Mexico Electric Vehicle Battery Market Size, Share, Trends and Forecast by Battery Type, Propulsion Type, Vehicle Type, and Region, 2025-2033

Mexico Electric Vehicle Battery Market Overview:

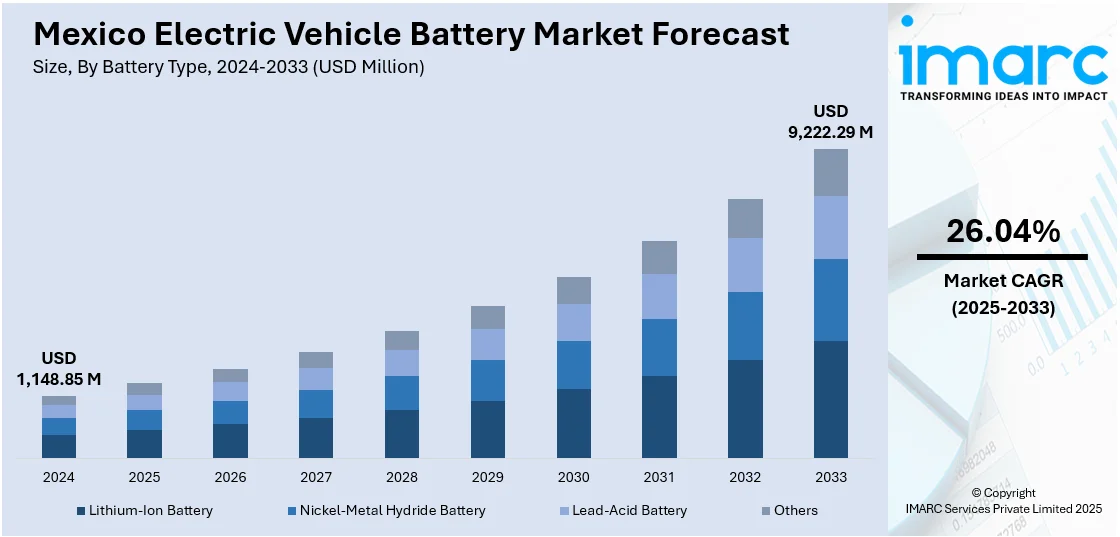

The Mexico electric vehicle battery market size reached USD 1,148.85 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 9,222.29 Million by 2033, exhibiting a growth rate (CAGR) of 26.04% during 2025-2033. The market in Mexico is expanding because of supportive government policies, climate-aligned investment incentives, and a growing focus on localized electric vehicle (EV) production and supply chains that reduce import dependence and boost domestic manufacturing of key components like lithium.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,148.85 Million |

| Market Forecast in 2033 | USD 9,222.29 Million |

| Market Growth Rate 2025-2033 | 26.04% |

Mexico Electric Vehicle Battery Market Trends:

Government Incentives and Policy Alignment

The EV battery sector is experiencing growth in Mexico due to focused government efforts that encourage sustainable transportation. This encompasses advantageous tax regulations, clear guidelines, and tactical incentives aimed at drawing both local and international investment into EV battery production and infrastructure growth. The government's commitment to global climate objectives, especially the decrease of greenhouse gas emissions, is making the EV sector a national focus. This dedication is strengthened by trade alliances that allow Mexico to become part of global EV supply networks. Public funding for charging infrastructure and renewable energy further enhances the market framework, creating a favorable environment for the adoption of EVs. For instance, in 2025, Nuvve Holding Corp. announced it was awarded a contract by the State of New Mexico to support the state’s zero-emission vehicle (ZEV) and renewable energy goals. The contract will facilitate fleet electrification, including EV charging infrastructure. Nuvve expects the first project to be announced by the end of Q2 2025. This partnership highlights how government initiatives stimulate market involvement and infrastructure preparedness. As these frameworks develop and enforcement enhances, investor confidence is increasing, leading to steadier capital flows and stronger dedication to the local battery supply chain. Collectively, these policy initiatives and global partnerships are establishing the foundation for ongoing expansion in Mexico's EV battery sector.

Domestic EV Development and Supply Chain Localization

The growing focus of Mexico on self-reliance in EV manufacturing and component production is offering a favorable market outlook. The government and private industry are placing greater emphasis on creating a localized supply chain to facilitate the production of cost-effective electric vehicles. This change is decreasing reliance on imports and generating chances for local battery manufacturing, particularly for vital elements such as lithium and cathode materials. Promoting local manufacturing not only reduces production expenses but also enhances energy security and economic stability. The action corresponds with nationwide initiatives to foster industrial creativity, create jobs, and draw sustained investment into the EV sector. Moreover, by focusing on the use of indigenous resources and the advancement of technology, Mexico is establishing itself as a competitive contender in the global EV marketplace. The increasing focus on local solutions promotes the creation of battery manufacturing hubs, encouraging infrastructure growth and technology collaborations within the nation. This targeted strategy not only improves the practicality of widespread EV adoption among different consumer groups but also aids in ongoing market growth for EV batteries. In 2024, Mexico developed its own affordable electric vehicles, called "Olinia," to compete with low-cost models from China and India. President Claudia Sheinbaum emphasized the country's goal to create a domestic supply chain, reducing reliance on imports. Prototypes were already being built, and the country focused on securing local production of essential components like lithium.

