Mexico Electrical Wires and Cables Market Size, Share, Trends and Forecast by Type, End User, and Region, 2025-2033

Mexico Electrical Wires and Cables Market Overview:

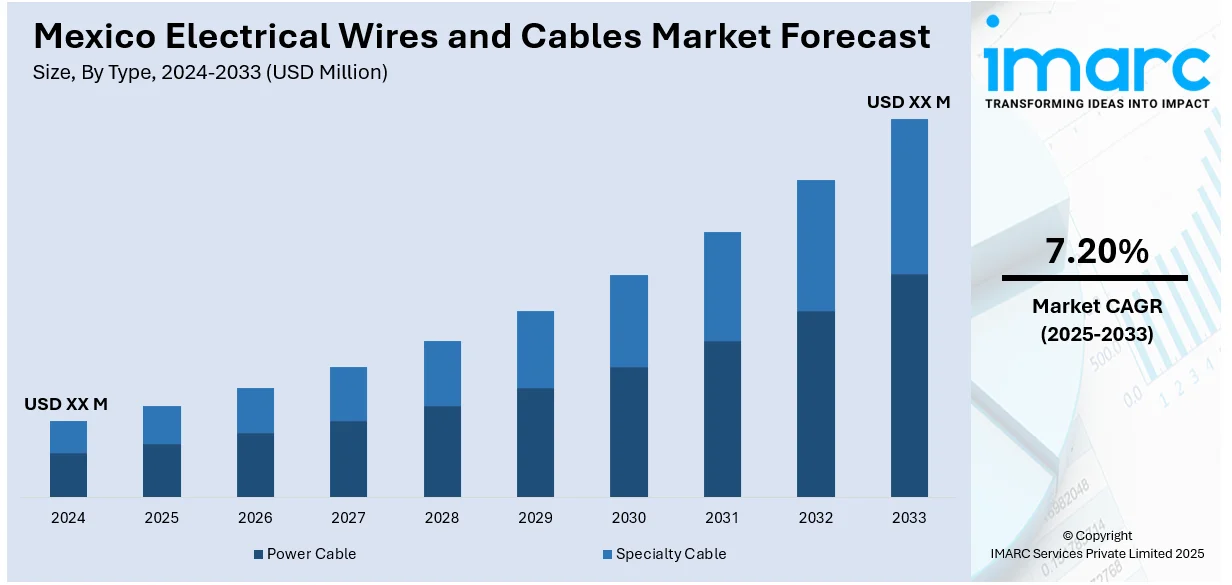

The Mexico electrical wires and cables market size is projected to exhibit a growth rate (CAGR) of 7.20% during 2025-2033. The market is experiencing steady growth driven by increasing infrastructure development, rising energy efficiency demands, and the integration of smart cabling solutions. Expanding urbanization and government investments in renewable energy and digital infrastructure are key factors boosting demand. High-performance, durable cables are essential for supporting these initiatives, ensuring reliable power transmission and data connectivity. These dynamics collectively contribute to the expanding Mexico electrical wires and cables market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 7.20% |

Mexico Electrical Wires and Cables Market Analysis:

- Major Market Drivers: Modernization drives for infrastructure and expansions in renewable energy projects are propelling strong Mexico electrical wires and cables market demand. Government investments in city development, transportation infrastructure, and digital infrastructure drive constant demand for high-performance cabling products in residential, commercial, and industrial segments across Mexico.

- Key Market Trends: Cutting-edge energy-efficient cable technologies and intelligent cabling solutions are transforming the market scenario. Incorporating IoT features, real-time monitoring technology, and eco-friendly materials demonstrates changing consumer behavior and regulatory needs for improved performance, reliability, and environmental sustainability in contemporary infrastructure applications.

- Competitive Landscape: The market forecast depicts heightening competition between local and foreign manufacturers with a focus on product innovation, quality improvement, and strategic alliances. Firms prioritize research and development spending, increasing production facilities, and creating niche solutions for automotive, telecommunication, and renewable energy industries.

