Mexico Electroplating Market Size, Share, Trends and Forecast by Type, Metal Type, End Use Industry, and Region, 2025-2033

Mexico Electroplating Market Overview:

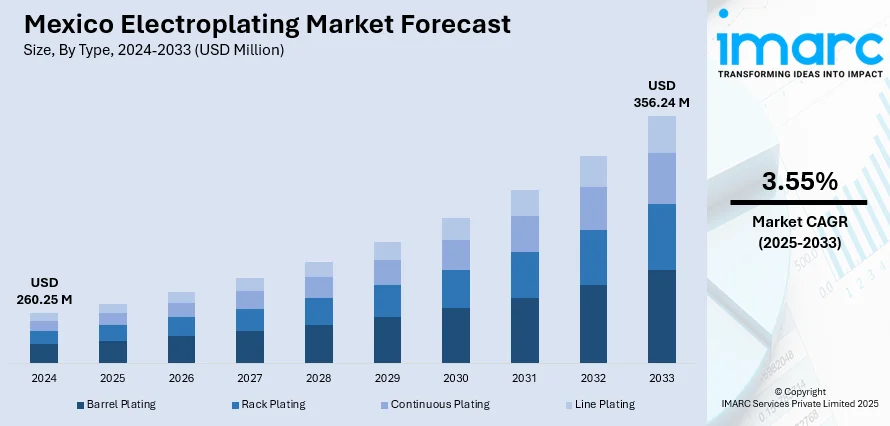

The Mexico electroplating market size reached USD 260.25 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 356.24 Million by 2033, exhibiting a growth rate (CAGR) of 3.55% during 2025-2033. The industry is being propelled by growing demand in sectors like automotive, electronics, and manufacturing. Growth is being driven by technological developments like advanced coating systems and effective metal reclamation. Additionally, these trends are boosting the Mexico electroplating market share in the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 260.25 Million |

| Market Forecast in 2033 | USD 356.24 Million |

| Market Growth Rate 2025-2033 | 3.55% |

Mexico Electroplating Market Trends:

Advancements in Electroplating Technology

The Mexican electroplating industry is undergoing rapid technological development making plating processes efficient and cheaper. Technologies are helping in being adapted for fine applications, particularly those in the automotive, electrical, and aerospace fields. Hendor got a silver reclamation system, the HRC system, introduced in March 2025, whereby plating houses can directly recover precious metals from rinse tanks. This technology eliminates any post-processing; hence it saves labor and equipment costs while improving the recovery rate of metals. Employing these technologies would potentially increase the overall productivity and the sustainability of electroplating processes in Mexico. Also, such innovations help increase metal recovery efficiency, significantly reduce wastes, and lessen the environmental footprints. Electroplating process can be upgraded in such a manner that revives demand in an expense-efficient way. The increasing demand for high-performance plating technologies, including the Hendor HRC system, is making Mexico a rising center for electroplating in Latin America and further enhancing the Mexico electroplating market growth. These new technologies not only keep Mexican manufacturers competitive but also address the increasing global demand for environmentally friendly and efficient electroplating solutions.

Increasing Demand Across Major Industries

The rising need for electroplating across major industries like automotive, electronics, and industrial manufacturing is a major growth driver for the Mexico electroplating market. With the growing automotive business and the growth of electronics manufacturing, the demand for high-quality electroplated parts keeps on increasing. In April 2025, MacDermid Enthone announced its investment in acquiring a partnership with RM Plating, a plant that deals in electroplating and surface finishing in Mexico. This alliance focuses on the increasing significance of electroplating in the manufacture of quality parts for sectors such as automotive and electronics. With Mexico receiving increased foreign investment and firms widening their footprint in the nation, the use of electroplated parts and components is likely to see a hike. Such industries need electroplated components due to durability, conductivity, and protection from corrosion, which fuels market demand. Further, the quick growth of manufacturing in Mexico is also driving the growth of electroplating operations. The trend is expected to persist, driven by the business-friendly environment of Mexico and its strategic position as a manufacturing platform. Technological advancements, as well as the growth of electroplating facilities within the region, are anticipated to be significant contributors to the growth of the Mexico electroplating market, solidifying its dominance in electroplating within Latin America.

