Mexico Fiber Cement Market Size, Share, Trends and Forecast by Raw Material, Construction Type, End Use, and Region, 2025-2033

Mexico Fiber Cement Market Overview:

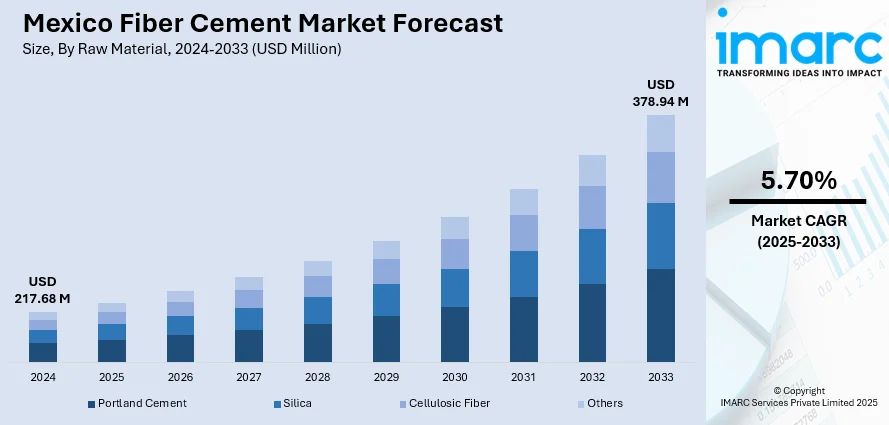

The Mexico fiber cement market size reached USD 217.68 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 378.94 Million by 2033, exhibiting a growth rate (CAGR) of 5.70% during 2025-2033. The market is expanding steadily due to rising demand for durable, low-maintenance building materials across residential and commercial construction. Furthermore, the Mexico fiber cement market share is supported by eco-friendly advantages and product adaptability in roofing, siding, and partition applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 217.68 Million |

| Market Forecast in 2033 | USD 378.94 Million |

| Market Growth Rate 2025-2033 | 5.70% |

Mexico Fiber Cement Market Trends:

Rising Demand for Sustainable Materials

The growing emphasis on sustainable construction materials in Mexico has significantly influenced the demand for fiber cement products. Developers and contractors increasingly favor fiber cement boards and panels for their fire resistance, moisture tolerance, and long service life. Unlike traditional materials such as wood or metal, fiber cement offers a balance of cost efficiency and environmental benefits, which aligns with the rising awareness of green building practices. Construction regulations are also gradually shifting to encourage energy-efficient and low-impact materials, further reinforcing this trend. A key factor driving this market is the gradual shift among developers toward prefabricated housing systems, where fiber cement is widely used due to its strength and ease of installation. Mid-paragraph developments such as Sto Corp.'s upcoming plant in Nuevo Leon are expected to increase domestic capacity and reduce dependence on imports. Such infrastructure investments directly support the expansion of Mexico's fiber cement market share by ensuring quicker delivery timelines and improved customization options for local builders.

Infrastructure Growth and Urbanization

Urban development and large-scale infrastructure investments in Mexico have triggered the rising usage of fiber cement products in commercial and industrial projects. Expanding cities require durable, weather-resistant materials for facades and partitions, positioning fiber cement as a reliable option. The country's infrastructure projects particularly those under state-backed housing programs and urban renewal efforts are prompting greater integration of fiber cement across multiple applications. Additionally, the relocation of global manufacturing operations to Mexico has accelerated the construction of warehouses and industrial plants, where fiber cement is used for insulation and cladding purposes. In this context, the keyword Mexico fiber cement market growth becomes relevant as increased building activity drives material demand. In February 2025, Rock Fiber Inc. and ReforceTech Ltd. launched a joint venture to promote composite reinforcement, reflecting industry interest in strengthening non-metallic materials like fiber cement. Such advancements indicate the market's shift toward innovation and durability. This steady urban expansion, coupled with technological upgrades, continues to shape the Mexico fiber cement market growth and enhance its competitiveness across North America.

Mexico Fiber Cement Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on raw material, construction type, and end use.

Raw Material Insights:

- Portland Cement

- Silica

- Cellulosic Fiber

- Others

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes Portland cement, silica, cellulosic fiber, and others.

Construction Type Insights:

- Siding

- Roofing

- Molding and Trim

- Others

The report has provided a detailed breakup and analysis of the market based on the construction type. This includes siding, roofing, molding and trim, and others.

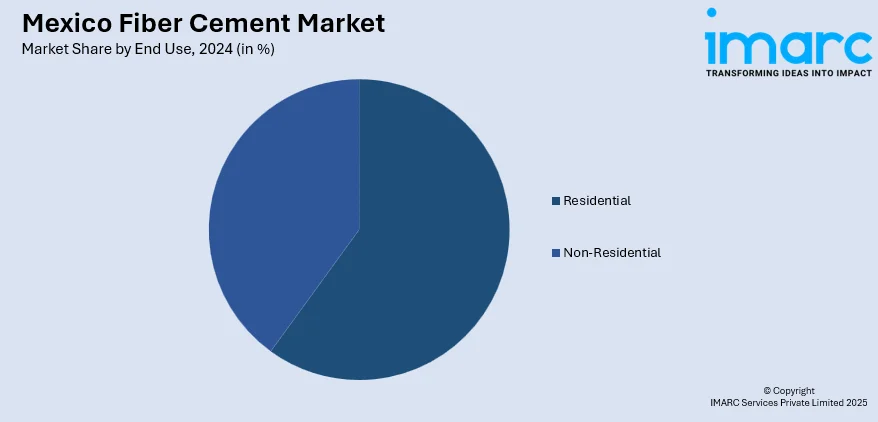

End Use Insights:

- Residential

- Non-Residential

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes residential and non-residential.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Fiber Cement Market News:

- February 2025: Rock Fiber Inc. and ReforceTech Ltd. launched ReforceTech Americas to supply basalt fiber-based reinforcement for concrete. This initiative offered a sustainable alternative to steel, advancing fiber cement innovation and expanding eco-friendly construction solutions across North American infrastructure and data center projects.

- June 2024: Sto Corp. began construction of a manufacturing plant in Nuevo Leon, Mexico, aimed at producing cladding systems with future inclusion of StoCast fibre cement aesthetics. This development expanded local capacity, reduced import reliance, and supported regional fibre cement demand growth in Mexico and Southern Texas.

Mexico Fiber Cement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Portland Cement, Silica, Cellulosic Fiber, Others |

| Construction Types Covered | Siding, Roofing, Molding and Trim, Others |

| End Uses Covered | Residential, Non-Residential |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico fiber cement market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico fiber cement market on the basis of raw material?

- What is the breakup of the Mexico fiber cement market on the basis of construction type?

- What is the breakup of the Mexico fiber cement market on the basis of end use?

- What is the breakup of the Mexico fiber cement market on the basis of region?

- What are the various stages in the value chain of the Mexico fiber cement market?

- What are the key driving factors and challenges in the Mexico fiber cement market?

- What is the structure of the Mexico fiber cement market and who are the key players?

- What is the degree of competition in the Mexico fiber cement market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico fiber cement market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico fiber cement market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico fiber cement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)