Mexico Enterprise Content Management Market Size, Share, Trends and Forecast by Component, Deployment Mode, Enterprise Size, End Use Industry, and Region, 2026-2034

Mexico Enterprise Content Management Market Summary:

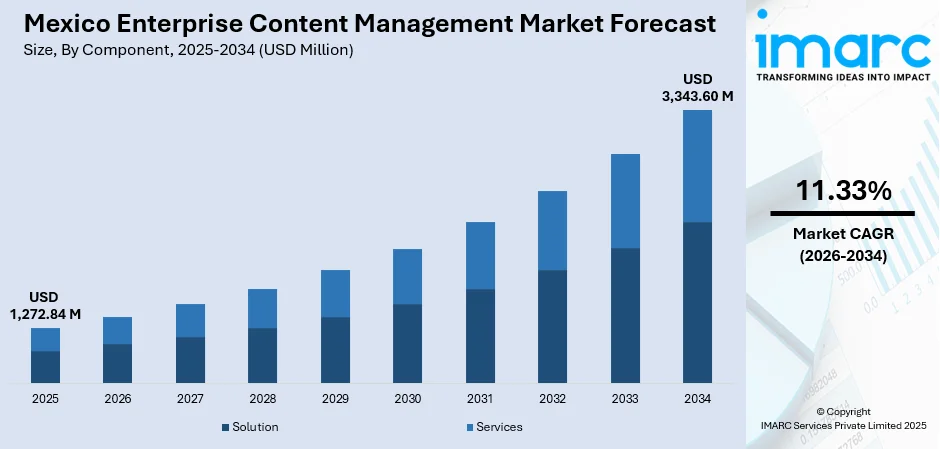

The Mexico enterprise content management market size was valued at USD 1,272.84 Million in 2025 and is projected to reach USD 3,343.60 Million by 2034, growing at a compound annual growth rate of 11.33% from 2026-2034.

The Mexico enterprise content management market growth is driven by accelerated digital transformation initiatives across industries, with enterprises increasingly adopting cloud-based content management solutions to enhance operational efficiency and regulatory compliance. The convergence of nearshoring activities, expanding hyperscale cloud infrastructure, and rising demand for intelligent document processing capabilities is fundamentally reshaping the competitive landscape and creating substantial opportunities for market participants, strengthening the market growth.

Key Takeaways and Insights:

- By Component: Solution dominates the market with a share of 71.98% in 2025, driven by the extensive deployment of document management systems, web content management platforms, and business process management tools across Mexican enterprises seeking comprehensive content lifecycle management capabilities.

- By Deployment Mode: Cloud-based represents the largest segment with a market share of 60.92% in 2025. This dominance is because of scalability advantages, cost efficiency, enhanced accessibility for remote workforces, and the establishment of hyperscale data center regions by major cloud providers.

- By Enterprise Size: Large enterprises lead the market with a share of 56.97% in 2025, due to their substantial IT infrastructure investments, complex content management requirements, and compliance-driven adoption of enterprise-grade document management platforms.

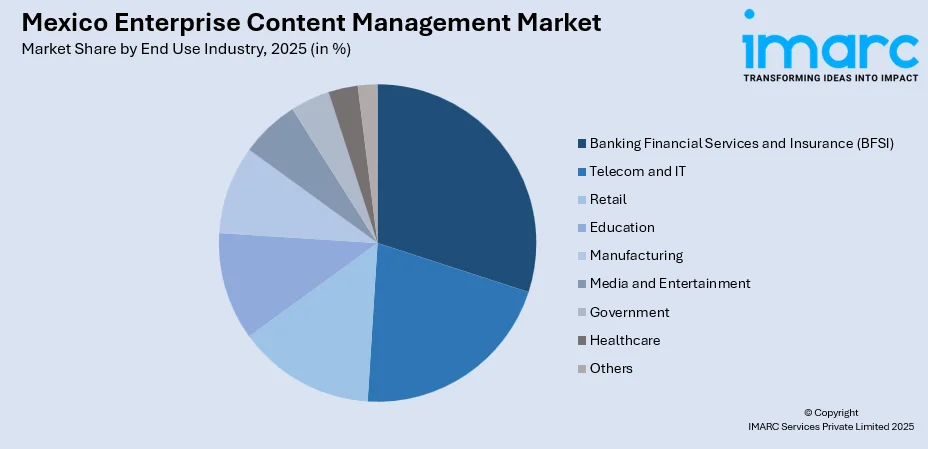

- By End Use Industry: Banking financial services and insurance (BFSI) dominates the market with a share of 18.98% in 2025, owing to stringent regulatory compliance requirements, digital banking transformation initiatives, and increasing demand for secure document management solutions.

