Mexico Endpoint Security Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, Vertical, and Region, 2026-2034

Mexico Endpoint Security Market Summary:

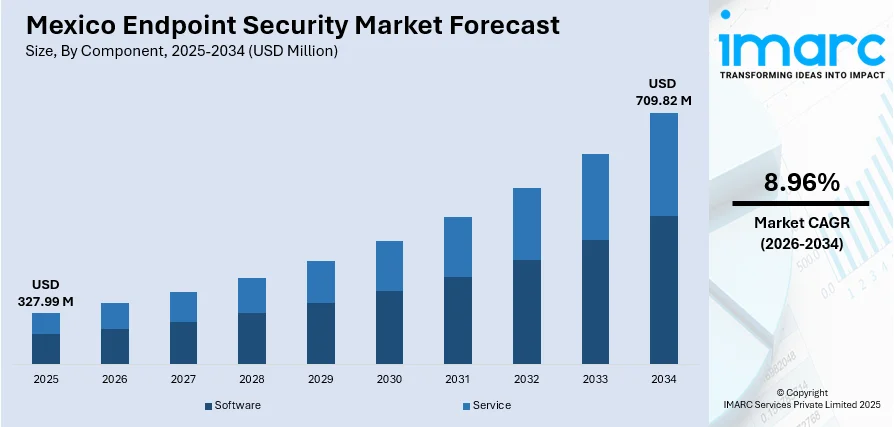

The Mexico endpoint security market size was valued at USD 327.99 Million in 2025 and is projected to reach USD 709.82 Million by 2034, growing at a compound annual growth rate of 8.96% from 2026-2034.

The Mexico endpoint security market growth is driven by the rising cyber threat cases, with the country accounting for the majority of cyberattacks in the Latin American region. The convergence of digital transformation initiatives, widespread adoption of remote and hybrid work models, and stringent regulatory compliance requirements is fundamentally reshaping enterprise security strategies. Organizations across key verticals are prioritizing endpoint protection solutions to safeguard critical infrastructure, protect sensitive data assets, and maintain operational continuity, thereby contributing to the market growth.

Key Takeaways and Insights:

- By Component: Software dominates the market with a share of 68% in 2025, driven by the comprehensive protection capabilities offered by endpoint protection platforms, advanced threat detection algorithms, and seamless integration with existing enterprise security infrastructure.

- By Deployment Mode: On-premises leads the market with a share of 62% in 2025, owing to data sovereignty requirements, regulatory compliance mandates in sensitive sectors, and organizational preferences for maintaining direct control over security infrastructure.

- By Organization Size: Large enterprises represent the largest segment with a market share of 60% in 2025. This dominance is because of substantial cybersecurity budgets, dedicated security operations centers, and comprehensive endpoint protection requirements across geographically distributed operations.

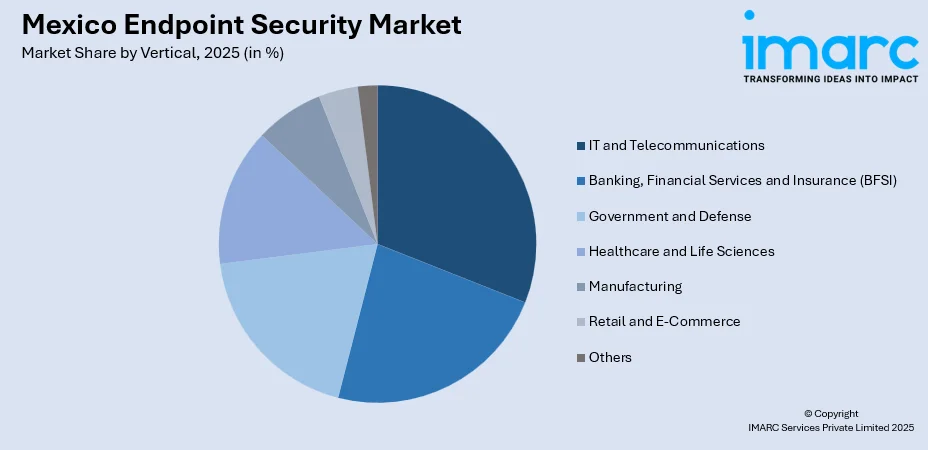

- By Vertical: IT and telecommunications dominate the market with a share of 18% in 2025, due to the sector's critical infrastructure status, high-value data assets requiring protection, and accelerated digital transformation initiatives across telecommunications networks.

