Mexico Fleet Leasing Market Size, Share, Trends and Forecast by Lease Type, Vehicle Type, Lease Duration, End Use Industry, and Region, 2026-2034

Mexico Fleet Leasing Market Summary:

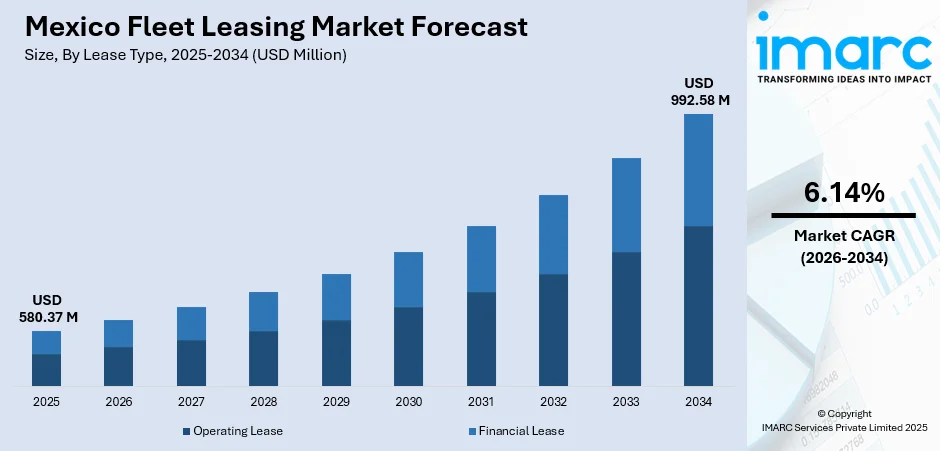

The Mexico fleet leasing market size was valued at USD 580.37 Million in 2025 and is projected to reach USD 992.58 Million by 2034, growing at a compound annual growth rate of 6.14% from 2026-2034.

Mexico's fleet leasing market is experiencing robust expansion as businesses increasingly prioritize operational flexibility over traditional vehicle ownership. The trend toward leasing indicates a larger organizational shift in corporate mobility policies, with companies in the logistics, retail, and corporate sectors moving toward flexible vehicle solutions to manage the allocation of capital and operational efficiency. The market has been steadily growing due to the increasing need for e-commerce and last-mile delivery services, along with the positive trend in the economic conditions and the improvement of the technologies of managing the digital fleet.

Key Takeaways and Insights:

-

By Lease Type: Operating lease dominates the market with a share of 68% in 2025, driven by businesses seeking predictable monthly expenses, off-balance sheet financing benefits, and bundled maintenance services that eliminate ownership complexities.

-

By Vehicle Type: Passenger vehicles leads the market with a share of 41% in 2025, fueled by corporate fleet requirements for employee transportation, executive vehicles, and field service operations across major metropolitan areas.

-

By Lease Duration: Medium-term leasing (1-3 years) represents the largest segment with a market share of 48% in 2025, offering an optimal balance between flexibility and cost efficiency for businesses planning mid-range operational commitments.

