Mexico Facade Market Size, Share, Trends and Forecast by Product Type, Material, End Use, and Region, 2025-2033

Mexico Facade Market Overview:

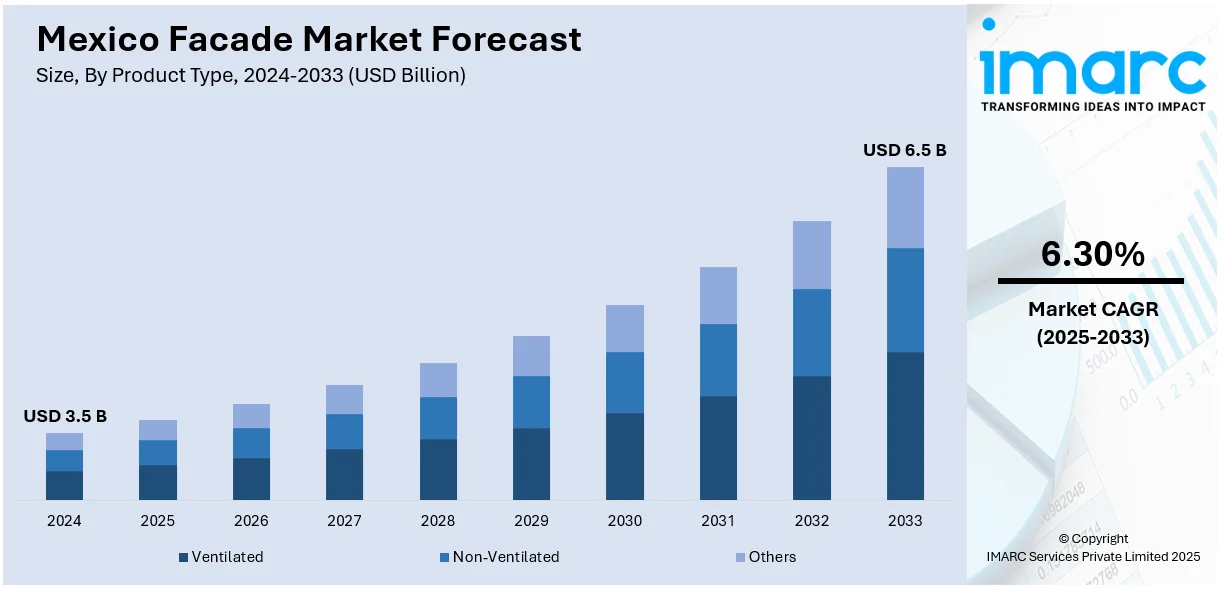

The Mexico facade market size reached USD 3.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.5 Billion by 2033, exhibiting a growth rate (CAGR) of 6.30% during 2025-2033. The market is experiencing growth due to increasing investments in smart city projects, energy-efficient construction, and rising demand for modern architectural designs. In line with this, sustainable materials, technological integration, and enhanced building performance for commercial and residential infrastructure are also contributing to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 6.5 Billion |

| Market Growth Rate 2025-2033 | 6.30% |

Mexico Facade Market Trends:

Sustainability Drives Material Choices

The facade market is currently experiencing a significant trend towards incorporating locally sourced and sustainable materials. This shift is strongly driven by a growing environmental consciousness among both consumers and developers, coupled with a desire to reflect regional architectural heritage authentically. Natural stones, such as Cantera and travertine, alongside locally produced clay bricks and tiles, are increasingly favored due to their inherent aesthetic appeal, long-term durability, and a lower overall environmental impact compared to imported or synthetic alternatives. Government initiatives that actively promote green building certifications and offer incentives for sustainable construction practices further amplify this preference. Simultaneously, a rising interest in blending contemporary design principles with established Mexican aesthetics is evident. This manifests in the thoughtful integration of clean architectural lines, the incorporation of expansive glazed areas to optimize natural light penetration, and the innovative application of textures that respectfully complement the inherent rustic character of traditional materials. Advancements in construction technologies are also enabling the implementation of intricate and energy-efficient facade solutions, including ventilated systems and sophisticated insulation layers, thereby enhancing both the visual presentation and the functional performance of buildings throughout Mexico. This convergence of ecological responsibility, cultural appreciation, and modern technological adoption is fundamentally reshaping the evolving landscape of Mexican architectural exteriors.

