Mexico Feed Additives Market Size, Share, Trends and Forecast by Source, Product Type, Livestock, Form, and Region, 2025-2033

Mexico Feed Additives Market Overview:

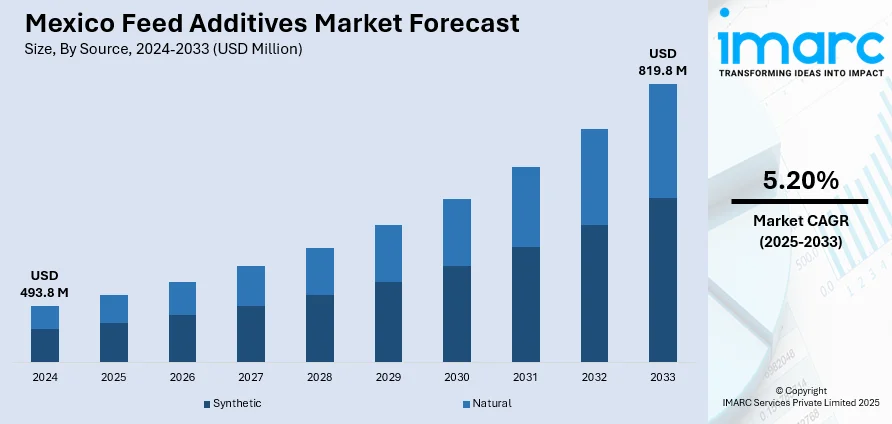

The Mexico feed additives market size reached USD 493.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 819.8 Million by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033. Rising protein consumption and heightened biosecurity measures are increasing the market share, as producers seek to boost animal performance, ensure food safety, and sustain efficient, disease-resilient livestock systems in response to evolving consumer demand and stricter health and production standards.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 493.8 Million |

| Market Forecast in 2033 | USD 819.8 Million |

| Market Growth Rate 2025-2033 | 5.20% |

Mexico Feed Additives Market Trends:

Rising Demand for Animal Protein

The increasing demand for meat, dairy, and poultry items in Mexico is a significant factor bolstering the growth of the market. With population growth, urban development, and rising disposable incomes transforming eating patterns, more individuals are moving towards diets high in protein. This changing demand is challenging the livestock industry to increase production while ensuring elevated food quality and safety standards are upheld. In this context, the growing protein consumption and the push for efficient, high-quality livestock production is offering a favorable Mexico feed additives market outlook. Producers are also ramping up their activities and increasingly depending on feed additives to improve growth performance, feed conversion rates, and overall animal well-being. These additives are becoming vital elements of effective and sustainable livestock production systems, especially in an environment where market competition and consumer demands are continuously increasing. Based on the USDA Agricultural Projections for 2033, Mexico's overall meat consumption, encompassing poultry, pork, and beef, is anticipated to hit 82.5 kilograms per person by 2033. Poultry is expected to experience the highest growth, rising from 38.3 kg per capita in 2023 to 43.8 kg by 2033. Pork usage is projected to increase from 20.2 to 22.6 kg per individual, whereas beef will see a slight rise from 15.7 to 16.0 kg. These trends emphasize the ongoing demand for animal protein, underscoring the necessity for feed additives that can enhance intensive production, boost animal performance, and guarantee a consistent supply of high-quality animal products to satisfy Mexico’s increasing nutritional requirements.

Biosecurity Measures and Disease Management

The increasing focus on biosecurity and disease prevention in livestock farming is a major factor contributing to the Mexico feed additives market growth. Regular threats from viral, bacterial, and parasitic outbreaks are emphasizing the necessity for proactive health management approaches, with feed additives being crucial. Additives like immune enhancers, gut regulators, and pathogen inhibitors are progressively utilized to improve animal resilience and lessen the chances of disease transmission. A recent instance highlights this trend, in 2024, SENASICA proclaimed the successful elimination of an H5N1 avian influenza outbreak in Temascalcingo, Estado de México. Identified only two weeks prior on August 17, the virus was rapidly controlled via depopulation and disinfection efforts. This swift action maintained Mexico’s disease-free status and strengthened its dedication to international biosecurity standards. Occurrences such as this highlight the vital significance of preventive measures, with feed additives acting as a primary defense in preserving animal health and production consistency, especially in commercial and export-focused enterprises. With rising awareness and regulatory backing, the Mexico feed additives market forecast indicates continued expansion, supported by the country’s proactive stance on livestock health and disease control.

Mexico Feed Additives Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on source, product type, livestock, and form.

Source Insights:

- Synthetic

- Natural

The report has provided a detailed breakup and analysis of the market based on the source. This includes synthetic and natural.

