Mexico Filtration Systems Market Size, Share, Trends and Forecast by Product Type, Filter Media, Technology, End Use Industry, and Region, 2025-2033

Mexico Filtration Systems Market Overview:

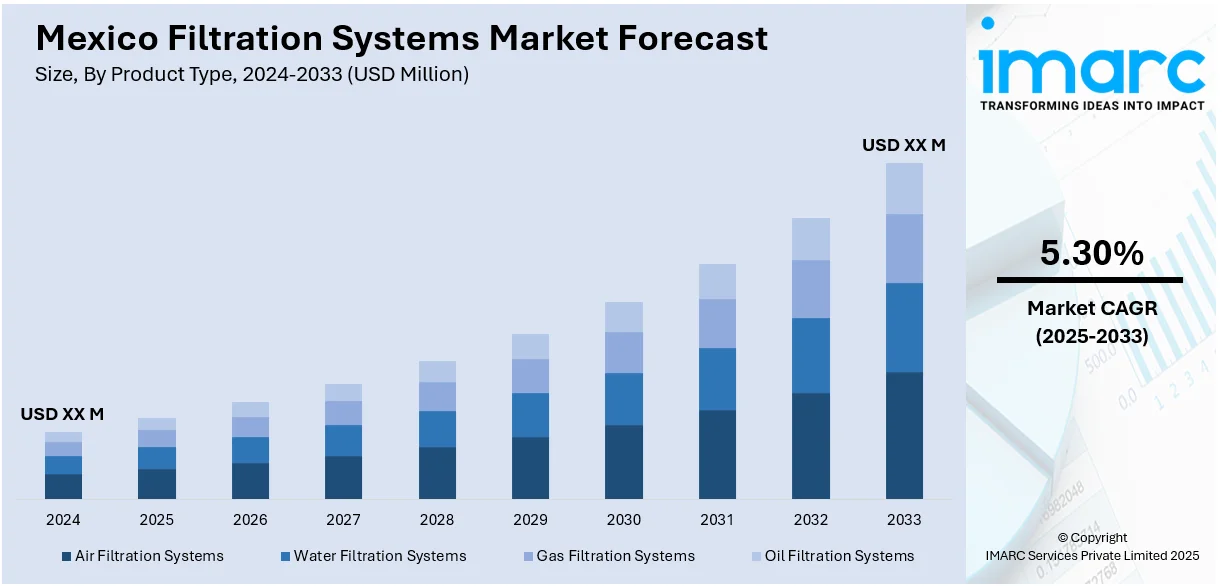

The Mexico filtration systems market size is projected to exhibit a growth rate (CAGR) of 5.30% during 2025-2033. The market is driven by rising concerns over water quality and contamination, including PFAS, lead, and pharmaceuticals. Increasing demand for clean water solutions, coupled with technological advancements like AquaTower and PFAS filters, is boosting Mexico filtration systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 5.30% |

Mexico Filtration Systems Market Trends:

Surging Demand for Clean Water Solutions

The need for effective water filtration systems has gradually been rising in Mexico due to the necessity for clean and safe water for consumption in rural and urban populations. Access to clean water is one of the biggest issues in most areas, particularly rural areas, where water pollution and shortages are frequent. In order to stem this rising tide, several efforts are directed at enhancing access to clean water. For example, in August 2024, Planet Water Foundation and MetLife Foundation concluded an effective program in rural Mexico by installing 30 AquaTower water filtration systems in six states. The initiative targeted to give access to clean drinking water to more than 50,000 individuals, showing a notable attempt to enhance water availability and quality for marginalized communities. The AquaTower systems, which are installed with cutting-edge filtration technology, focus on contaminants in local water supplies, providing a steady source of clean water. Such initiatives are one aspect of a general trend toward the use of water treatment technologies as knowledge of the correlation between bad water quality and health conditions increases. Furthermore, as urban population grows, urban cities are also embracing advanced filtration systems, leading to an increased demand for high-quality, efficient, and scalable water filtration technologies that address different regional demands. In addition, growing awareness of contaminants, such as pharmaceuticals and other toxic chemicals, has seen filtration systems developed to manage such contaminants. In September 2024, OASIS International introduced three next-generation filtration solutions, namely the Total PFAS and Pharmaceutical filters, that directly address increasing concerns about contaminants such as PFAS, lead, and microplastics in potable water.

Environmental Sustainability and Technological Innovation

Environmental issues regarding water pollution and water contamination have emerged as the major drivers for the Mexico filtration systems market. Mexico has experienced severe challenges owing to increased levels of pollution in water sources, such as chemicals such as PFAS and pharmaceuticals. This has led to heightened demand for filtration systems that are capable of handling a broad array of contaminants while ensuring environmental sustainability. The need to fight water pollution has spurred the creation of new technologies that have more complete answers. OASIS International's release of Total PFAS and Pharmaceutical filters in September 2024 is the best example of how filtration systems are innovating to answer for particular contaminants. These filters address forever chemicals, heavy metals, and pharmaceutical residues in potable water, providing a better quality of water filtration for Mexican communities and businesses. The capacity of these systems to extract sophisticated contaminants is a major advancement in the water filtration industry, responding to increasing anxiety surrounding water security and public health. At the same time, sustainability practices have been an important component of water treatment approaches in Mexico. In August 2024, Planet Water Foundation and MetLife Foundation furthered their commitment to promoting water sustainability by distributing AquaTower filtration systems throughout rural Mexico. The systems deliver a constant source of clean water with minimal environmental footprint. The integration of cutting-edge filtration technology and emphasis on sustainable practices is driving the market, with a significant influence in both rural and urban communities.

