Mexico False Ceiling Market Size, Share, Trends and Forecast by Material, Cost Range, Installation, Application, and Region, 2026-2034

Mexico False Ceiling Market Summary:

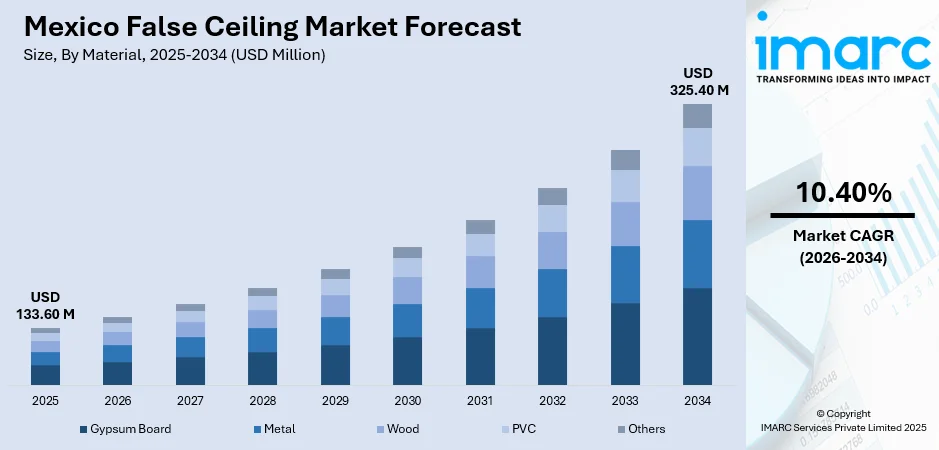

The Mexico false ceiling market size reached USD 133.60 Million in 2025. Looking forward, the market is projected to reach USD 325.40 Million by 2034, exhibiting a growth rate (CAGR) of 10.40% from 2026-2034.

The market is experiencing robust growth, driven by the rapid expansion of commercial and industrial construction activities across the country. The government's ambitious housing initiatives, coupled with significant nearshoring-related investments transforming Mexico into a manufacturing hub, are creating substantial demand for interior construction materials. Rising urbanization, growing emphasis on sustainable building practices, and increasing adoption of energy-efficient construction solutions are further propelling the market share.

Key Takeaways and Insights:

-

By Material: Gypsum board dominates the market with a share of 45% in 2025, driven by its fire resistance, cost-effectiveness, lightweight properties, and ease of installation, making it the preferred choice for residential, commercial, and industrial applications.

-

By Cost Range: Medium-cost leads the market with a share of 44% in 2025, owing to its optimal balance between quality and affordability, meeting the requirements of price-sensitive commercial projects and government-backed housing developments.

-

By Installation: Suspended represents the largest segment with a market share of 56% in 2025, attributed to its superior acoustic properties, thermal insulation capabilities, and ability to conceal electrical wiring and plumbing infrastructure.

-

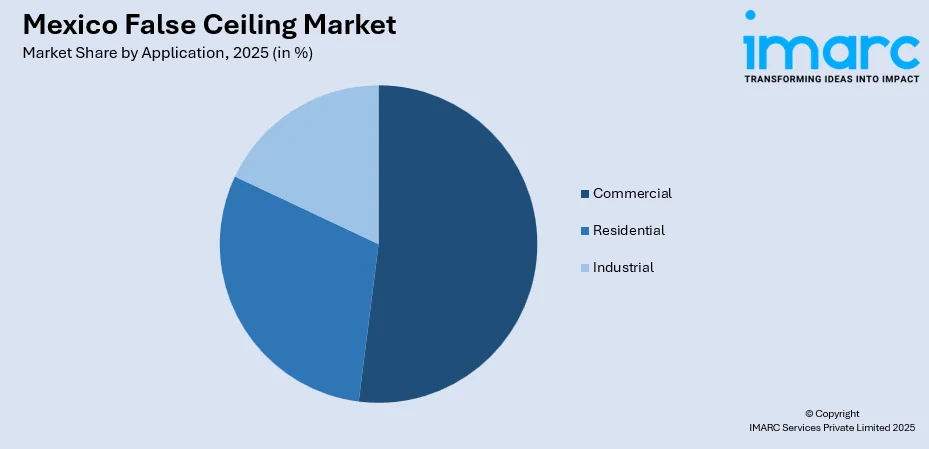

By Application: Commercial prevails the market with a share of 52% in 2025, fueled by the expansion of office buildings, retail spaces, hospitality establishments, and healthcare facilities requiring enhanced aesthetic appeal and functional interiors.