- Key Players: The Mexico enterprise content management market shows moderate competitive intensity, with multinational technology corporations, specialized software providers, and regional system integrators competing to deliver comprehensive content services platforms. This diverse competition fosters innovation and helps meet the varied needs of businesses in the region.

To get more information on this market Request Sample

The growth of the Mexico enterprise content management market is driven by the critical necessity for businesses to effectively manage and govern ever-increasing volumes of digital content and data. As organizations accelerate their digital transformation initiatives, the requirement for robust enterprise content management solutions that optimize document management collaboration and workflow automation intensifies. These systems are indispensable for ensuring compliance with stringent regulatory requirements and upholding data security standards which are crucial for effective data governance and risk mitigation. This trend is significantly bolstered by advancements in cloud computing infrastructure. In 2024 Microsoft launched its first cloud data center region in Mexico located in Querétaro providing scalable and secure cloud services to both local and international organizations. This new data center directly supported enhanced digital transformation by offering improved latency and data residency options thus removing a key barrier to the adoption of sophisticated cloud-based enterprise content management solutions essential for operational efficiency and competitive advantage.

Mexico Enterprise Content Management Market Trends:

Cloud Infrastructure Expansion

The Mexico enterprise content management market is being propelled by significant investments in cloud infrastructure, enabling businesses to adopt scalable and efficient content solutions. As enterprises migrate their content management systems to the cloud, they gain benefits, such as enhanced scalability, improved collaboration, and reduced capital expenditures. A prime example is Amazon Web Services' (AWS) launch of its Mexico Central Region in Querétaro in January 2025, backed by a USD 5 billion investment. This expansion provides local cloud hosting, offering companies in Mexico greater access to advanced, reliable enterprise content management solutions and further accelerating the market's growth.

Growing Focus on Digital Skill Development

The increasing national commitment to digital skill enhancement and AI proficiency is driving the adoption of enterprise content management systems in Mexico, as businesses seek to leverage advanced technologies for improved efficiency and competitive advantage. These initiatives cultivate a technically skilled workforce capable of deploying and fully utilizing sophisticated enterprise content management solutions. The commitment is demonstrated by Microsoft’s 2024 announcement of a USD 1.3 billion investment in Mexico to enhance its AI infrastructure. This initiative aimed to train 5 million people through the Artificial Intelligence National Skills program. Such initiatives directly facilitate the comprehensive adoption and integration of enterprise content management systems across the country's business landscape by equipping the workforce with the necessary AI skills to efficiently manage and optimize content workflows, fostering digital transformation and improving operational efficiency.

Streamlined Workflow and Process Automation

The increasing need of businesses to automate routine content management tasks, including document approval and data entry, is bolstering the market growth. Enterprise content management systems facilitate the creation of automated workflows thereby minimizing manual intervention enhancing procedural consistency and significantly accelerating processing times. This critical capability to automate content-centric operations directly boosts operational efficiency and ensures timely and accurate task completion. The demand for such automation is underscored by the 2025 strategic partnership between SimplyAsk.ai and Axtel to introduce the no-code AI platform Symphona to the Mexican market. This collaboration specifically aims to automate workflows and business operations across over 300 enterprise accounts in key sectors like finance retail and logistics confirming the strong market preference for automated content processes.

Market Outlook 2026-2034:

The Mexico enterprise content management market shows strong growth potential, driven by accelerating digital transformation and the expanding availability of cloud infrastructure. The market generated a revenue of USD 1,272.84 Million in 2025 and is projected to reach a revenue of USD 3,343.60 Million by 2034, growing at a compound annual growth rate of 11.33% from 2026-2034. This growth is supported by the rising need for businesses to manage, store, and access content efficiently while leveraging cloud solutions for improved collaboration and scalability.

Mexico Enterprise Content Management Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Component | Solution | 71.98% |

| Deployment Mode | Cloud-based | 60.92% |

| Enterprise Size | Large Enterprises | 56.97% |

| End Use Industry | Banking Financial Services and Insurance (BFSI) | 18.98% |

Component Insights:

- Solution

- Document Management System (DMS)

- Web Content Management (WCM)

- Document-Centric Collaboration (DCC)

- Records Management

- Document Imaging

- Business Process Management (BPM)

- Others

- Services

- Professional

- Managed

Solution dominates with a market share of 71.98% of the total Mexico enterprise content management market in 2025.