- Opportunities and Challenges: Raw material price instability and rigorous regulatory compliance are ongoing challenges, while opportunities for the market growth come from smart city programs, renewable energy growth, and industrial automation. Manufacturers gain from creating green products, improving distribution networks, and targeting new application segments.

Mexico Electrical Wires and Cables Market Trends:

Increased Use of Energy-Efficient Cables

The Mexico electrical wires and cables market is observing a massive upsurge powered by the increased use of energy-efficient cables. Rising energy prices and country-level pledges toward sustainability have heightened demand for cables that reduce energy losses through better insulation and lower electrical resistance. Such cables provide longer service life and improved durability, so these are perfect for both industrial and public infrastructure projects. Regulatory structures encouraging energy conservation further encourage the integration of next-generation cable technologies. Power generation, transmission, and distribution industries are among the major drivers for this innovation, aiming to improve grid reliability and lower the cost of operation. Therefore, energy-efficient cables are increasingly becoming a critical part of Mexico's growing electrical infrastructure, serving both environmental objectives and economic productivity. This is a trend that is expected to continue, with Mexico still focusing on cleaner and more sustainable energy options, setting the stage for continued growth in the Mexico electrical wires and cables market forecast.

To get more information on this market, Request Sample

Integration of Smart Cabling Solutions in Digital Infrastructure

Digitalization in Mexico is driving the adoption of smart cabling solutions within its electrical infrastructure. Smart cables with data transmission capabilities, real-time monitoring, and automation are becoming a key requirement for telecommunications, industrial automation, and smart city projects in urban infrastructure. Such cables improve the efficiency of operations by facilitating remote fault detection, load balancing, and enhanced system reliability. Mexico's increasing investment in smart cities and renewable energy projects boosts demand for cables that integrate conventional electrical functions with digital connectivity. This multi-purposeful serves the Internet of Things (IoT) and other new technologies essential to contemporary infrastructure. The growing sophistication of Mexico's energy and communications networks demand cables that can support high-performing electrical and data demands in tandem. Consequently, smart cabling solutions are becoming a strategic priority in the Mexico electrical wires and cables market outlook, driving innovation and long-term development in keeping with the nation's modernization aspirations.

Infrastructure Growth as a Market Stimulus

Infrastructure growth is a leading stimulant of the Mexico electrical wires and cables market. The expansion of urban areas, improvements in transport networks, and growth of renewable energy installations necessitate large-scale use of trusted, high-performance cable. Both power cables for electricity transmission and specialty cables for communications and industrial applications are seeing growing demand. The focus on reliability, security, and regulatory needs is directing procurement towards high-quality cabling solutions. For instance, in November 2024, UL Solutions enlarged its Querétaro Mexico lab, increasing testing of consumer technology, automotive, and wire and cable products for supporting exports across Latin America and North America. Moreover, Mexico's continued national electrification programs and infrastructure upgradation projects further drive market expansion by necessitating future-proof cabling with the capability to adapt to changing technologies and increased electrical loads. The trend highlights the strategic position of electrical cables not just as basic building material but as integral features making infrastructure efficient and durable. As a result, infrastructure expansion remains the primary driver for Mexico electrical wires and cables market growth, underpinning strong and continued industry enhancement.

Mexico Electrical Wires and Cables Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end user.

Type Insights:

- Power Cable

- Specialty Cable

The report has provided a detailed breakup and analysis of the market based on the type. This includes power cable and specialty cable.

