Mexico Electronic Toll Collection Market Size, Share, Trends and Forecast by Technology, System, Subsystem, Offering, Toll Charging, Application, and Region, 2025-2033

Mexico Electronic Toll Collection Market Overview:

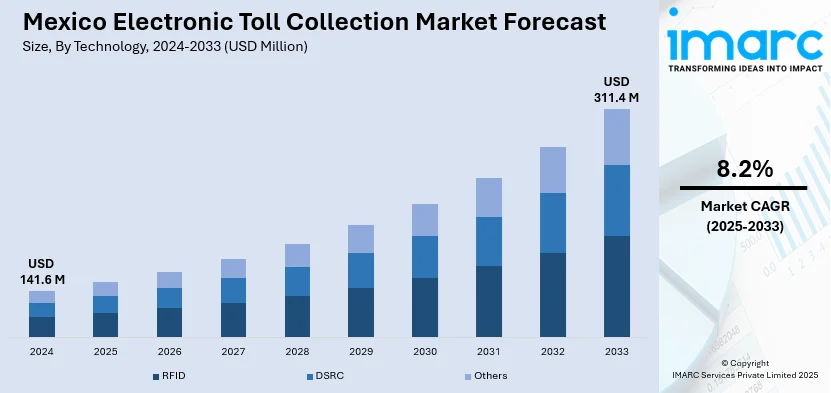

The Mexico electronic toll collection market size reached USD 141.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 311.4 Million by 2033, exhibiting a growth rate (CAGR) of 8.2% during 2025-2033. The market share is expanding, driven by the ongoing shift towards digital solutions that offer time savings and ease of use, along with the increasing government efforts aimed at modernizing transportation infrastructure.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 141.6 Million |

| Market Forecast in 2033 | USD 311.4 Million |

| Market Growth Rate 2025-2033 | 8.2% |

Mexico Electronic Toll Collection Market Trends:

Rising smartphone penetration

The growing smartphone penetration is offering a favorable Mexico electronic toll collection market outlook. As more people are gaining access to smartphones and the internet, digital payment options are becoming more accessible and convenient, encouraging wider adoption of cashless toll systems. According to Digital 2024 data, the overall count of internet users increased by 6.6% in 2024 from 2023, accounting for a total of 107.3 Million people across the various states of Mexico. Smartphone users can easily manage toll accounts, check balances, receive real-time updates, and make instant payments through dedicated apps or linked payment platforms. This convenience reduces the need for physical toll booths and speeds up the tolling process. With a rising tech-savvy population, especially among younger drivers and daily commuters, there is a growing shift towards digital solutions that offer time savings and ease of use. Increased smartphone usage also supports the integration of global positioning system (GPS) and mapping tools, which help drivers plan routes that include electronic toll roads for quicker travel. As telecom infrastructure is improving and mobile internet is becoming more reliable across urban and rural areas, more people are finding electronic tolling systems accessible and practical. This growing reliance on smartphones, combined with user-friendly toll apps, is driving the demand for efficient and smart toll collection systems in Mexico’s evolving transport network.

Increasing government efforts to modernize transportation systems

The rising government efforts aimed at modernizing transportation infrastructure are impelling the Mexico electronic toll collection market growth. In January 2024, Mexico's Secretariat of Communications and Transport (SCT) announced a bold initiative to spend USD12.53 Billion in constructing and enhancing 8,115 KM of roads in 2024. SCT identified 51 significant projects for essential federal roads, focusing on upgrades and maintenance aimed at alleviating traffic congestion and enhancing safety. Moreover, 53 new roads were set to be constructed in rural regions at an anticipated expense of USD 910 Million. As the country is working to improve road connectivity and boost efficiency on highways, electronic toll systems are becoming an important part of the strategy. These systems help reduce wait times at toll booths, cut down fuel utilization from idling vehicles, and make long-distance travel smoother for both commercial and private transport. With high expenditure on highway expansion and smart road networks, authorities are adopting electronic tolling solutions to support seamless traffic flow and better resource management. The government is promoting digital and cashless payments, which aligns perfectly with these toll systems. These changes are especially useful for heavy traffic corridors, where quick toll processing aids in avoiding congestion. As smart mobility is becoming a key focus, electronic toll collection is seen as a practical and scalable way to support the broader goal of modern infrastructure. By making transportation more user-friendly, government-led modernization initiatives are driving the demand for electronic toll collection systems across the country.

