Mexico EV Battery Cooling Systems Market Size, Share, Trends and Forecast by Cooling Technology, Battery Type, Vehicle Type, Propulsion Type, End User, and Region, 2025-2033

Mexico EV Battery Cooling Systems Market Overview:

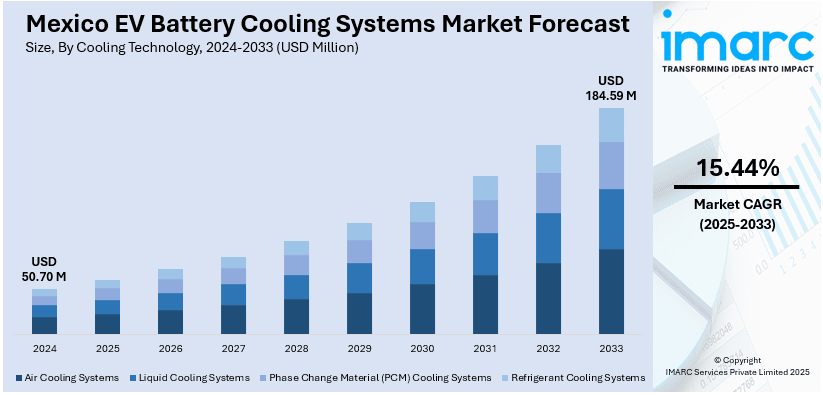

The Mexico EV Battery Cooling Systems Market market size reached USD 50.70 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 184.59 Million by 2033, exhibiting a growth rate (CAGR) of 15.44% during 2025-2033. The market is driven by the growing government support through incentives and policies promoting electric vehicle (EVs) adoption and local manufacturing. Increasing demand for high-performance EVs with longer range and faster charging necessitates advanced thermal management to maintain battery safety and efficiency. Additionally, the push for nearshoring encourages domestic production of EV components, boosting market growth. Rising consumer awareness about EV benefits and technological advancements in cooling solutions further supporting the Mexico EV battery cooling systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 50.70 Million |

| Market Forecast in 2033 | USD 184.59 Million |

| Market Growth Rate 2025-2033 | 15.44% |

Mexico EV Battery Cooling Systems Market Trends:

Modular and Lightweight Cooling Solutions

There is increasing demand in Mexico’s EV market for modular and lightweight battery cooling systems that improve efficiency and adaptability. Manufacturers are focusing on compact, flexible solutions such as mini-channel plates and targeted air cooling, which provide precise temperature control at the cell or module level. These modular designs allow easier integration into different battery pack layouts, reducing system weight and size. Lightweight cooling systems enhance overall vehicle efficiency and extend driving range, key factors influencing consumer acceptance of electric vehicles. This shift reflects a broader trend toward highly customizable, performance-driven battery thermal management, meeting the needs of evolving Mexico EV battery cooling systems market growth. By improving cooling effectiveness while minimizing weight and space, these advanced systems contribute to safer, more reliable, and longer-lasting batteries, positioning Mexican EV manufacturers to stay competitive in a rapidly growing industry.

Government Support and Nearshoring

Mexico’s government is actively promoting the electric vehicle industry by offering strong incentives and policies to attract investment in EV manufacturing, including battery cooling technologies. To encourage production and uptake, a substantial 86% tax break was implemented in 2025 for investments in EVs and hybrid electric vehicles (HEVs). This initiative is part of a broader nearshoring strategy to reduce reliance on Asian supply chains by encouraging local manufacturing. As a result, many automakers and tech companies are setting up manufacturing and R&D facilities in Mexico, positioning the country as a growing hub for EV components. This government-backed support accelerates innovation and infrastructure development in battery thermal management, making Mexico a key player in the EV ecosystem. Consequently, the battery cooling systems market is expanding rapidly, driven by a favorable regulatory environment and close collaboration between public and private sectors.

Advanced Thermal Management Technologies

To meet the demands of modern EVs batteries, Mexico’s EV market is adopting sophisticated thermal management solutions. These include liquid cooling, phase change materials, and smart systems that leverage sensors and AI for real-time temperature control. Such technologies help keep batteries within optimal temperature ranges, enhancing safety, performance, and lifespan. The integration of Internet of Things (IoT) and artificial intelligence (AI) allows adaptive cooling strategies that respond dynamically to changing driving conditions and battery states. This focus on innovation ensures that Mexican EV manufacturers can compete globally by offering vehicles with reliable and efficient battery cooling systems. The shift toward intelligent and advanced thermal management reflects the need to support fast charging and high energy densities in next-generation EV batteries.

Mexico EV Battery Cooling Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on cooling technology, battery type, vehicle type, propulsion type, and end user.

