Mexico Extended Warranty Market Size, Share, Trends and Forecast by Coverage, Application, Distribution Channel, End User, and Region, 2025-2033

Mexico Extended Warranty Market Overview:

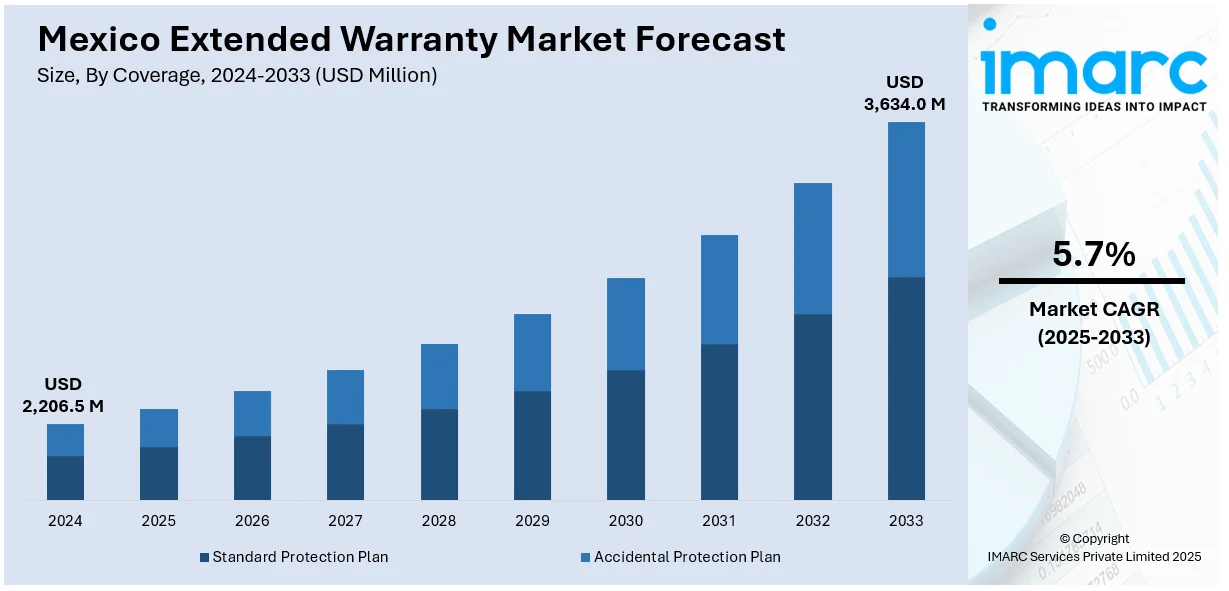

The Mexico extended warranty market size reached USD 2,206.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,634.0 Million by 2033, exhibiting a growth rate (CAGR) of 5.7% during 2025-2033. The increasing consumer awareness about product protection, rising repair costs of advanced electronics, growing sales of high-value items, and the expansion of e-commerce platforms facilitating easier access to warranty services are some of the major factors fueling the Mexico extended warranty market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,206.5 Million |

| Market Forecast in 2033 | USD 3,634.0 Million |

| Market Growth Rate 2025-2033 | 5.7% |

Mexico Extended Warranty Market Trends:

Rising Consumer Electronics and Automotive Sales

The growth in consumer electronics and automobile sales in Mexico is a significant driver of the extended warranty market. For instance, in April 2025, the Instituto Nacional de Estadistica y Geografia (INEGI) of Mexico announced that sales of light automobiles in March were 127,352, a 1.3% rise over the 125,756 sales in March 2024. In March, Nissan sold 23,625 units, up 0.4% from the year before. With 13,850 vehicles sold overall, the Volkswagen Group had a 2.8% rise in March compared to 2024. 18,009 units were sold by General Motors, a 2.7% increase over the previous year. The growing market demand for protection plans directly correlates with the increase in consumer purchases of high-end products such as smartphones and laptops, and vehicles. These items are prone to mechanical and technical failures, and buyers are seeking ways to safeguard their investments beyond the standard manufacturer warranty. This trend is particularly evident among middle-class consumers, who are becoming more quality-conscious and prefer financial coverage to avoid unexpected repair costs, thus creating a positive Mexico extended warranty market outlook.

Growing Awareness and Consumer Trust in Warranty Programs

Awareness about the benefits of extended warranties is increasing among Mexican consumers, driven by targeted marketing, online reviews, and improved customer education. Retailers and manufacturers have also strengthened their warranty offerings with clearer terms, better service, and more transparent claim processes, which have helped build trust. Consumers are now more willing to spend extra on extended coverage, viewing it as a value-added service rather than an unnecessary cost. As the market matures, trust in warranty providers becomes a crucial factor, reinforcing customer willingness to opt into extended protection plans.

