Mexico Electrical Conduit Market Size, Share, Trends and Forecast by Type, Material, Application, and Region, 2025-2033

Mexico Electrical Conduit Market Overview:

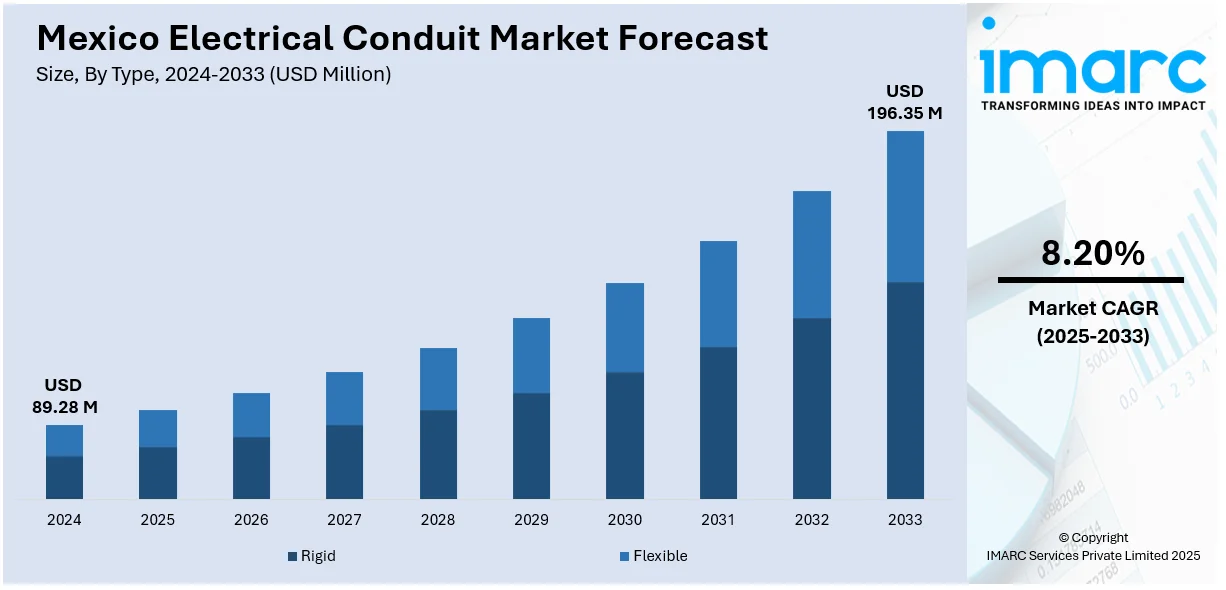

The Mexico electrical conduit market size reached USD 89.28 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 196.35 Million by 2033, exhibiting a growth rate (CAGR) of 8.20% during 2025-2033. Growing infrastructure projects, increased demand for energy-efficient solutions, and advances in construction technology drive the market. As urbanization rises, the Mexico electrical conduit market share continues to expand with innovations focused on safety, durability, and compliance with standards.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 89.28 Million |

| Market Forecast in 2033 | USD 196.35 Million |

| Market Growth Rate 2025-2033 | 8.20% |

Mexico Electrical Conduit Market Trends:

Increased Demand for Strong and Efficient Materials

The growing construction market in Mexico has led to an increasing demand for electrical conduit systems that are energy-efficient and durable. Urbanization processes and infrastructure projects bring forth this large-scale application of quality materials for long-term performance and efficiency. This shift is contributed to by the need to reduce installation and maintenance costs while enhancing operational safety in electrically related systems for residential, commercial, and industrial usages. Better options are the materials bases of PVC, steel, and aluminum, confronted manufacturers, which have higher resistance against corrosion, fire, and wear. These products are also made to serve energy-efficient systems: renewable energy technologies and smart-grid applications. The trend towards better and more efficient materials is crucial for providing safety to modern electrical systems and is, therefore, fast-tracking the trend of energy conservation and sustainability. With the ongoing trend, the electrical conduit market share in Mexico is steadily rising as both domestic and foreign suppliers are pouring money into even stronger product lines to cater to these changing demands.

Expansion in Smart and Sustainable Infrastructure

Mexico is witnessing a boom in smart and sustainable infrastructure development, increasing the need for smart electrical conduit systems. With the nation emphasizing upgrading its infrastructure and adopting smart city projects, the demand for efficient, flexible, and high-performance electrical systems is becoming increasingly important. Electrical conduit systems are critical in these endeavors, as they offer the required protection for wiring systems, particularly for high-technology and energy-efficient uses such as automation, IoT networks, and renewable energy systems. This move towards intelligent infrastructure has generated a change in the kind of electrical conduits utilized. Producers are now making flexible, fire-resistant, and corrosion-proof conduit solutions to keep up with the increased complexity of current electrical systems. In addition, they should be highly compatible with the implementation of smart meters, renewable sources of energy, and charging stations for electric vehicles. As sustainable and intelligent infrastructure continues to grow in demand, the Mexico electrical conduit market is anticipated to gain momentum, offering new avenues for manufacturers to participate and driving the Mexico electrical conduit market growth further. With increased emphasis on sustainability, the need for sophisticated conduit systems will keep increasing, and with that, there will be a stable growth path in the years to come.

