Mexico Engine Oils Market Size, Share, Trends and Forecast by Grade, Sales Channel, Engine Type, Vehicle Type, and Region, 2025-2033

Mexico Engine Oils Market Overview:

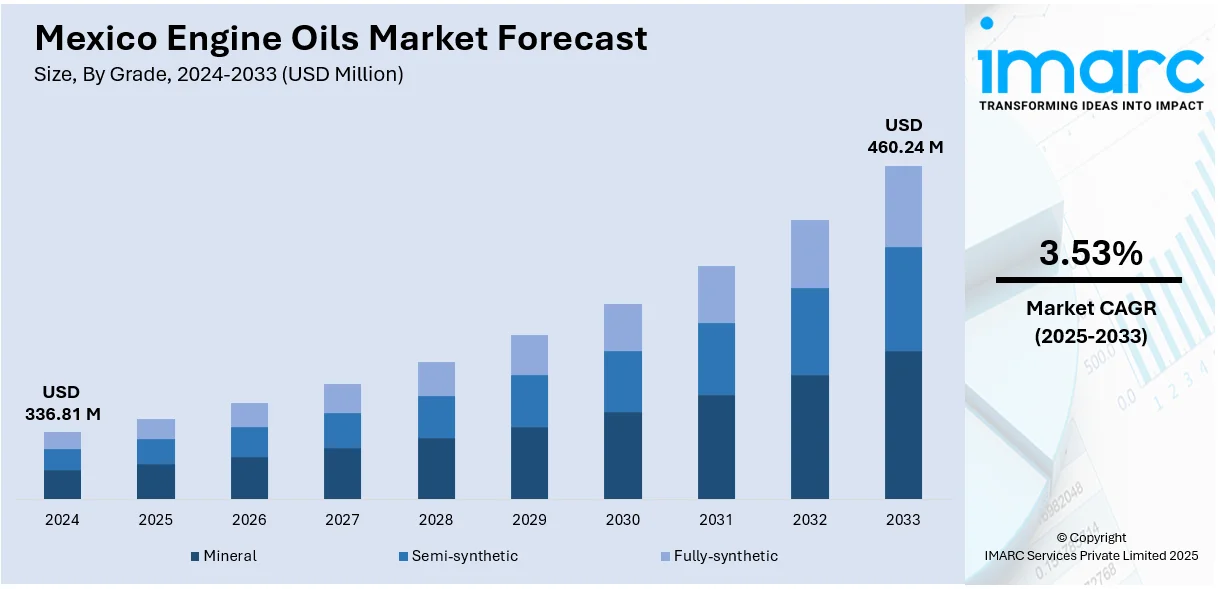

The Mexico engine oils market size reached USD 336.81 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 460.24 Million by 2033, exhibiting a growth rate (CAGR) of 3.53% during 2025-2033. The market is driven by the growing automotive sector, increasing vehicle ownership, and rising demand for high-performance lubricants. Urban expansion and improved road infrastructure support regular vehicle maintenance, while the shift toward synthetic oils continues to shape product preferences. These dynamics collectively influence the evolving landscape of the Mexico engine oils market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 336.81 Million |

| Market Forecast in 2033 | USD 460.24 Million |

| Market Growth Rate 2025-2033 | 3.53% |

Mexico Engine Oils Market Analysis:

- Major Market Drivers: Mexico's expanding automotive manufacturing sector and rising vehicle ownership rates drive substantial demand for engine oils. The Mexico engine oils market forecast indicates continued growth supported by urbanization, improved disposable incomes, and infrastructure development. Fleet expansion across commercial and personal transportation segments creates sustained lubricant consumption patterns throughout the country's diverse regional markets.

- Key Market Trends: The market outlook shows increasing consumer preference for synthetic and semi-synthetic lubricants over conventional mineral oils. Advanced formulations meeting stricter OEM specifications gain market acceptance. Service networks expand accessibility while environmental awareness promotes longer drain intervals. Premium product positioning strengthens as technology-conscious consumers prioritize engine protection and fuel efficiency benefits.

- Competitive Landscape: Major international lubricant manufacturers dominate the Mexican market through established distribution networks and brand recognition. Local players compete on pricing and regional access. The market growth benefits from strategic partnerships between global suppliers and domestic service chains. Competition intensifies as companies diversify product portfolios addressing specific vehicle segments and applications.

- Challenges and Opportunities: The market is facing threats from volatile crude prices, counterfeit products, and stricter environmental regulations. However, rising Mexico engine oils market demand, driven by expanding vehicle ownership and industrial growth, creates opportunities for synthetic and eco-friendly formulations that enhance engine performance, ensure sustainability, and strengthen long-term market competitiveness.

Mexico Engine Oils Market Trends:

Expanding Automotive Industry and Vehicle Ownership

Mexico's growing automotive industry significantly boosts the demand for engine oils. The country has become a key manufacturing hub for both domestic use and export, attracting global automakers and part suppliers. The demand for both original and aftermarket lubricants rises as vehicle production increases. Rising personal incomes and more people moving to cities have caused a growth in personal vehicle ownership in cities. More vehicles on the road require regular use of engine oil for proper car care. Because of this vehicle increase and continued manufacturing, people in Mexico use countless different lubricants in both personal and business vehicles.

