Mexico Engineering Plastics Market Size, Share, Trends and Forecast by Type, Performance Parameter, Application, and Region, 2025-2033

Mexico Engineering Plastics Market Overview:

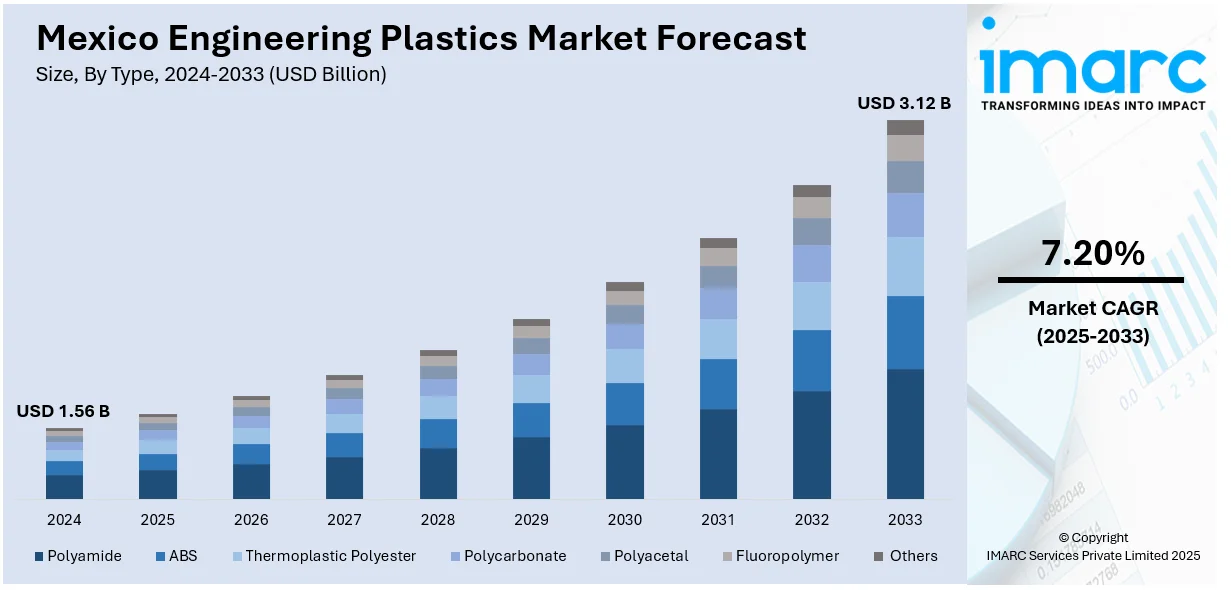

The Mexico engineering plastics market size reached USD 1.56 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.12 Billion by 2033, exhibiting a growth rate (CAGR) of 7.20% during 2025-2033. Mexico's automotive industry growth, usage of lightweight plastics in electric vehicles, and growth in consumer electronics manufacturing are driving the demand for high-tech plastics. Further, the focus on sustainable and recyclable engineering plastics is propelling the market. Government schemes, recycling processes, and green manufacturing processes are a few drivers boosting the Mexico engineering plastics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.56 Billion |

| Market Forecast in 2033 | USD 3.12 Billion |

| Market Growth Rate 2025-2033 | 7.20% |

Mexico Engineering Plastics Market Trends:

Strong Growth in Automotive and Consumer Electronics Sectors

Mexico’s automotive industry, one of the largest in the world, continues to drive significant demand for engineering plastics. With automakers increasingly focused on reducing vehicle weight to meet fuel efficiency and emissions standards, high-performance polymers such as polyamide, polycarbonate, and polypropylene are being extensively used in components like dashboards, under-the-hood parts, and exterior body panels. In particular, the use of lightweight, durable materials in electric vehicle (EV) production is seeing a rapid rise, as these vehicles require innovative plastic solutions to balance performance, energy consumption, and sustainability. The demand for devices such as smartphones, laptops, and home appliances has led to a greater need for high-performance plastics that provide strength, heat resistance, and design flexibility.

On March 25, 2025, Nefab Group, a Sweden-based packaging company, announced the opening of a 58,000-square-foot facility in Zapopan, near Guadalajara, effectively doubling its manufacturing capacity in Mexico. The new site will produce thin-gauge thermoformed sustainable plastic packaging tailored for the data communications, electronics, and automotive industries. This expansion reinforces Mexico’s role as a key manufacturing hub for eco-efficient plastics and supports growing demand for industrial packaging solutions aligned with circular economy goals. Advances in plastic formulations allow for thinner, more resilient components, enabling manufacturers to achieve sleek designs without compromising on durability or functionality. These factors, especially in automotive and electronics, are key contributors to Mexico engineering plastics market growth as industries prioritize advanced material solutions for performance and sustainability.

Growing Emphasis on Sustainability and Circular Economy Initiatives

As global demand for sustainable materials increases, Mexico is seeing a rise in the adoption of bio-based and recyclable engineering plastics. Several companies in the region are exploring the use of post-consumer recycled plastics and renewable polymers to meet growing sustainability expectations from both consumers and regulatory bodies. This shift is in response to global pressure to reduce plastic waste and curb reliance on petroleum-based materials. Industry leaders are collaborating with government bodies to establish recycling infrastructure and support the development of eco-friendly plastic alternatives, further aligning with the global circular economy trend. Additionally, the Mexican government’s environmental policies, particularly those aimed at reducing the carbon footprint of manufacturing, are encouraging industries to integrate more sustainable materials in their production processes. This includes offering incentives for manufacturers that adopt greener solutions, such as reduced emissions and energy-efficient production practices. The combination of consumer demand for greener products and legislative incentives has propelled the shift towards eco-conscious engineering plastics in Mexico.

