Mexico Extruded Snack Food Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2025-2033

Mexico Extruded Snack Food Market Overview:

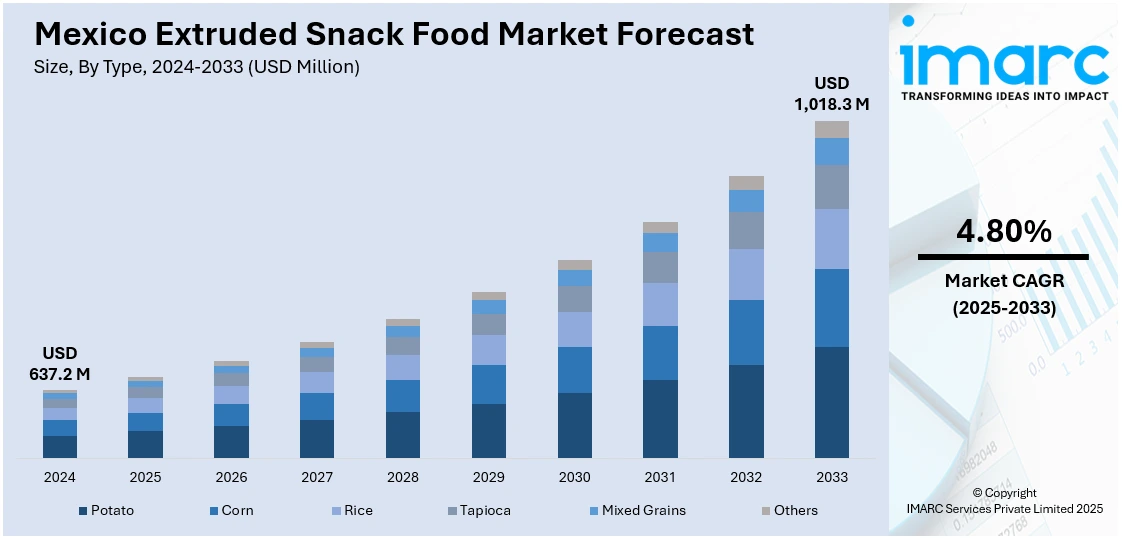

The Mexico extruded snack food market size reached USD 637.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,018.3 Million by 2033, exhibiting a growth rate (CAGR) of 4.80% during 2025-2033. The market is driven by growing urbanization, increasing demand for ready-to-eat snacks, rising disposable income, and evolving dietary preferences. The adoption of Western snacking habits, expansion of retail distribution channels, and product innovations in texture, flavor, and nutrition are also encouraging broader consumer acceptance and market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 637.2 Million |

| Market Forecast in 2033 | USD 1,018.3 Million |

| Market Growth Rate 2025-2033 | 4.80% |

Mexico Extruded Snack Food Market Trends:

Rising Popularity of Regionally Inspired Flavors

Manufacturers in Mexico’s extruded snack segment are increasingly incorporating local and traditional flavors into their product portfolios to cater to culturally rooted taste preferences. Flavors such as chili-lime, tamarind, jalapeño, and queso are gaining traction, especially among younger consumers seeking bold, familiar experiences in convenient formats. This trend reflects a strategic balance between innovation and cultural relevance, allowing brands to differentiate themselves in a crowded market. As global brands enter the space, domestic companies are leveraging their understanding of regional palates to retain market share. Additionally, promotional campaigns centered around nostalgia and regional pride have reinforced this movement, helping to boost brand loyalty and drive repeat purchases. Flavor localization continues to be a key tactic in sustaining market engagement and sales momentum. For instance, in June 2024, Cheetos launched the fifth Deja tu Huella campaign, inviting entries for a new ambassador. Fans can apply via QR codes on limited-edition Salsa con Queso packs, a flavor inspired by traditional Mexican salsa. This initiative blends cultural pride with flavor localization, using bold, nostalgic tastes and community engagement to strengthen ties with Hispanic consumers and support PepsiCo’s inclusion efforts.

Demand for Nutritionally Enhanced Snack Options

The increasing health awareness among Mexican consumers is leading to greater interest in extruded snacks with nutritional value, such as high-protein, low-fat, or enriched with vitamins and fiber. In response, manufacturers are incorporating legumes, multigrains, and vegetable-based ingredients to enhance product appeal without compromising on taste or texture. Functional ingredients like chia seeds, amaranth, and flaxseed are also appearing more frequently, aligning with consumer interest in wellness-oriented diets. This shift has influenced product labeling and advertising strategies, with more emphasis placed on health claims and clean ingredient lists. As parents seek healthier alternatives for children’s snacks and working adults look for better on-the-go options, the market is seeing a clear pivot towards nutritionally balanced, yet indulgent, snack formulations. For instance, in May 2024, Snack’in For You, a brand by Sigma Foods, showcased its award-winning, vegetable-based, high-protein baked puffs at the 2024 Sweets & Snacks Expo in Indianapolis. Available in flavors like Sour Cream and Onion Cauliflower and Cheddar Jalapeño Broccoli, the puffs contain four grams of protein per serving and use simple ingredients like cauliflower, broccoli, chickpeas, and pea protein.