-

Key Players: Key players are driving the market expansion through continuous product innovations, design customization, and improved material quality. They strengthen distribution networks, partner with contractors, and promote modern interior solutions, increasing adoption across residential, commercial, and institutional construction projects nationwide.

To get more information on this market Request Sample

The market growth is supported by Mexico's thriving construction sector and favorable government initiatives. As reported by Mexico's National Institute of Statistics and Geography (INEGI), the index of construction production in Mexico grew by 6.3% year-on-year (YoY) during the first nine months of 2024, attributed to YoY increases in buildings (8.4%), civil engineering works (2.3%), and specialized construction activities (0.8%). Mexico's growing prominence as a nearshoring destination has attracted substantial foreign direct investment (FDI) in manufacturing facilities, further expanding the commercial construction sector. Offices, hotels, malls, and hospitals are increasingly using ceiling systems to improve interior design and space functionality. Home renovation trends are also supporting steady demand, as homeowners prefer stylish and low maintenance ceiling options. Technological improvements in materials, including lightweight and moisture resistant panels, are encouraging wider usage.

Mexico False Ceiling Market Trends:

Growing Emphasis on Sustainable Construction and Green Building Certifications

Mexico is witnessing accelerating adoption of sustainable construction practices, with building developers increasingly pursuing internationally recognized certifications for their projects. In 2024, Mexico secured the sixth position worldwide for LEED certifications. Torre Diana in Mexico City achieved the world's first LEED v5 Platinum certification for an office project, highlighting the nation's role as a leader in sustainable construction practices that promote eco-friendly ceiling materials.

Nearshoring-Driven Expansion of Industrial and Commercial Facilities

The nearshoring phenomenon continues to transform Mexico's construction landscape as multinational companies relocate manufacturing operations closer to North American markets. Major industrial cities, including Monterrey, Tijuana, and Ciudad Juárez, are experiencing unprecedented demand for industrial space with vacancy rates dropping significantly. In November 2023, the Mexican Association of Private Industrial Parks (AMPIP) announced plans to develop 50 new industrial parks, expected to begin operations from 2024 to 2025. In two years, these parks are anticipated to be operational in the northern, Bajío, and central areas of Mexico, involving an overall investment of USD 3 Billion. This is creating sustained demand for commercial-grade false ceiling installations.

Burgeoning construction chemical industry

A thriving construction chemical industry is fueling the market expansion by improving the performance and durability of ceiling systems. In August 2024, Saint-Gobain finalized a deal to purchase Ovniver Group, a construction chemicals manufacturer located in Mexico, for USD 815 Million. Ovniver Group produces adhesives, renders, surface preparations, and waterproofing solutions at locations in Mexico, Guatemala, Honduras, and the United States. The purchase enhanced Saint-Gobain's portfolio of building materials in Latin America. Advanced adhesives, sealants, coatings, and insulation materials enhance moisture resistance, bonding strength, and fire safety. Better chemical solutions also simplify installation and maintenance, encouraging wider adoption across residential, commercial, and institutional projects.

Market Outlook 2026-2034:

The market expansion will be supported by continued investments in commercial and industrial construction, government-backed housing initiatives, and the ongoing transformation of Mexico into a premier nearshoring destination. The market generated a revenue of USD 133.60 Million in 2025 and is projected to reach a revenue of USD 325.40 Million by 2034, growing at a compound annual growth rate of 10.40% from 2026-2034. Rising urbanization, increasing demand for energy-efficient building solutions, and growing adoption of sustainable construction practices will create favorable conditions for market participants. Rising awareness about sound control and energy efficiency is further boosting installation. In addition, growth in organized retail and availability of diverse designs support consumer choice.

Mexico False Ceiling Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Material |

Gypsum Board |

45% |

|

Cost Range |

Medium-Cost |

44% |

|

Installation |

Suspended |

56% |

|

Application |

Commercial |

52% |

Material Insights:

- Gypsum Board

- Metal

- Wood

- PVC

- Others

Gypsum board dominates with a market share of 45% of the total Mexico false ceiling market in 2025.

Gypsum board has established itself as the preferred material for false ceiling applications across Mexico due to its combination of fire resistance, acoustic insulation, and cost-effectiveness. The material's lightweight properties facilitate easier handling and faster installation compared to traditional construction methods, reducing overall project timelines and labor costs. According to IMARC Group, the Mexico gypsum board market reached nearly USD 475.50 Million in 2024, reflecting strong demand from both residential and commercial construction sectors.

The widespread adoption of gypsum board is further supported by government-backed affordable housing initiatives that prioritize economical and efficient building materials. Major domestic manufacturers have expanded production capabilities, with facilities across key industrial regions, including Monterrey, Ciudad Juárez, and San Luis Potosí, ensuring reliable supply chain coverage throughout the country.

