Mexico Endoscopy Devices Market Size, Share, Trends and Forecast by Type, Application, End Use, and Region, 2025-2033

Mexico Endoscopy Devices Market Overview:

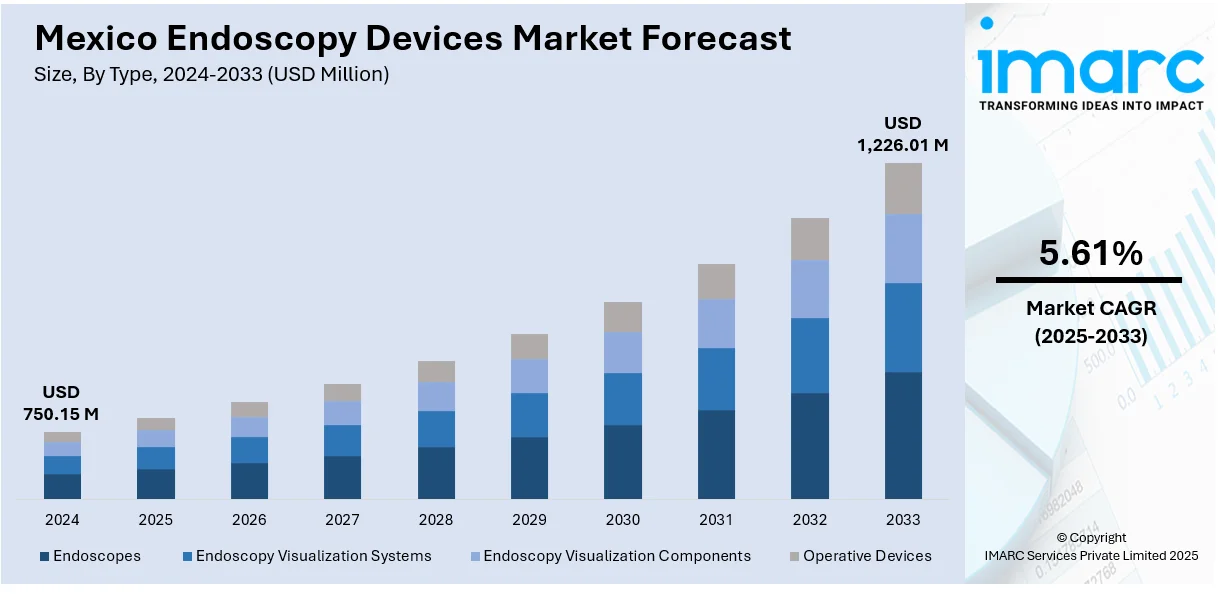

The Mexico endoscopy devices market size reached USD 750.15 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,226.01 Million by 2033, exhibiting a growth rate (CAGR) of 5.61% during 2025-2033. The growing incidence of gastrointestinal (GI) diseases and other chronic illnesses, increasing modernization of healthcare infrastructure, and demographic shifts, particularly the aging population, which is more susceptible to conditions requiring endoscopic intervention are expanding the Mexico endoscopy devices market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 750.15 Million |

| Market Forecast in 2033 | USD 1,226.01 Million |

| Market Growth Rate 2025-2033 | 5.61% |

Mexico Endoscopy Devices Market Trends:

Increasing Prevalence of Gastrointestinal and Chronic Disorders

The Mexico market is growing as the incidence of gastrointestinal (GI) diseases and other chronic illnesses continues to increase. Physicians are diagnosing more cases of colorectal cancer, irritable bowel syndrome (IBS), ulcers, and gastrointestinal bleeding, which need frequent endoscopic examinations for diagnosis, treatment, and follow-up. The increasing occurrence of obesity, poor dietary habits, and a sedentary lifestyle is driving the prevalence of such disorders among various age groups. Advanced endoscopic solutions are being embraced by healthcare professionals to facilitate minimally invasive (MI) diagnosis, thereby decreasing patients' hospital stay and recovery time. Hospitals and clinics are also increasing their gastroenterology departments to meet the growing patient volumes, thus driving the demand for flexible and rigid endoscopes, imaging systems, and endoscopic accessories. Moreover, government health initiatives and private sector efforts are encouraging early screening and awareness, further driving procedural volumes and device usage throughout the nation. In 2024, Olympus Latin America announced that it introduced Mexican healthcare professionals to the new generation EVIS X1™ endoscopy system at a launch event in Mexico City. Olympus Latin America gave physicians, nurses and biomedical engineers at the event hands-on demonstrations of Olympus' latest endoscopy system.

Advancing Healthcare Infrastructure and Medical Technology Adoption

Mexican healthcare infrastructure is being updated and modernized, which is impelling the Mexico endoscopy devices market growth. Private and public hospitals continue to invest in technologically sophisticated endoscopic devices to increase diagnostic power and better clinical outcomes. As medical centers broaden their portfolios of services, they are also expanding purchases of high-definition video endoscopes, robotic endoscopy systems, and intelligent imaging technology. Demographic expansion in Mexico's large cities is driving the need for well-equipped hospitals and specialty clinics, where endoscopy is becoming a routine diagnostic and therapeutic intervention. Health authorities and private investors are also developing partnerships and public–private partnerships to construct new medical centers and enhance access to services in poor areas. With stepped-up healthcare expenditures, medical staff training, and more focus on patient safety, medical centers are giving greater importance to the incorporation of minimally invasive endoscopy, thus fueling the upward trend of the market. In 2025, the government improved the production of medical supplies by 15% and invested US$2 billion in annual investments for clinical research initiatives.