Solution holds the biggest market share, as organizations require comprehensive platforms that centralize document handling, workflow automation, and compliance management. Solution streamlines operations, reduce manual processes, and support digital transformation efforts across industries seeking greater efficiency.

The widespread preference for comprehensive solution is reflected in its market dominance and the rapid expansion of related segments, such as the Mexico business process management market, which reached USD 191.7 Million in 2024, according to the IMARC Group. Additionally, solution offers scalability, integration capabilities, and advanced features like analytics and content classification, which appeal to businesses aiming to enhance productivity and secure information.

Deployment Mode Insights:

- On-premises

- Cloud-based

Cloud-based exhibits a clear dominance with a 60.92% share of the total Mexico enterprise content management market in 2025.

Cloud-based represents the largest segment owing to its ability to offer scalability, flexibility, and remote accessibility for organizations modernizing their operations. Businesses benefit from reduced dependence on physical infrastructure, faster implementation, and simplified system updates that support evolving digital workflows.

It is also preferred for its cost efficiency, as cloud models reduce upfront capital expenses and shift spending toward manageable subscription plans. Strong data backup capabilities, easier integration with other digital tools, and better support for distributed teams further strengthen the appeal of cloud-based enterprise content management in Mexico.

Enterprise Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

Large enterprises lead with a market share of 56.97% of the total Mexico enterprise content management market in 2025.

Large enterprises dominate the market, driven by their extensive operations generate large volumes of documents and digital content requiring structured management. These organizations prioritize advanced platforms that support compliance, workflow automation, and secure information handling across multiple departments.

Their larger budgets and established IT infrastructures also enable faster adoption of sophisticated solutions. Large enterprises invest heavily in digital transformation, seeking systems that improve collaboration, enhance decision-making, and streamline complex processes. This focus on digital transformation by large entities, which drives their adoption of enterprise content management systems for enhanced collaboration and streamlined processes, is exemplified by the strategic collaboration announced in 2025 between Veea Inc. and Viasat Mexico, which aims to accelerate digital transformation even in underserved Mexican communities.

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Telecom and IT

- Banking Financial Services and Insurance (BFSI)

- Retail

- Education

- Manufacturing

- Media and Entertainment

- Government

- Healthcare

- Others

Banking, financial services and insurance (BFSI) dominate with a market share of 18.98% of the total Mexico enterprise content management market in 2025.

BFSI leads the market because it handles extensive volumes of sensitive documents, transactions, and client records requiring strict organization and secure storage. Efficient content management supports regulatory compliance and improves operational accuracy across financial processes.

This sector also prioritizes digital transformation to enhance individual experience and streamline internal workflows. Enterprise content management systems help financial institutions automate document handling, reduce manual errors, and strengthen data governance, making them essential tools for supporting service delivery and maintaining competitive advantage.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico benefits from strong industrial activity, rising cross-border trade, and increasing technology adoption. The region’s expanding manufacturing base and the growing investment in digital infrastructure support steady demand for advanced enterprise solutions.

Central Mexico, home to major business and government centers, shows rapid digital transformation and strong enterprise technology uptake. Expanding corporate activity and improved connectivity drive sustained growth in modern content management and digital systems.

Southern Mexico is experiencing rising investment in infrastructure and emerging digital initiatives. Efforts to improve connectivity and support regional development encourage businesses to adopt modern enterprise technologies to enhance efficiency and competitiveness.

Others are gradually increasing technology adoption through improved access to digital tools and supportive local development programs. The growing awareness about digital transformation benefits is encouraging wider use of enterprise solutions across diverse industries.

Market Dynamics:

Growth Drivers:

Why is the Mexico Enterprise Content Management Market Growing?

Support for Remote and Hybrid Work Environments

The increasing adoption of remote and hybrid work structures is a crucial factor bolstering the market growth in Mexico. Organizations embracing flexible arrangements require robust systems for secure, centralized, and readily accessible content management to maintain operational continuity. Enterprise content management solutions ensure that geographically distributed employees can seamlessly access and share necessary documentation. The opening of a new 1300-square-meter coworking center by Spaces in the Torres Obispado skyscraper in Monterrey in 2024 exemplified this profound shift towards flexible workspaces in Mexico. This expansion confirms the strong market trend for hybrid models making sophisticated enterprise content management technology indispensable for safeguarding data security and sustaining high productivity within a decentralized working environment.