Cost Range Insights:

- Low-Cost

- Medium-Cost

- High-Cost

Medium-cost leads with a share of 44% of the total Mexico false ceiling market in 2025.

The medium-cost segment has emerged as the dominant price category in the Mexican false ceiling market, balancing quality performance with accessible pricing that meets the requirements of commercial developers, government contractors, and residential builders. This segment offers products with adequate fire resistance, acoustic properties, and aesthetic appeal without the premium pricing associated with high-end specialty materials.

The growing commercial construction sector, driven by office buildings, retail establishments, and hospitality projects, predominantly specifies medium-cost ceiling solutions to optimize construction budgets. Market dynamics favor medium-cost offerings as developers seek to maximize value while meeting regulatory requirements and performance standards. The segment benefits from competitive pricing strategies among manufacturers and distributors, ensuring adequate margins throughout the supply chain while maintaining affordability for end-users. Investments in industrial, commercial, and service buildings in Mexico have increased, creating sustained demand for cost-effective interior construction materials.

Installation Insights:

- Drywall

- Suspended

- Stretch Ceilings

- Others

Suspended exhibits a clear dominance with a 56% share of the total Mexico false ceiling market in 2025.

Suspended ceiling systems have secured market leadership due to their versatility in accommodating building services infrastructure while providing superior acoustic and thermal performance. The installation method creates a plenum space between the structural ceiling and the suspended grid, enabling concealment of electrical wiring, plumbing, and fire suppression systems while maintaining easy accessibility for maintenance and modifications.

Commercial buildings, particularly modern office complexes and retail spaces, favor suspended systems for their ability to integrate lighting fixtures and climate control components seamlessly. The thermal insulation properties of suspended ceiling systems contribute to energy efficiency by reducing heat transfer between floors and minimizing heating, ventilation, and air conditioning (HVAC) energy consumption. In Mexico, the expanding commercial construction sector, supported by nearshoring-related industrial development and growing hospitality and healthcare infrastructure, continues to favor suspended installation methods for their functional benefits and design flexibility.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Commercial

- Residential

- Industrial

Commercial represents the leading segment with a 52% share of the total Mexico false ceiling market in 2025.

The commercial application segment maintains market dominance, driven by the expansion of office buildings, retail establishments, hospitality facilities, and healthcare institutions across Mexico. As per IMARC Group, the Mexico retail market size reached USD 475.2 Billion in 2025. Commercial spaces require false ceiling solutions that address multiple functional requirements, including acoustic control for productivity, aesthetic appeal for brand image, fire safety compliance, and integration of building services.

The growing emphasis on workplace wellness and employee comfort has elevated the importance of interior design elements, including ceiling systems that contribute to overall indoor environmental quality. Mexico's position as a leading destination for nearshoring investments has accelerated commercial construction activities, particularly in industrial corridors and major metropolitan areas. Modern commercial developments increasingly incorporate LEED-certified sustainable features, with false ceiling specifications reflecting environmental performance requirements and contributing to overall building certification scores.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico holds prominence due to its proximity to the United States border and concentration of manufacturing facilities benefiting from nearshoring trends. Major cities, including Monterrey, Tijuana, and Ciudad Juárez, host significant industrial parks and commercial developments requiring extensive false ceiling installations.

Central Mexico represents a major market hub anchored by Mexico City and surrounding metropolitan areas where commercial construction, government buildings, and residential developments drive substantial demand. The region benefits from concentrated economic activities and higher construction standards.

Southern Mexico presents emerging growth opportunities, supported by tourism infrastructure development, government housing initiatives, and regional commercial expansion. Coastal resort destinations and developing urban centers contribute to growing demand for interior construction materials.

Market Dynamics:

Growth Drivers:

Why is the Mexico False Ceiling Market Growing?

Expansion of Commercial and Industrial Construction Activities

Mexico's construction sector is experiencing significant growth supported by expanding commercial and industrial development across the country. Nearshoring trends have turned Mexico into a favored location for manufacturing activities seeking closeness to North American markets, prompting the development of industrial sites, warehouses, and supporting commercial infrastructure. In December 2025, DP World launched a new shared warehouse in Querétaro, increasing its rapidly expanding logistics presence in Mexico. The facility, covering 117,000 square feet (10,869 square meters) in La Bomba Industrial Park in El Marqués, boosted DP World’s third-party logistics (3PL) capabilities in Central Mexico, allowing the company to effectively meet the needs of key industries due to increasing demand from nearshoring. Investment announcements in manufacturing and industrial development have reached substantial levels, with the construction industry attracting billions of dollars in planned investments. This expansion creates sustained demand for interior construction materials, including false ceiling systems required for commercial spaces, manufacturing facilities, and logistics centers.