- Key Players: The Mexico endpoint security market exhibits moderate competitive intensity, with multinational cybersecurity corporations competing alongside regional managed security service providers across enterprise and SME segments.

To get more information on this market Request Sample

The Mexico endpoint security market is primarily driven by the increasing frequency and sophistication of cyberattacks targeting endpoint devices. As organizations implement remote work policies and expand their digital infrastructure, the attack surface for cybercriminals grows, driving the need for advanced endpoint protection. Stricter government regulations and data privacy laws further encourages businesses to adopt compliant security measures to safeguard sensitive information. The growing use of cloud services, mobile devices, and Internet of Things (IoT) technologies also requires comprehensive endpoint security solutions to mitigate new vulnerabilities. Additionally, rising awareness about cybersecurity risks, alongside the demand for real-time threat detection and response, significantly contributes to the market growth. In 2025, Mexico established the General Directorate of Cybersecurity within the newly created Digital Transformation and Telecommunications Agency (ATDT). This division is tasked with securing the country’s digital assets and government platforms, aiming to strengthen Mexico’s technological sovereignty and protect against escalating digital threats, underscoring the increasing importance of robust cybersecurity measures.

Mexico Endpoint Security Market Trends:

Rising Cybersecurity Threats and Attacks

The increasing frequency and advanced nature of cyber threats, including sophisticated ransomware and targeted phishing campaigns, are catalyzing the demand for endpoint security solutions in Mexico. As malicious actors increasingly exploit vulnerable endpoint devices organizations are investing in comprehensive security measures to safeguard their networks and sensitive data. This critical need for defense is being addressed through strategic national initiatives. In 2025, Kyndryl announced a partnership with the Government of Mexico to enhance national cybersecurity capabilities. This collaboration involves training 1000 individuals in cybersecurity fundamentals through a rigorous twenty-week program which directly supports Mexico's digital transformation and reinforces the ability of organizations to deploy and manage robust endpoint protection solutions.

Expansion of Digital Payment Systems

The swift growth of digital payment systems in Mexico is driving the need for robust endpoint security solutions. As an increasing number of individuals and businesses adopt online payment platforms and mobile wallets, these endpoints become prime targets for cybercriminals seeking sensitive financial data. Comprehensive endpoint security is therefore essential for protecting transactional integrity at point-of-sale (POS) systems and mobile devices. This necessity is particularly acute for the SME segment. In 2025 fintech company tapi launched tapipay a platform designed to enhance digital payments for small and medium-sized enterprises in Mexico. By leveraging sophisticated corporate infrastructure and integrating AI to automate collections this service accelerates the transition to digital payments which inherently heightens the need for advanced endpoint protection to safeguard transactions against fraud and data breaches.

Increased Use of Cloud Services and Digital Transformation

The growing dependency on cloud services and pervasive digital transformation initiatives are driving the demand for endpoint security solutions in Mexico. As organizations migrate operations to the cloud and integrate new digital tools, securing the endpoints connected to these environments becomes paramount to prevent unauthorized access and data exfiltration. The provision of robust cloud infrastructure is a key enabler. In 2024 Google Cloud announced the opening of its 41st cloud region in Querétaro Mexico offering faster more reliable cloud services to local and international entities. This strategic deployment focused on low-latency high-performance infrastructure accelerates digital transformation while simultaneously underscoring the critical need for integrated endpoint security solutions to comprehensively safeguard digital assets within the rapidly expanding cloud ecosystem.

Market Outlook 2026-2034:

The Mexico endpoint security market shows strong growth potential due to rising cyber threats and evolving enterprise security needs. The market generated a revenue of USD 327.99 Million in 2025 and is projected to reach a revenue of USD 709.82 Million by 2034, growing at a compound annual growth rate of 8.96% from 2026-2034. This growth is driven by increasing adoption of security solutions to protect endpoints from sophisticated cyber-attacks, alongside heightened awareness about the importance of robust cybersecurity measures.

Mexico Endpoint Security Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Component | Software | 68% |

| Deployment Mode | On-premises | 62% |

| Organization Size | Large Enterprises | 60% |

| Vertical | IT and Telecommunications | 18% |

Component Insights:

- Software

- Service

Software dominates with a market share of 68% of the total Mexico endpoint security market in 2025.

Software represents the largest segment due to the growing reliance of organizations on advanced solutions to protect devices against evolving cyber threats. This tool provides continuous monitoring, automated threat detection, and rapid response capabilities, making it essential for securing modern digital environments.