To get more information on this market, Request Sample

Growing Preference for Synthetic and High-Performance Oils

Mexican consumers and service centers are increasingly opting for synthetic and semi-synthetic engine oils due to their extended drain intervals, better fuel efficiency, and superior engine protection. As vehicles become more advanced, the demand for high-performance lubricants that meet strict OEM requirements is rising. Synthetic oils are especially popular in newer vehicles and under harsh driving conditions common in urban areas. This shift is also driven by increasing awareness among consumers regarding the benefits of synthetic oils in terms of engine longevity and environmental impact. Additionally, service providers and workshops are promoting premium lubricants to boost service value and customer satisfaction, making synthetic oil adoption a strong market driver across both personal and fleet vehicles, supporting the positive Mexico engine oils market outlook.

Presence of a Strong Aftermarket Service Network

Mexico has a well-developed automotive aftermarket that plays a critical role in engine oil distribution and consumption, which is further driving the Mexico engine oils market growth. Independent repair shops, service centers, dealerships, and quick lube chains are widely spread across the country, making oil changes and maintenance accessible to a broad population. These outlets serve both private vehicle owners and fleet operators, ensuring continuous lubricant consumption. The aftermarket also promotes product awareness and brand loyalty through targeted marketing, discounts, and bundled maintenance services. With many vehicle owners choosing to maintain their cars beyond warranty periods, aftermarket providers become key touchpoints for regular engine oil sales. This widespread and competitive network enhances product availability, supports a variety of lubricant options, and sustains demand throughout the vehicle lifecycle.

Mexico Engine Oils Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on grade, sales channel, engine type, and vehicle type.

Grade Insights:

- Mineral

- Semi-synthetic

- Fully-synthetic

The report has provided a detailed breakup and analysis of the market based on the grade. This includes mineral, semi-synthetic, and fully-synthetic.

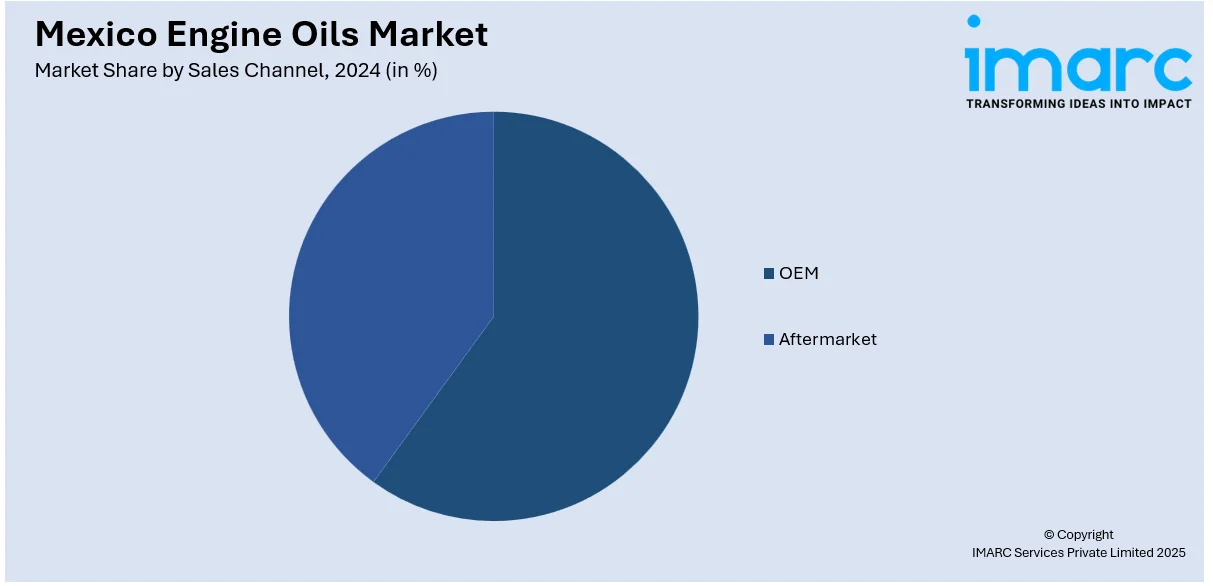

Sales Channel Insights:

- OEM

- Aftermarket

A detailed breakup and analysis of the market based on sales channel have also been provided in the report. This includes OEM and aftermarket.

Engine Type Insights:

- Gasoline

- Diesel

A detailed breakup and analysis of the market based on the engine type have also been provided in the report. This includes gasoline and diesel.

Vehicle Type Insights:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Two Wheelers

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger cars, light commercial vehicles, heavy commercial vehicles, and two wheelers.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Engine Oils Market News:

- April 2025: Valvoline partnered with Mexican distributor RIMSA to expand its presence across six key states, including Veracruz and Mexico City. The collaboration will broaden access to Valvoline’s full range of premium motor oils, transmission fluids, and gear oils, leveraging RIMSA’s extensive network to accelerate the brand’s growth in Mexico.

Mexico Engine Oils Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Grades Covered | Mineral, Semi-synthetic, Fully-synthetic |

| Sales Channels Covered | OEM, Aftermarket |

| Engine Types Covered | Gasoline, Diesel |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Two Wheelers |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico engine oils market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico engine oils market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico engine oils industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The engine oils market in Mexico was valued at USD 336.81 Million in 2024.

The Mexico engine oils market is projected to exhibit a CAGR of 3.53% during 2025-2033, reaching a value of USD 460.24 Million by 2033.

The market is driven by expanding automotive industry, increasing vehicle ownership, rising demand for synthetic oils, urban expansion, improved infrastructure, growing aftermarket networks, and enhanced consumer awareness regarding engine maintenance and performance optimization needs across diverse vehicle segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)