Mexico Flooring Market Size, Share, Trends and Forecast by Type, End User, and Region, 2025-2033

Mexico Flooring Market Overview:

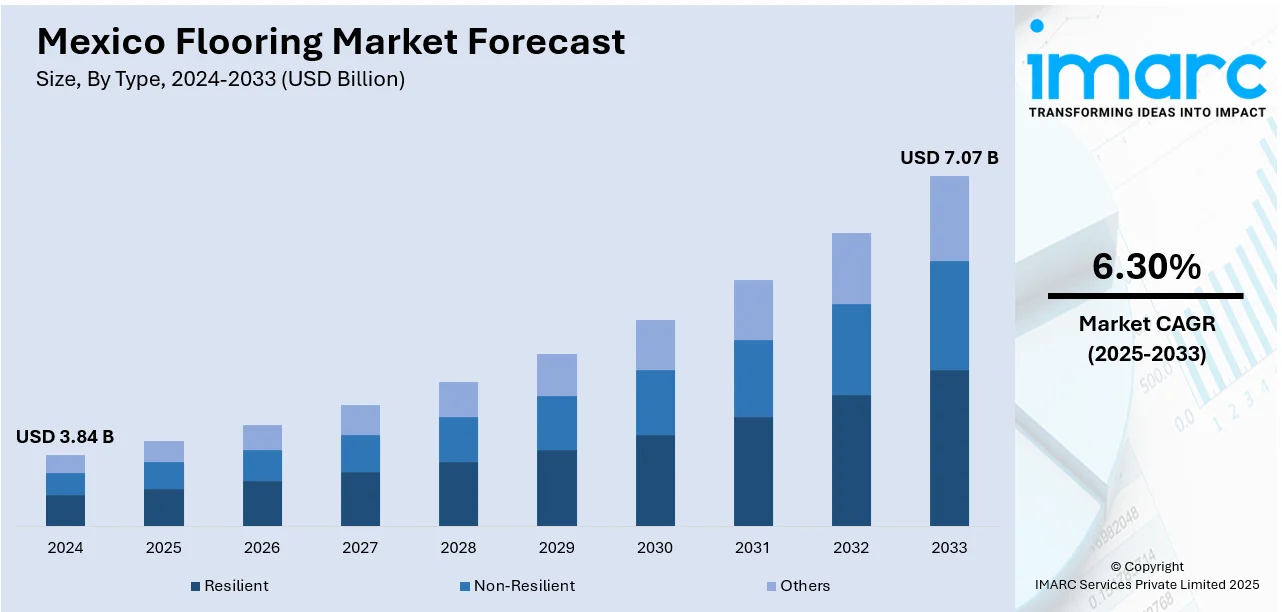

The Mexico flooring market size reached USD 3.84 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.07 Billion by 2033, exhibiting a growth rate (CAGR) of 6.30% during 2025-2033. The market is being driven by robust development in the construction and tourism sectors, rising urbanization, increased government investment in affordable housing, and foreign direct investments, all of which boost demand for diverse, durable, and cost-effective flooring solutions across residential, commercial, and industrial applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.84 Billion |

| Market Forecast in 2033 | USD 7.07 Billion |

| Market Growth Rate 2025-2033 | 6.30% |

Mexico Flooring Market Trends:

Expansion of the Tourism and Hospitality Industry

Mexico’s thriving tourism and hospitality sector significantly contributes to the growth of the flooring market. Tourism represents a significant portion of the country’s GDP, with key destinations, including Cancun, Riviera Maya, Los Cabos, and Mexico City, experiencing a surge in the construction of hotels, resorts, and vacation properties. This construction boom is driving strong demand for flooring materials that strike a balance between aesthetic appeal and durability. Hospitality establishments require a wide array of flooring solutions. High-end resorts often specify premium hardwood or natural stone, whereas wet areas, such as pool decks and bathrooms, require slip-resistant vinyl or ceramic tiles. High-traffic zones such as lobbies and conference areas typically use commercial-grade carpeting. Developers in Mexico are also increasingly attentive to sustainability and contemporary design, opting for environmentally certified and locally influenced flooring options. The entry of multinational hotel chains and boutique developers is raising quality benchmarks and fostering greater demand for imported premium flooring products.

