, including the Kemper and Keeness, highlighting cutting-edge technology such as fast charging and app connectivity. The company aims to expand its market presence and contribute to the sustainable mobility revolution in Mexico.

- In May 2024, BMW Group begun constructing a high-voltage battery assembly plant at its San Luis Potosí facility in Mexico to support production of its sixth-generation batteries for the Neue Klasse models. With an €800 million investment, this move reinforces BMW's “local for local” strategy and enhances sustainability and supply chain resilience. Production in Mexico will begin in 2027, utilizing BMW’s new round cells to improve energy density and charging performance.

Mexico Electric Two-Wheeler Batteries Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Battery Types Covered | Lithium-ion Battery, Lead-Acid Battery, Others |

| Vehicle Types Covered | Electric Motorcycle, Electric Scooter |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico,Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico electric two-wheeler batteries market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico electric two-wheeler batteries market on the basis of battery type?

- What is the breakup of the Mexico electric two-wheeler batteries market on the basis of vehicle type?

- What is the breakup of the Mexico electric two-wheeler batteries market on the basis of region?

- What are the various stages in the value chain of the Mexico electric two-wheeler batteries market?

- What are the key driving factors and challenges in the Mexico electric two-wheeler batteries?

- What is the structure of the Mexico electric two-wheeler batteries market and who are the key players?

- What is the degree of competition in the Mexico electric two-wheeler batteries market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico electric two-wheeler batteries market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico electric two-wheeler batteries market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico electric two-wheeler batteries industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)