-

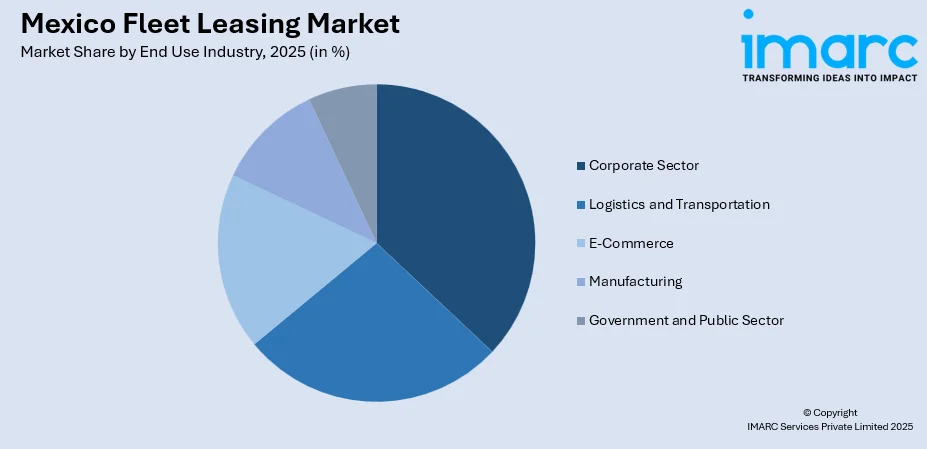

By End Use Industry: Corporate sector leads with a share of 32% in 2025, as multinational companies and large domestic enterprises increasingly outsource fleet management to focus on core business activities.

-

By Region: Central Mexico dominates with 38% revenue share in 2025, anchored by Mexico City's concentration of corporate headquarters, financial institutions, and logistics hubs serving the nation's most densely populated economic zone.

-

Key Players: The Mexico fleet leasing market exhibits moderate competitive intensity, with international fleet management companies competing alongside regional financial institutions and automotive manufacturer-backed lessors, each offering specialized solutions tailored to diverse corporate requirements and industry-specific operational demands.

To get more information on this market Request Sample

The evolving landscape of vehicle acquisition in Mexico reflects a fundamental transformation in how businesses approach mobility and asset management. Organizations are increasingly recognizing that fleet leasing provides strategic advantages beyond simple cost savings, including access to advanced telematics technologies, simplified compliance management, and the flexibility to adapt fleet composition to changing market conditions. The integration of digital platforms has streamlined the leasing process, enabling real-time fleet monitoring, automated maintenance scheduling, and data-driven decision-making capabilities. Major leasing associations report sustained growth in new vehicle acquisitions, with fleet operators demonstrating a strong preference for comprehensive service packages that bundle vehicle access with insurance, maintenance, and administrative support. This trend aligns with the broader corporate focus on total cost of ownership analysis and operational efficiency optimization.

Mexico Fleet Leasing Market Trends:

Digital Transformation Reshaping Fleet Management Practices

The adoption of advanced telematics and IoT-enabled fleet management solutions is transforming operational capabilities across Mexico's leasing sector. The Mexico fleet management market size reached USD 345.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 841.0 Million by 2033, exhibiting a growth rate (CAGR) of 9.30% during 2025-2033. Leasing providers are integrating GPS tracking, automated diagnostics, and predictive maintenance systems that enhance vehicle uptime and reduce operational disruptions. These technologies enable fleet managers to optimize route planning, monitor driver behavior, and implement proactive maintenance schedules, ultimately delivering superior value propositions that strengthen the competitive positioning of leasing over traditional ownership models.

Rising Demand for Sustainable and Electric Fleet Solutions

Environmental sustainability considerations are increasingly influencing fleet procurement decisions across Mexican corporations. Leasing models offer an accessible pathway for businesses to transition toward electric and hybrid vehicle technologies without bearing the full capital burden or residual value risks associated with emerging powertrains. Major corporations in consumer goods, logistics, and beverage sectors are leveraging leasing arrangements to expand their electric vehicle fleets, supported by government incentives and growing charging infrastructure investments. For instance, in August 2025, Unilever Mexico introduced its inaugural fleet of electric trucks, advancing its commitment to reach net-zero emissions across its entire value chain by 2039.

Emergence of Flexible Subscription-Based Mobility Models

Vehicle subscription services are emerging as modern alternatives to conventional leasing, providing users with greater flexibility and convenience. These programs typically feature shorter-term commitments, bundled services such as insurance and maintenance, and the option to switch vehicles as needs evolve. The growing popularity of subscriptions reflects a shift in consumer and corporate behavior toward on-demand mobility solutions that adapt to changing personal or business requirements, enabling access to newer vehicles without the constraints of long-term contracts while supporting more dynamic and flexible transportation choices.