Technological Advancements in Warranty Services

Digital transformation is revolutionizing the extended warranty market in Mexico. Technology-driven solutions like mobile apps, AI-powered claim processing, and blockchain-based warranty tracking systems are making warranty services more efficient and customer-friendly. These innovations reduce paperwork, speed up approvals, and enhance user experience, encouraging more consumers to enroll. Furthermore, the integration of predictive analytics helps providers forecast product failures and offer personalized coverage, making extended warranties more relevant. Such advancements not only improve operational efficiency but also build consumer confidence, making technology a key driver in the Mexico extended warranty market growth.

Mexico Extended Warranty Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on coverage, application, distribution channel, and end user.

Coverage Insights:

- Standard Protection Plan

- Accidental Protection Plan

The report has provided a detailed breakup and analysis of the market based on the coverage. This includes standard protection plan and accidental protection plan.

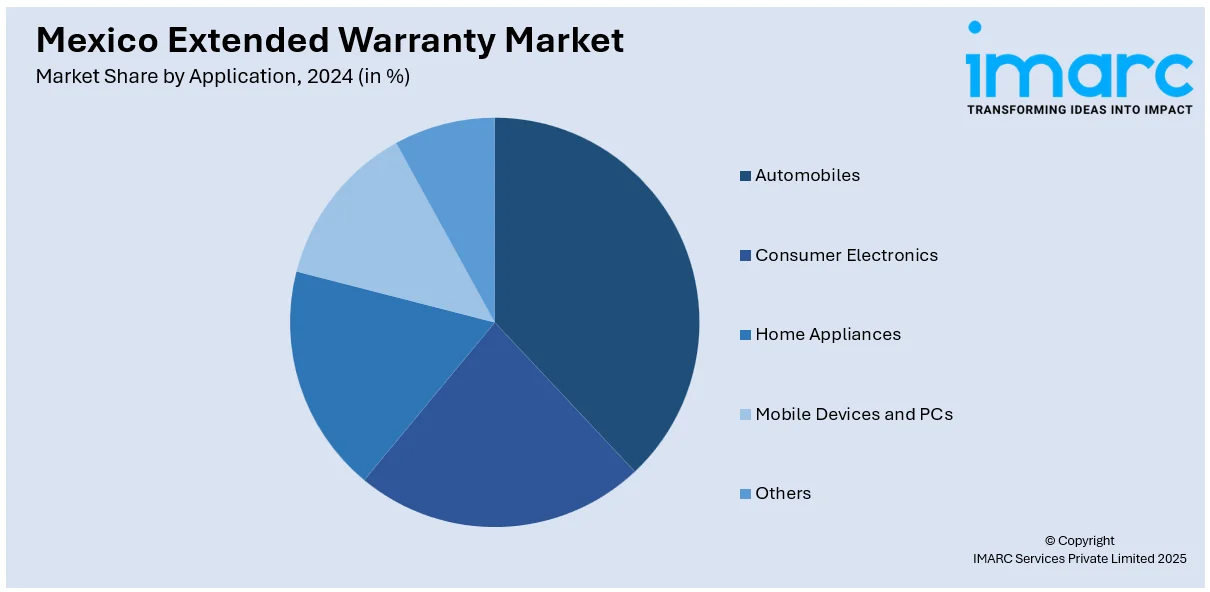

Application Insights:

- Automobiles

- Consumer Electronics

- Home Appliances

- Mobile Devices and PCs

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automobiles, consumer electronics, home appliances, mobile devices and PCs, and others.

Distribution Channel Insights:

- Manufacturers

- Retailers

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes manufacturers, retailers, and others.

End User Insights:

- Individuals

- Business

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes individuals, and business.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Extended Warranty Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Coverages Covered | Standard Protection Plan, Accidental Protection Plan |

| Applications Covered | Automobiles, Consumer Electronics, Home Appliances, Mobile Devices and PCs, Others |

| Distribution Channels Covered | Manufacturers, Retailers, Others |

| End Users Covered | Individuals, Business |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico extended warranty market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico extended warranty market on the basis of coverage?

- What is the breakup of the Mexico extended warranty market on the basis of application?

- What is the breakup of the Mexico extended warranty market on the basis of distribution channel?

- What is the breakup of the Mexico extended warranty market on the basis of end user?

- What is the breakup of the Mexico extended warranty market on the basis of region?

- What are the various stages in the value chain of the Mexico extended warranty market?

- What are the key driving factors and challenges in the Mexico extended warranty market?

- What is the structure of the Mexico extended warranty market and who are the key players?

- What is the degree of competition in the Mexico extended warranty market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico extended warranty market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico extended warranty market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico extended warranty industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)