Mexico Electric Vehicle Battery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on battery type, propulsion type, and vehicle type.

Battery Type Insights:

- Lithium-Ion Battery

- Nickel-Metal Hydride Battery

- Lead-Acid Battery

- Others

The report has provided a detailed breakup and analysis of the market based on the battery type. This includes lithium-ion battery, nickel-metal hydride battery, lead-acid battery, and others.

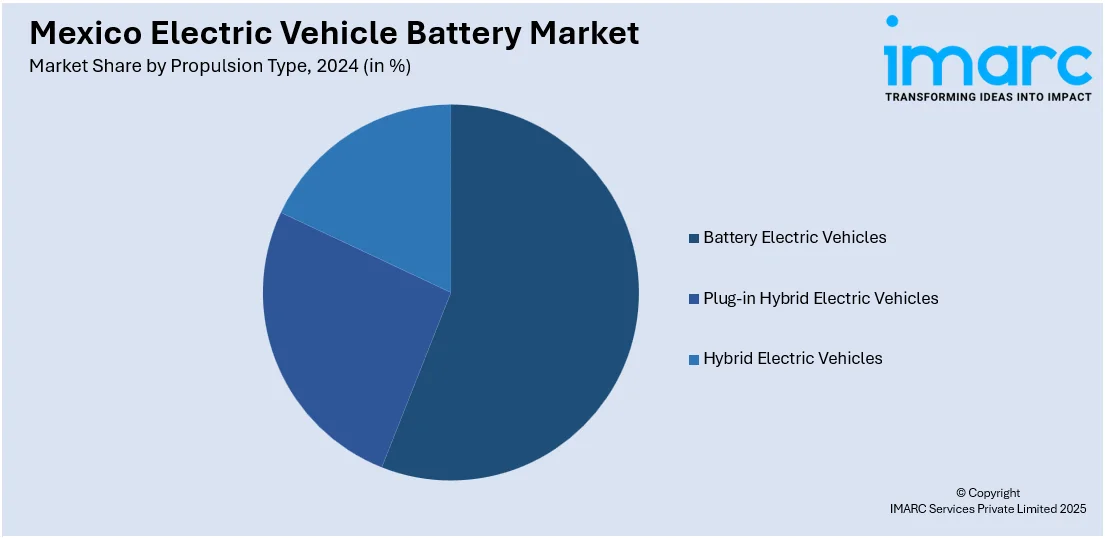

Propulsion Type Insights:

- Battery Electric Vehicles

- Plug-in Hybrid Electric Vehicles

- Hybrid Electric Vehicles

A detailed breakup and analysis of the market based on the propulsion type have also been provided in the report. This includes battery electric vehicles, plug-in hybrid electric vehicles, and hybrid electric vehicles.

Vehicle Type Insights:

- Passenger Car

- Commercial Vehicles

- Two-Wheeler

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger car, commercial vehicles, and two-wheeler.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Electric Vehicle Battery Market News:

- In December 2024, Audi announced the construction of its first battery assembly plant outside Germany, located in Puebla, Mexico. The facility produced over 300 high-voltage battery packs daily for the upcoming Audi Q8 e-tron, prioritizing sustainability with energy-saving technologies and heat recovery systems.

- In October 2024, BMW announced an $800 million expansion of its San Luis Potosí plant in Mexico to begin lithium battery production by the end of 2025. The 80,000 sqm expansion supported electric vehicle production, targeting 140,000 battery packs annually, aligning with BMW's sustainability goals of reducing CO₂ emissions per vehicle by 80% by 2030.

Mexico Electric Vehicle Battery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Battery Types Covered | Lithium-Ion Battery, Nickel-Metal Hydride Battery, Lead-Acid Battery, Others |

| Propulsion Types Covered | Battery Electric Vehicles, Plug-in Hybrid Electric Vehicles, Hybrid Electric Vehicles |

| Vehicle Types Covered | Passenger Car, Commercial Vehicles, Two-Wheeler |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico electric vehicle battery market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico electric vehicle battery market on the basis of battery type?

- What is the breakup of the Mexico electric vehicle battery market on the basis of propulsion type?

- What is the breakup of the Mexico electric vehicle battery market on the basis of vehicle type?

- What is the breakup of the Mexico electric vehicle battery market on the basis of region?

- What are the various stages in the value chain of the Mexico electric vehicle battery market?

- What are the key driving factors and challenges in the Mexico electric vehicle battery?

- What is the structure of the Mexico electric vehicle battery market and who are the key players?

- What is the degree of competition in the Mexico electric vehicle battery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico electric vehicle battery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico electric vehicle battery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico electric vehicle battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)