Mexico Ferroalloys Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

Mexico Ferroalloys Market Overview:

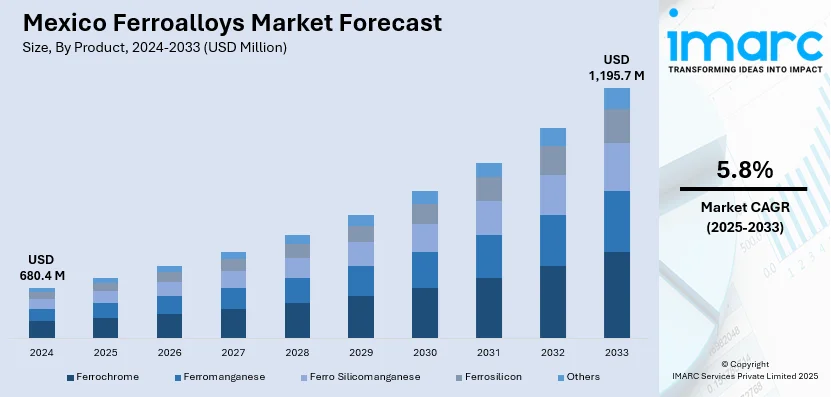

The Mexico ferroalloys market size reached USD 680.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,195.7 Million by 2033, exhibiting a growth rate (CAGR) of 5.8% during 2025-2033. The market share is expanding, driven by the broadening network of local suppliers that ensure a consistent supply of raw materials, along with increasing investments in mining infrastructure, which is encouraging the adoption of advanced materials.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 680.4 Million |

| Market Forecast in 2033 | USD 1,195.7 Million |

| Market Growth Rate 2025-2033 | 5.8% |

Mexico Ferroalloys Market Trends:

Increasing vehicle production

Rising vehicle manufacturing is fueling the Mexico ferroalloys market growth. As more vehicles are being produced, the demand for high-quality steel is increasing, leading to a high need for various ferroalloys, such as ferrochrome, ferromanganese, and ferrosilicon. According to the INEGI, in Mexico, sales of light vehicles reached 127,360 in March 2025, reflecting a rise of 1.3% from the 125,760 sales in March 2024. Ferroalloys improve the hardness, tensile strength, and resistance to wear and corrosion in steel components, making them essential for manufacturing vehicle frames, engine parts, and body panels. Mexico's growing position as a key automotive manufacturing hub, with rising exports and increasing investments from international automobile companies, is further encouraging the usage of ferroalloys. The expanding network of local suppliers also ensures a consistent supply of raw materials, supporting steady production levels. Moreover, technological advancements in automotive designs are motivating manufacturers to employ more specialized steel grades, which, in turn, is creating the need for ferroalloys. The ongoing trend of electric vehicle (EV) production also contributes to this demand, as lightweight and strong materials are being utilized.

Growing mining activities

Rising mining activities are offering a favorable Mexico ferroalloys market outlook. According to DENUE 2024, the sectors of mining, quarrying, and oil and gas extraction recorded 3,415 economic units in Mexico. The regions that had the most economic units were Puebla (575), Guerrero (283), and Sonora (209). Ferroalloys play a key role in enhancing the mechanical properties of steel and other alloys used in mining machinery, such as drills, conveyors, and crushers. As mining activities are broadening across the country to extract minerals like copper, silver, and lithium, the need for robust and wear-resistant materials is increasing, driving the demand for ferroalloys. These alloys improve the strength, heat resistance, and corrosion protection of metals employed in harsh mining environments. Moreover, with Mexico being one of the major players in the worldwide mining sector, the high scale of operations is offering continuous opportunities for domestic ferroalloy suppliers. The increasing Investments in mining infrastructure and the rise in export demand for extracted minerals is further encouraging the adoption of advanced materials, including those enhanced by ferroalloys.

Mexico Ferroalloys Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product and application.

Product Insights:

- Ferrochrome

- Ferromanganese

- Ferro Silicomanganese

- Ferrosilicon

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes ferrochrome, ferromanganese, ferro silicomanganese, ferrosilicon, and others.

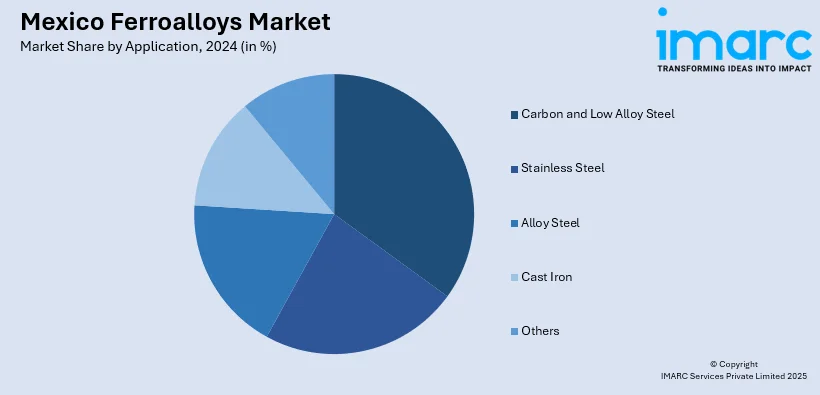

Application Insights:

- Carbon and Low Alloy Steel

- Stainless Steel

- Alloy Steel

- Cast Iron

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes carbon and low alloy steel, stainless steel, alloy steel, cast iron, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Ferroalloys Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Ferrochrome, Ferromanganese, Ferro Silicomanganese, Ferrosilicon, Others |

| Applications Covered | Carbon and Low Alloy Steel, Stainless Steel, Alloy Steel, Cast Iron, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico ferroalloys market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico ferroalloys market on the basis of product?

- What is the breakup of the Mexico ferroalloys market on the basis of application?

- What is the breakup of the Mexico ferroalloys market on the basis of region?

- What are the various stages in the value chain of the Mexico ferroalloys market?

- What are the key driving factors and challenges in the Mexico ferroalloys market?

- What is the structure of the Mexico ferroalloys market and who are the key players?

- What is the degree of competition in the Mexico ferroalloys market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico ferroalloys market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico ferroalloys market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico ferroalloys industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)