Mexico Express Cargo Market Size, Share, Trends and Forecast by Service Type, Mode of Transportation, Cargo Type, Customer Type, End-User Industry, and Region, 2025-2033

Mexico Express Cargo Market Overview:

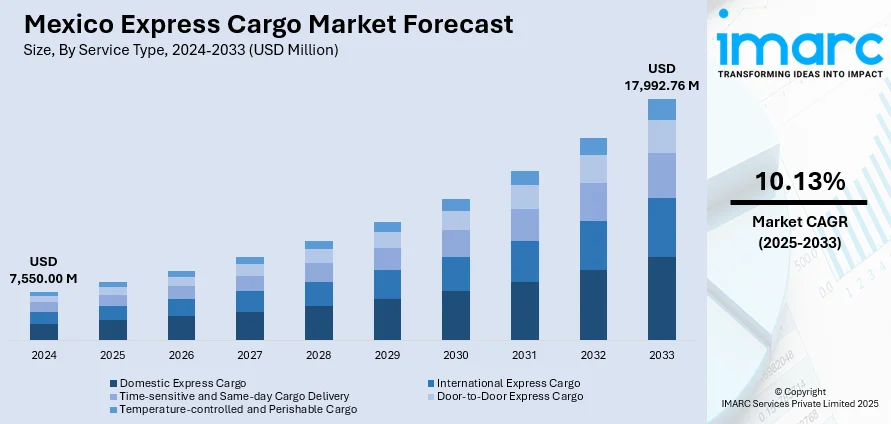

The Mexico express cargo market size reached USD 7,550.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 17,992.76 Million by 2033, exhibiting a growth rate (CAGR) of 10.13% during 2025-2033. The market is driven by the rapid expansion of e-commerce, with rising demand for fast, reliable deliveries fueled by major retailers and cross-border trade, supported by growing digital adoption. Additionally, sustainability initiatives, including electric fleets and optimized routes, are gaining traction due to regulatory pressures and shifting consumer preferences. Technological advancements, such as automation and route optimization, enhance operational efficiency, further augmenting the Mexico express cargo market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7,550.00 Million |

| Market Forecast in 2033 | USD 17,992.76 Million |

| Market Growth Rate 2025-2033 | 10.13% |

Mexico Express Cargo Market Trends:

Growth of E-Commerce Driving Demand for Express Cargo Services

The rapid expansion of e-commerce in Mexico is significantly enhancing the market. In 2023, Mexico's internet economy increased to MXN 2.04 Trillion (approximately USD 105.98 Billion), representing 6.4% of the country's GDP, driven by a year-on-year growth rate of 8.5%. This strong expansion, particularly in services (51.1% of e-commerce value) and wholesale trade (25.7%), underscores the increasing need for efficient express freight and last-mile delivery services across the country. As shoppers increasingly dedicate more time to their shopping activities, both online and through the as-a-service retail model, businesses must seek faster and more reliable delivery alternatives to satisfy customer expectations. Retail giants are making substantial investments in logistics infrastructure to offer same-day and next-day delivery services. Furthermore, with the rise in internet accessibility and smartphone usage, consumers are now better equipped to compare product features and prices, as well as locate sources for their desired goods. This includes cross-border e-commerce for shoppers in Mexico who are sourcing products from the United States or China, which necessitates a swift and efficient commercial express cargo service. Logistics companies are also required to modernize their delivery protocols, incorporating efficient methods such as software solutions and warehouse automation, to implement last-mile e-commerce services effectively. As the e-commerce sector continues to expand, the express cargo segment is projected to grow, making it a key area of interest within Mexico's logistics landscape.

Increasing Adoption of Sustainable Logistics Practices

Sustainability is becoming a major factor in the Mexico express cargo market growth as companies seek to reduce their environmental impact. Many logistics providers are transitioning to electric and hybrid delivery vehicles to lower carbon emissions, particularly in urban areas with high pollution levels. Additionally, there is a growing emphasis on optimizing delivery routes to minimize fuel consumption and improve efficiency. Some companies are also implementing eco-friendly packaging solutions, such as biodegradable materials and reduced plastic use, to align with consumer preferences for sustainable practices. Government regulations and incentives promoting green logistics are further accelerating this shift. For instance, Mexico City has introduced stricter emissions standards, pushing logistics firms to adopt cleaner technologies. For instance, Mexico has made significant strides in addressing plastic pollution with the Mexico Without Plastic Alliance and government bans on single-use plastics, including bags and disposable items. Such major initiatives as BioBoxes, which recycles 500,000 tons of plastic every month, and supermarket stores offering refillable containers illustrate the city's commitment to green practices. With the growing biodegradable packaging market, these efforts highlight Mexico's position as a global leader in the fight against plastic waste and promoting circular economy practices. As environmental awareness grows among businesses and consumers, sustainable express cargo solutions will likely become a competitive differentiator, shaping the future of the industry in Mexico.

Mexico Express Cargo Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service type, mode of transportation, cargo type, customer type, and end-user industry.

Service Type Insights:

- Domestic Express Cargo

- International Express Cargo

- Time-sensitive and Same-day Cargo Delivery

- Door-to-Door Express Cargo

- Temperature-controlled and Perishable Cargo

The report has provided a detailed breakup and analysis of the market based on the service type. This includes domestic express cargo, international express cargo, time-sensitive and same-day cargo delivery, door-to-door express cargo, and temperature-controlled and perishable cargo.