To get more information on this market, Request Sample

Government Housing Initiatives and Affordable Housing Programs

Government-supported affordable housing initiatives represent another distinct driver of flooring demand in Mexico. Institutions such as INFONAVIT (Instituto del Fondo Nacional de la Vivienda para los Trabajadores) and FOVISSSTE (Fondo de la Vivienda del Instituto de Seguridad y Servicios Sociales de los Trabajadores del Estado) provide loans and housing credits to low- and middle-income families for home construction and rehabilitation. This has led to a notable increase in residential construction, particularly in suburban and rural areas. In contrast to the luxury specifications seen in the tourism sector, these housing programs prioritize cost-effective, durable, and low-maintenance flooring materials. Ceramic tiles, concrete surfaces, and affordable laminates are widely used in this segment. The surge in demand for affordable housing has also prompted domestic flooring manufacturers to optimize supply chains and reduce production costs, resulting in improved price competitiveness and broader access among lower-income groups. Additionally, ongoing urbanization and demographic growth continue to drive the need for expanded housing capacity, reinforcing the demand for flooring in newly built and subsidized residential developments.

Mexico Flooring Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and end user.

Type Insights:

- Resilient

- Non-Resilient

- Others

The report has provided a detailed breakup and analysis of the market based on the type This includes resilient, non-resilient, and others.

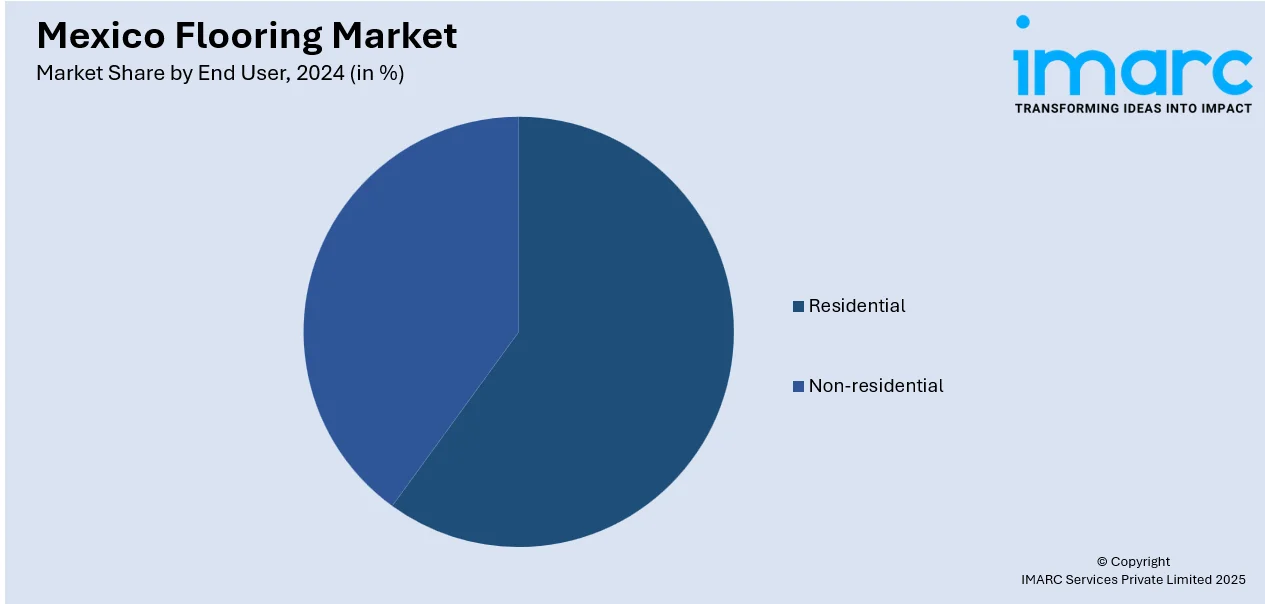

End User Insights:

- Residential

- Non-residential

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential and non-residential.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Flooring Market News:

- May 2025: Gigamon opened a new office in Mexico City to support growing regional demand. New office projects such as this boost demand for durable, versatile flooring suitable for high-traffic office spaces, creating opportunities for flooring suppliers to provide materials that combine functionality with modern design.

- February 2025: The Mexican government announced its Housing for Well-Being Program with the aim to build 1.1 million affordable homes by 2030, boosting demand for construction materials, including flooring solutions. As new houses require durable, cost-effective, and easy-to-install flooring, this large-scale initiative will drive growth in the flooring market, encouraging innovation and supply to meet the needs of affordable housing projects across Mexico.

Mexico Flooring Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Resilient, Non-Resilient, Others |

| End Users Covered | Residential, Non-residential |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico flooring market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico flooring market on the basis of type?

- What is the breakup of the Mexico flooring market on the basis of end user?

- What is the breakup of the Mexico flooring market on the basis of region?

- What are the various stages in the value chain of the Mexico flooring market?

- What are the key driving factors and challenges in the Mexico flooring market?

- What is the structure of the Mexico flooring market and who are the key players?

- What is the degree of competition in the Mexico flooring market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico flooring market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico flooring market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico flooring industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)