Mexico Electric Two-Wheeler Components Market Size, Share, Trends and Forecast by Vehicle Type, Demand Category, Component Type, and Region, 2025-2033

Mexico Electric Two Wheeler Components Market Overview:

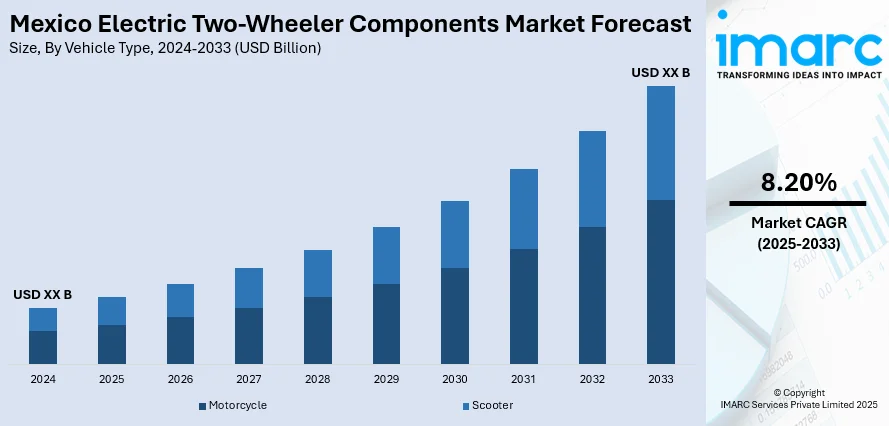

The Mexico electric two wheeler components market size is anticipated to exhibit a growth rate (CAGR) of 8.20% during 2025-2033. The market is experiencing significant growth, driven by factors such as increasing environmental awareness, government incentives, and advancements in battery technology. Urban congestion and the need for cost-effective transportation solutions further contribute to the adoption of electric two-wheelers. The market's expansion is also supported by a growing manufacturing base and favorable policies promoting e-mobility. These elements collectively enhance the Mexico electric two-wheeler components market share, indicating a robust upward trajectory.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 8.20% |

Mexico Electric Two Wheeler Components Market Trends:

Government Incentives and Policy Support

The proactive policy of the Mexican government towards electric mobility has caused immense stimulation in the electric two-wheeler parts market. Tax exemptions, subsidies, and easy registration procedures have reduced entry barriers for both manufacturers and consumers. They not only support the adoption of electric vehicles but also promote local manufacturing and innovation within the industry. For instance, Mexico's "Olinia" project aims to introduce affordable, locally produced electric vehicles (EVs) by 2026. Priced between 90,000 and 150,000 pesos (approximately $4,400–$7,400), these compact EVs target urban families and young city dwellers. The initiative seeks to reduce reliance on imported EVs, such as those from BYD and Chery, and promote national manufacturing. Such governmental support is pivotal in accelerating the transition towards sustainable transportation and is expected to continue driving the Mexico electric two-wheeler components market growth.

Expansion of Charging Infrastructure

The development of a comprehensive charging infrastructure is essential for the widespread adoption of electric two-wheelers in Mexico. Urban areas are witnessing an increase in the number of charging stations, facilitated by both public and private sector investments. For instance, as per industry reports, Mexico currently has 2,089 public electric vehicle (EV) charging stations and plans to add up to 38,000 more by 2041, aligning with forecasts that the national EV fleet will grow from 43,000 to 700,000 units. This expansion includes Evergo’s commitment of USD 400 million to install 15,000 charging points over the next decade, supporting the country’s shift to electric mobility. This expansion addresses one of the primary concerns of potential electric vehicle users, charging convenience. Moreover, initiatives to standardize charging protocols and integrate smart grid technologies are enhancing the efficiency and accessibility of charging networks. As the charging infrastructure continues to grow, it is expected to significantly bolster the Mexico electric two-wheeler components market growth, fostering greater consumer confidence and adoption rates.

Mexico Electric Two Wheeler Components Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on vehicle type, demand category, and component type.

