Mexico eSIM Market Size, Share, Trends and Forecast by Type, Solution, Application, Industry Vertical, and Region, 2025-2033

Mexico eSIM Market Overview:

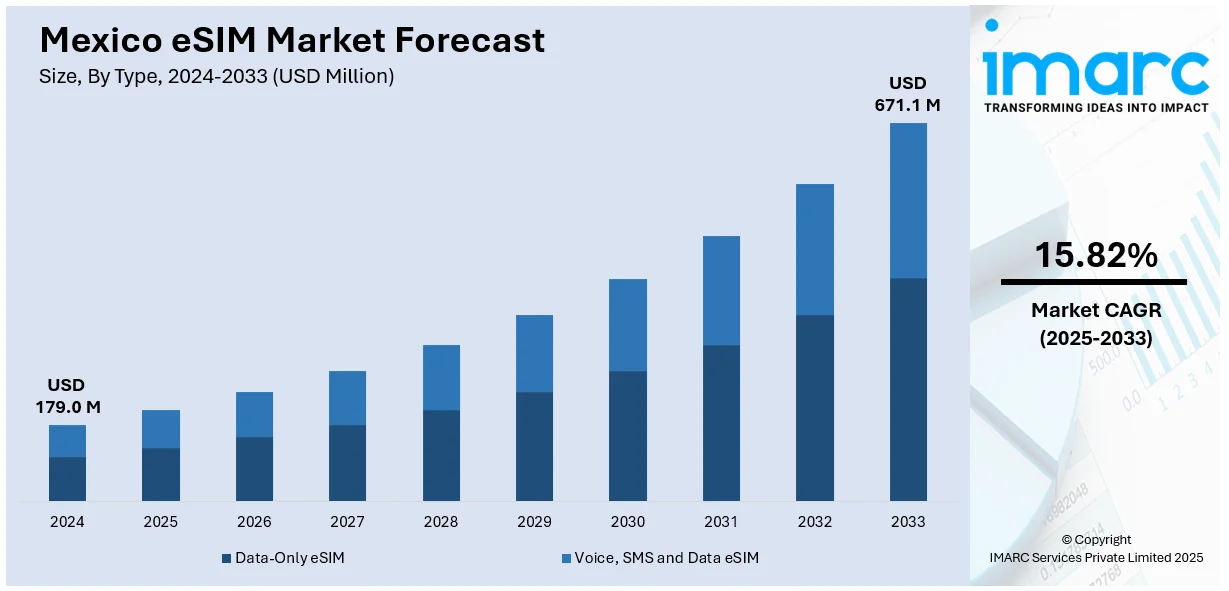

The Mexico eSIM market size reached USD 179.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 671.1 Million by 2033, exhibiting a growth rate (CAGR) of 15.82% during 2025-2033. The market is driven by the increasing smartphone penetration, growing demand from digital nomads and travelers, advancements in IoT applications, and shift toward remote SIM provisioning in consumer electronics, enhancing connectivity and user convenience.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 179.0 Million |

| Market Forecast in 2033 | USD 671.1 Million |

| Market Growth Rate 2025-2033 | 15.82% |

Mexico eSIM Market Trends:

Growing Smartphone and Wearable Penetration

The rise in smartphone and wearable device adoption in Mexico is a key driver of the eSIM market. As global tech brands increasingly integrate eSIM functionality into their devices, especially premium smartphones, smartwatches, and tablets, Mexican consumers are shifting toward these advanced technologies. According to industry reports, the smartphone is by far the most favored device for Internet access among Mexicans. Over 97% of internet users in Mexico access the web using their mobile devices. eSIMs eliminate the need for physical SIM cards, allowing users to switch networks, activate plans remotely, and maintain multiple profiles on one device. This appeals to tech-savvy consumers who prioritize convenience, flexibility, and a seamless user experience. With urbanization and increasing disposable income, the demand for eSIM-compatible devices is surging in metro cities like Mexico City, Guadalajara, and Monterrey. Additionally, as telecom operators improve their infrastructure and expand eSIM support, adoption becomes even more feasible. This symbiotic growth between consumer tech and telecom support is significantly creating a positive Mexico eSIM market outlook.

Rise in International Tourism and Digital Nomadism

Mexico's growing popularity as a tourist and remote work destination is fueling demand for flexible, borderless connectivity—something eSIMs are ideally positioned to offer. Tourists and digital nomads arriving in Mexico prefer eSIMs because they can avoid high roaming fees and switch to local data plans quickly without visiting a store or swapping physical SIMs. This convenience has become especially attractive to long-stay travelers and remote professionals looking for reliable internet on-the-go. Cities like Playa del Carmen and Mexico City have seen a surge in remote workers who rely on uninterrupted connectivity, often juggling work across multiple countries. eSIMs support this need by allowing easy carrier transitions and multi-network access. Mexican telecom providers are responding by offering competitive prepaid and travel eSIM packages, further fueling the Mexico eSIM market share. As global mobility increases, so does the demand for instant, flexible mobile solutions—positioning eSIMs as a go-to connectivity option in Mexico.

