Mexico Elevator and Escalator Market Size, Share, Trends and Forecast by Type, Service, End Use, and Region, 2025-2033

Mexico Elevator and Escalator Market Overview:

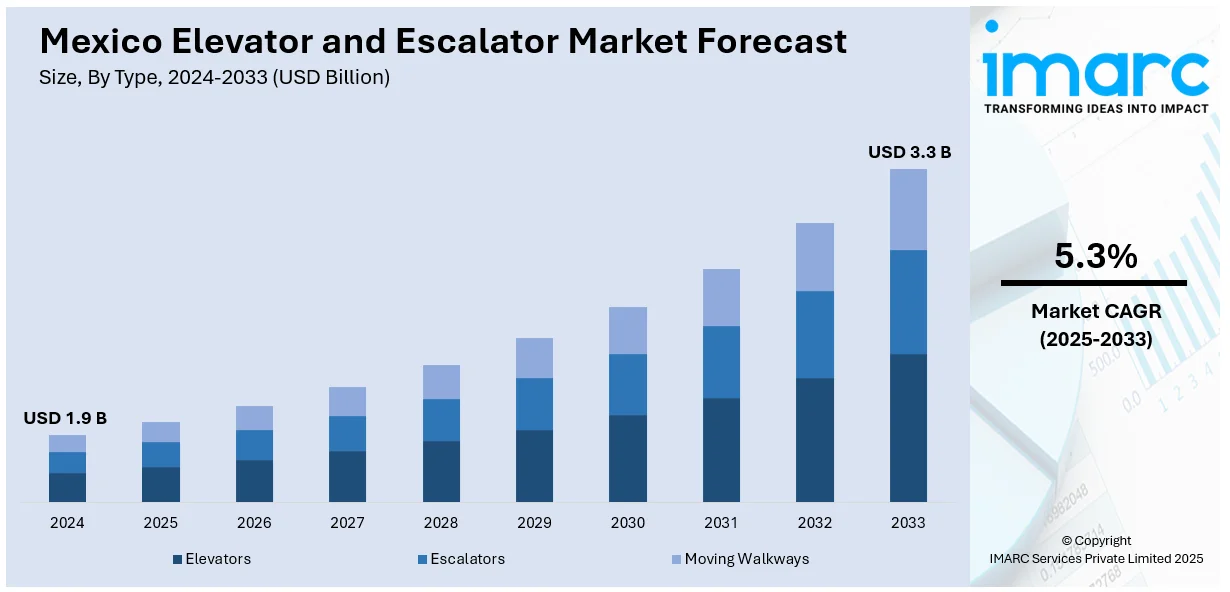

The Mexico elevator and escalator market size reached USD 1.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.3 Billion by 2033, exhibiting a growth rate (CAGR) of 5.3% during 2025-2033. The market is fueled by rapid urbanization, growing commercial and residential development, and government investment in infrastructure. Expanding demand for intelligent, energy-saving vertical transportation systems and upgrading old equipment in urban areas coupled with growing safety standards and accessibility demands further accelerates market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.9 Billion |

| Market Forecast in 2033 | USD 3.3 Billion |

| Market Growth Rate 2025-2033 | 5.3% |

Mexico Elevator and Escalator Market Trends:

Urbanization and Smart City Development

Urbanization in Mexico is gaining momentum, especially in cities such as Mexico City, Guadalajara, and Monterrey. This expansion is driving the need for high-rise residential, commercial, and mixed-use buildings, which directly contributes to the Mexico elevator and escalator market growth. Moreover, the governmental initiative toward smart city development is promoting the adoption of intelligent building systems, where elevators and escalators are fitted with smart controls, predictive maintenance, and energy-saving technologies. Developers and managers are preferring the vertical transportation systems that enhance user experience and operational efficiency. These intelligent systems enable real-time monitoring, minimize downtime, and prolong equipment lifespan, thereby being the preference in new developments. Urbanization and densification of the population are also likely to continue pushing this trend, making Mexico a developing market for technology-intensive vertical mobility solutions.

Existing Infrastructure Modernization

Most of Mexico's elevators and escalators, especially in older commercial and public buildings, are outdated and inefficient. This has led to a strong trend in modernization and retrofitting projects. Building owners are replacing or updating legacy installations to keep up with today's safety standards, energy efficiency requirements, and user demands. Stricter government building codes and regulations have also been put in place, which has spurred compliance-related upgrades, and helped in shaping the Mexico elevator and escalator market outlook. Moreover, new-generation systems provide advanced functions, such as destination control and touchless operation, which have grown in popularity since the COVID-19 pandemic. This is enhancing the reliability and safety of installed equipment while also developing business possibilities for maintenance and service companies. As sustainability is also a priority area, upgrading to energy-efficient versions contributes to environmental objectives while saving on costs of operation, making modernization a viable and strategic investment in the Mexican market.