On February 13, 2025, Asahi Kasei Plastics Mexico (APMX) announced its participation in PLASTIMAGEN® MÉXICO 2025, to be held in Mexico City from March 11–14 at Booth #460. APMX showcased its portfolio of high-performance engineering plastics, including LEONA™, XYRON™, TENAC™, Thermylon®, and Thermylene®, alongside initiatives focused on sustainable and recyclable materials aimed at advancing circular economy practices. The event underscores APMX's strategic engagement in the Mexican market, targeting industries seeking durable, lightweight, and environmentally responsible polymer solutions. As businesses increasingly focus on environmental compliance, these trends contribute to Mexico engineering plastics market growth, driving the demand for more sustainable and recyclable solutions.

Mexico Engineering Plastics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, performance parameter, and application.

Type Insights:

- Polyamide

- ABS

- Thermoplastic Polyester

- Polycarbonate

- Polyacetal

- Fluoropolymer

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes polyamide, ABS, thermoplastic polyester, polycarbonate, polyacetal, fluoropolymer, and others.

Performance Parameter Insights:

- High Performance

- Low Performance

The report has provided a detailed breakup and analysis of the market based on the performance parameter. This includes high performance and low performance.

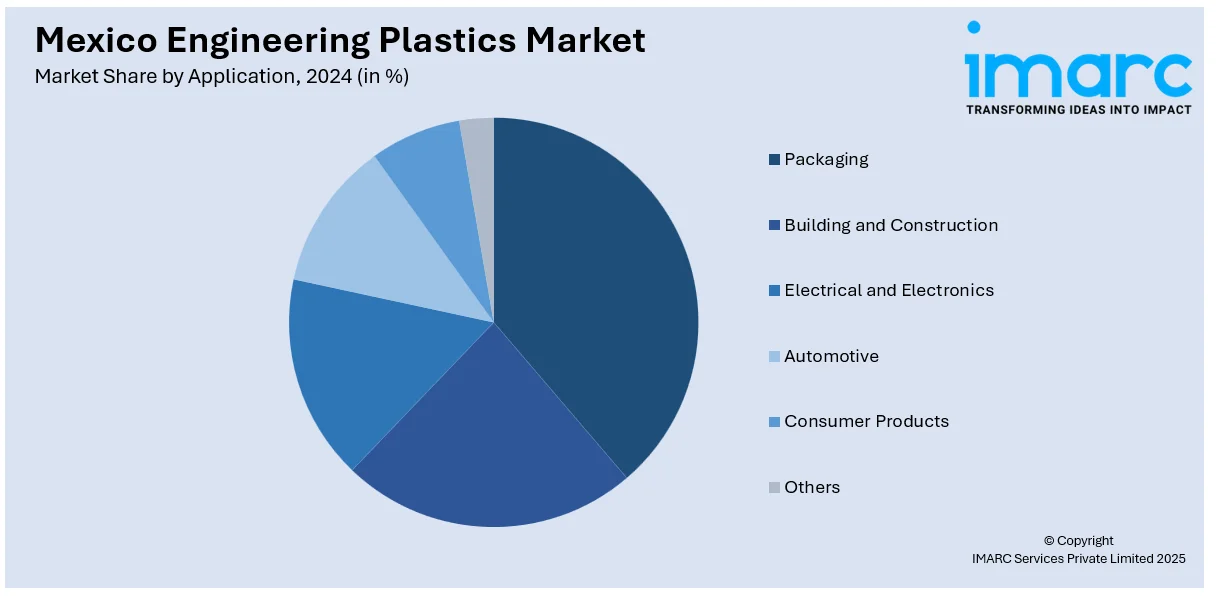

Application Insights:

- Packaging

- Building and Construction

- Electrical and Electronics

- Automotive

- Consumer Products

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes packaging, building and construction, electrical and electronics, automotive, consumer products, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has provided a comprehensive analysis of all major regional markets, including demand trends by type, performance parameter, and application. This includes Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Engineering Plastics Market News:

- On January 22, 2024, BASF announced that Polímeros Nacionales will serve as its exclusive distribution partner in Mexico for selected grades of engineering plastics, effective March 1, 2024. The distributed portfolio includes Ultramid® PA, Ultradur® PBT, Ultraform® POM, and recycled grades Nypel® PA6/PA66 and Petra® PET, aligning with BASF’s focus on high-performance materials and sustainability. This partnership enhances market access to BASF's advanced materials solutions in Mexico’s automotive, electronics, and industrial sectors.

Mexico Engineering Plastics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Polyamide, ABS, Thermoplastic Polyester, Polycarbonate, Polyacetal, Fluoropolymer, Others |

| Performance Parameters Covered | High Performance, Low Performance |

| Applications Covered | Packaging, Building and Construction, Electrical and Electronics, Automotive, Consumer Products, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico engineering plastics market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico engineering plastics market on the basis of type?

- What is the breakup of the Mexico engineering plastics market on the basis of performance parameter?

- What is the breakup of the Mexico engineering plastics market on the basis of application?

- What is the breakup of the Mexico engineering plastics market on the basis of region?

- What are the various stages in the value chain of the Mexico engineering plastics market?

- What are the key driving factors and challenges in the Mexico engineering plastics market?

- What is the structure of the Mexico engineering plastics market and who are the key players?

- What is the degree of competition in the Mexico engineering plastics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico engineering plastics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico engineering plastics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico engineering plastics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)