Growing Geriatric Population and Increasing Health Awareness

The Mexico market is propelled by demographic shifts, particularly the aging population, which is more susceptible to conditions requiring endoscopic intervention. As life expectancy rises and the proportion of elderly individuals increases, healthcare systems are observing higher demand for screening and treatment of age-related diseases such as colorectal cancer, esophageal disorders, and urological complications. Older adults are undergoing routine checkups more frequently, and physicians are recommending endoscopic procedures to ensure timely and accurate diagnosis. Concurrently, public awareness about preventive healthcare and early disease detection is gaining momentum. Media campaigns, community health programs, and educational outreach are informing the population about the benefits of endoscopy for early diagnosis, which is crucial for improving treatment outcomes and reducing healthcare costs. As awareness continues to spread and healthcare-seeking behavior improves among both urban and rural populations, demand for endoscopy devices is steadily increasing across various care settings in Mexico.

Mexico Endoscopy Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, application, and end use.

Type Insights:

- Endoscopes

- Endoscopy Visualization Systems

- Endoscopy Visualization Components

- Operative Devices

The report has provided a detailed breakup and analysis of the market based on the type. This includes endoscopes, endoscopy visualization systems, endoscopy visualization components, and operative devices.

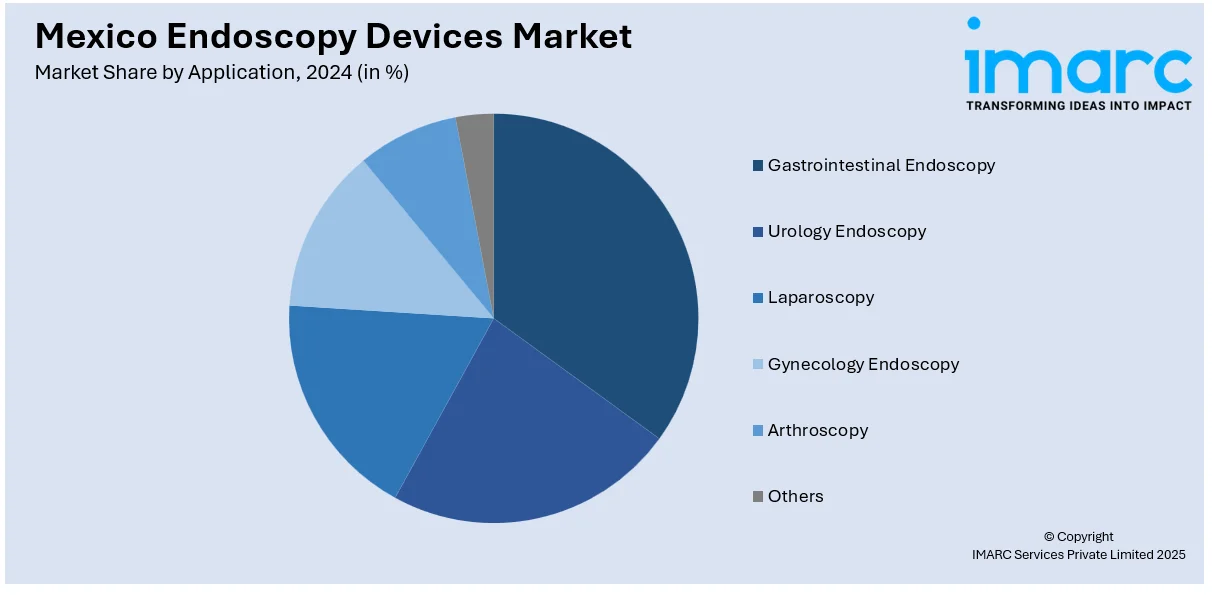

Application Insights:

- Gastrointestinal Endoscopy

- Urology Endoscopy

- Laparoscopy

- Gynecology Endoscopy

- Arthroscopy

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes gastrointestinal endoscopy, urology endoscopy, laparoscopy, gynecology endoscopy, arthroscopy, and others.

End Use Insights:

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes hospitals and clinics, ambulatory surgical centers, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Endoscopy Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Endoscopes, Endoscopy Visualization Systems, Endoscopy Visualization Components, Operative Devices |

| Applications Covered | Gastrointestinal Endoscopy, Urology Endoscopy, Laparoscopy, Gynecology Endoscopy, Arthroscopy, Others |

| End Uses Covered | Hospitals and Clinics, Ambulatory Surgical Centers, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico endoscopy devices market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico endoscopy devices market on the basis of type?

- What is the breakup of the Mexico endoscopy devices market on the basis of application?

- What is the breakup of the Mexico endoscopy devices market on the basis of end use?

- What is the breakup of the Mexico endoscopy devices market on the basis of region?

- What are the various stages in the value chain of the Mexico endoscopy devices market?

- What are the key driving factors and challenges in the Mexico endoscopy devices market?

- What is the structure of the Mexico endoscopy devices market and who are the key players?

- What is the degree of competition in the Mexico endoscopy devices market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico endoscopy devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico endoscopy devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico endoscopy devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)