Mexico Factory Ventilation Systems Market Size, Share, Trends and Forecast by Component, Type of Ventilation System, Application, End Use Industry, and Region, 2025-2033

Mexico Factory Ventilation Systems Market Overview:

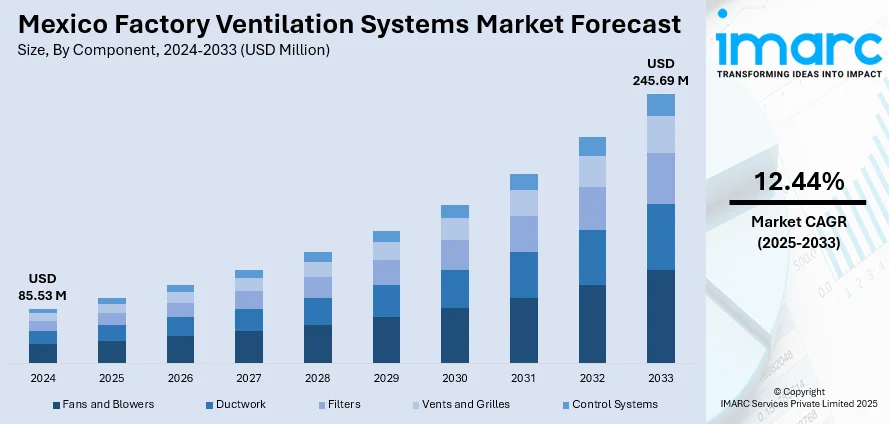

The Mexico factory ventilation systems market size reached USD 85.53 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 245.69 Million by 2033, exhibiting a growth rate (CAGR) of 12.44% during 2025-2033. The market is driven by stringent environmental regulations and rising energy costs, compelling manufacturers to adopt energy-efficient systems. Additionally, the growing need for modular, customized solutions across automotive, aerospace, and chemical industries supports demand for scalable, high-performance ventilation tailored to specific operational requirements. Further, Industry 4.0 integration and government sustainability initiatives are augmenting the Mexico factory ventilation systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 85.53 Million |

| Market Forecast in 2033 | USD 245.69 Million |

| Market Growth Rate 2025-2033 | 12.44% |

Mexico Factory Ventilation Systems Market Trends:

Rising Demand for Energy-Efficient Ventilation Systems

The market is experiencing a growing demand for energy-efficient solutions, driven by stricter environmental regulations and rising operational costs. In 2023, the total energy consumption of Mexico amounted to 8.45 exajoules and was fueled chiefly by oil (45.4%) and gas (41.5%). 374.62 TWh were generated through electricity, with fossil fuels contributing 80%. Proven reserves in Mexico for oil amount to 5.978 billion barrels and for natural gas amount to 12.297 Tcf, making the nation the third largest in Latin America in oil potential. This tremendous need for fuel and energy infrastructure provides significant growth opportunities for the factory ventilation systems market in both industrial and energy markets across the country. Manufacturers are increasingly adopting advanced HVAC technologies, such as heat recovery ventilators (HRVs) and demand-controlled ventilation (DCV) systems, to reduce energy consumption while maintaining optimal air quality. The Mexican government’s push toward sustainable industrial practices, including compliance with international standards such as ISO 14001, is further accelerating this trend. Additionally, companies are investing in smart ventilation systems integrated with IoT sensors to monitor airflow, humidity, and pollutants in real time, ensuring efficient performance. As electricity costs continue to rise, factories are prioritizing long-term savings through high-efficiency motors and variable speed drives in ventilation units. This shift not only supports environmental sustainability but also enhances productivity by creating healthier work environments, making energy efficiency a key driver in the market.

Growth of Modular and Customized Ventilation Solutions

The increasing preference for modular and customized ventilation systems is significantly supporting the Mexico factory ventilation systems market growth. Industries such as automotive, aerospace, and food processing require tailored solutions to meet specific air quality and safety standards. Modular systems offer flexibility, allowing factories to scale ventilation capacity as production needs change, reducing upfront costs and installation time. Manufacturers are also focusing on corrosion-resistant and explosion-proof ventilation units for harsh industrial environments, particularly in chemical and pharmaceutical sectors. Additionally, the rise of Industry 4.0 has led to greater adoption of automated ventilation controls that adjust airflow based on real-time data, improving efficiency. With a global use of factory robots of 4.28 million units in 2023, Mexico contributed 5,832 installations, 70% of which came from the automotive sector. Industrial automation in Mexico has been resilient and in line with cyclical behavior. With this continued growth, there is a growing demand for precision factory ventilation systems in the automotive and machinery sectors. Local ventilation suppliers are partnering with international firms to provide advanced, customized designs, catering to Mexico’s expanding manufacturing sector. This trend reflects the industry’s move toward adaptable, high-performance ventilation solutions that align with changing operational demands.

