Mexico Electric Water Heater Market Size, Share, Trends and Forecast by Product Type, Capacity, Distribution Channel, End User, and Region, 2025-2033

Mexico Electric Water Heater Market Overview:

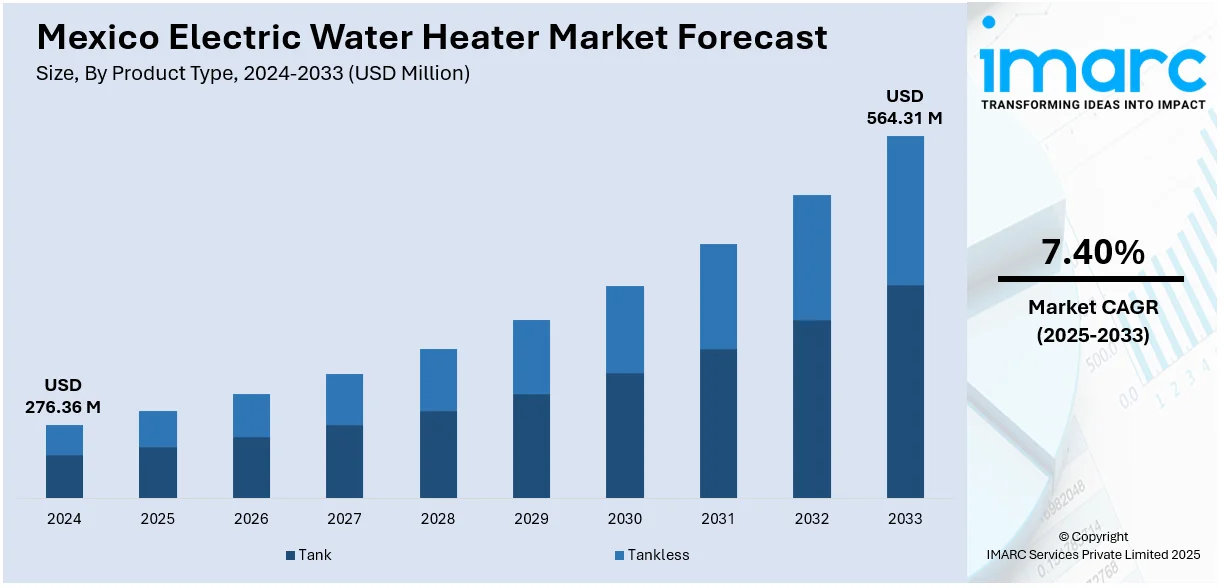

The Mexico electric water heater market size reached USD 276.36 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 564.31 Million by 2033, exhibiting a growth rate (CAGR) of 7.40% during 2025-2033. The market is driven by the growing demand for energy-efficient water heating solutions in residential areas, with consumers seeking cost-effective and sustainable options. Government incentives and policies promoting energy efficiency and the adoption of green technologies have made electric water heaters more accessible to a broader population. Technological advancements, such as smart thermostats and improved insulation, are enhancing the performance and appeal of electric water heaters, further augmenting the Mexico electric water heater market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 276.36 Million |

| Market Forecast in 2033 | USD 564.31 Million |

| Market Growth Rate 2025-2033 | 7.40% |

Mexico Electric Water Heater Market Trends:

Increasing Residential Demand for Efficient Water Heating Solutions

Increased demand for energy-saving water heating systems in residential structures is a key growth driver of the Mexican electric water heater market. As the middle-class population continues to increase and urbanization occurs, more and more homes are adopting modern features, such as electric water heaters, because they are convenient and can save energy. The transition from conventional water heating systems, including gas-based systems, to electric systems is consistent with the government emphasis on sustainability and conserving energy. Secondly, with the enhancement in the infrastructure of electricity grids, electric water heaters are becoming more viable as a dependable means of delivering constant hot water. This shift is playing an important role in driving the market expansion. Increased energy efficiency and lower environmental footprint are two major factors in the energy consumption of Mexico. Thus, residential demand is increasing, fueling the Mexico electric water heater market growth. The market is also driven by improved awareness on long-term savings and government backing for sustainable energy usage.

Government Incentives and Support for Sustainable Energy Solutions

Government regulations and incentives for the installation of energy-efficient appliances have played a leading role in boosting the Mexican electric water heater market. Mexico has actively been driving policies towards energy reform that target decreasing the dependence on fossil fuels and increasing the country's renewable energy base. Such policies are leading to the adoption of electric water heaters as part of residential and commercial energy efficiency initiatives. Tax credits, rebates, and financing vehicles have reduced the cost of electric water heaters to a wider segment of consumers. As the government becomes more inclined towards green solutions, the use of electric water heaters will also be a priority area, adding momentum to market development. With increased focus on minimizing carbon footprints and energy efficiency, the market for electric water heaters is poised for further growth.

