Mexico Family Offices Market Size, Share, Trends and Forecast by Type, Office Type, Asset Class, Service Type, and Region, 2026-2034

Mexico Family Offices Market Overview:

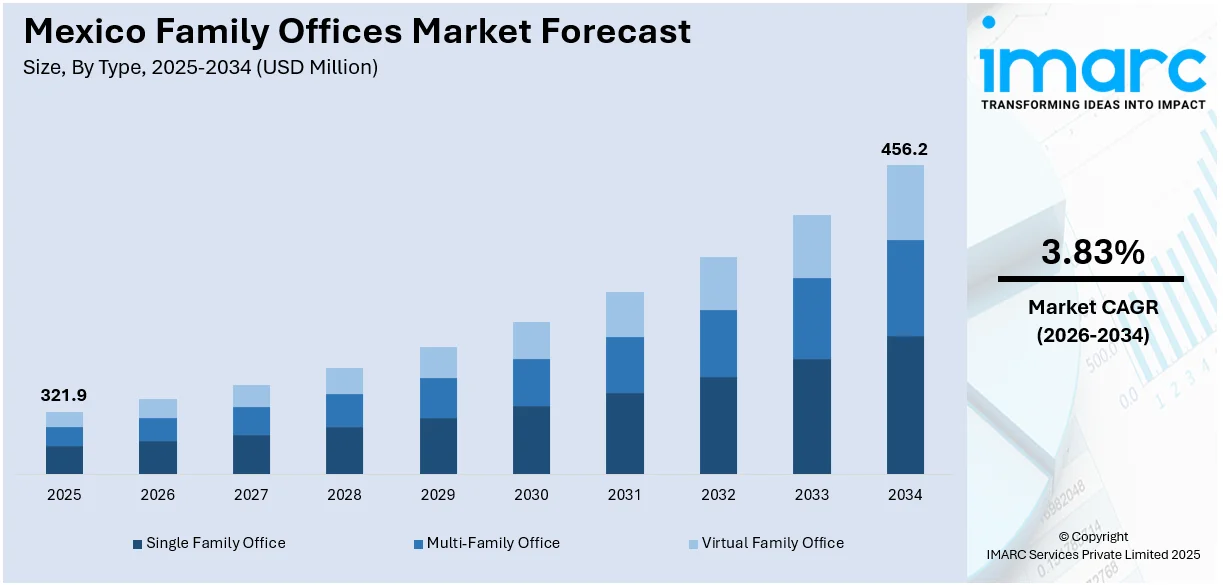

The Mexico family offices market size reached USD 321.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 456.2 Million by 2034, exhibiting a growth rate (CAGR) of 3.83% during 2026-2034. The market is witnessing significant growth, with increased demand for structured wealth management, alternative investments, and intergenerational planning. In line with this, the rise of multi-family and virtual offices is expanding reach and contributing significantly to the overall market growth across Mexico.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 321.9 Million |

| Market Forecast in 2034 | USD 456.2 Million |

| Market Growth Rate 2026-2034 | 3.83% |

Mexico Family Offices Market Trends:

Growing Interest in Alternative Investments

Family offices in Mexico are showing a strong shift toward alternative investment avenues, aiming to enhance returns and reduce reliance on traditional equity and debt instruments. This trend is playing a key role in Mexico family offices market growth, as more families seek access to high-performing, less correlated asset classes. Investments in private equity, real estate, infrastructure, and venture capital are gaining popularity, particularly among first- and second-generation wealth holders looking for long-term value creation. These asset classes offer greater control, potential tax advantages, and the ability to align investments with personal values or sector preferences. Additionally, access to global opportunities and co-investment networks is encouraging family offices to expand their portfolios strategically. As this investment mindset matures, it is expected to significantly shape the market outlook over the coming years.

To get more information on this market Request Sample

Intergenerational Wealth Planning

In Mexico, family offices are placing growing emphasis on intergenerational wealth planning to ensure the smooth transfer of assets and values across generations. This includes formal succession planning, establishing governance structures, and engaging younger family members through education and involvement in investment decisions. As wealth transitions to second- and third-generation inheritors, family offices are prioritizing long-term sustainability over short-term gains. Many are setting up family constitutions, boards, and trusts to manage roles, responsibilities, and conflict resolution. There's also a rising trend of mentoring and grooming future leaders within the family to uphold legacy while adapting to modern financial practices. This proactive approach not only preserves wealth but strengthens internal cohesion and continuity. These initiatives are becoming foundational to strategic planning and are expected to play a pivotal role in shaping the Mexico family offices market outlook.

Rise of Impact and ESG Investing

Environmental, social, and governance (ESG) factors are gaining momentum in the investment strategies of family offices in Mexico, particularly as younger generations take on decision-making roles. These stakeholders are prioritizing ethical, sustainable, and socially responsible portfolios that align with personal values and long-term global impact. Investments are increasingly directed toward renewable energy, social enterprises, inclusive finance, and green real estate. Family offices are also incorporating ESG metrics into their due diligence and risk assessment processes. Beyond financial returns, the focus is on legacy building, transparency, and reputational integrity. As regulatory awareness and stakeholder demand grow, ESG integration is becoming a standard component of asset allocation. This shift reflects a broader transformation in wealth management priorities and is contributing to the evolving structure and strategy of family offices. These developments are expected to influence the Mexico family offices market share going forward.

