Mexico Electrical Steel Market Size, Share, Trends and Forecast by Type, Application, End Use Industry, and Region, 2025-2033

Mexico Electrical Steel Market Overview:

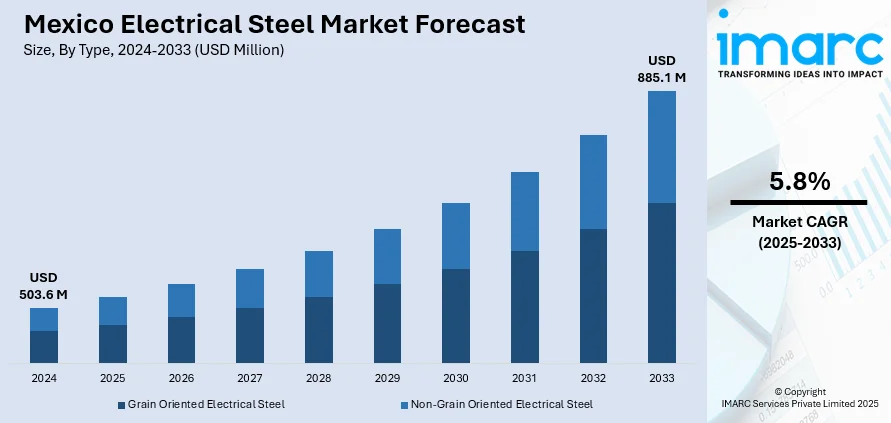

The Mexico electrical steel market size reached USD 503.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 885.1 Million by 2033, exhibiting a growth rate (CAGR) of 5.8% during 2025-2033. Rising investments in power infrastructure, the expansion of electric vehicle (EV) production, government initiatives to modernize the grid, shift toward renewable energy, increasing industrialization, surging demand for smart grid technologies, innovations in domestic steel production, energy efficiency regulations, and the growing electronics sector are factors fostering the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 503.6 Million |

| Market Forecast in 2033 | USD 885.1 Million |

| Market Growth Rate 2025-2033 | 5.8% |

Mexico Electrical Steel Market Trends:

Rising Investments in Power Infrastructure

Mexico is undergoing a significant transformation in its energy landscape, marked by substantial investments in modernizing and expanding power infrastructure. Public and private sector initiatives are being directed toward enhancing the transmission and distribution network to meet growing electricity demand across residential, industrial, and commercial sectors. These infrastructure projects require large volumes of electrical steel, which is a critical material in the production of transformers, reactors, and other electrical components. In addition to this, the integration of smart grid systems is creating new requirements for advanced materials capable of operating efficiently under fluctuating loads. This trend is further expected to sustain long-term demand for electrical steel, reinforcing the material’s strategic importance in the country’s energy development plans, which is boosting the Mexican electrical steel market share.

To get more information of this market, Request Sample

Expansion of Electric Vehicle (EV) Production

As per the Mexican electrical steel market forecast, the country’s emergence as a key manufacturing hub for electric vehicles (EVs) is a major catalyst for the market growth. Global automotive giants, including Tesla, General Motors, and BMW, are increasing their production capacities in Mexico, driven by its skilled labor force, cost efficiencies, and favorable trade environment under the USMCA agreement. For instance, in 2024, Volkswagen allocated USD 942 million to its Puebla plant to create a strategic electromobility center, focusing on the assembly of electric and hybrid cars. BMW announced an investment of nearly USD 900 million in San Luis Potosí to manufacture electric vehicles, with operations expected to commence in 2027. Electric vehicles (EVs) require specialized grades of electrical steel, particularly for motor cores and power electronics, where magnetic properties and energy efficiency are paramount. As EV production scales, so does the need for non-grain-oriented electrical steel with low core loss and high magnetic permeability. Furthermore, supporting infrastructure such as charging stations and battery management systems also relies on components made with electrical steel. Furthermore, the localization of EV supply chains is intensifying demand for high-quality electrical materials, positioning Mexico as a critical link in the regional and global EV manufacturing ecosystem, which is accelerating the Mexico electrical steel market growth.

