Mexico Electric Welding Equipment Market Size, Share, Trends and Forecast by Equipment, Technology, Application, and Region, 2025-2033

Mexico Electric Welding Equipment Market Overview:

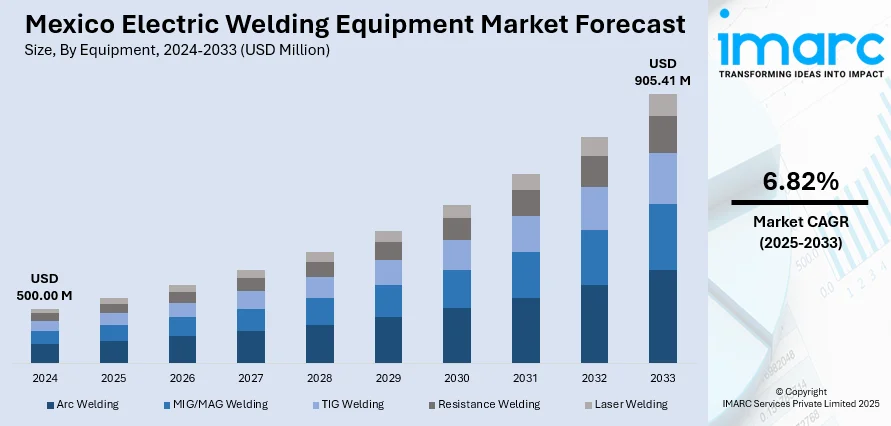

The Mexico electric welding equipment market size reached USD 500.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 905.41 Million by 2033, exhibiting a growth rate (CAGR) of 6.82% during 2025-2033. Rising automotive production, strong foreign direct investment in manufacturing, and growing infrastructure development are fueling the market growth. Moreover, the rising demand from the energy sector, is also fostering the market growth. Apart from this, renewable energy project growth, higher maintenance needs in industrial machinery, availability of advanced inverter-based systems, favorable trade under the United States-Mexico-Canada Agreement, shift to automation for safety and precision, and stricter welding quality standards are bolstering the Mexico electric welding equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 500.00 Million |

| Market Forecast in 2033 | USD 905.41 Million |

| Market Growth Rate 2025-2033 | 6.82% |

Mexico Electric Welding Equipment Market Trends:

Automotive Industry Growth

Mexico’s automotive sector has become a backbone of its industrial economy, directly influencing demand for electric welding equipment. As of 2023, Mexico ranked as the seventh-largest vehicle producer in the world and the fourth-largest exporter of auto parts, with exports valued at over USD 107 billion. The sector relies heavily on advanced welding processes for chassis assembly, bodywork, and exhaust fabrication, especially as global automakers shift toward lighter, more complex materials like aluminum and high-strength steel. Plants operated by major automakers such as General Motors, Volkswagen, and Nissan are integrating automated welding systems to improve output precision and safety. With an increasing number of original equipment manufacturer (OEMs) investing in hybrid and electric vehicle (EV) production, the requirement for precise and reliable electric welding tools is rising, which is propelling the Mexico electric welding equipment market growth.

Foreign Direct Investment in Manufacturing

Rising foreign direct investment (FDI) in Mexico’s industrial corridors is a strong catalyst for the welding equipment market. During January–June 2024, the country received USD 31 billion in FDI—its highest ever for a half-year period. Much of this investment has been targeted toward expanding or upgrading manufacturing clusters in states like Nuevo León, Guanajuato, and Querétaro. These zones host a concentration of factories engaged in metal fabrication, automotive parts, electronics, and appliance manufacturing, all of which require consistent welding operations. New production lines being set up by firms like Tesla and BMW in northern Mexico are installing robotic welding systems for large-scale automation. With more industrial parks being developed and equipped with modern machinery, there’s a direct increase in the procurement of electric welding machines to support production capacity and meet global quality standards.