Economic Expansion Fuels Market Demand

The Mexican facade market is currently experiencing substantial growth, primarily fueled by a dynamic interplay of economic and demographic factors. A key driver is the consistent expansion of the middle class and the ongoing trend of urbanization, which together are generating a significant surge in both residential and commercial construction projects, particularly concentrated within major metropolitan centers. This heightened level of building activity directly translates into a robust demand for a diverse range of high-quality facade materials and comprehensive solutions. Furthermore, the thriving tourism sector plays a vital role, with hotels, resorts, and related infrastructure consistently investing in visually appealing and durable facades to attract and retain visitors, thereby upholding their aesthetic standards. Significant government investments in essential infrastructure projects, encompassing airports, healthcare facilities, and educational institutions, also contribute substantially to the overall market expansion. Additionally, the increasing societal awareness regarding energy efficiency and stringent building performance regulations is actively driving the adoption of advanced facade systems that offer superior thermal insulation properties and contribute to significant reductions in energy consumption. This powerful combination of sustained economic growth, rapid urbanization, a vibrant tourism industry, strategic infrastructure development, and an increasing focus on sustainability collectively positions the Mexican facade market for continued expansion and significant innovation in the foreseeable future.

Mexico Facade Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, material, and end use.

Product Type Insights:

- Ventilated

- Non-Ventilated

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes ventilated, non-ventilated and others.

Material Insights:

- Glass

- Metal

- Plastic and Fiber

- Stones

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes glass, metal, plastic and fiber, stones and others.

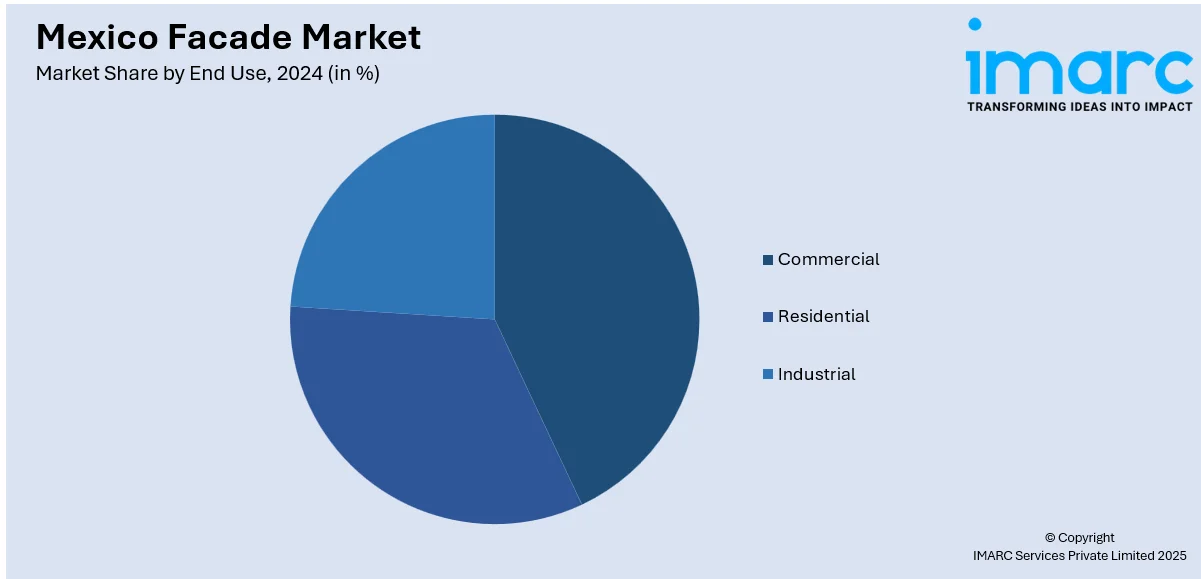

End Use Insights:

- Commercial

- Residential

- Industrial

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes commercial, residential, and industrial.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Facade Market News:

- August 2024: PILARES Quetzalcóatl, designed by Dellekamp Arquitectos, featured an exposed brick facade with large arched openings, reflecting Mexico City's rich masonry tradition. This community center’s architectural approach influenced local facade designs, emphasizing structural simplicity, cultural relevance, and functional aesthetics, boosting interest in traditional materials.

Mexico Facade Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Ventilated, Non-Ventilated, Others |

| Materials Covered | Glass, Metal, Plastic Fiber, Stones, Others |

| End Uses Covered | Commercial, Residential, Industrial |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico facade market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico facade market on the basis of product type?

- What is the breakup of the Mexico facade market on the basis of material?

- What is the breakup of the Mexico facade market on the basis of end use?

- What are the various stages in the value chain of the Mexico facade market?

- What are the key driving factors and challenges in the Mexico facade?

- What is the structure of the Mexico facade market and who are the key players?

- What is the degree of competition in the Mexico facade market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico facade market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico facade market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico facade industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)