Mexico Fiberglass Market Size, Share, Trends and Forecast by Glass Product Type, Glass Fiber Type, Resin Type, Application, End User, and Region, 2025-2033

Mexico Fiberglass Market Overview:

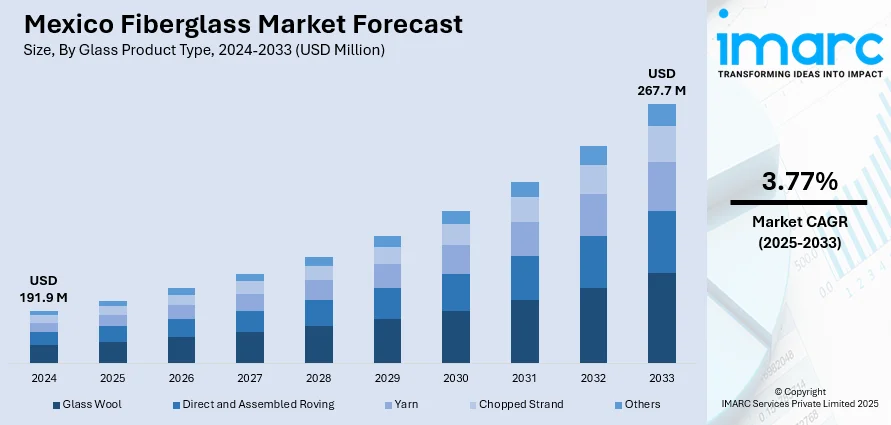

The Mexico fiberglass market size reached USD 191.9 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 267.7 Million by 2033, exhibiting a growth rate (CAGR) of 3.77% during 2025-2033. The market is witnessing steady growth, driven by rising demand from construction, automotive, and wind energy sectors. Additionally, fiberglass is a preferred material for insulation, structural components, and reinforced plastics due to lightweight, durable, and corrosion-resistant properties, along with growing infrastructure projects and industrial applications, which are supporting local production and imports, contributing to an overall increase in Mexico fiberglass market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 191.9 Million |

| Market Forecast in 2033 | USD 267.7 Million |

| Market Growth Rate 2025-2033 | 3.77% |

Mexico Fiberglass Market Trends:

Infrastructure and Construction Boom

Mexico’s expanding infrastructure and construction sectors are driving increased demand for fiberglass-based materials. Known for its strength, lightweight properties, and resistance to moisture and corrosion, fiberglass is being widely used in roofing panels, wall reinforcements, insulation products, and composite construction components. In both residential and commercial developments, fiberglass insulation is favored for its thermal efficiency and acoustic performance, aligning with growing energy-saving standards. Government-backed urban development projects, smart city initiatives, and housing schemes are contributing to higher consumption of durable, cost-effective materials like fiberglass. For instance, in April 2025, Mexico's government increased its housing target to 1.1 million homes under the Vivienda para el Bienestar program, adding 100,000 homes. It plans to provide 1.55 million home improvement grants and 1 million property titles, generating 9.6 million direct jobs and injecting MX$94.4 billion into local economies. Additionally, the rising popularity of prefab and modular construction systems has enhanced the use of fiberglass-reinforced plastics (FRPs) for faster and more sustainable builds. As construction activities spread across urban and semi-urban regions, fiberglass continues to play a vital role in modern building solutions, supporting the overall growth of the Mexico fiberglass market.

To get more information of this market, Request Sample

Growth in Wind Energy

Mexico’s renewable energy sector, particularly wind power, is experiencing significant growth as the country works to diversify its energy mix and reduce carbon emissions. In November 2024, Mexico's National Strategy for the Electricity Sector (2024-2030) includes a US$23bn investment in the Federal Electricity Commission (CFE). The plan allocates US$12.3bn for new generation (13,024 MW), US$7.5bn for transmission, and US$3.6bn for distribution. As of 2023, installed capacity reached 90.6 GW, including 6.9 GW from wind. Wind energy projects require turbine blades that are strong, lightweight, and durable qualities that make fiberglass an ideal material for their production. The excellent strength-to-weight ratio of fiberglass allows for the manufacturing of longer, more efficient blades that can withstand high stress and harsh weather conditions. This has led to increased adoption of fiberglass composites in wind turbine construction across wind farms in states like Oaxaca and Tamaulipas. As developers scale up renewable energy investments, the demand for high-performance fiberglass materials is expected to rise further. The ongoing shift toward clean energy and sustainable infrastructure is becoming a major factor driving the Mexico fiberglass market growth.