The flexibility and scalability of software-based security further strengthen its position, allowing businesses to integrate new features, apply updates quickly, and adapt to changing risks. As digital transformation accelerates, software remains the preferred choice for enhancing endpoint protection across diverse industries.

Deployment Mode Insights:

- On-premises

- Cloud-based

On-premises leads with a market share of 62% of the total Mexico endpoint security market in 2025.

On-premises dominates the market, as many organizations prioritize direct control over their security infrastructure. This model allows businesses to manage sensitive data internally, maintain strict governance, and customize security settings based on specific operational or regulatory requirements.

It is also preferred by sectors with heightened compliance needs, as on-premises offers predictable performance, dedicated resources, and reduced dependence on external networks. This approach supports organizations seeking higher assurance, greater visibility, and tightly managed protection across their endpoint environments.

Organization Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

Large enterprises exhibit a clear dominance with a 60% share of the total Mexico endpoint security market in 2025.

Large enterprises hold the biggest market share because they manage extensive device networks and large volumes of sensitive data, requiring advanced protection measures. Their complex operations demand robust security solutions capable of addressing diverse threats and ensuring strong governance across all endpoints.

These organizations also have greater financial and technical resources, enabling investment in comprehensive security platforms, dedicated IT teams, and continuous monitoring capabilities. As digital transformation accelerates, large enterprises prioritize endpoint security to safeguard operations, maintain business continuity, and meet growing regulatory expectations.

Vertical Insights:

Access the comprehensive market breakdown Request Sample

- Banking, Financial Services and Insurance (BFSI)

- IT and Telecommunications

- Government and Defense

- Healthcare and Life Sciences

- Manufacturing

- Retail and E-Commerce

- Others

IT and telecommunications dominate with a market share of 18% of the total Mexico endpoint security market in 2025.

IT and telecommunications dominate the market, driven by their ability to operates large, interconnected networks that require strong protection against frequent and sophisticated cyber threats. These companies prioritize advanced endpoint tools to safeguard infrastructure, customer data, and service reliability. The growing digitalization, cloud adoption, and expansion of mobile services further increase security needs across the sector.

Furthermore, the dominance of the IT and telecommunications sector, which heavily prioritizes advanced endpoint protection to safeguard its large, interconnected networks against sophisticated cyber threats, is underpinned by its significant operational presence, as highlighted by DENUE 2025 data showing 9,630 registered economic units in Telecommunications.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico is experiencing strong economic growth, particularly in manufacturing and logistics, which drives the demand for robust endpoint security solutions. The region’s proximity to the US also fosters technological innovation and encourages businesses to adopt advanced cybersecurity measures.

Central Mexico, home to major business hubs like Mexico City, benefits from rapid digital transformation. The region’s growing focus on innovation and technology adoption leads to an increasing need for endpoint security to safeguard corporate data and maintain operational continuity.

Southern Mexico is witnessing a gradual increase in technology adoption, driven by government and private sector initiatives. As digital infrastructure improves, businesses in the region are increasingly investing in endpoint security to protect against evolving cyber threats and ensure secure growth.

Others are benefiting from expanding digital access and the growing cybersecurity awareness. As more businesses adopt digital tools, there is a rise in the demand for endpoint security solutions, ensuring that organizations in underserved areas can safeguard their operations and data.

Market Dynamics:

Growth Drivers:

Why is the Mexico Endpoint Security Market Growing?

Rising Adoption of Managed Security Services (MSS)

The increasing reliance on managed security services (MSS) is a major contributor to the growth of the Mexico endpoint security market. Organizations facing difficulty in managing complex and evolving cybersecurity demands are increasingly outsourcing endpoint security to third-party providers. MSSPs offer specialized expertise, round-the-clock monitoring, and incident response capabilities, allowing businesses to focus on their core operations while ensuring that their endpoints are protected against emerging threats. The Mexico managed security services market size reached USD 426.0 Million in 2024, as per the IMARC Group, demonstrating the scale of investment in external security expertise. The demand for outsourced endpoint security management is accelerating the market as businesses seek cost-effective and efficient security solutions.

Growing Adoption of Remote Work and Bring Your Own Device (BYOD) Policies

The transition towards remote and hybrid work models coupled with the integration of bring your own device (BYOD) policies is significantly influencing the Mexico endpoint security market. As personnel access organizational networks using diverse devices outside the conventional perimeter, the risk exposure increases substantially. Securing these numerous endpoints is critical to protecting sensitive corporate data irrespective of user location or device. The growing market for flexible work arrangements underscores this trend. In 2024 Spaces announced the opening of a new 1300-square-meter coworking center in Torres Obispado Monterrey Latin America's tallest skyscraper. This expansion reflects the heightened demand for hybrid office solutions driven by nearshoring and flexible work patterns consequently necessitating robust endpoint security platforms to ensure data protection and regulatory compliance across a decentralized workforce.