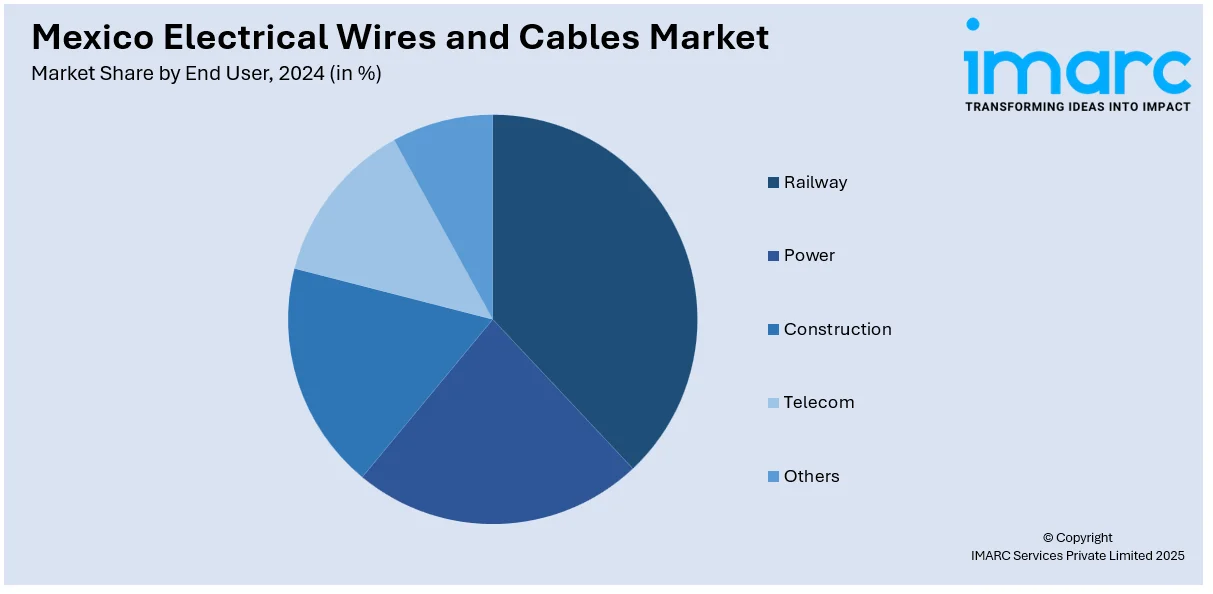

End User Insights:

- Railway

- Power

- Construction

- Telecom

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes railway, power, construction, telecom, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Electrical Wires and Cables Market News:

- In June 2024, Amphenol TPC Wire & Cable introduced cutting-edge wiring solutions such as high-performance cables aimed at automotive, industrial, and telecom applications. These robust, efficient cables enable harsh environments and changing infrastructure requirements. This product release is most essential to monitor trends in Mexico's electrical wires and cables market.

- November 2024: UL Solutions expanded its laboratory in Querétaro, Mexico, enhancing testing capabilities for consumer technology, automotive, and wire and cable products. The upgrade supports manufacturers in Latin America with safety, performance, and export compliance for the U.S., Canada, and regional markets, strengthening UL’s role in the Mexican testing industry.

- April 2024: Amphenol TPC Wire & Cable launched its ATPC Medium Voltage Cables in Macedonia, Ohio, designed for harsh industrial environments. Compliant with UL 1072, these cables feature aluminum or copper conductors, EPR insulation, and durable PVC jackets, supporting applications in automotive, mining, utilities, and factory automation industries.

- January 2024: Amphenol Corporation acquired TPC Wire & Cable, a specialist in ruggedized industrial cabling solutions. Renamed “Amphenol TPC Wire & Cable,” it will operate within Amphenol’s Harsh Environment Solutions Division from its Ohio headquarters, aiming to expand global reach, enhance industrial applications, and drive innovation across demanding environments.

Mexico Electrical Wires and Cables Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Power Cable, Specialty Cable |

| End Users Covered | Railway, Power, Construction, Telecom, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico electrical wires and cables market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico electrical wires and cables market on the basis of type?

- What is the breakup of the Mexico electrical wires and cables market on the basis of end user?

- What is the breakup of the Mexico electrical wires and cables market on the basis of region?

- What are the various stages in the value chain of the Mexico electrical wires and cables market?

- What are the key driving factors and challenges in the Mexico electrical wires and cables?

- What is the structure of the Mexico electrical wires and cables market and who are the key players?

- What is the degree of competition in the Mexico electrical wires and cables market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico electrical wires and cables market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico electrical wires and cables market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico electrical wires and cables industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)