Increased Foreign Direct Investment (FDI)

The growth of Mexico enterprise content management market is significantly propelled by the increasing levels of foreign direct investment (FDI). As global corporations establish or expand operations within Mexico, there is a commensurate need for sophisticated systems to efficiently manage large volumes of documents and digital assets. This capital inflow fosters greater technological investment, specifically in enterprise content management solutions, to optimize workflows and enhance regulatory compliance. The latest report from the Economy Ministry (SE) shows that total FDI for the first six months of 2025 rose to nearly US $34.3 billion continuing a steady climb. This substantial financial commitment drives the necessity for advanced digital infrastructure and operational efficiency effectively accelerating the adoption and growth of the enterprise content management market.

Regulatory Compliance Requirements Driving Information Governance Investments

Stringent regulatory obligations across pivotal Mexican sectors such as financial services and healthcare necessitate the adoption of comprehensive information governance within content management strategies. Organizations are compelled to implement advanced enterprise content management solutions to manage detailed audit trails enforce strict retention policies and ensure compliance with anti-money laundering statutes. This focus on technology for compliance and security is evident, as in 2024 Citibanamex announced a 70% reduction in fraud attempts through the integration of AI into its operations. This AI-driven initiative directly underscores the need for sophisticated content and process management systems that not only strengthen the bank's security posture but also enhance its competitive position against emerging fintech companies.

Market Restraints:

What Challenges the Mexico Enterprise Content Management Market is Facing?

Limited Specialized Talent Pool for Advanced Implementation

Mexico faces a growing shortage of specialized professionals with the skills required to implement, integrate, and manage sophisticated enterprise content management platforms. Organizations often struggle to find experts in advanced document processing technologies, content services architectures, and AI applications. This talent gap can delay deployment timelines and hinder the optimization of content management solutions, creating challenges for businesses striving to stay competitive in the digital age.

Budget Constraints Among Small and Medium Enterprises

For small and medium-sized firms in Mexico, cost considerations are a significant barrier when it comes to adopting comprehensive content management solutions. The total cost of ownership, which includes licensing, implementation services, training, and ongoing maintenance, can be prohibitive for these organizations. With limited IT budgets, many businesses find it difficult to invest in modern content management systems despite recognizing the operational benefits they could bring to improve efficiency and scalability.

Legacy System Integration Complexity

Many local organizations are still reliant on outdated information systems that present considerable challenges when integrating modern content management capabilities. Compatibility issues with legacy infrastructure, the need for data migration, and necessary business process re-engineering efforts can extend project timelines and increase risks. These complexities may discourage businesses from adopting advanced content management systems, as they face the prospect of lengthy, costly, and technically challenging integration projects.

Competitive Landscape:

The Mexico enterprise content management market exhibits moderate competitive intensity characterized by the presence of multinational technology corporations alongside specialized content services providers competing across deployment models and industry verticals. Market dynamics reflect strategic positioning, ranging from comprehensive enterprise platforms emphasizing advanced integration capabilities and AI features to focused solutions targeting specific industry requirements. The competitive landscape is increasingly shaped by cloud platform availability, AI capabilities, partner ecosystem strength, and regional implementation expertise as organizations evaluate content management investments.

Mexico Enterprise Content Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Modes Covered | On-premises, Cloud-based |

| Enterprise Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| End Use Industries Covered | Telecom and IT, Banking Financial Services and Insurance (BFSI), Retail, Education, Manufacturing, Media and Entertainment, Government, Healthcare, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico enterprise content management market size was valued at USD 1,272.84 Million in 2025.

The Mexico enterprise content management market is expected to grow at a compound annual growth rate of 11.33% from 2026-2034 to reach USD 3,343.60 Million by 2034.

Solution dominates the market with a share of 71.98% in 2025, driven by comprehensive deployment of document management systems, web content management platforms, and business process management tools across enterprises in Mexico.

Key factors driving the Mexico enterprise content management market include investments in cloud infrastructure, offering scalable, efficient solutions. A notable instance is the launch of AWS's Mexico Central Region in Querétaro in January 2025, supported by a USD 5 billion investment, enhancing access to advanced enterprise content management solutions.

Major challenges include limited specialized talent pool for advanced implementation, budget constraints among small and medium enterprises, legacy system integration complexity, data security concerns, and the need for organizational change management during digital transformation initiatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)