Mexico Filtration Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on product type, filter media, technology, and end use industry.

Product Type Insights:

- Air Filtration Systems

- Water Filtration Systems

- Gas Filtration Systems

- Oil Filtration Systems

The report has provided a detailed breakup and analysis of the market based on the product type. This includes air filtration systems, water filtration systems, gas filtration systems, and oil filtration systems.

Filter Media Insights:

- Activated Carbon

- Fiberglass

- Nonwoven Fabrics

- Metals

- Filter Paper

- Combination Filters

- Others

A detailed breakup and analysis of the market based on the filter media have also been provided in the report. This includes activated carbon, fiberglass, nonwoven fabrics, metals, filter paper, combination filters, and others.

Technology Insights:

- Microfiltration

- Ultrafiltration

- Nanofiltration

- Reverse Osmosis

- Electrodialysis

- Chromatography

- Centrifugation

The report has provided a detailed breakup and analysis of the market based on the technology. This includes microfiltration, ultrafiltration, nanofiltration, reverse osmosis, electrodialysis, chromatography, and centrifugation.

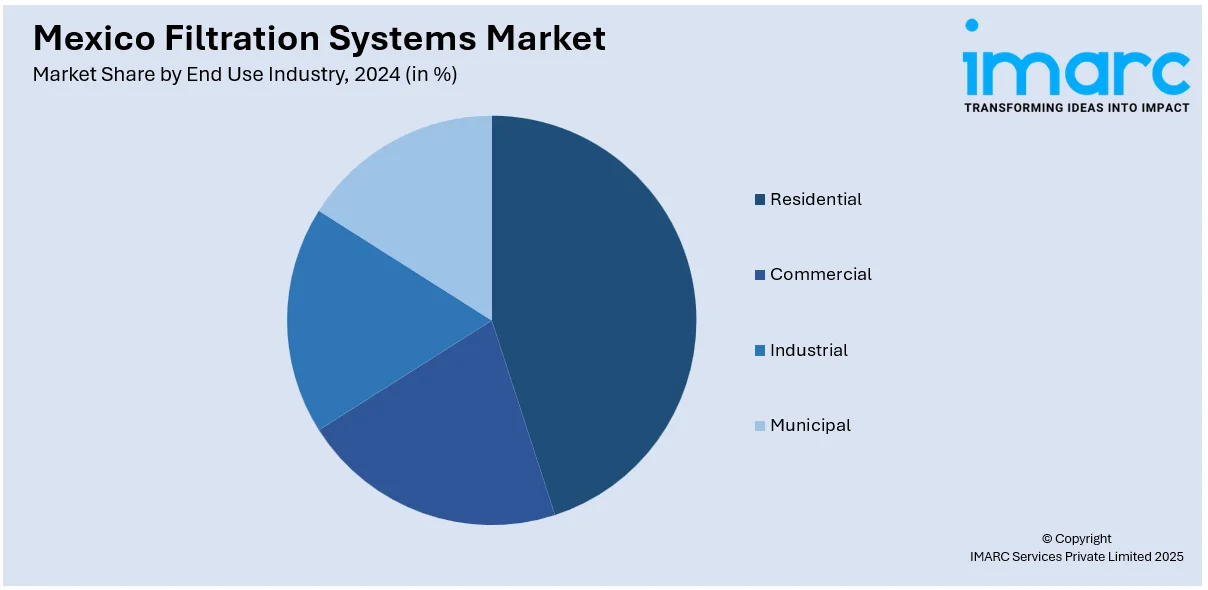

End Use Industry Insights:

- Residential

- Commercial

- Industrial

- Municipal

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes residential, commercial, industrial, and municipal.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Filtration Systems Market News:

- March 2025: Cleanova acquired Micronics Engineered Filtration Group, enhancing its global filtration portfolio. This acquisition strengthened Cleanova’s position in North America, EMEA, and Mexico, diversifying its product offerings in industrial filtration and air, vacuum, and pressure filtration systems.

- January 2025: Transition Industries and Veolia partnered to implement advanced filtration systems for the Pacifico Mexinol project in Sinaloa, Mexico. The project employed cutting-edge water treatment technologies like ZeeWeed ultrafiltration and reverse osmosis, contributing to industrial water reuse and addressing water scarcity, enhancing the Mexico filtration systems market growth.

Mexico Filtration Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Air Filtration Systems, Water Filtration Systems, Gas Filtration Systems, Oil Filtration Systems |

| Filter Medias Covered | Activated Carbon, Fiberglass, Nonwoven Fabrics, Metals, Filter Paper, Combination Filters, Others |

| Technologies Covered | Microfiltration, Ultrafiltration, Nanofiltration, Reverse Osmosis, Electrodialysis, Chromatography, Centrifugation |

| End Use Industries Covered | Residential, Commercial, Industrial, Municipal |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, and Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico filtration systems market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico filtration systems market on the basis of product type?

- What is the breakup of the Mexico filtration systems market on the basis of filter media?

- What is the breakup of the Mexico filtration systems market on the basis of technology?

- What is the breakup of the Mexico filtration systems market on the basis of end use industry?

- What is the breakup of the Mexico filtration systems market on the basis of region?

- What are the various stages in the value chain of the Mexico filtration systems market?

- What are the key driving factors and challenges in the Mexico filtration systems market?

- What is the structure of the Mexico filtration systems market and who are the key players?

- What is the degree of competition in the Mexico filtration systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico filtration systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico filtration systems market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico filtration systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)