Mexico Electric Vehicle Aftermarket Size, Share, Trends and Forecast by Replacement Part, Propulsion Type, Vehicle Type, Certification, Distribution Channel, and Region, 2025-2033

Mexico Electric Vehicle Aftermarket Overview:

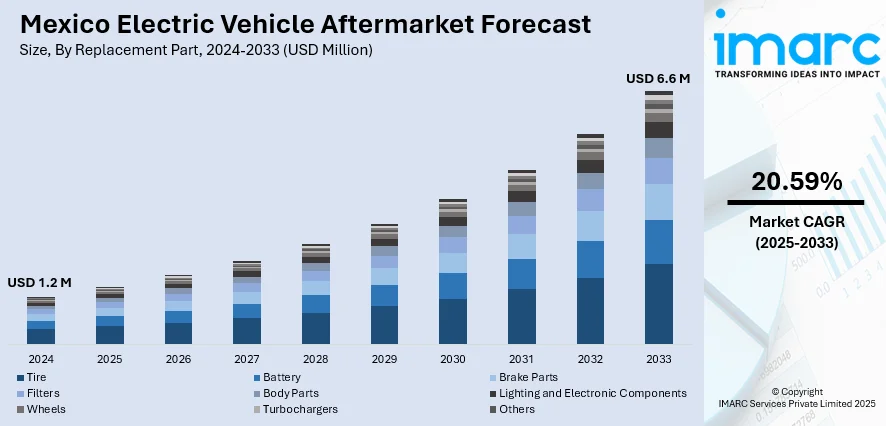

The Mexico electric vehicle aftermarket size reached USD 1.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 6.6 Million by 2033, exhibiting a growth rate (CAGR) of 20.59% during 2025-2033. The market share is expanding, driven by the rising demand for customization of electric vehicles, which is encouraging the usage of efficient aftermarket products, along with the increasing introduction of technical training programs.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.2 Million |

| Market Forecast in 2033 | USD 6.6 Million |

| Market Growth Rate 2025-2033 | 20.59% |

Mexico Electric Vehicle Aftermarket Trends:

Growing need for electric vehicles

The rising need for electric vehicles is offering a favorable Mexico electric vehicle aftermarket outlook. As per the information provided by the Electro Movilidad Asociación (EMA), in 2024, the sales of plug-in hybrid electric vehicles (PHEVs) and electric vehicles in Mexico increased by 84%. As more individuals are shifting from traditional towards electric cars, there is a high demand for electric vehicle-specific components, accessories, and maintenance services. This requirement is not only limited to replacing worn-out equipment, but also encompasses battery diagnostics, software updates, charging accessories, and cosmetic changes. Because electric vehicles need different maintenance than gasoline vehicles, the aftermarket is expanding to meet their specific demands. Local workshops and service centers are starting to train their staff to handle electric vehicles, and more businesses are entering the market with specialized tools and services. The rising popularity of electric vehicles is creating opportunities for businesses to introduce innovative solutions, such as mobile servicing and eco-friendly part replacements. In addition, people are becoming more interested in customizing and optimizing their electric vehicles, which adds to the demand for aftermarket items.

Increasing foreign direct investment (FDI) in automotive industry

The rising FDI in the automotive industry is impelling the Mexico electric vehicle aftermarket growth. According to the data published by the Ministry of Economy, from January to September 2024, FDIs in automobile and truck manufacturing totaled USD 7.552 Billion in Mexico. This indicated an increase of 27.3% compared to 2023. As more international companies are spending resources on the country's electric vehicle sector, there is a noticeable improvement in infrastructure, supply chains, and access to advanced technology. This directly benefits the aftermarket because better access to components, tools, and expertise makes it easier for local businesses to service and upgrade electric vehicles. FDI also brings in technical know-how and best practices, which helps to raise the quality and reliability of aftermarket services. More training programs and partnerships are allowing technicians to learn how to handle electric vehicle-specific systems like battery packs, regenerative braking, and smart software. Moreover, these investments often lead to the setting up of local manufacturing units for electric vehicle parts, making aftermarket supplies more affordable and readily available.