Market Outlook 2026-2034:

The Mexico fleet leasing market is positioned for sustained expansion as economic fundamentals and structural demand drivers continue to support industry growth. The ongoing nearshoring trend is attracting manufacturing investments that require efficient logistics operations, while the e-commerce sector's expansion drives demand for last-mile delivery fleets. Hybrid and electric vehicle adoption within leased fleets is accelerating, with industry associations reporting significant year-over-year growth in alternative fuel vehicle registrations. The market generated a revenue of USD 580.37 Million in 2025 and is projected to reach a revenue of USD 992.58 Million by 2034, growing at a compound annual growth rate of 6.14% from 2026-2034.

Mexico Fleet Leasing Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Lease Type | Operating Lease | 68% |

| Vehicle Type | Passenger Vehicles | 41% |

| Lease Duration | Medium-Term (1-3 years) | 48% |

| End Use Industry | Corporate Sector | 32% |

| Region | Central Mexico | 38% |

Lease Type Insights:

- Operating Lease

- Financial Lease

The operating lease dominates with a market share of 68% of the total Mexico fleet leasing market in 2025.

Operating leases have emerged as the preferred financing mechanism for Mexican businesses seeking comprehensive fleet solutions without balance sheet implications. This leasing structure offers predictable fixed monthly payments that encompass vehicle depreciation, interest costs, and frequently include maintenance, insurance, and administrative services. Organizations benefit from the ability to upgrade vehicles regularly, ensuring access to modern technologies and improved fuel efficiency without bearing residual value risks.

The dominance of operating leases reflects the growing sophistication of Mexican fleet managers who prioritize total cost of ownership optimization and operational simplicity. Leasing providers have enhanced their value propositions by bundling advanced fleet management technologies, real-time tracking capabilities, and comprehensive service packages that address the complete vehicle lifecycle. This comprehensive approach enables lessees to concentrate resources on core business operations while professional fleet management organizations handle vehicle-related complexities.

Vehicle Type Insights:

- Passenger Vehicles

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

The passenger vehicles segment leads with a share of 41% of the total Mexico fleet leasing market in 2025.

The passenger vehicles segment leads the Mexico fleet leasing market primarily due to strong corporate demand. Businesses rely on leased passenger cars for employee transportation, executive mobility, and sales operations, benefiting from cost-efficient fleet management without committing large capital expenditures. Leasing allows companies to scale their fleets according to operational needs while ensuring access to newer, reliable vehicles that reduce maintenance requirements and operational risks, supporting business efficiency and productivity.

On the consumer side, passenger vehicles appeal to urban professionals and daily commuters seeking modern, convenient personal mobility. Leasing offers access to cars with advanced safety, connectivity, and fuel-efficiency features without high upfront costs, while flexible upgrade options align with lifestyle and financial planning needs. Compact, fuel-efficient models are particularly attractive in Mexico’s congested cities. Combined with bundled services like maintenance and insurance, these factors make passenger vehicles the most practical and widely adopted category in the country’s fleet leasing market.

Lease Duration Insights:

- Short-Term Leasing (Less than 12 months)

- Medium-Term Leasing (1-3 years)

- Long-Term Leasing (More than 3 years)

The medium-term leasing (1-3 years) exhibits clear dominance with a 48% share of the total Mexico fleet leasing market in 2025.

The medium-term leasing segment, typically spanning one to three years, leads the Mexico fleet leasing market due to its balance of flexibility and financial predictability, which appeals to both corporate clients and small-to-medium enterprises. This leasing model allows businesses to manage fleet expenses without the long-term capital commitment required for outright vehicle purchases, while still benefiting from the operational advantages of newer vehicles, such as improved fuel efficiency, lower maintenance requirements, and enhanced safety features.

Medium-term leases also provide companies with the ability to scale or adjust their fleets according to changing operational demands, making it ideal for industries with fluctuating transportation needs, including logistics, e-commerce, and delivery services. Additionally, these leases often include bundled services such as insurance, maintenance, and roadside assistance, reducing administrative burdens and total cost of ownership for fleet operators. The combination of manageable lease terms, predictable budgeting, and access to modern vehicles makes medium-term leasing the preferred choice in Mexico, supporting both operational efficiency and financial planning for businesses across various sectors.