Infrastructure Development and Construction Projects

Mexico’s ongoing infrastructure push is another strong growth engine for electric welding equipment. In 2024, the federal government announced its third infrastructure investment package valued at MXN 70 billion (approx. USD 3.9 billion), spanning projects in transport, energy, and public utilities. Large-scale developments such as the Tren Maya railway, new refineries, highway expansions, and airport upgrades demand extensive use of arc welding, particularly in steel structure fabrication and pipeline construction. Additionally, the private sector’s involvement in commercial real estate and industrial warehousing continues to grow, with prefabricated metal structures relying on electric welding for on-site assembly. With stricter safety codes and tighter deadlines, contractors are increasingly adopting efficient, portable welding machines. This trend is driving growth in demand not only for basic welding tools but also for automated and high-duty cycle equipment that can withstand continuous, high-output operation on construction sites.

Mexico Electric Welding Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on equipment, technology, and application.

Equipment Insights:

- Arc Welding

- MIG/MAG Welding

- TIG Welding

- Resistance Welding

- Laser Welding

The report has provided a detailed breakup and analysis of the market based on the equipment. This includes arc welding, MIG/MAG welding, TIG welding, resistance welding, and laser welding.

Technology Insights:

- Conventional Welding

- Automated Welding

- Robotic Welding

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes conventional welding, automated welding, and robotic welding.

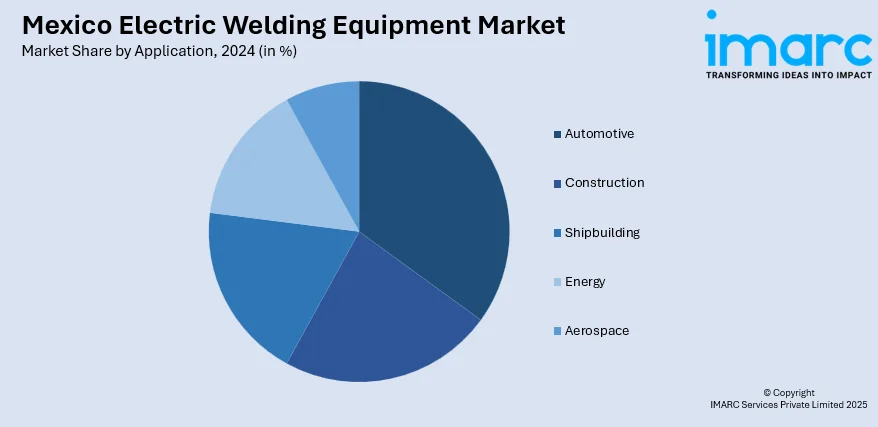

Application Insights:

- Automotive

- Construction

- Shipbuilding

- Energy

- Aerospace

The report has provided a detailed breakup and analysis of the market based on the application. This includes automotive, construction, shipbuilding, energy, and aerospace.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Electric Welding Equipment Market News:

- In March 2024, Lincoln Electric focused on welding automation solutions at FABTECH Mexico, unveiling enhanced systems that combine robotics, sensors, and artificial intelligence (AI) based process controls. These technologies are designed to address labor shortages and enhance consistency across production lines in Mexico’s growing metal fabrication industry.

- In July 2024, Heron Intelligent Equipment announced a strategic partnership with Mexico’s QUAT Industrial to expand access to advanced resistance welding and self-pierce riveting technologies, aiming to enhance automation capabilities for local manufacturers.

Mexico Electric Welding Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipments Covered | Arc Welding, MIG/MAG Welding, TIG Welding, Resistance Welding, Laser Welding |

| Technologies Covered | Conventional Welding, Automated Welding, Robotic Welding |

| Applications Covered | Automotive, Construction, Shipbuilding, Energy, Aerospace |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico electric welding equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico electric welding equipment market on the basis of equipment?

- What is the breakup of the Mexico electric welding equipment market on the basis of technology?

- What is the breakup of the Mexico electric welding equipment market on the basis of application?

- What is the breakup of the Mexico electric welding equipment market on the basis of region?

- region are the various stages in the value chain of the Mexico electric welding equipment market?

- What are the key driving factors and challenges in the Mexico electric welding equipment market?

- What is the structure of the Mexico electric welding equipment market and who are the key players?

- What is the degree of competition in the Mexico electric welding equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico electric welding equipment market from 2019-2033

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico electric welding equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico electric welding equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)