Mexico Extruded Snack Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on type and distribution channel.

Analysis by Type:

- Potato

- Corn

- Rice

- Tapioca

- Mixed Grains

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes potato, corn, rice, tapioca, mixed grains, and others.

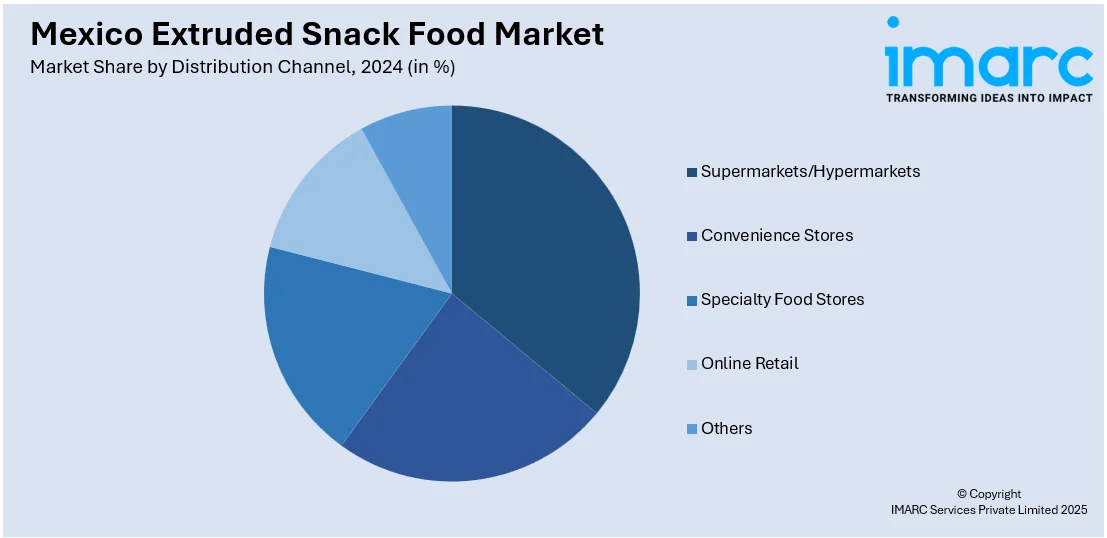

Analysis by Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Food Stores

- Online Retail

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets/hypermarkets, convenience stores, specialty food stores, online retail, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Extruded Snack Food Market News:

- In October 2024, PepsiCo announced plans to acquire Siete Foods, a Mexican-American brand known for heritage-inspired, better-for-you products like tortillas, salsas, and snacks, for USD 1.2 Billion. The acquisition expands PepsiCo’s multicultural and health-focused portfolio. The deal, expected to close in the first half of 2025, supports PepsiCo’s commitment to cultural representation and healthier food innovation.

- In September 2024, South Korea’s Ministry of Agriculture, Food and Rural Affairs (MAFRA) held a Korean food tasting event in Monterrey, Mexico, serving meals to 3,000 factory workers. The initiative received strong positive feedback, with 97% of participants wanting Korean food served regularly and 98% expressing intent to purchase Korean products. Targeting Mexico’s growing taste for spicy food and Korean culture, MAFRA is also promoting K-food through digital ads, social media challenges, and retail activities, helping drive a 43% increase in Korean agri-food exports to Mexico.

- In June 2024, Goya Foods introduced a new line of Chickpea Puffs, available in three Latin-inspired flavors: Chili Limón, Elote (Mexican Street Corn), and Churro. These snacks are made with chickpea flour, rice flour, pea protein, cassava starch, and sunflower oil, and are nut-free, gluten-free, vegan, and Kosher. The launch reflects Goya’s continued focus on authentic, culturally rooted snack innovations.

Mexico Extruded Snack Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Potato, Corn, Rice, Tapioca, Mixed Grains, Others |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Convenience Stores, Specialty Food Stores, Online Retail, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico extruded snack food market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico extruded snack food market on the basis of type?

- What is the breakup of the Mexico extruded snack food market on the basis of distribution channel?

- What is the breakup of the Mexico extruded snack food market on the basis of region?

- What are the various stages in the value chain of the Mexico extruded snack food market?

- What are the key driving factors and challenges in the Mexico extruded snack food market?

- What is the structure of the Mexico extruded snack food market and who are the key players?

- What is the degree of competition in the Mexico extruded snack food market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico extruded snack food market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico extruded snack food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico extruded snack food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)