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Corporate Sector

- Logistics and Transportation

- E-Commerce

- Manufacturing

- Government and Public Sector

The corporate sector dominates with a market share of 32% of the total Mexico fleet leasing market in 2025.

The corporate sector dominates the Mexico fleet leasing market due to its substantial and consistent demand for vehicles to support business operations. Companies across industries such as logistics, retail, pharmaceuticals, and IT require reliable transportation for employee commuting, sales activities, deliveries, and client services. Leasing offers organizations the flexibility to manage large fleets without the capital-intensive burden of outright ownership, allowing businesses to preserve working capital while maintaining operational efficiency.

Moreover, fleet leasing simplifies vehicle management for companies by providing comprehensive solutions that include maintenance, insurance, and replacement options. This reduces administrative overhead and ensures compliance with regulatory and safety standards. The ability to regularly upgrade vehicles through leasing arrangements also aligns with corporate priorities for cost control, employee satisfaction, and sustainability initiatives, particularly as organizations integrate fuel-efficient or electric vehicles into their fleets. Additionally, tax benefits and structured payment plans further incentivize leasing over purchasing, reinforcing the corporate sector’s leadership in Mexico’s fleet leasing market by offering financial predictability and operational scalability.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Central Mexico exhibits clear dominance with a 38% share of the total Mexico fleet leasing market in 2025.

The Mexico fleet leasing market in Central Mexico is driven by a combination of economic, demographic, and infrastructural factors. The region hosts the country’s largest metropolitan areas, including Mexico City and surrounding urban centers, which are home to a high concentration of businesses across industries such as logistics, retail, pharmaceuticals, and professional services. The presence of multinational corporations and financial institutions creates substantial and sustained demand for corporate fleets, positioning leasing as a cost-effective alternative to vehicle ownership.

Robust road networks, well-developed commercial hubs, and a dense concentration of service providers, including maintenance, insurance, and fleet management companies, facilitate efficient fleet operations and enhance the appeal of leasing. Additionally, rising awareness of sustainability and fuel efficiency is encouraging companies to adopt leasing solutions that provide access to newer, low-emission vehicles, including hybrids and electric models. Flexible lease structures, bundled services, and tax benefits further reduce financial and operational burdens for businesses. Collectively, these factors, urban concentration, corporate demand, infrastructure availability, and sustainability considerations, drive the strong growth of the fleet leasing market in Central Mexico.

Market Dynamics:

Growth Drivers:

Why is the Mexico Fleet Leasing Market Growing?

Expanding E-Commerce and Last-Mile Delivery Requirements

The exponential growth of e-commerce in Mexico is fundamentally transforming fleet leasing demand patterns across the logistics and delivery sectors. The Mexico e-commerce market size reached USD 54.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 175.8 Billion by 2034, exhibiting a growth rate (CAGR) of 13.92% during 2026-2034. Online retail expansion has created unprecedented requirements for delivery vehicles capable of serving urban, suburban, and regional markets efficiently. Major e-commerce platforms and retail operators are scaling their distribution capabilities through leased vehicle fleets that provide flexibility to match capacity with fluctuating demand volumes. This trend is particularly pronounced in metropolitan areas where same-day and next-day delivery expectations necessitate extensive vehicle networks.

Corporate Focus on Capital Efficiency and Operational Optimization

Mexican businesses are increasingly adopting leasing as a strategic tool for capital allocation optimization and balance sheet management. The shift from vehicle ownership to leasing enables organizations to preserve working capital for core business investments while accessing modern vehicle fleets through predictable operating expenses. Total cost of ownership analysis has become standard practice among fleet managers, revealing the comprehensive economic advantages of leasing arrangements that bundle acquisition, maintenance, insurance, and disposal services into streamlined monthly payments.