Mexico Fiberglass Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on glass product type, glass fiber type, resin type, application, and end user.

Glass Product Type Insights:

- Glass Wool

- Direct and Assembled Roving

- Yarn

- Chopped Strand

- Others

The report has provided a detailed breakup and analysis of the market based on the glass product type. This includes glass wool, direct and assembled roving, yarn, chopped strand, and others.

Glass Fiber Type Insights:

- E-Glass

- A-Glass

- S-Glass

- AR-Glass

- C-Glass

- R-Glass

- Others

A detailed breakup and analysis of the market based on the glass fiber type have also been provided in the report. This includes E-glass, A-glass, S-glass, AR-glass, C-glass, R-glass, and others.

Resin Type Insights:

- Thermoset Resin

- Thermoplastic Resin

A detailed breakup and analysis of the market based on the resin type have also been provided in the report. This includes thermoset resin and thermoplastic resin.

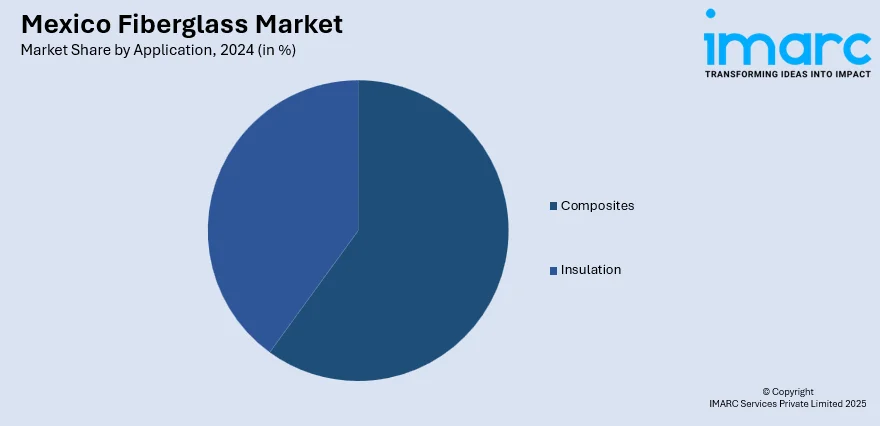

Application Insights:

- Composites

- Insulation

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes composites and insulation.

End User Insights:

- Construction

- Automotive

- Wind Energy

- Aerospace and Defense

- Electronics

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes construction, automotive, wind energy, aerospace and defense, electronics, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Fiberglass Market News:

- In May 2024, AZULIK Mobility unveiled EK, a prototype doorless electric car featuring a fiberglass body and a tropical zapote wooden steering wheel. Designed by Roth Fablab in Mexico, the vehicle accommodates three passengers and is ideal for low-speed transport within the AZULIK Basin development. Its maximum speed is 40 km/h.

Mexico Fiberglass Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Glass Product Types Covered | Glass Wool, Direct and Assembled Roving, Yarn, Chopped Strand, Others |

| Glass Fiber Types Covered | E-Glass, A-Glass, S-Glass, AR-Glass, C-Glass, R-Glass, Others |

| Resin Types Covered | Thermoset Resin, Thermoplastic Resin |

| Applications Covered | Composites, Insulation |

| End Users Covered | Construction, Automotive, Wind Energy, Aerospace and Defense, Electronics, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico fiberglass market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico fiberglass market on the basis of product type?

- What is the breakup of the Mexico fiberglass market on the basis of glass fiber type?

- What is the breakup of the Mexico fiberglass market on the basis of resin type?

- What is the breakup of the Mexico fiberglass market on the basis of application?

- What is the breakup of the Mexico fiberglass market on the basis of end user?

- What is the breakup of the Mexico fiberglass market on the basis of region?

- What are the various stages in the value chain of the Mexico fiberglass market?

- What are the key driving factors and challenges in the Mexico fiberglass market?

- What is the structure of the Mexico fiberglass market and who are the key players?

- What is the degree of competition in the Mexico fiberglass market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico fiberglass market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico fiberglass market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico fiberglass industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)