Tourism and Commercial Infrastructure Expansion

Tourism and hospitality business in the country is a major impetus for the expansion of Mexico elevator and escalator market share. Mexico's tourism sector is seeing growth, with a noted 15.5% rise in visitors for 2024. In accordance with this trend, President Claudia Sheinbaum has launched Plan Mexico, a detailed initiative designed to position Mexico as the fifth most-visited country globally by 2030. The strategy emphasizes boosting tourism marketing, upgrading infrastructure, and elevating the attractiveness of both popular and up-and-coming destinations nationwide. As the government continues to invest in airports, hotels, shopping malls, and entertainment facilities, there is a greater demand for vertical transportation efficiency. Travel destinations such as Cancun, Los Cabos, and Riviera Maya are experiencing a hotel-building boom, with airports and transportation nodes nationwide expansion and modernization. Such projects demand sophisticated escalators and elevators to handle large volumes of passengers efficiently and safely. In addition, nearshoring-driven foreign direct investment in commercial property and logistics facilities is driving demand for freight lifts and industrial elevators. Suppliers and manufacturers that emphasize durability, design, and customization in high-traffic settings are particularly well-poised to take advantage of this demand.

Mexico Elevator and Escalator Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, service, and end use.

Type Insights:

- Elevators

- Escalators

- Moving Walkways

The report has provided a detailed breakup and analysis of the market based on the type. This includes elevators, escalators, and moving walkways.

Service Insights:

- New Installation

- Maintenance and Repair

- Modernization

The report has provided a detailed breakup and analysis of the market based on the service. This includes new installation, maintenance and repair, and modernization.

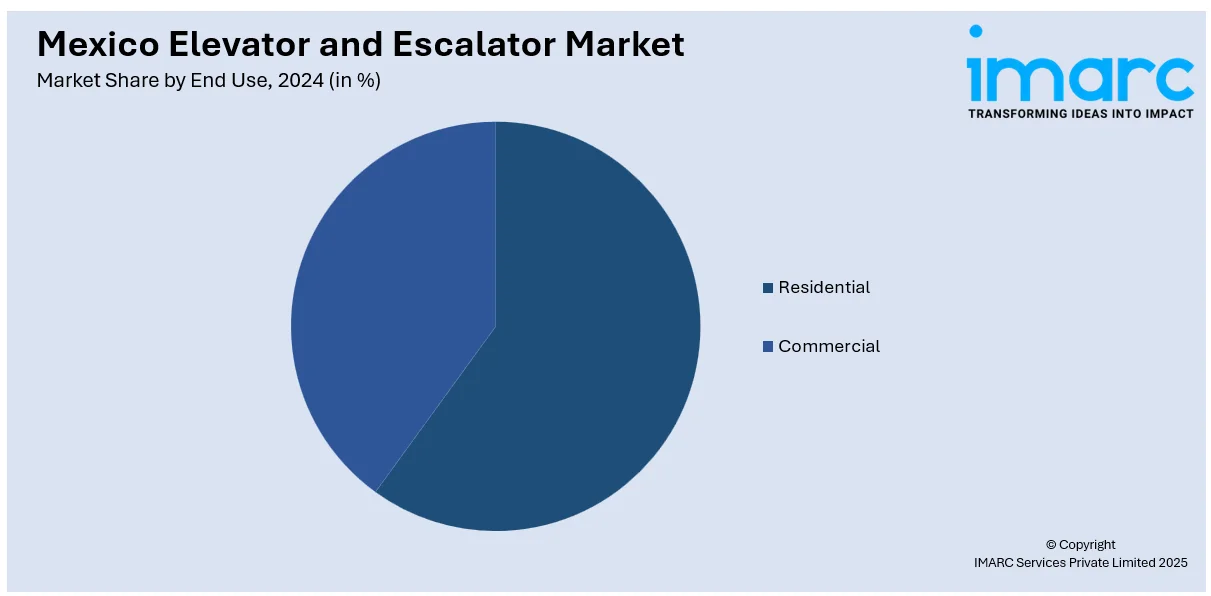

End Use Insights:

- Residential

- Commercial

- Offices

- Hospitality

- Mixed Block

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes residential and commercial (offices, hospitality, mixed block, and others).

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Elevator and Escalator Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Elevators, Escalators, Moving Walkways |

| Services Covered | New Installation, Maintenance and Repair, Modernization |

| End Uses Covered |

|

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico and Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico elevator and escalator market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico elevator and escalator market on the basis of type?

- What is the breakup of the Mexico elevator and escalator market on the basis of service?

- What is the breakup of the Mexico elevator and escalator market on the basis of end use?

- What is the breakup of the Mexico elevator and escalator market on the basis of region?

- What are the various stages in the value chain of the Mexico elevator and escalator market?

- What are the key driving factors and challenges in the Mexico elevator and escalator market?

- What is the structure of the Mexico elevator and escalator market and who are the key players?

- What is the degree of competition in the Mexico elevator and escalator market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico elevator and escalator market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico elevator and escalator market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico elevator and escalator industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)