Vehicle Type Insights:

- Motorcycle

- Scooter

A detailed breakup and analysis of the market based on the vehicle type have been provided in the report. This includes motorcycle and scooter.

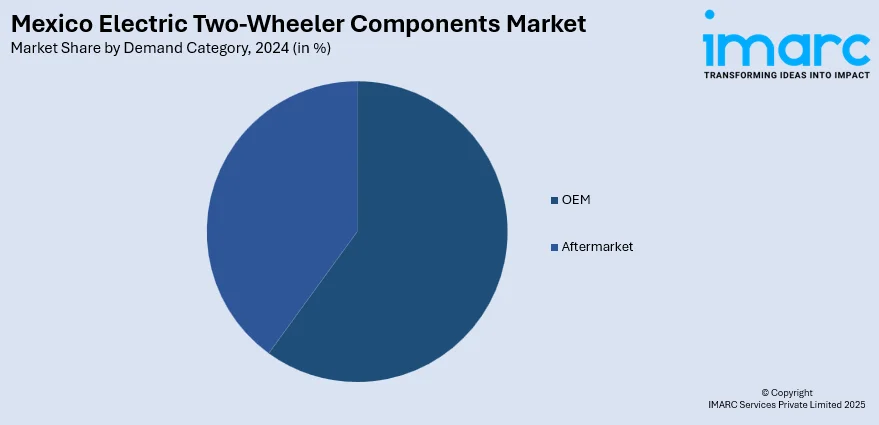

Demand Category Insights:

- OEM

- Aftermarket

A detailed breakup and analysis of the market based on the demand category have also been provided in the report. This includes OEM and aftermarket.

Component Type Insights:

- Battery Packs

- DC-DC Converter

- Controller and Inverter

- Motor

- On-Board Charges

- Others

A detailed breakup and analysis of the market based on the component type have also been provided in the report. This includes battery packs, DC-DC converter, controller and inverter, motor, on-board charges, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Electric Two Wheeler Components Market News:

- In November 2024, Hero MotoCorp and its U.S.-based partner Zero Motorcycles reached the advanced stage of developing a mid-sized performance electric motorcycle. The collaboration combines Hero's manufacturing scale with Zero's expertise in electric powertrains.

- In September 2024, Yadea introduced its premium electric motorcycle, the Kemper, at the 2024 SIMM Exhibition in Mexico City, alongside other leading models like the Keeness and Modern. Boasting a top speed of 160 km/h and powered by advanced technology—including a CATL battery capable of reaching 80% charge in just 10 minutes—the Kemper highlights Yadea’s dedication to smart, sustainable transportation.

- In April 2024, Sona Comstar inaugurated a new manufacturing facility in Silao, Mexico, located within the Fipasi Industrial Park. This expansion aims to meet the rising demand for driveline solutions in North America's Battery Electric Vehicle (BEV) market. The plant will specialize in producing differential assemblies and reduction gears for BEVs, with plans to diversify its product range to align with evolving electric vehicle technologies.

Mexico Electric Two Wheeler Components Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Motorcycle, Scooter |

| Demand Categories Covered | OEM, Aftermarket |

| Component Types Covered | Battery Packs, Dc-Dc Converter, Controller and Inverter, Motor, On-Board Charges, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico electric two wheeler components market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico electric two wheeler components market on the basis of vehicle type?

- What is the breakup of the Mexico electric two wheeler components market on the basis of demand category?

- What is the breakup of the Mexico electric two wheeler components market on the basis of component type?

- What is the breakup of the Mexico electric two wheeler components market on the basis of region?

- What are the various stages in the value chain of the Mexico electric two wheeler components market?

- What are the key driving factors and challenges in the Mexico electric two wheeler components market?

- What is the structure of the Mexico electric two wheeler components market and who are the key players?

- What is the degree of competition in the Mexico electric two wheeler components market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico electric two wheeler components market from 2019-2033

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico electric two wheeler components market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico electric two wheeler components industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)