Product Type Insights:

- Amino Acids

- Lysine

- Methionine

- Threonine

- Tryptophan

- Phosphates

- Monocalcium Phosphate

- Dicalcium Phosphate

- Mono-Dicalcium Phosphate

- Defluorinated Phosphate

- Tricalcium Phosphate

- Others

- Vitamins

- Fat-Soluble

- Water-Soluble

- Acidifiers

- Propionic Acid

- Formic Acid

- Citric Acid

- Lactic Acid

- Sorbic Acid

- Malic Acid

- Acetic Acid

- Others

- Carotenoids

- Astaxanthin

- Canthaxanthin

- Lutein

- Beta-Carotene

- Enzymes

- Phytase

- Protease

- Others

- Mycotoxin Detoxifier

- Binders

- Modifiers

- Flavors and Sweeteners

- Antibiotics

- Tetracycline

- Penicillin

- Others

- Minerals

- Potassium

- Calcium

- Phosphorus

- Magnesium

- Sodium

- Iron

- Zinc

- Copper

- Manganese

- Others

- Antioxidants

- BHA

- BHT

- Ethoxyquin

- Others

- Non-Protein Nitrogen

- Urea

- Ammonia

- Others

- Preservatives

- Mold Inhibitors

- Anticaking Agents

- Phytogenics

- Essential Oils

- Herbs and Spices

- Oleoresin

- Others

- Probiotics

- Lactobacilli

- Streptococcus Thermophilus

- Bifidobacteria

- Yeast

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes amino acids (lysine, methionine, threonine, and tryptophan), phosphates (monocalcium phosphate, dicalcium phosphate, mono-dicalcium phosphate, defluorinated phosphate, tricalcium phosphate, and others), vitamins (fat-soluble and water-soluble), acidifiers (propionic acid, formic acid, citric acid, lactic acid, sorbic acid, malic acid, acetic acid, and others), carotenoids (astaxanthin, canthaxanthin, lutein, and beta-carotene), enzymes (phytase, protease, and others), mycotoxin detoxifiers (binders and modifiers), flavors and sweeteners, antibiotics (tetracycline, penicillin, and others), minerals (potassium, calcium, phosphorus, magnesium, sodium, iron, zinc, copper, manganese, and others), antioxidants (BHA, BHT, ethoxyquin, and others), non-protein nitrogen (urea, ammonia, others), preservatives (mold inhibitors and anticaking agents), phytogenics (essential oils, herbs and spices, oleoresin, and others), probiotics (lactobacilli, streptococcus thermophilus, bifidobacteria, and yeast).

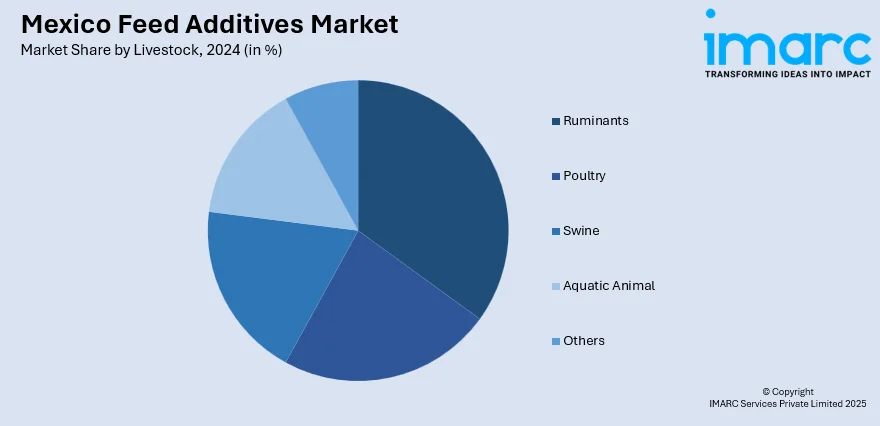

Livestock Insights:

- Ruminants

- Calves

- Dairy Cattle

- Beef Cattle

- Others

- Poultry

- Broilers

- Layers

- Breeders

- Swine

- Starters

- Growers

- Sows

- Aquatic Animal

- Others

A detailed breakup and analysis of the market based on the livestock have also been provided in the report. This includes ruminants (calves, dairy cattle, beef cattle, and others), poultry (broilers, layers, and breeders), swine (starters, growers, and sows), aquatic animal, and others.

Form Insights:

- Dry

- Liquid

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes dry and liquid.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Feed Additives Market News:

- In February 2025, Trouw Nutrition Mexico inaugurated its new premix and ‘Young Animal Feed (YAF)’ facility, named the “Aguila Project” feed plant in Colón, Querétaro, with a 1000 million peso investment. The facility can produce up to 100,000 tons annually and features automation, solar power, and digital traceability. It aims to boost sustainability and innovation in the livestock sector.

- In February 2025, Amlan International began showcasing its natural feed additives at the XXXI AMVECAJ International Congress in Jalisco, Mexico. In partnership with KOFARM, Amlan highlighted products like Varium and Calibrin-Z to support swine health and efficiency. The event emphasizes innovation and profitability in the swine industry.

Mexico Feed Additives Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Synthetic, Natural |

| Product Types Covered |

|

| Livestock Covered |

|

| Forms Covered | Dry, Liquid |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico feed additives market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico feed additives market on the basis of source?

- What is the breakup of the Mexico feed additives market on the basis of product type?

- What is the breakup of the Mexico feed additives market on the basis of livestock?

- What is the breakup of the Mexico feed additives market on the basis of form?

- What is the breakup of the Mexico feed additives market on the basis of region?

- What are the various stages in the value chain of the Mexico feed additives market?

- What are the key driving factors and challenges in the Mexico feed additives?

- What is the structure of the Mexico feed additives market and who are the key players?

- What is the degree of competition in the Mexico feed additives market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico feed additives market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico feed additives market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico feed additives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)