Mexico EV Battery Components Market Size, Share, Trends and Forecast by Component Type, Battery Type, Vehicle Type, Propulsion Type, End User, and Region, 2025-2033

Mexico EV Battery Components Market Overview:

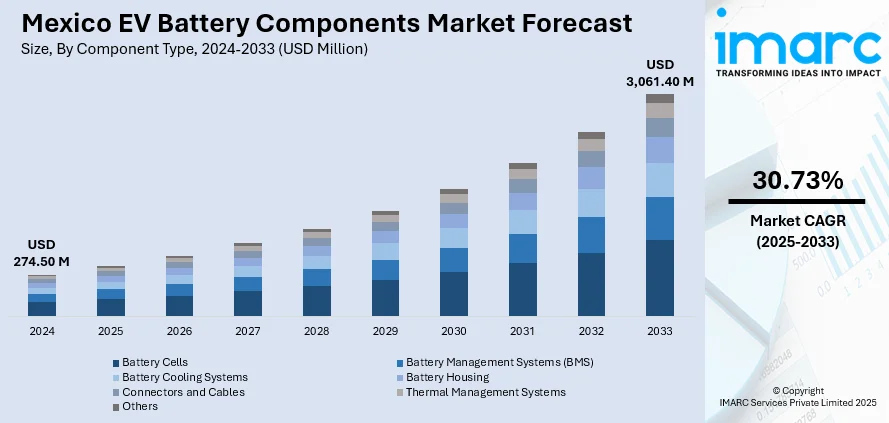

The Mexico EV battery components market size reached USD 274.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,061.40 Million by 2033, exhibiting a growth rate (CAGR) of 30.73% during 2025-2033. The market is driven by growing demand for electric vehicles (EVs) driven by environmental policies, Mexico’s strategic location with access to North American markets under United States-Mexico-Canada Agreement (USMCA) and increasing investments in local battery manufacturing and raw material processing. Additionally, government incentives and support for clean technology, along with rising consumer interest in sustainable transportation, are fueling Mexico EV battery components market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 274.50 Million |

| Market Forecast in 2033 | USD 3,061.40 Million |

| Market Growth Rate 2025-2033 | 30.73% |

Mexico EV Battery Components Market Trends:

Localization of Battery Manufacturing and Raw Material Processing

Mexico is rapidly building its EV battery supply chain by emphasizing local manufacturing and raw material processing, especially lithium. The country is investing heavily in battery production facilities and lithium refining plants to reduce reliance on imports and improve supply chain security. The Sonora region, rich in lithium resources, is becoming a focal point for lithium extraction and processing, positioning Mexico as a key supplier of critical battery materials. These efforts attract international investments and partnerships aiming for a reliable, regional source of EV battery components. By expanding domestic capacity, Mexico not only enhances its competitiveness in the global EV market but also promotes innovation and economic growth linked to green technologies. This strategic localization supports sustainable development and strengthens Mexico’s role as an emerging hub in the rapidly growing EVs industry.

Strategic Nearshoring and Compliance with USMCA

Mexico’s close proximity to the U.S. and favorable trade agreements, especially the USMCA, have positioned it as a key hub for nearshoring electric vehicle component manufacturing. Companies are shifting production to Mexico to take advantage of tariff exemptions that require sourcing parts within North America. This strategy helps automakers and suppliers avoid costly tariffs on imported goods from outside the region. Mexico’s competitive labor costs, expanding industrial infrastructure, and skilled workforce experienced in automotive manufacturing further enhance its attractiveness. The country’s location also reduces logistics costs and shortens delivery times to the U.S. market. By embracing nearshoring, Mexico is strengthening its supply chain resilience and becoming increasingly integrated into North America’s fast-growing EV industry, attracting significant foreign investment and boosting Mexico EV battery components market growth.

Government Incentives and Policy Support

The Mexican government is actively backing the EV battery component industry with incentives and policies that seek to encourage local production. These efforts involve tax exemptions, infrastructure investments, as well as research and development funding. These efforts promote the assembly of electric vehicles and key battery components locally, enabling Mexico to compete in the global EV market. By encouraging public-private partnerships, the government is creating an innovative and sustainable environment. This partnership draws in foreign investment and creates a skilled workforce, which is essential for the long-term success of the sector. Overall, these initiatives underscore Mexico's ambitions to be a key player in clean transport and battery technology, making it an essential axis in the transition to sustainable mobility on the global stage.

Mexico EV Battery Components Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component type, battery type, vehicle type, propulsion type, end user.

