Mexico Firearms Market Size, Share, Trends and Forecast by Type, Technology, Operation, End Use, and Region, 2025-2033

Mexico Firearms Market Overview:

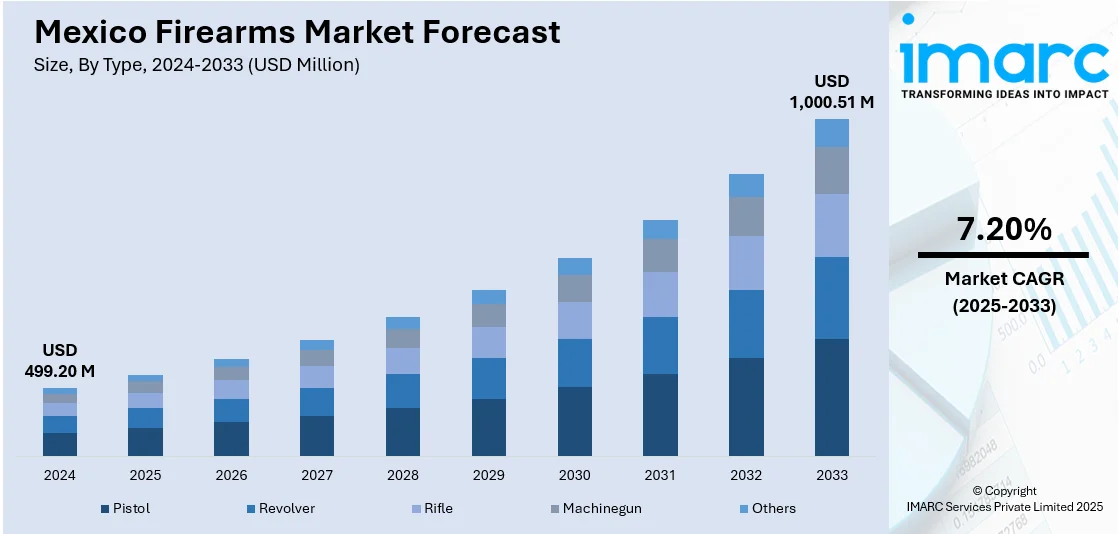

The Mexico firearms market size reached USD 499.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,000.51 Million by 2033, exhibiting a growth rate (CAGR) of 7.20% during 2025-2033. The market includes rising concerns over personal and community security due to ongoing cartel violence and crime. Demand is also fueled by hunting and sport shooting traditions, particularly in rural areas. Increased digital access has made firearms more available through online platforms, expanding consumer reach. Additionally, gaps in border control and firearm regulation enforcement contribute to the illegal arms trade, sustaining market activity despite strict gun laws. Government policies and legal actions also influence market dynamics.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 499.20 Million |

| Market Forecast in 2033 | USD 1,000.51 Million |

| Market Growth Rate 2025-2033 | 7.20% |

Mexico Firearms Market Trends:

Legal Pressure on U.S. Gun Manufacturers

Mexico is intensifying legal actions against U.S. gun manufacturers to hold them accountable for the illegal flow of firearms fueling violence in the country. These weapons, often trafficked into Mexico, are heavily used by drug cartels and criminal groups, worsening national security. In 2022, firearms were involved in 67.56% of the 32,223 homicides recorded, underscoring their central role in Mexico’s violence crisis. The government argues that some U.S. companies actively market and distribute guns in ways that facilitate trafficking, making them more than passive suppliers. This legal strategy marks a significant shift toward international corporate accountability, aiming to reshape how firearm manufacturers operate and are regulated. If successful, Mexico’s lawsuits could set a precedent for other nations to challenge global arms practices through legal means, promoting greater transparency and responsibility in the manufacturing and distribution of firearms worldwide.

Digital Transformation of the Firearms Market

The firearms and hunting equipment market in Mexico is undergoing a digital transformation, with more consumers turning to online platforms for their purchases. This shift reflects broader changes in consumer behavior, where convenience, variety, and accessibility are key driving factors. Online shopping allows buyers to explore a wide range of products, compare brands, and access items that may not be readily available in physical stores. As trust in e-commerce grows, more firearm retailers are establishing digital storefronts, streamlining transactions, and improving customer support. This evolution is also influencing how regulations are enforced, as authorities must adapt to monitor online sales effectively. The trend underscores the need for updated digital policies to ensure that firearms sold online adhere to national laws and safety standards, while also offering a safer, more regulated environment for legitimate buyers.