Cooling Technology Insights:

- Air Cooling Systems

- Liquid Cooling Systems

- Phase Change Material (PCM) Cooling Systems

- Refrigerant Cooling Systems

The report has provided a detailed breakup and analysis of the market based on the cooling technology. This includes air cooling systems, liquid cooling systems, phase change material (PCM) cooling systems, and refrigerant cooling systems.

Battery Type Insights:

- Lithium-Ion Batteries

- Nickel-Metal Hydride Batteries

- Solid-State Batteries

- Others

A detailed breakup and analysis of the market based on the battery type have also been provided in the report. This includes lithium-ion batteries, nickel-metal hydride batteries, solid-state batteries, and others.

Vehicle Type Insights:

- Passenger Vehicles

- Commercial Vehicles

- Two-Wheelers

- Three-Wheelers

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger vehicles, commercial vehicles, two-wheelers, and three-wheelers.

Propulsion Type Insights:

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Hybrid Electric Vehicles (HEVs)

A detailed breakup and analysis of the market based on the propulsion type have also been provided in the report. This includes battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and hybrid electric vehicles (HEVs).

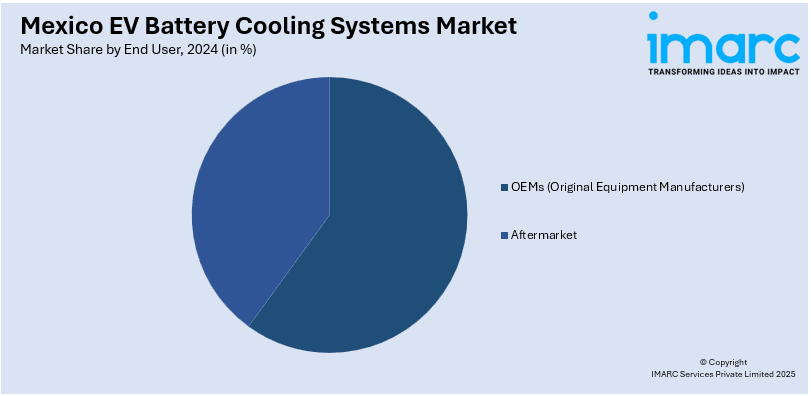

End User Insights:

- OEMs (Original Equipment Manufacturers)

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the end user. This includes OEMs (original equipment manufacturers) and aftermarket.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern, Central, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico EV Battery Cooling Systems Market News:

- In September 2024, XING Mobility unveiled its new Immersio XM28 immersion cooling battery system for medium and heavy-duty commercial EVs. Building on its earlier XM25 model, the XM28 offers higher energy density using ternary lithium chemistry and optimized design. It features active thermal runaway suppression, cooling cells below 100°C in 30 seconds to prevent overheating. This innovation enhances battery safety, lifespan, and efficiency—delivering cost benefits for commercial EV fleet operators.

- In July 2024, FORVIA HELLA launched the Coolant Control Hub max (CCH max), an advanced EV thermal management system that integrates drivetrain, battery, and interior cooling. Using a water-glycol circuit and eco-friendly refrigerants like propane or CO2, it reduces system weight by 20%, cuts complexity, and eliminates PFAS chemicals. The innovation improves efficiency and vehicle range, with significant orders and its first launch planned in Mexico, boosting EV performance and sustainability.

Mexico EV Battery Cooling Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Cooling Technologies Covered | Air Cooling Systems, Liquid Cooling Systems, Phase Change Material (PCM) Cooling Systems, Refrigerant Cooling Systems |

| Battery Types Covered | Lithium-Ion Batteries, Nickel-Metal Hydride Batteries, Solid-State Batteries, Others |

| Vehicle Types Covered | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Three-Wheelers |

| Propulsion Types Covered | Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), Hybrid Electric Vehicles (HEVs) |

| End Users Covered | OEMs (Original Equipment Manufacturers), Aftermarket |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico EV battery cooling systems market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico EV battery cooling systems market on the basis of cooling technology?

- What is the breakup of the Mexico EV battery cooling systems market on the basis of battery type?

- What is the breakup of the Mexico EV battery cooling systems market on the basis of vehicle type?

- What is the breakup of the Mexico EV battery cooling systems market on the basis of propulsion type?

- What is the breakup of the Mexico EV battery cooling systems market on the basis of end user?

- What is the breakup of the Mexico EV battery cooling systems market on the basis of region?

- What are the various stages in the value chain of the Mexico EV battery cooling systems market?

- What are the key driving factors and challenges in the Mexico EV battery cooling systems market?

- What is the structure of the Mexico EV battery cooling systems market and who are the key players?

- What is the degree of competition in the Mexico EV battery cooling systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico EV battery cooling systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico EV battery cooling systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico EV battery cooling systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)