Mexico Electrical Conduit Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on type, material, and application.

Type Insights:

- Rigid

- Flexible

The report has provided a detailed breakup and analysis of the market based on the type. This includes rigid and flexible.

Material Insights:

- Metallic

- Non-Metallic

The report has provided a detailed breakup and analysis of the market based on the material. This includes metallic and non-metallic.

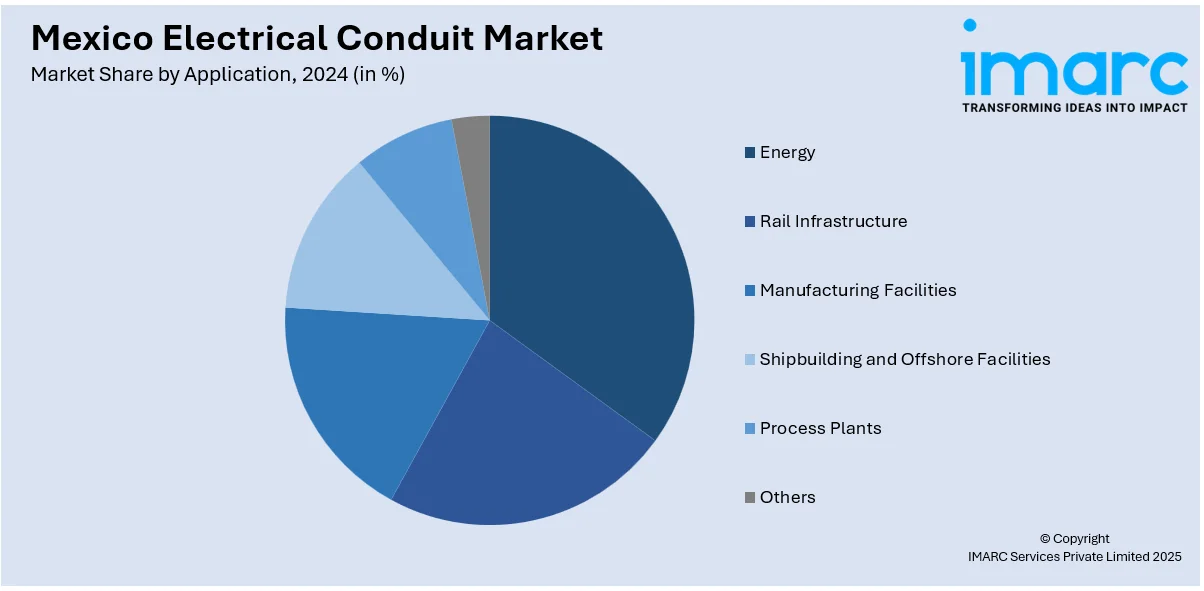

Application Insights:

- Energy

- Rail Infrastructure

- Manufacturing Facilities

- Shipbuilding and Offshore Facilities

- Process Plants

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes energy, rail infrastructure, manufacturing facilities, shipbuilding and offshore facilities, process plants, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Electrical Conduit Market News:

- November 2024: Mexico unveiled a USD 23.4 Billion energy plan, focusing on electricity generation and transmission infrastructure. This initiative, which includes significant investments in renewable energy and transmission networks, is expected to drive demand for electrical conduit solutions, stimulating growth in the Mexican electrical conduit market.

- October 2024: Schneider Electric’s Monterrey factory was recognized as an Advanced Lighthouse by the World Economic Forum. This recognition highlighted the integration of Fourth Industrial Revolution technologies, driving innovation in manufacturing. This development likely boosted demand for advanced electrical conduit solutions in Mexico’s growing industrial market.

Mexico Electrical Conduit Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Rigid, Flexible |

| Materials Covered | Metallic, Non-Metallic |

| Applications Covered | Energy, Rail Infrastructure, Manufacturing Facilities, Shipbuilding and Offshore Facilities, Process Plants, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico electrical conduit market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico electrical conduit market on the basis of type?

- What is the breakup of the Mexico electrical conduit market on the basis of material?

- What is the breakup of the Mexico electrical conduit market on the basis of application?

- What is the breakup of the Mexico electrical conduit market on the basis of region?

- What are the various stages in the value chain of the Mexico electrical conduit market?

- What are the key driving factors and challenges in the Mexico electrical conduit market?

- What is the structure of the Mexico electrical conduit market and who are the key players?

- What is the degree of competition in the Mexico electrical conduit market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico electrical conduit market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico electrical conduit market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico electrical conduit industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)