Mexico Energy Efficient HVAC Systems Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

Mexico Energy Efficient HVAC Systems Market Overview:

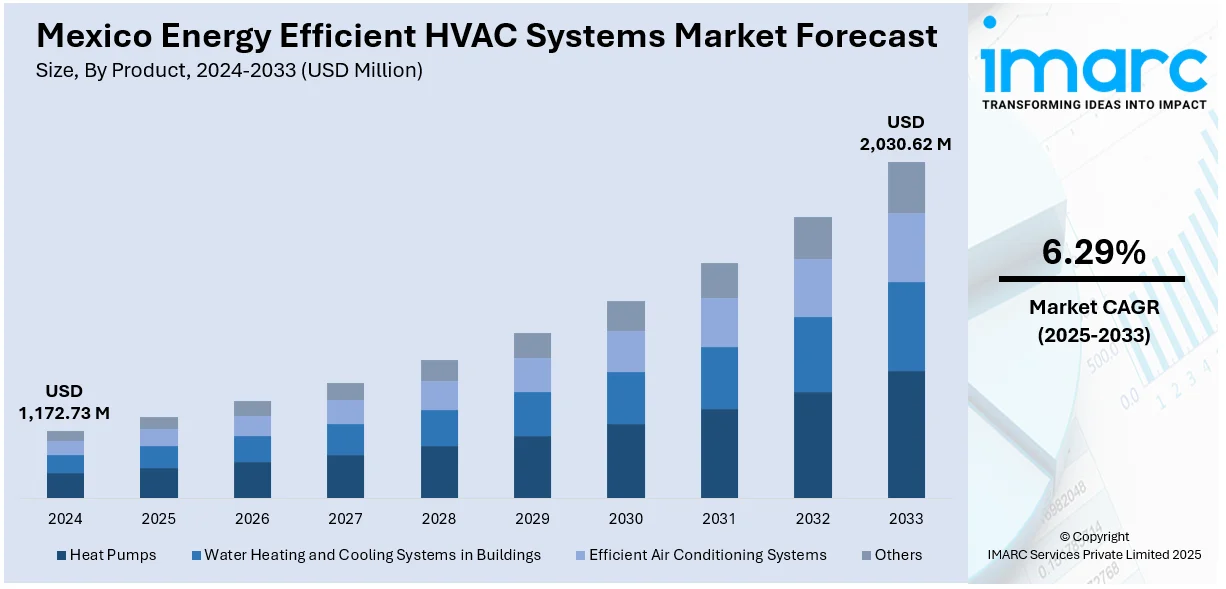

The Mexico energy efficient HVAC systems market size reached USD 1,172.73 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,030.62 Million by 2033, exhibiting a growth rate (CAGR) of 6.29% during 2025-2033. Government incentives, urbanization, and industrial expansion are encouraging the adoption of sustainable HVAC technologies in Mexico. Rising electricity tariffs and environmental regulations further boost the shift toward efficient systems. These factors collectively contribute to increasing demand and strengthen the Mexico energy efficient HVAC systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,172.73 Million |

| Market Forecast in 2033 | USD 2,030.62 Million |

| Market Growth Rate 2025-2033 | 6.29% |

Mexico Energy Efficient HVAC Systems Market Trends:

Urban Redevelopment and Smart Building Integration

Northern Mexico frequently experiences extreme temperatures above 40°C, contributing to the installation of approximately 1 million HVAC systems annually, according to industry reports. With air conditioner installations projected to grow by 7% from 2024 to 2032 (AHR Expo Mexico), there is increasing pressure to adopt smarter, more energy-efficient HVAC solutions. This surge aligns with Mexico’s urban redevelopment initiatives, which emphasize smart building technologies to curb rising energy demands. Modern developments in cities like Mexico City, Monterrey, and Guadalajara are incorporating intelligent HVAC systems equipped with occupancy sensors, real-time monitoring, and demand-based cooling. These systems enhance operational efficiency and reduce energy costs, playing a crucial role in advancing Mexico energy efficient HVAC systems market growth across high-density urban areas.

Growth in Green Construction and LEED-Certified Projects

The rise of green construction in Mexico, particularly projects seeking LEED certification, is influencing HVAC design and procurement decisions. Developers aiming for environmental credentials are increasingly selecting HVAC systems that meet or exceed ASHRAE and other international energy efficiency standards. Projects across office complexes, hotels, healthcare facilities, and universities are prioritizing systems that deliver high Seasonal Energy Efficiency Ratios (SEER) and incorporate natural refrigerants. HVAC manufacturers are responding by offering modular, scalable solutions that meet stringent building codes and sustainability goals. For instance, in January 2024, LG Electronics launched a new scroll compressor production line in Monterrey, Nuevo León, to enhance its HVAC supply chain across North America. This move addresses logistical challenges and aligns with sustainability goals. The Gen 3 Scroll Compressors produced there support upcoming 2025 refrigerant regulations with low-GWP refrigerants (<700). LG aims to boost regional responsiveness, reduce energy waste, and meet eco-efficiency standards.

Mexico Energy Efficient HVAC Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on product and application.