Mexico Electroplating Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on type, metal type, and end use industry.

Type Insights:

- Barrel Plating

- Rack Plating

- Continuous Plating

- Line Plating

The report has provided a detailed breakup and analysis of the market based on the type. This includes barrel plating, rack plating, continuous plating, and line plating.

Metal Type Insights:

- Gold

- Zinc

- Platinum

- Copper

- Nickel

- Chromium

- Others

The report has provided a detailed breakup and analysis of the market based on the metal type. This includes gold, zinc, platinum, copper, nickel, chromium, and others.

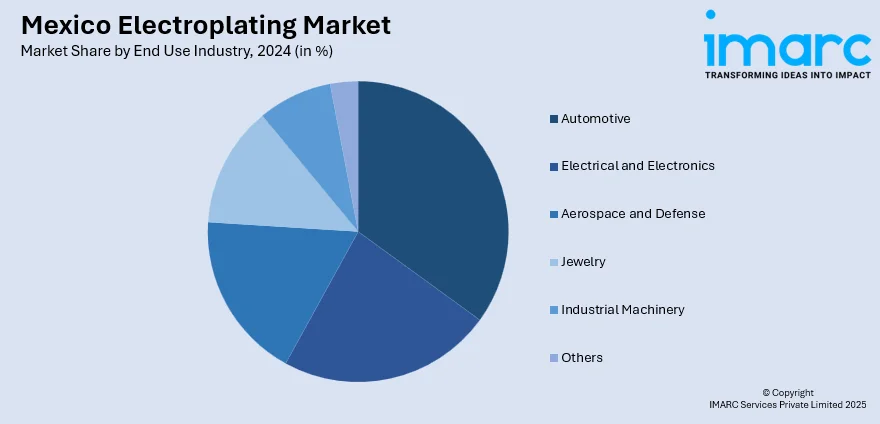

End Use Industry Insights:

- Automotive

- Electrical and Electronics

- Aerospace and Defense

- Jewelry

- Industrial Machinery

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes automotive, electrical and electronics, aerospace and defense, jewelry, industrial machinery, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Electroplating Market News:

- April 2025: MacDermid Enthone Industrial Solutions invested in RM Plating, a metal finishing company in Irapuato, Mexico. The partnership enhances plating efficiency, quality, and innovation. This development boosts Mexico's electroplating market by advancing technology and supporting diverse industries, including automotive and power distribution.

- March 2025: Hendor launched the HRC system for silver reclamation directly at the rinse tank, offering a highly efficient plate-out process. With a reclaim rate of up to 20g/h, this innovation reduces costs for electroplating companies, boosting efficiency and supporting sustainable practices in the electroplating market.

Mexico Electroplating Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Barrel Plating, Rack Plating, Continuous Plating, Line Plating |

| Metal Types Covered | Gold, Zinc, Platinum, Copper, Nickel, Chromium, Others |

| End Use Industries Covered | Automotive, Electrical and Electronics, Aerospace and Defense, Jewelry, Industrial Machinery, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico electroplating market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico electroplating market on the basis of type?

- What is the breakup of the Mexico electroplating market on the basis of metal type?

- What is the breakup of the Mexico electroplating market on the basis of end use industry?

- What is the breakup of the Mexico electroplating market on the basis of region?

- What are the various stages in the value chain of the Mexico electroplating market?

- What are the key driving factors and challenges in the Mexico electroplating market?

- What is the structure of the Mexico electroplating market and who are the key players?

- What is the degree of competition in the Mexico electroplating market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico electroplating market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico electroplating market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico electroplating industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)