Mexico Electric Vehicle Aftermarket Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on replacement part, propulsion type, vehicle type, certification, and distribution channel.

Replacement Part Insights:

- Tire

- Battery

- Brake Parts

- Filters

- Body Parts

- Lighting and Electronic Components

- Wheels

- Turbochargers

- Others

The report has provided a detailed breakup and analysis of the market based on the replacement part. This includes tire, battery, brake parts, filters, body parts, lighting and electronic components, wheels, turbochargers, and others.

Propulsion Type Insights:

- Battery Electric Vehicles

- Hybrid Electric Vehicles

- Fuel Cell Electric Vehicles

- Plug-in Hybrid Electric Vehicles

A detailed breakup and analysis of the market based on the propulsion type have also been provided in the report. This includes battery electric vehicles, hybrid electric vehicles, fuel cell electric vehicles, and plug-in hybrid electric vehicles.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars and commercial vehicles.

Certification Insights:

- Genuine Parts

- Certified Parts

- Uncertified Parts

A detailed breakup and analysis of the market based on the certification have also been provided in the report. This includes genuine parts, certified parts, and uncertified parts.

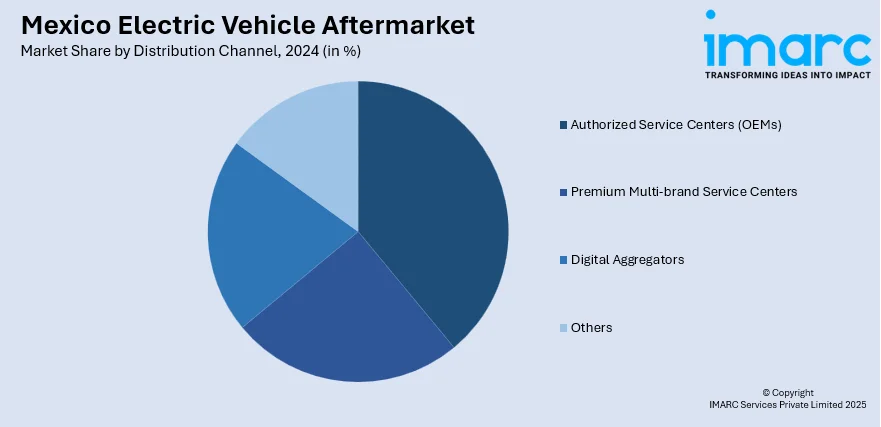

Distribution Channel Insights:

- Authorized Service Centers (OEMs)

- Premium Multi-brand Service Centers

- Digital Aggregators

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes authorized service centers (OEMs), premium multi-brand service centers, digital aggregators, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Electric Vehicle Aftermarket Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Replacement Parts Covered | Tire, Battery, Brake Parts, Filters, Body Parts, Lighting and Electronic Components, Wheels, Turbochargers, Others |

| Propulsion Types Covered | Battery Electric Vehicles, Hybrid Electric Vehicles, Fuel Cell Electric Vehicles, Plug-in Hybrid Electric Vehicles |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Certifications Covered | Genuine Parts, Certified Parts, Uncertified Parts |

| Distribution Channels Covered | Authorized Service Centers (OEMs), Premium Multi-brand Service Centers, Digital Aggregators, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico electric vehicle aftermarket performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico electric vehicle aftermarket on the basis of replacement part?

- What is the breakup of the Mexico electric vehicle aftermarket on the basis of propulsion type?

- What is the breakup of the Mexico electric vehicle aftermarket on the basis of vehicle type?

- What is the breakup of the Mexico electric vehicle aftermarket on the basis of certification?

- What is the breakup of the Mexico electric vehicle aftermarket on the basis of distribution channel?

- What is the breakup of the Mexico electric vehicle aftermarket on the basis of region?

- What are the various stages in the value chain of the Mexico electric vehicle aftermarket?

- What are the key driving factors and challenges in the Mexico electric vehicle?

- What is the structure of the Mexico electric vehicle aftermarket and who are the key players?

- What is the degree of competition in the Mexico electric vehicle aftermarket?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico electric vehicle aftermarket from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico electric vehicle aftermarket.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico electric vehicle aftermarket industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)