Mexico Factory Ventilation Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, type of ventilation system, application, and end use industry.

Component Insights:

- Fans and Blowers

- Ductwork

- Filters

- Vents and Grilles

- Control Systems

The report has provided a detailed breakup and analysis of the market based on the component. This includes fans and blowers, ductwork, filters, vents and grilles, and control systems.

Type of Ventilation System Insights:

- Natural Ventilation Systems

- Mechanical Ventilation Systems

- Hybrid Ventilation Systems

A detailed breakup and analysis of the market based on the type of ventilation system have also been provided in the report. This includes natural ventilation systems, mechanical ventilation systems, and hybrid ventilation systems.

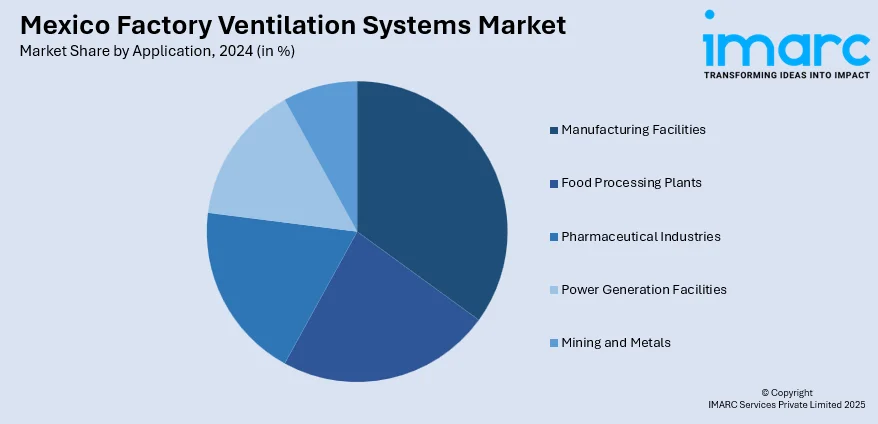

Application Insights:

- Manufacturing Facilities

- Food Processing Plants

- Pharmaceutical Industries

- Power Generation Facilities

- Mining and Metals

The report has provided a detailed breakup and analysis of the market based on the application. This includes manufacturing facilities, food processing plants, pharmaceutical industries, power generation facilities, and mining and metals.

End Use Industry Insights:

- Manufacturing and Heavy Industries

- Food and Beverage Processing

- Pharmaceuticals and Healthcare

- Electronics and Semiconductor Plants

- Chemical and Petrochemical Industries

- Automotive and Aerospace

- Textiles and Garments

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes manufacturing and heavy industries, food and beverage processing, pharmaceuticals and healthcare, electronics and semiconductor plants, chemical and petrochemical industries, automotive and aerospace, textiles and garments, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Factory Ventilation Systems Market News:

- June 13, 2024: Daikin Applied's subsidiary, Alliance Air, invested USD 121 Million to set up a new energy-efficient air conditioning manufacturing plant in Tijuana, Mexico, which is expected to create 1,150 permanent positions. The factory, measuring 46,000m², will focus on producing cooling products for data centers, thus meeting the rising need for green infrastructure across North America. Production is expected to be in June 2025, thus enhancing Alliance Air's HVAC functionality in the region.

Mexico Factory Ventilation Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Fans And Blowers, Ductwork, Filters, Vents and Grilles, Control Systems |

| Type of Ventilation Systems Covered | Natural Ventilation Systems, Mechanical Ventilation Systems, Hybrid Ventilation Systems |

| Applications Covered | Manufacturing Facilities, Food Processing Plants, Pharmaceutical Industries, Power Generation Facilities, Mining and Metals |

| End Use Industries Covered | Manufacturing and Heavy Industries, Food and Beverage Processing, Pharmaceuticals and Healthcare, Electronics and Semiconductor Plants, Chemical and Petrochemical Industries, Automotive and Aerospace, Textiles and Garments, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico factory ventilation systems market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico factory ventilation systems market on the basis of component?

- What is the breakup of the Mexico factory ventilation systems market on the basis of type of ventilation system?

- What is the breakup of the Mexico factory ventilation systems market on the basis of application?

- What is the breakup of the Mexico factory ventilation systems market on the basis of end use industry?

- What is the breakup of the Mexico factory ventilation systems market on the basis of region?

- What are the various stages in the value chain of the Mexico factory ventilation systems market?

- What are the key driving factors and challenges in the Mexico factory ventilation systems market?

- What is the structure of the Mexico factory ventilation systems market and who are the key players?

- What is the degree of competition in the Mexico factory ventilation systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico factory ventilation systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico factory ventilation systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico factory ventilation systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)