Mexico Ferrous Scrap Recycling Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

Mexico Ferrous Scrap Recycling Market Overview:

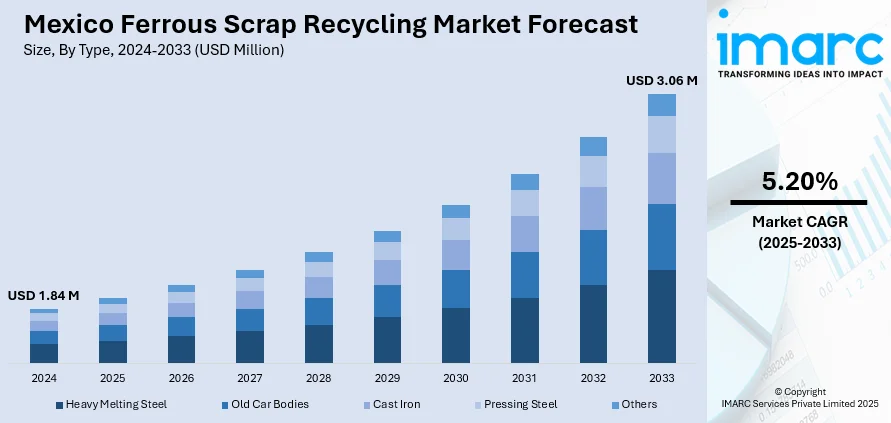

The Mexico ferrous scrap recycling market size reached USD 1.84 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3.06 Million by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033. The market is driven by increasing industrialization, rising demand for steel in the construction and automotive sectors, and the growing emphasis on sustainable waste management practices. Moreover, the country's strategic position as a manufacturing hub, along with government initiatives promoting circular economy models, supports market expansion. Additionally, continual advancements in recycling technologies and the rising cost of raw materials further expand the Mexico ferrous scrap recycling market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.84 Million |

| Market Forecast in 2033 | USD 3.06 Million |

| Market Growth Rate 2025-2033 | 5.20% |

Mexico Ferrous Scrap Recycling Market Trends:

Rising Industrialization and Construction Activity

The growing industrial and construction sectors are creating substantial volumes of ferrous scrap, simultaneously driving both supply and demand within the recycling ecosystem. Moreover, increasing infrastructure development, rapid urbanization, and a booming manufacturing sector, especially in automotive, appliances, and machinery, are generating increased scrap metal from production waste, decommissioned equipment, and demolition activities. For instance, as per industry reports, manufacturing production in Mexico rose by 3.10% in March 2025 compared to March 2024, underscoring the sector's upward trajectory. This industrial momentum directly correlates with heightened scrap volumes, which recyclers can process and reintroduce into the production cycle. In addition to this, as manufacturers seek to meet international environmental, social, and governance (ESG) criteria to remain globally competitive, recycling ferrous scrap becomes an essential component of sustainable production. The cyclical relationship between economic growth, scrap generation, and recycled input demand creates a reinforcing dynamic that supports market stability. With industrial clusters expanding in states like Nuevo León, Jalisco, and the Bajío region, the consistent generation of scrap materials is expected to fuel localized recycling operations and contribute to the Mexico ferrous scrap recycling market growth.

Strengthening Domestic Scrap Collection Infrastructure

The industry is experiencing a transformative push toward developing a more efficient and formalized scrap collection infrastructure. As per industry reports, the country is estimated to use over 18 Million Metric Tons of ferrous scrap while producing approximately 14 Million Metric Tons in 2025. Therefore, there is an increased need to strengthen and regulate the national scrap collection framework to ensure a reliable and high-quality supply of recyclable material. Historically, much of the scrap collection in Mexico has been dominated by informal networks, which lack regulatory oversight and consistency in material quality. However, with the growing industrial demand for reliable scrap feedstock, particularly from EAF-based steelmakers, there is increasing investment in structured supply chains. Furthermore, emergence of new logistics systems, partnerships between recyclers and industrial manufacturers, and government efforts to formalize the informal sector are enabling better scrap aggregation and traceability. This is leading to improved pricing mechanisms, material sorting standards, and volume predictability, all of which are essential for large-scale steel production. Additionally, the growing presence of digital platforms and smart logistics in scrap sourcing is helping to connect smaller suppliers to centralized recycling facilities more efficiently. As this infrastructure strengthens, the flow of ferrous scrap is becoming more stable, enabling recyclers and steelmakers to operate with reduced input volatility and enhanced operational planning.

Mexico Ferrous Scrap Recycling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, application, and end user.

Type Insights:

- Heavy Melting Steel

- Old Car Bodies

- Cast Iron

- Pressing Steel

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes heavy melting steel, old car bodies, cast iron, pressing steel, and others.

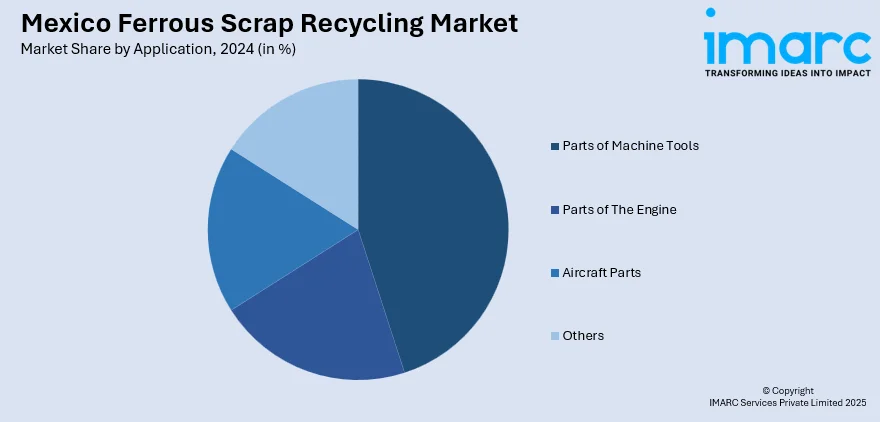

Application Insights:

- Parts of Machine Tools

- Parts of The Engine

- Aircraft Parts

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes parts of machine tools, parts of the engine, aircraft parts, and others.

End User Insights:

- Construction

- Automotive

- Shipbuilding

- Equipment Manufacturing

- Consumer Appliances

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes construction, automotive, shipbuilding, equipment manufacturing, consumer appliances, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Ferrous Scrap Recycling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Heavy Melting Steel, Old Car Bodies, Cast Iron, Pressing Steel, Others |

| Applications Covered | Parts of Machine Tools, Parts of The Engine, Aircraft Parts, Others |

| End Users Covered | Construction, Automotive, Shipbuilding, Equipment Manufacturing, Consumer Appliances, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico ferrous scrap recycling market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico ferrous scrap recycling market on the basis of type?

- What is the breakup of the Mexico ferrous scrap recycling market on the basis of application?

- What is the breakup of the Mexico ferrous scrap recycling market on the basis of end user?

- What is the breakup of the Mexico ferrous scrap recycling market on the basis of region?

- What are the various stages in the value chain of the Mexico ferrous scrap recycling market?

- What are the key driving factors and challenges in the Mexico ferrous scrap recycling market?

- What is the structure of the Mexico ferrous scrap recycling market and who are the key players?

- What is the degree of competition in the Mexico ferrous scrap recycling market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico ferrous scrap recycling market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico ferrous scrap recycling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico ferrous scrap recycling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)