Mexico Electronic Toll Collection Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on technology, system, subsystem, offering, toll charging, and application.

Technology Insights:

- RFID

- DSRC

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes RFID, DSRC, and others.

System Insights:

- Transponder - or Tag-Based Toll Collection Systems

- Other Toll Collection Systems

A detailed breakup and analysis of the market based on the system have also been provided in the report. This includes transponder - or tag-based toll collection systems and other toll collection systems.

Subsystem Insights:

- Automated Vehicle Identification

- Automated Vehicle Classification

- Violation Enforcement System

- Transaction Processing

The report has provided a detailed breakup and analysis of the market based on the subsystem. This includes automated vehicle identification, automated vehicle classification, violation enforcement system, and transaction processing.

Offering Insights:

- Hardware

- Back Office and Other Services

A detailed breakup and analysis of the market based on the offering have also been provided in the report. This includes hardware and back office and other services.

Toll Charging Insights:

- Distance Based

- Point Based

- Time Based

- Perimeter Based

The report has provided a detailed breakup and analysis of the market based on the toll charging. This includes distance based, point based, time based, and perimeter based.

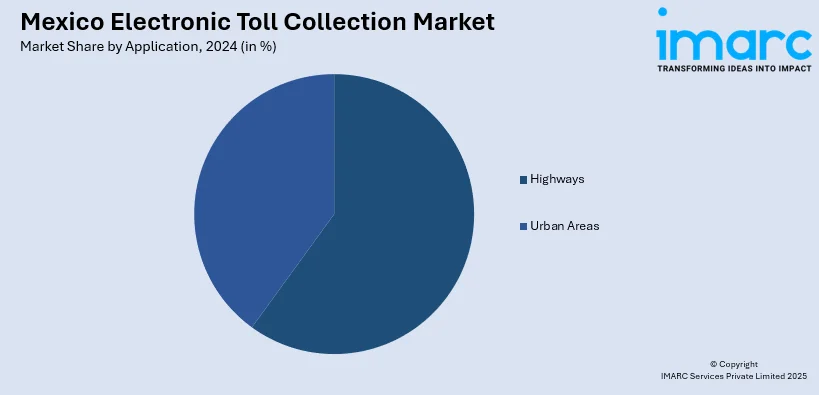

Application Insights:

- Highways

- Urban Areas

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes highways and urban areas.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Electronic Toll Collection Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | RFID, DSRC, Others |

| Systems Covered | Transponder - or Tag-Based Toll Collection Systems, Other Toll Collection Systems |

| Subsystems Covered | Automated Vehicle Identification, Automated Vehicle Classification, Violation Enforcement System, Transaction Processing |

| Offerings Covered | Hardware, Back Office and Other Services |

| Toll Charging Covered | Distance Based, Point Based, Time Based, Perimeter Based |

| Applications Covered | Highways, Urban Areas |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico electronic toll collection market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico electronic toll collection market on the basis of technology?

- What is the breakup of the Mexico electronic toll collection market on the basis of system?

- What is the breakup of the Mexico electronic toll collection market on the basis of subsystem?

- What is the breakup of the Mexico electronic toll collection market on the basis of offering?

- What is the breakup of the Mexico electronic toll collection market on the basis of toll charging?

- What is the breakup of the Mexico electronic toll collection market on the basis of application?

- What is the breakup of the Mexico electronic toll collection market on the basis of region?

- What are the various stages in the value chain of the Mexico electronic toll collection market?

- What are the key driving factors and challenges in the Mexico electronic toll collection market?

- What is the structure of the Mexico electronic toll collection market and who are the key players?

- What is the degree of competition in the Mexico electronic toll collection market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico electronic toll collection market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico electronic toll collection market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico electronic toll collection industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)