Mode of Transportation Insights:

- Air Express Cargo

- Road Express Cargo

- Rail Express Cargo

- Sea and Inland Waterways Express Cargo

A detailed breakup and analysis of the market based on the mode of transportation have also been provided in the report. This includes air express cargo, road express cargo, rail express cargo, and sea and inland waterways express cargo.

Cargo Type Insights:

- General Cargo

- High-value and Secured Cargo

- Hazardous Materials (HAZMAT)

- Perishable Goods

- Documents and Parcels

The report has provided a detailed breakup and analysis of the market based on the cargo type. This includes general cargo, high-value and secured cargo, hazardous materials (HAZMAT), perishable goods, and documents and parcels.

Customer Type Insights:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- Individual Consumers

A detailed breakup and analysis of the market based on the customer type have also been provided in the report. This includes small and medium enterprises (SMEs), large enterprises, and individual consumers.

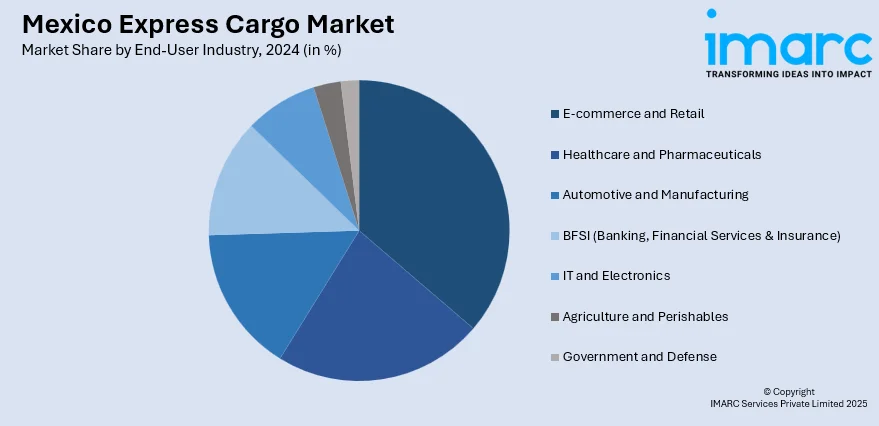

End-User Industry Insights:

- E-commerce and Retail

- Healthcare and Pharmaceuticals

- Automotive and Manufacturing

- BFSI (Banking, Financial Services & Insurance)

- IT and Electronics

- Agriculture and Perishables

- Government and Defense

The report has provided a detailed breakup and analysis of the market based on the end-user industry. This includes e-commerce and retail, healthcare and pharmaceuticals, automotive and manufacturing, BFSI (banking, financial services and insurance), IT and electronics, agriculture and perishables, government and defense.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Express Cargo Market News:

- March 20, 2025: Crowley announced launching its Mexico Gulf Express service with a weekly ocean-rail intermodal offer, offering three-day ocean transit from Tuxpan, Veracruz, to Gulfport, Mississippi. The groundbreaking service is expected to maximize the efficiency of express cargo hauling between Mexico, the US, the Midwest, and Canada, bypassing congested roads to provide quicker, greener, and more reliable supply chain solutions. It will also be integrated with the network of the Canadian National Railway, enhancing connectivity and easing cross-border logistics.

- December 18, 2024: DHL Express Mexico announced investing MXN 1.1 Billion (approximately USD 57.15 Million) to increase its express cargo operations, including the integration of over 600 new cars and the expansion of its hub at the Queretaro International Airport by 2025, including automated sorting and clean energy solutions. This strategic move is aimed at improving delivery times and helping Mexican SMEs access wider markets.

Mexico Express Cargo Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Domestic Express Cargo, International Express Cargo, Time-sensitive and Same-day Cargo Delivery, Door-to-Door Express Cargo, Temperature-controlled and Perishable Cargo |

| Modes of Transportation Covered | Air Express Cargo, Road Express Cargo, Rail Express Cargo, Sea and Inland Waterways Express Cargo |

| Cargo Types Covered | General Cargo, High-value and Secured Cargo, Hazardous Materials (HAZMAT), Perishable Goods, Documents and Parcels |

| Customer Types Covered | Small and Medium Enterprises (SMEs), Large Enterprises, Individual Consumers |

| End-User Industries Covered | E-commerce and Retail, Healthcare and Pharmaceuticals, Automotive and Manufacturing, BFSI (Banking, Financial Services & Insurance), IT and Electronics, Agriculture and Perishables, Government and Defense |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico express cargo market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico express cargo market on the basis of service type?

- What is the breakup of the Mexico express cargo market on the basis of mode of transportation?

- What is the breakup of the Mexico express cargo market on the basis of cargo type?

- What is the breakup of the Mexico express cargo market on the basis of customer type?

- What is the breakup of the Mexico express cargo market on the basis of end-user industry?

- What is the breakup of the Mexico express cargo market on the basis of region?

- What are the various stages in the value chain of the Mexico express cargo market?

- What are the key driving factors and challenges in the Mexico express cargo market?

- What is the structure of the Mexico express cargo market and who are the key players?

- What is the degree of competition in the Mexico express cargo market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico express cargo market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico express cargo market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico express cargo industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)