Government Efforts to Reduce Illegal Gun Ownership

Mexico’s government is expanding efforts to reduce illegal firearms through nationwide disarmament campaigns that allow citizens to anonymously surrender weapons with financial incentives. These initiatives aim to address the root causes of gun violence, which accounted for 70% of the 31,062 homicides in 2023. Alongside community engagement and public education to change attitudes toward gun ownership, the government is increasing military presence in violence-prone areas and strengthening border controls to stop smuggling. This comprehensive strategy tackles both supply and demand in the illegal arms market, emphasizing prevention, enforcement, and rehabilitation. The success of these efforts relies on ongoing cooperation among federal, local, and international agencies, reflecting a unified approach to improving public safety and reducing the devastating impact of firearms-related crime across Mexico.

Mexico Firearms Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, technology, operation, and end use.

Type Insights:

- Pistol

- Revolver

- Rifle

- Machinegun

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes pistol, revolver, rifle, machinegun, and others.

Technology Insights:

- Guided

- Unguided

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes guided and unguided.

Operation Insights:

- Automatic

- Semi-Automatic

- Manual

The report has provided a detailed breakup and analysis of the market based on the operation. This includes automatic, semi-automatic, and manual.

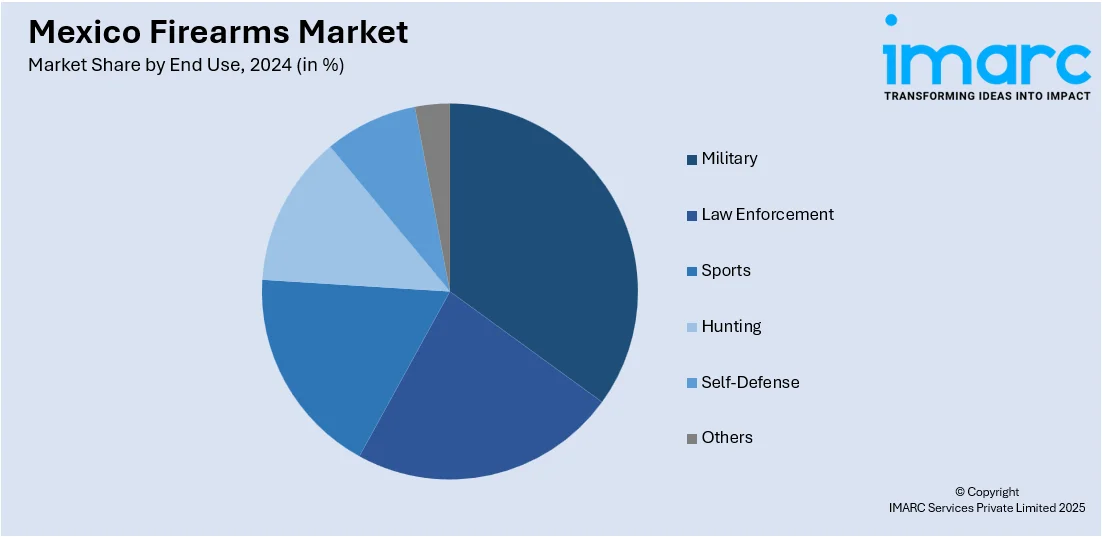

End Use Insights:

- Military

- Law Enforcement

- Sports

- Hunting

- Self-Defense

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes military, law enforcement, sports, hunting, self-defense, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern, Central, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Firearms Market News:

- In January 2025, Mexico’s President Claudia Sheinbaum launched the nationwide “Yes to Disarmament, Yes to Peace” campaign to reduce street violence by encouraging citizens to surrender guns anonymously for cash rewards. Firearms collected, from revolvers to machine guns, will be destroyed. Previously limited to Mexico City, the program now involves multiple government ministries and religious groups. It aims to combat rampant gun violence linked to drug cartels, amid Mexico’s strict gun control and calls for U.S. cooperation on arms trafficking.

Mexico Firearms Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Pistol, Revolver, Rifle, Machinegun, Others |

| Technologies Covered | Guided, Unguided |

| Operations Covered | Automatic, Semi-Automatic, Manual |

| End Uses Covered | Military, Law Enforcement, Sports, Hunting, Self-Defense, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico firearms market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico firearms market on the basis of type?

- What is the breakup of the Mexico firearms market on the basis of technology?

- What is the breakup of the Mexico firearms market on the basis of operation?

- What is the breakup of the Mexico firearms market on the basis of end use?

- What is the breakup of the Mexico firearms market on the basis of region?

- What are the various stages in the value chain of the Mexico firearms market?

- What are the key driving factors and challenges in the Mexico firearms market?

- What is the structure of the Mexico firearms market and who are the key players?

- What is the degree of competition in the Mexico firearms market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico firearms market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico firearms market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico firearms industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)