Technological Advancements in Electric Water Heater Systems

Technological innovations have played a pivotal role in the growth of the electric water heater market in Mexico. Manufacturers are increasingly introducing advanced features, such as smart thermostats, better insulation, and energy-efficient heating elements, which offer higher performance at lower operating costs. With the integration of IoT capabilities, modern electric water heaters enable users to remotely control the temperature and manage their energy consumption, which is highly appealing to tech-savvy consumers. Additionally, manufacturers are developing models that are designed to be compact and more space-efficient, making them ideal for smaller living spaces, particularly in urban areas. The introduction of smart features and energy-saving technologies is helping to shape the consumer preferences toward electric water heaters. These developments are contributing to the continuous demand for modernized, high-efficiency water heaters across residential and commercial segments, aligning with the overall market growth.

Mexico Electric Water Heater Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, capacity, distribution channel, and end user.

Product Type Insights:

- Tank

- Tankless

The report has provided a detailed breakup and analysis of the market based on the product type. This includes tank and tankless.

Capacity Insights:

- Less Than 100 Liters

- 100 to 400 Liters

- More Than 400 Liters

The report has provided a detailed breakup and analysis of the market based on the capacity. This includes less than 100 liters, 100 to 400 liters, and more than 400 liters.

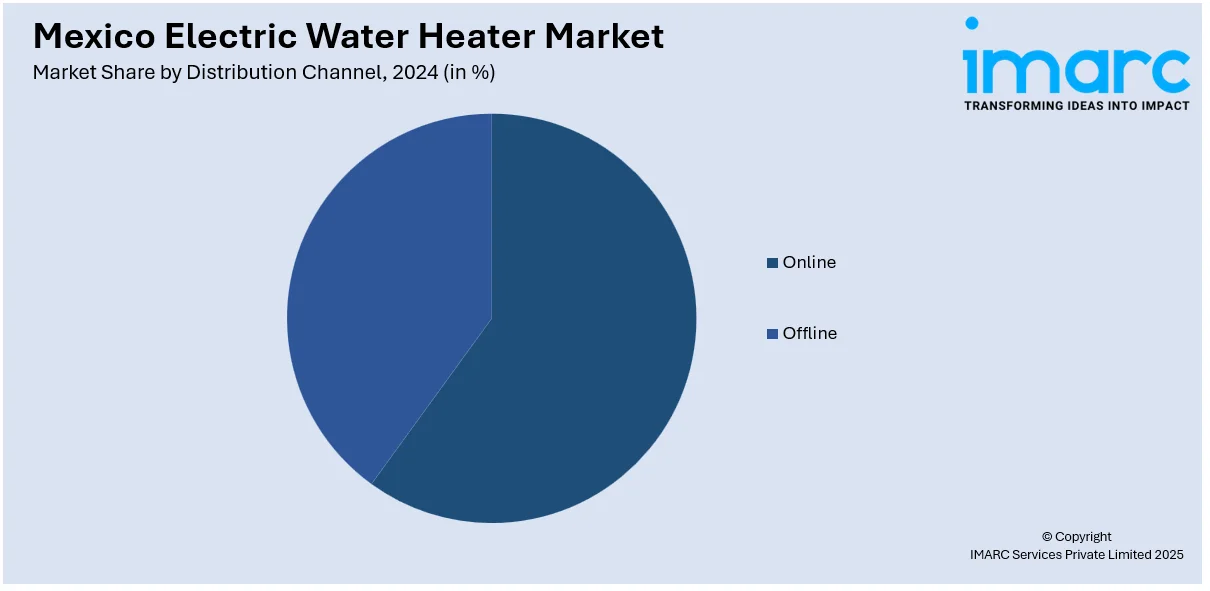

Distribution Channel Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online and offline.

End User Insights:

- Residential

- Commercial

- Industrial

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential, commercial, and industrial.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Electric Water Heater Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Tank, Tankless |

| Capacities Covered | Less Than 100 Liters, 100 to 400 Liters, More Than 400 Liters |

| Distribution Channels Covered | Online, Offline |

| End Users Covered | Residential, Commercial, Industrial |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico electric water heater market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico electric water heater market on the basis of product type?

- What is the breakup of the Mexico electric water heater market on the basis of capacity?

- What is the breakup of the Mexico electric water heater market on the basis of distribution channel?

- What is the breakup of the Mexico electric water heater market on the basis of end user?

- What is the breakup of the Mexico electric water heater market on the basis of region?

- What are the various stages in the value chain of the Mexico electric water heater market?

- What are the key driving factors and challenges in the Mexico electric water heater market?

- What is the structure of the Mexico electric water heater market and who are the key players?

- What is the degree of competition in the Mexico electric water heater market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico electric water heater market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico electric water heater market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico electric water heater industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)