Mexico Family Offices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on type, office type, asset class, and service type.

Type Insights:

- Single Family Office

- Multi-Family Office

- Virtual Family Office

The report has provided a detailed breakup and analysis of the market based on the type. This includes single family office, multi-family office, and virtual family office.

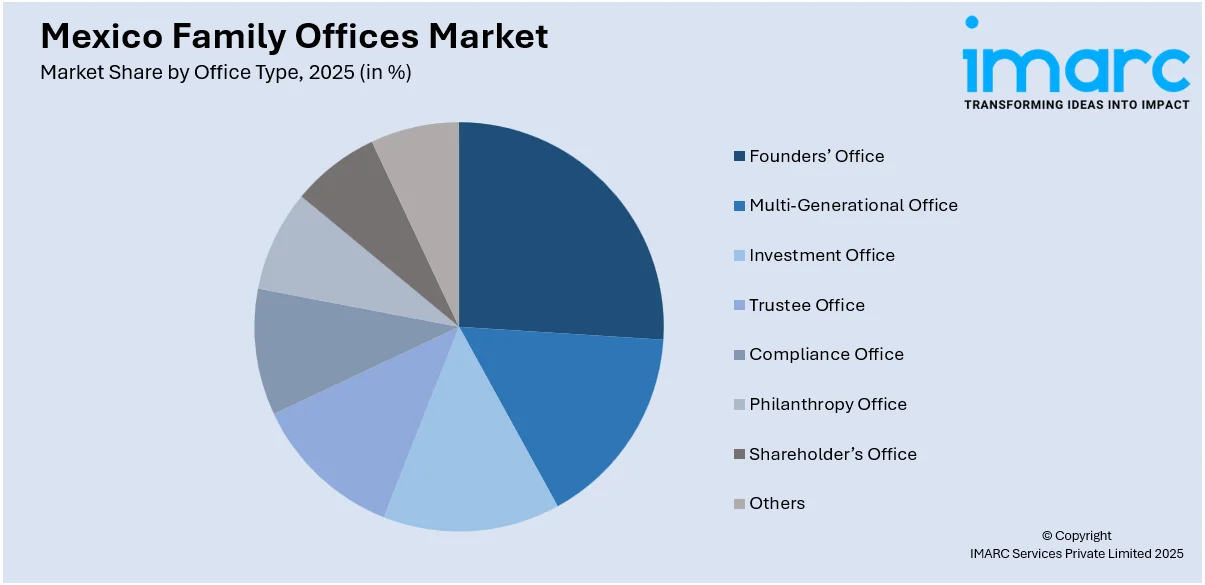

Office Type Insights:

Access the comprehensive market breakdown Request Sample

- Founders’ Office

- Multi-Generational Office

- Investment Office

- Trustee Office

- Compliance Office

- Philanthropy Office

- Shareholder’s Office

- Others

A detailed breakup and analysis of the market based on the office type have also been provided in the report. This includes founders’ office, multi-generational office, investment office, trustee office, compliance office, philanthropy office, shareholder’s office, and others.

Asset Class Insights:

- Bonds

- Equities

- Alternative Investments

- Commodities

- Cash or Cash Equivalents

A detailed breakup and analysis of the market based on the asset class have also been provided in the report. This includes bonds, equities, alternative investments, commodities, and cash or cash equivalents.

Service Type Insights:

- Financial Planning

- Strategy

- Governance

- Advisory

- Others

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes financial planning, strategy, governance, advisory, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Family Offices Market News:

- In February 2025, TMF Group expanded its fund and entity management services in Mexico through the acquisition of PLC, a local fund administrator. This move enhances TMF's capabilities in serving international fund managers and family offices, while strengthening their position in the Latin American market, particularly in passive fund administration.

- In June 2024, Americana Partners launched Americana Partners International, focusing on family office services for ultra-high-net-worth individuals in Latin America, particularly Mexico. The expansion reflects Americana's commitment to serving wealthy families as they navigate cross-border ties and investments. The firm continues its rapid growth trajectory.

Mexico Family Offices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Single Family Office, Multi-Family Office, Virtual Family Office |

| Office Types Covered | Founders’ Office, Multi-Generational Office, Investment Office, Trustee Office, Compliance Office, Philanthropy Office, Shareholder’s Office, Others |

| Asset Classes Covered | Bonds, Equities, Alternative Investments, Commodities, Cash or Cash Equivalents |

| Service Types Covered | Financial Planning, Strategy, Governance, Advisory, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico family offices market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico family offices market on the basis of type?

- What is the breakup of the Mexico family offices market on the basis of office type?

- What is the breakup of the Mexico family offices market on the basis of asset class?

- What is the breakup of the Mexico family offices market on the basis of service type?

- What is the breakup of the Mexico family offices market on the basis of region?

- What are the various stages in the value chain of the Mexico family offices market?

- What are the key driving factors and challenges in the Mexico family offices?

- What is the structure of the Mexico family offices market and who are the key players?

- What is the degree of competition in the Mexico family offices market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico family offices market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico family offices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico family offices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)