Support from Telecom Operators and Regulatory Advancements

Telecom operators in Mexico are increasingly integrating eSIM capabilities into their offerings, recognizing the technology's potential to reduce logistics costs and enhance customer experience. Major carriers like Telcel, AT&T Mexico, and Movistar now provide eSIM activation for a variety of devices, making it easier for users to switch to digital SIMs. This support is critical, as network compatibility and availability have historically been bottlenecks in eSIM adoption. Furthermore, favorable regulatory developments from the Federal Telecommunications Institute (IFT) have encouraged innovation and opened the door for broader implementation of eSIMs in consumer and enterprise sectors. Streamlined activation processes and the push toward digital identity solutions also align with eSIM capabilities, further boosting their relevance. By reducing dependency on physical infrastructure and simplifying mobile subscriptions, telecom providers are helping accelerate the eSIM ecosystem, fostering the Mexico eSIM market growth and enhancing customer retention through improved flexibility and digital-first service delivery.

Mexico eSIM Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, solution, application, and industry vertical.

Type Insights:

- Data-Only eSIM

- Voice, SMS and Data eSIM

The report has provided a detailed breakup and analysis of the market based on the type. This includes data-only eSIM and voice, SMS and data eSIM.

Solution Insights:

- Hardware

- Connectivity Services

A detailed breakup and analysis of the market based on the solution have also been provided in the report. This includes hardware and connectivity services.

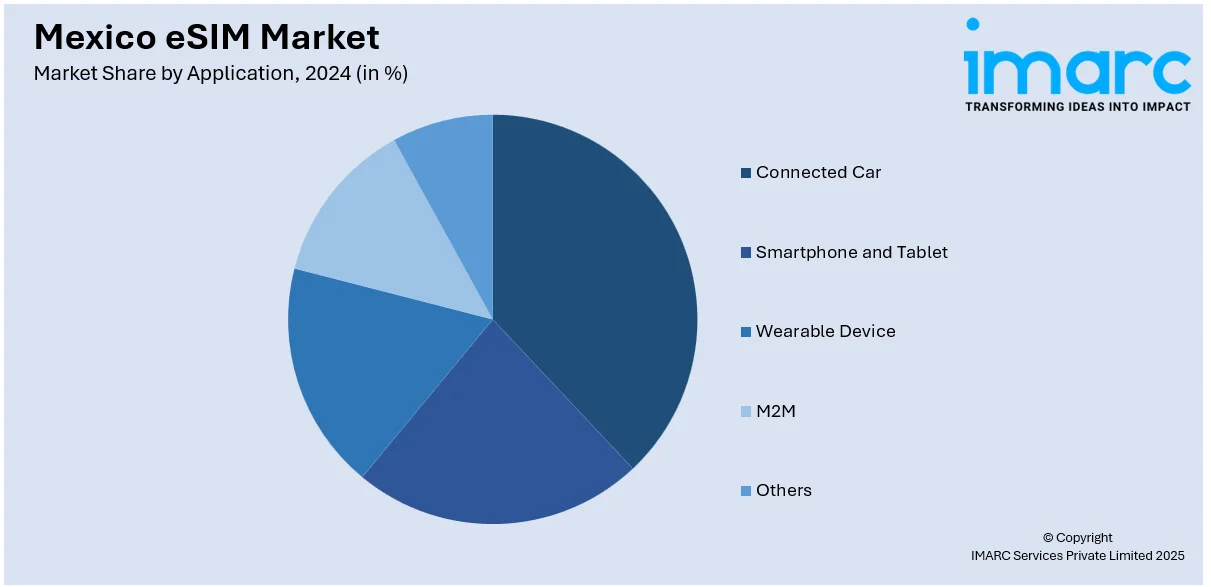

Application Insights:

- Connected Car

- Smartphone and Tablet

- Wearable Device

- M2M

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes connected car, smartphone and tablet, wearable device, m2m, and others.

Industry Vertical Insights:

- Automotive

- Consumer Electronics

- Manufacturing

- Telecommunication

- Transportation and Logistics

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes automotive, consumer electronics, manufacturing, telecommunication, transportation and logistics, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico eSIM Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Data-Only eSIM, Voice, SMS and Data eSIM |

| Solutions Covered | Hardware, Connectivity Services |

| Applications Covered | Connected Car, Smartphone and Tablet, Wearable Device, M2M, Others |

| Industry Verticals Covered | Automotive, Consumer Electronics, Manufacturing, Telecommunication, Transportation and Logistics, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico eSIM market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico eSIM market on the basis of type?

- What is the breakup of the Mexico eSIM market on the basis of solution?

- What is the breakup of the Mexico eSIM market on the basis of application?

- What is the breakup of the Mexico eSIM market on the basis of industry vertical?

- What is the breakup of the Mexico eSIM market on the basis of region?

- What are the various stages in the value chain of the Mexico eSIM market?

- What are the key driving factors and challenges in the Mexico eSIM market?

- What is the structure of the Mexico eSIM market and who are the key players?

- What is the degree of competition in the Mexico eSIM market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico eSIM market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico eSIM market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico eSIM industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)