Component Type Insights:

- Battery Cells

- Battery Management Systems (BMS)

- Battery Cooling Systems

- Battery Housing

- Connectors and Cables

- Thermal Management Systems

- Others

The report has provided a detailed breakup and analysis of the market based on the component type. This includes battery cells, battery management systems (BMS), battery cooling systems, battery housing, connectors and cables, thermal management systems, and others.

Battery Type Insights:

- Lithium-Ion Batteries

- Nickel-Metal Hydride Batteries

- Solid-State Batteries

- Lead-Acid Batteries

A detailed breakup and analysis of the market based on the battery type have also been provided in the report. This includes lithium-ion batteries, nickel-metal hydride batteries, solid-state batteries, and lead-acid batteries.

Vehicle Type Insights:

- Passenger Vehicles

- Commercial Vehicles

- Two-Wheelers

- Three-Wheelers

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger vehicles, commercial vehicle, two-wheelers, and three-wheelers.

Propulsion Type Insights:

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Hybrid Electric Vehicles (HEVs)

A detailed breakup and analysis of the market based on the propulsion type have also been provided in the report. This includes battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and hybrid electric vehicles (HEVs).

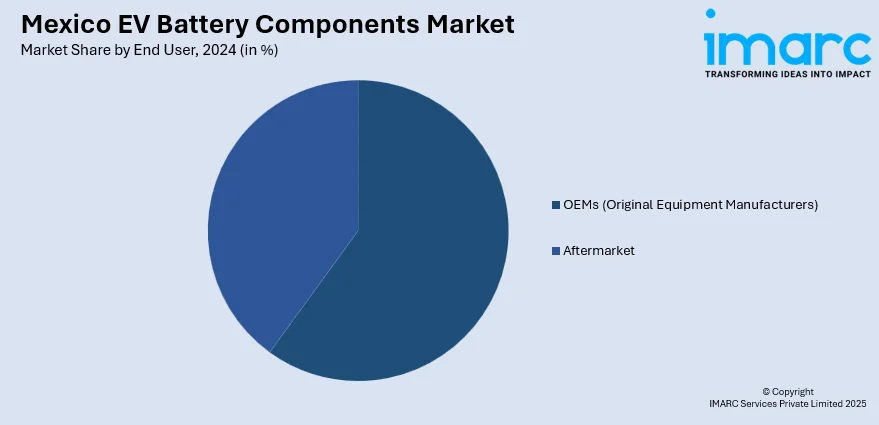

End User Insights:

- OEMs (Original Equipment Manufacturers)

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the end user. This includes OEMs (original equipment manufacturers) and aftermarket.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern, Central, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico EV Battery Components Market News:

- In January 2024, Mexico launched Olinia, its first domestic EV OEM, focused on affordable, sustainable mini electric vehicles for personal use, local transit, and last-mile delivery. Backed by MX$25 million in public-private funding, Olinia plans to release three modular models by 2030, priced between MX$90,000 and MX$150,000. The vehicles will be developed using local talent and components, with a prototype debut expected at the 2026 FIFA World Cup opening event.

- In October 2024, BMW is expanding EV and battery production in Mexico, investing $800 million in its San Luis Potosi plant, which will begin high-voltage battery pack output in 2025 and EV manufacturing by 2027. Despite U.S. policy shifts favoring domestic output, BMW and other automakers remain committed to Mexico due to existing infrastructure, skilled labor, and supply chains. The plant exports to 80 countries, reducing reliance on the U.S. market.

Mexico EV Battery Components Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered | Battery Cells, Battery Management Systems (BMS), Battery Cooling Systems, Battery Housing, Connectors and Cables, Thermal Management Systems, Others |

| Battery Types Covered | Lithium-Ion Batteries, Nickel-Metal Hydride Batteries, Solid-State Batteries, Lead-Acid Batteries |

| Vehicle Types Covered | Passenger Vehicles, Commercial Vehicle, Two-Wheelers, Three-Wheelers |

| Propulsion Types Covered | Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), Hybrid Electric Vehicles (HEVs) |

| End Users Covered | OEMs (original equipment manufacturers), Aftermarket |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico EV battery components market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico EV battery components market on the basis of component type?

- What is the breakup of the Mexico EV battery components market on the basis of battery type?

- What is the breakup of the Mexico EV battery components market on the basis of vehicle type?

- What is the breakup of the Mexico EV battery components market on the basis of propulsion type?

- What is the breakup of the Mexico EV battery components market on the basis of end user?

- What is the breakup of the Mexico EV battery components market on the basis of region?

- What are the various stages in the value chain of the Mexico EV battery components market?

- What are the key driving factors and challenges in the Mexico EV battery components market?

- What is the structure of the Mexico EV battery components market and who are the key players?

- What is the degree of competition in the Mexico EV battery components market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico EV battery components market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico EV battery components market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico EV battery components industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)