Mexico Faucet Market Size, Share, Trends and Forecast by Type, Application, Technology, Material, Distribution Channel, End User, and Region, 2025-2033

Mexico Faucet Market Overview:

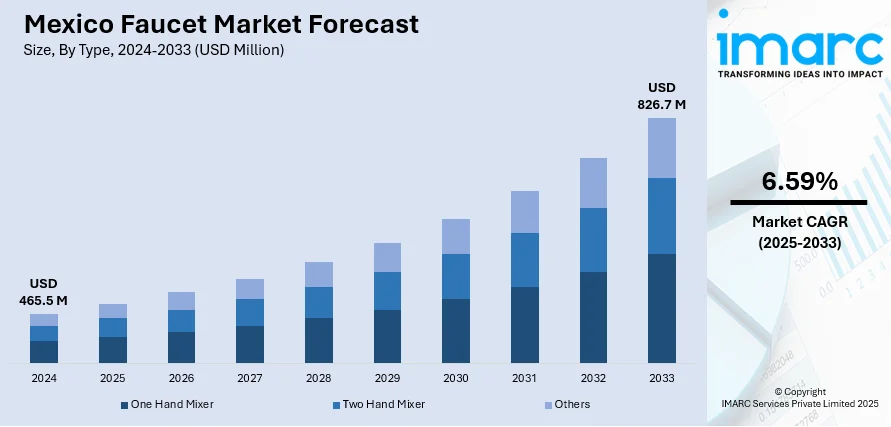

The Mexico faucet market size reached USD 465.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 826.7 Million by 2033, exhibiting a growth rate (CAGR) of 6.59% during 2025-2033. The market is driven by rapid urbanization, rising disposable incomes, growing residential and commercial construction, increasing renovation activities, water conservation awareness, surging demand for smart and touchless faucets, and the expansion of modern retail and e-commerce channels.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 465.5 Million |

| Market Forecast in 2033 | USD 826.7 Million |

| Market Growth Rate 2025-2033 | 6.59% |

Mexico Faucet Market Trends:

Rapid Urbanization and Infrastructure Development

The Mexico faucet market is significantly expanding because of the fast-paced urbanization and major infrastructure advancements. In line with this, the growing residential and commercial construction sector demands modern plumbing fixtures such as faucets. Moreover, the market demands faucets which unite practical features with attractive styles to match modern architectural styles. Besides this, the rising household earnings have allowed both residential and commercial sectors to purchase stylish faucets with high durability. Furthermore, the expanding construction activities across the nation receive support from government initiatives that focus on improving urban infrastructure. For example, in January 2025, Globe Union, the parent company of Gerber Plumbing Fixtures LLC, completed the acquisition of its vitreous China manufacturing facility and the land it resides on in Saltillo, Mexico. This strategic move enhances the company's flexibility to meet evolving customer needs in the region. As a result, the market in the region is growing because manufacturers develop innovative designs and advanced technologies that match consumer preferences, thereby boosting the Mexico faucet market share.

Growing Adoption of Smart and Water-Efficient Faucets

The growing adoption of smart and water-efficient faucet products is driving the Mexico faucet market growth. In addition to this, people are recognizing the value of environmental sustainability and water preservation, which is motivating them to choose faucets that incorporate touchless operation and low-flow mechanisms. Concurrent with this, smart faucets installed in residential and commercial areas are becoming increasingly popular because they feature motion sensors and temperature controls that reduce water consumption. For instance, in September 2024, Desalytics emphasized the importance of partnerships in addressing water challenges, potentially influencing the adoption of smart water management solutions like water-efficient faucets. Furthermore, the Mexican market sustainability goals align with worldwide green building initiatives, thus demonstrating broad Mexican market dedication to environmental stewardship. Apart from this, the market responds through the creation of modern products that exceed water efficiency requirements while targeting tech-oriented consumer tastes, significantly enhancing the Mexico faucet market outlook.

Mexico Faucet Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, application, technology, material, distribution channel, and end user.

Type Insights:

- One Hand Mixer

- Two Hand Mixer

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes one hand mixer, two hand mixer, and others.

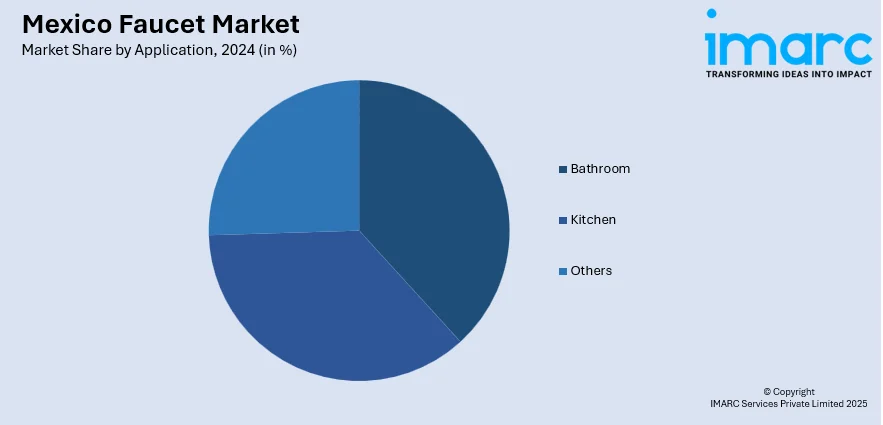

Application Insights:

- Bathroom

- Kitchen

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes bathroom, kitchen, and others.

Technology Insights:

- Cartridge

- Compression

- Ceramic Disc

- Ball

The report has provided a detailed breakup and analysis of the market based on the technology. This includes cartridge, compression, ceramic disc, and ball.

Material Insights:

- Metal

- Plastics

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes metal and plastics.

Distribution Channel Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online and offline.

End User Insights:

- Residential

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential, commercial, and industrial.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Faucet Market News:

- In May 2024, Delta introduced this innovation, allowing users to activate kitchen faucets via motion sensor, touch, or manual handle. This technology enhances hygiene and convenience, aligning with the growing demand for touchless solutions.

- In May 2024, Kohler introduced WaterMind Technology, designed to standardize showering experiences regardless of water pressure. This innovation reflects a commitment to consistent performance and user satisfaction.

Mexico Faucet Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | One Hand Mixer, Two Hand Mixer, Others |

| Applications Covered | Bathroom, Kitchen, Others |

| Technologies Covered | Cartridge, Compression, Ceramic Disc, Ball |

| Materials Covered | Metal, Plastics |

| Distribution Channels Covered | Online, Offline |

| End Users Covered | Residential, Commercial, Industrial |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico faucet market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico faucet market on the basis of type?

- What is the breakup of the Mexico faucet market on the basis of application?

- What is the breakup of the Mexico faucet market on the basis of technology?

- What is the breakup of the Mexico faucet market on the basis of material?

- What is the breakup of the Mexico faucet market on the basis of distribution channel?

- What is the breakup of the Mexico faucet market on the basis of end user?

- What is the breakup of the Mexico faucet market on the basis of region?

- What are the various stages in the value chain of the Mexico faucet market?

- What are the key driving factors and challenges in the Mexico faucet?

- What is the structure of the Mexico faucet market and who are the key players?

- What is the degree of competition in the Mexico faucet market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico faucet market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico faucet market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico faucet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)