Government Housing Initiatives and Affordable Housing Development

The Mexican government has launched ambitious housing programs aimed at addressing housing deficits and providing affordable homes for underserved populations. In October 2024, the government of Mexico revealed an investment initiative of MXN 600 Billion (USD 30.2 Billion) aimed at constructing over one million homes for social interest throughout the six-year tenure of the new president Claudia Sheinbaum. This governmental initiative entails an average expenditure of USD 5.0 Billion and the construction of over 170,000 social interest dwellings annually. These initiatives prioritize the use of cost-effective and efficient building materials, creating substantial demand for gypsum-based false ceiling solutions. The program's focus on well-connected urban locations rather than remote developments ensures that new housing construction meets modern interior standards, including proper ceiling installations.

Rising Urbanization and Growing Middle-Class Population

Increasing urbanization and the growing middle-class population are strongly driving the market expansion, as more people move into cities and invest in better housing and workspaces. As per macrotrends, in Mexico, the urban population for 2023 stood at 105,844,290. Expanding urban population is elevating the demand for apartments, offices, shopping centers, and public buildings where false ceilings enhance visual appeal and comfort. Middle-income households are spending more on interior improvements, preferring ceilings that offer modern designs, concealed lighting, and improved ventilation. As living standards rise, consumers focus more on aesthetics and functional value rather than just basic shelter. Developers and builders respond by incorporating stylish ceiling solutions to attract buyers and tenants. Urban renovation projects also contribute to demand as older buildings are upgraded to match modern design trends. The preference for organized layouts, cleaner interiors, and noise control further supports adoption.

Market Restraints:

What Challenges the Mexico False Ceiling Market is Facing?

Rising Material Costs and Supply Chain Pressures

The market is facing challenges from increasing raw material costs and supply chain disruptions, affecting building materials availability and pricing. Fluctuations in gypsum, metal, and other input costs impact manufacturer margins and project economics, potentially constraining market growth. Inflationary pressures and currency depreciation have elevated construction costs across all material categories.

Skilled Labor Shortages in Construction Sector

Mexico's construction industry experiences persistent skilled labor shortages affecting project timelines and quality standards. The specialized installation requirements for certain false ceiling systems demand trained technicians who are increasingly difficult to recruit and retain. This constraint limits the pace of market expansion and affects service quality.

Economic Uncertainty and Trade Policy Volatility

The market remains sensitive to broader economic conditions and trade policy developments affecting construction investment decisions. Uncertainty regarding tariffs, trade agreements, and currency stability can impact foreign investment flows and construction project financing. Political and regulatory changes introduce additional planning challenges for market participants.

Competitive Landscape:

The Mexico false ceiling market features a moderately competitive environment with multinational building materials corporations, domestic manufacturers, and regional distributors serving diverse customer segments. Market participants compete on product quality, pricing, distribution coverage, technical support, and sustainability credentials. Leading manufacturers have established production facilities within Mexico to serve domestic demand while also exporting to neighboring markets. The competitive landscape favors companies with strong distribution networks, comprehensive product portfolios spanning multiple material types and price points, and the ability to provide technical support for specification and installation. Strategic partnerships between manufacturers and construction companies facilitate market penetration while ensuring product availability across geographic regions.

Mexico False Ceiling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Gypsum Board, Metal, Wood, PVC, Others |

| Cost Ranges Covered | Low-Cost, Medium-Cost, High-Cost |

| Installations Covered | Drywall, Suspended, Stretch Ceilings, Others |

| Applications Covered | Commercial, Residential, Industrial |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico false ceiling market size was valued at USD 133.60 Million in 2025.

The Mexico false ceiling market is expected to grow at a compound annual growth rate of 10.40% from 2026-2034 to reach USD 325.40 Million by 2034.

Gypsum board held the largest market share of 45%, driven by its fire resistance, cost-effectiveness, lightweight properties, and ease of installation across residential, commercial, and industrial applications.

Key factors driving the Mexico false ceiling market include expansion of commercial and industrial construction activities, government housing initiatives, rising urbanization, growing adoption of sustainable building practices, and nearshoring-driven foreign direct investment.

Major challenges include rising material costs and supply chain pressures affecting pricing stability, skilled labor shortages constraining installation capacity, economic uncertainty and trade policy volatility impacting investment decisions, and competition from alternative interior finishing solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)