Product Insights:

- Heat Pumps

- Water Heating and Cooling Systems in Buildings

- Efficient Air Conditioning Systems

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes heat pumps, water heating and cooling systems in buildings, efficient air conditioning systems, and others.

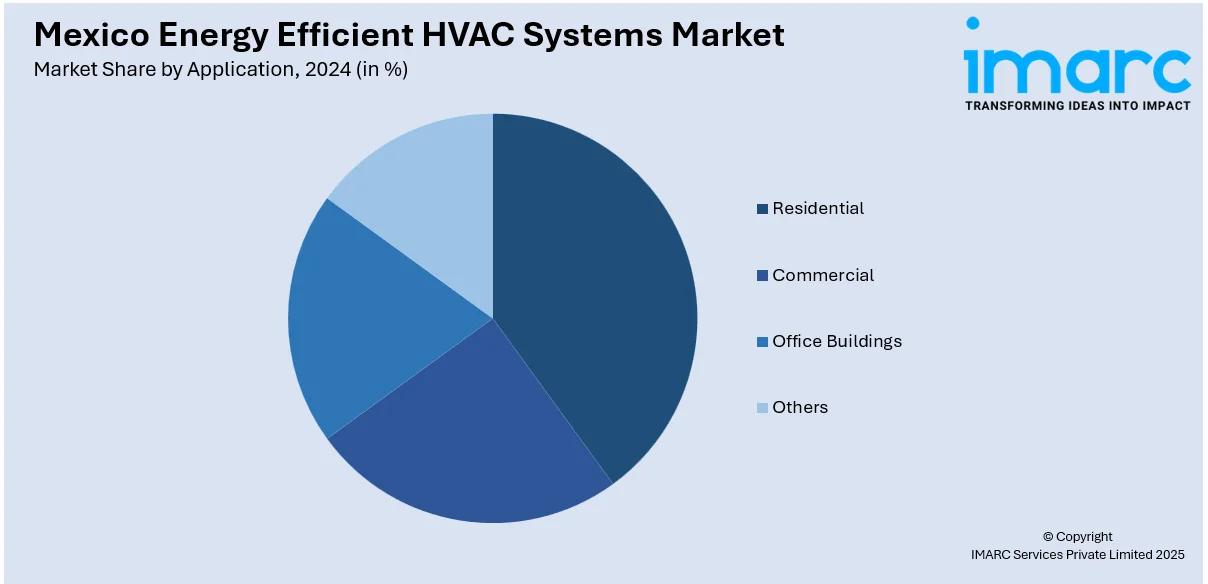

Application Insights:

- Residential

- Commercial

- Office Buildings

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential, commercial, office buildings, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Energy Efficient HVAC Systems Market News:

- In February 2025, Samsung launched a cutting-edge HVAC training center in Santa Catarina, Nuevo Leon, aimed at certifying technicians in refrigerant handling, automation, and control. The center also creates employment opportunities for migrant workers returning from the U.S. This initiative supports Mexico’s growing demand for skilled HVAC professionals amid rising cooling needs and sustainability goals.

- In January 2025, Mojave Energy Systems expanded its HVAC operations into Latin America, focusing on 60Hz markets like Mexico, Central America, and the Caribbean. The move supports demand for affordable, energy-efficient cooling with its patented ArctiDry liquid desiccant system, which cuts electricity use by up to 50%.

- In July 2024, Bosch acquired Johnson Controls’ global residential and light commercial HVAC business, including a full stake in the Johnson Controls-Hitachi joint venture, in an $8 billion deal. The acquisition boosts Bosch’s Home Comfort division revenue to €9 Billion and adds brands like York, Coleman, and Hitachi. With over 26,000 employees and operations in 30+ countries, the move strengthens Bosch’s global HVAC presence and supports energy-efficient technology expansion amid a projected 40% HVAC market growth by 2030.

- In June 2024, Alliance Air, a Daikin Applied subsidiary, announced a USD 121 Million investment in a new energy-efficient HVAC facility in Tijuana, Mexico. The 460,000 sq. ft. plant will create over 1,150 permanent jobs and support demand from North America’s data center market. Production begins in mid-2025, focusing on custom cooling solutions with high sustainability performance. This move strengthens Daikin’s regional presence, driving Mexico energy efficient HVAC systems market growth.

Mexico Energy Efficient HVAC Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Heat Pumps, Water Heating and Cooling Systems in Buildings, Efficient Air Conditioning Systems, Others |

| Applications Covered | Residential, Commercial, Office Buildings, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico energy efficient HVAC systems market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico energy efficient HVAC systems market on the basis of product?

- What is the breakup of the Mexico energy efficient HVAC systems market on the basis of application?

- What is the breakup of the Mexico energy efficient HVAC systems market on the basis of region?

- What are the various stages in the value chain of the Mexico energy efficient HVAC systems market?

- What are the key driving factors and challenges in the Mexico energy efficient HVAC systems market?

- What is the structure of the Mexico energy efficient HVAC systems market and who are the key players?

- What is the degree of competition in the Mexico energy efficient HVAC systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico energy efficient HVAC systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico energy efficient HVAC systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico energy efficient HVAC systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)