Nearshoring-Driven Industrial Expansion and Logistics Development

The acceleration of nearshoring investments in Mexico is generating substantial demand for commercial fleet solutions across the manufacturing and logistics sectors. Companies relocating production facilities and distribution operations require efficient vehicle fleets to support workforce transportation, supply chain logistics, and cross-border trade requirements. Industrial corridor development along the northern border region is creating concentrated demand clusters, while improved infrastructure investments enhance the operational efficiency of leased vehicle fleets serving manufacturing and distribution operations.

Market Restraints:

What Challenges the Mexico Fleet Leasing Market is Facing?

Vehicle Supply Constraints and Extended Delivery Timelines

Persistent disruptions in global supply chains are continuing to affect the availability of vehicles and extend delivery timelines for leasing companies. Delays in acquiring new vehicles hinder fleet expansion plans, challenging companies’ ability to meet corporate and individual demand promptly. These extended lead times can restrict market growth opportunities and affect customer satisfaction, emphasizing the importance of strategic planning and inventory management for leasing operators.

Regulatory Complexity Across State Jurisdictions

Mexico’s federal system creates diverse regulatory requirements for fleet operators across different states, including vehicle registration, road taxes, environmental inspections, and licensing fees. This regulatory fragmentation increases administrative workloads and compliance costs for leasing providers managing multi-state fleets. Navigating these varied legal obligations can create operational inefficiencies, requiring companies to adopt robust compliance strategies to ensure smooth service delivery and minimize disruptions.

Economic Uncertainty and Currency Fluctuation Impacts

Macroeconomic volatility and fluctuating currency exchange rates present challenges for fleet leasing, particularly for imported vehicles or international providers. Economic uncertainty can influence corporate budgeting, fleet investment, and expansion decisions, potentially slowing demand during periods of reduced business confidence. Leasing companies must manage these risks carefully to maintain pricing stability, profitability, and operational continuity amid unpredictable economic conditions.

Competitive Landscape:

The Mexico fleet leasing market demonstrates moderate consolidation with a diverse competitive landscape comprising international fleet management corporations, bank-affiliated leasing subsidiaries, automotive manufacturer financing arms, and specialized regional providers. Market participants differentiate through service breadth, geographic coverage, technology integration, and industry specialization. International players leverage global expertise and established fleet management methodologies, while regional providers compete through localized service networks and relationship-based approaches. Competitive dynamics increasingly emphasize digital capabilities, sustainability offerings, and comprehensive mobility solutions that extend beyond traditional vehicle leasing arrangements.

Recent Developments:

-

In January 2025, Mexico launched Olinia, its first domestic electric vehicle manufacturer, focusing on affordable mini EVs targeting personal mobility and last-mile delivery applications, potentially expanding electric vehicle options available for fleet leasing.

Mexico Fleet Leasing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Lease Types Covered | Operating Lease, Financial Lease |

| Vehicle Types Covered | Passenger Vehicles, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs) |

| Lease Durations Covered | Short-Term Leasing (Less than 12 months), Medium-Term Leasing (1-3 years), Long-Term Leasing (More than 3 years) |

| End Use Industries Covered | Corporate Sector, Logistics and Transportation, E-Commerce, Manufacturing, Government and Public Sector |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico fleet leasing market size was valued at USD 580.37 Million in 2025.

The Mexico fleet leasing market is expected to grow at a compound annual growth rate of 6.14% from 2026-2034 to reach USD 992.58 Million by 2034.

Operating lease dominates the Mexico fleet leasing market with a share of 68% in 2025, driven by businesses seeking predictable expenses, off-balance sheet benefits, and comprehensive service packages.

Key factors driving the Mexico fleet leasing market include expanding e-commerce and last-mile delivery requirements, corporate focus on capital efficiency, nearshoring-driven industrial expansion, digital fleet management adoption, and growing demand for sustainable mobility solutions.

Major challenges include vehicle supply constraints affecting delivery timelines, regulatory complexity across different state jurisdictions, economic uncertainty impacts on business planning, currency fluctuation risks for imported vehicles, and infrastructure limitations in certain regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)