Regulatory Compliance Requirements

Governments and regulatory bodies in Mexico are implementing stricter cybersecurity requirements that mandate organizations to protect endpoint devices against breaches, driving substantial investments in compliant security solutions. The increasing regulatory pressure, particularly concerning critical infrastructure protection, necessitates a unified and systematic approach to digital defense at the device level. The unveiling of Mexico's National Cybersecurity Plan 2025–2030 in 2025 is a key example of this strategic shift. This comprehensive, transversal plan aims to unify the country’s fragmented digital defense mechanisms and includes the imminent publication of a General Cybersecurity Policy. Such policies are encouraging the adoption of advanced endpoint security platforms, such as endpoint detection and response (EDR) and extended detection and response (XDR), to ensure adherence and enhance national cyber resilience.

Market Restraints:

What Challenges the Mexico Endpoint Security Market is Facing?

Severe Shortage of Cybersecurity Professionals Limiting Implementation Capacity

Mexico’s cybersecurity landscape is hindered by a pronounced shortage of qualified professionals, limiting organizations’ ability to deploy and maintain strong endpoint security systems. Many businesses struggle to build internal teams capable of managing threats, conducting monitoring, and ensuring continuous protection. This shortage heightens operational risks, increases dependency on external service providers, and raises overall security costs as companies compete for scarce talent while trying to meet growing cybersecurity demands.

High Implementation Costs Constraining Adoption Among Smaller Organizations

The financial burden associated with adopting advanced endpoint security solutions poses a substantial challenge for many organizations in Mexico. Smaller businesses, in particular, face difficulty allocating sufficient budget for licensing, integration, training, and ongoing monitoring requirements. These costs often delay or prevent adoption, leaving smaller enterprises more vulnerable to cyber risks. Limited financial flexibility further restricts their ability to upgrade systems, implement comprehensive safeguards, or pursue long-term security enhancements.

Limited Federal Cybersecurity Budget Constraining Public Sector Investments

Federal investment in cybersecurity remains insufficient to support broad modernization across public institutions, slowing the adoption of advanced endpoint protection technologies. Budgetary constraints limit the ability of agencies to upgrade legacy systems, strengthen digital defenses, or expand security programs. This restrictive funding environment dampens overall market momentum and contributes to ongoing vulnerabilities within public operations, while also influencing how private organizations prioritize their own cybersecurity investments.

Competitive Landscape:

The Mexico endpoint security market exhibits moderate competitive intensity characterized by the presence of multinational cybersecurity corporations alongside regional managed security service providers competing across enterprise segments and distribution channels. Global platform vendors dominate large-enterprise accounts through comprehensive product portfolios and established brand recognition. Regional managed security service providers are gaining traction by offering localized support, Spanish-language services, and customized solutions aligned with Mexican regulatory requirements. The competitive landscape is increasingly shaped by strategic partnerships, AI-powered innovation, and platformization strategies as vendors seek to deliver integrated endpoint-to-network security capabilities.

Mexico Endpoint Security Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Service |

| Deployment Modes Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Verticals Covered | Banking, Financial Services and Insurance (BFSI), IT and Telecommunications, Government and Defense, Healthcare and Life Sciences, Manufacturing, Retail and E-Commerce, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico endpoint security market size was valued at USD 327.99 Million in 2025.

The Mexico endpoint security market is expected to grow at a compound annual growth rate of 8.96% from 2026-2034 to reach USD 709.82 Million by 2034.

The software segment dominated the Mexico endpoint security market with a share of approximately 68% in 2025, driven by comprehensive protection capabilities, AI-powered threat detection, and seamless integration with existing enterprise security infrastructure.

Key factors driving the Mexico endpoint security market include the growing reliance on cloud services and digital transformation, which require robust endpoint security solutions. In 2024, Google Cloud launched its 41st cloud region in Querétaro, providing faster, reliable services and highlighting the need for robust endpoint security in cloud environments.

Mexico endpoint security market faces major hurdles due to a severe cybersecurity talent shortage, high implementation costs for smaller organizations, and limited federal investment. These constraints slow adoption, increase vulnerabilities, and restrict both public and private sectors from fully strengthening their security capabilities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)