Government Initiatives to Modernize the Grid

The Mexican government is actively promoting modernization of its national grid as part of broader energy reform initiatives. These efforts are aimed at improving energy efficiency, reducing system losses, and integrating renewable energy sources into the grid. Through agencies such as the Comisión Federal de Electricidad (CFE), substantial funding is being allocated to upgrade aging infrastructure, replace outdated transformers, and deploy new substations, applications where electrical steel plays a foundational role. Additionally, regulatory measures promoting energy-efficient technologies are influencing utility companies to adopt higher-grade electrical steel to meet performance standards, which is creating a positive Mexican electrical steel market outlook. The grid modernization program also includes digital infrastructure enhancements, which require precise, reliable electrical components. These strategic government actions are not only strengthening Mexico’s energy security but are also creating a conducive environment for sustained demand in the market.

Mexico Electrical Steel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, application, and end use industry.

Type Insights:

- Grain Oriented Electrical Steel

- Non-Grain Oriented Electrical Steel

The report has provided a detailed breakup and analysis of the market based on the electrical steel type. This includes grain oriented electrical steel and non-grain oriented electrical steel.

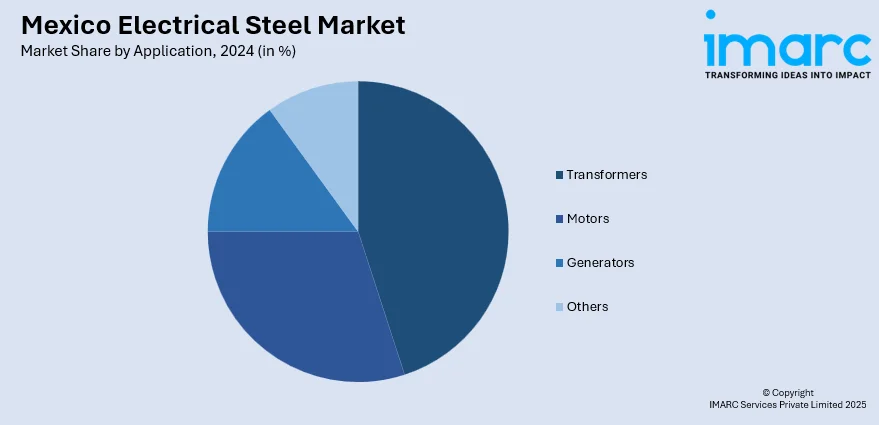

Application Insights:

- Transformers

- Motors

- Generators

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes transformers, motors, generators, and others.

End Use Industry Insights:

- Energy and Power

- Automobiles

- Household Appliances

- Building and Construction

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes energy and power, automobiles, household appliances, building and construction, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Electrical Steel Market News:

- In 2024, Nippon Steel Trading Corporation (NST) is constructing a new coil center for electrical steel sheets in Apaseo El Grande, Guanajuato. This project, supported by local government officials, is set to commence operations in April 2025, aiming to enhance the supply chain for electrical steel products in the region.

Mexico Electrical Steel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Grain Oriented Electrical Steel, Non-Grain Oriented Electrical Steel |

| Applications Covered | Transformers, Motors, Generators, Others |

| End-Use Industries Covered | Energy and Power, Automobiles, Household Appliances, Building and Construction, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico electrical steel market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico electrical steel market on the basis of type?

- What is the breakup of the Mexico electrical steel market on the basis of application?

- What is the breakup of the Mexico electrical steel market on the basis of end use industry?

- What is the breakup of the Mexico electrical steel market on the basis of region?

- What are the various stages in the value chain of the Mexico electrical steel market?

- What are the key driving factors and challenges in the Mexico electrical steel market?

- What is the structure of the Mexico electrical steel market and who are the key players?

- What is the degree of competition in the Mexico electrical steel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico electrical steel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico electrical steel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico electrical steel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)