Mexico Food Flavors Market Size, Share, Trends and Forecast by Type, Form, End User, and Region, 2025-2033

Mexico Food Flavors Market Overview:

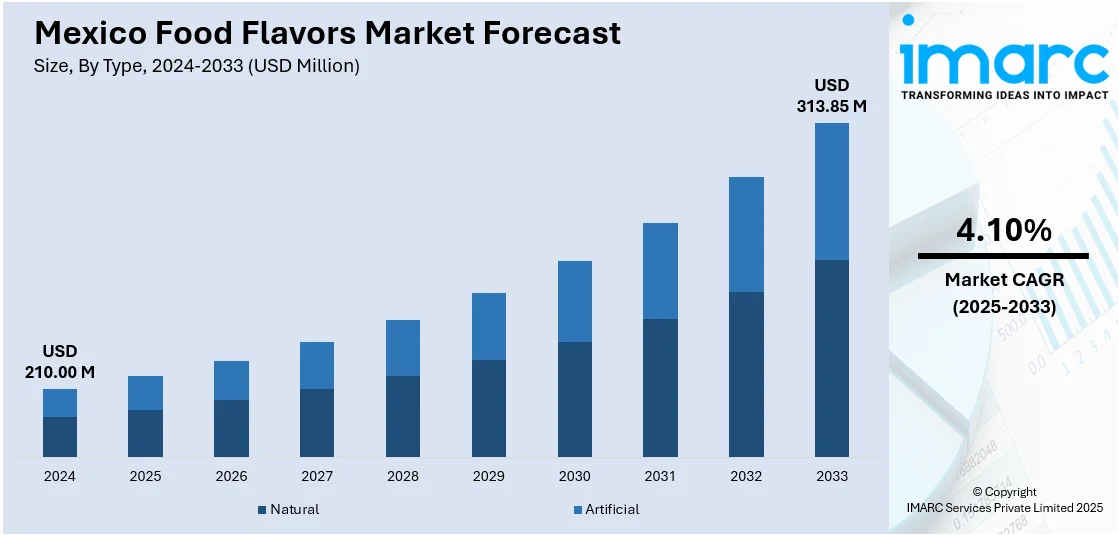

The Mexico food flavors market size reached USD 210.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 313.85 Million by 2033, exhibiting a growth rate (CAGR) of 4.10% during 2025-2033. The market is driven by rising demand for authentic regional tastes, health-conscious preferences for natural and clean-label ingredients, and the influence of global culinary trends. Additionally, food manufacturers are innovating with functional and plant-based flavors to cater to changing consumer preferences for healthier and sustainable options. Growing disposable incomes, urbanization, and the popularity of convenience foods are further expanding the Mexico food flavors market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 210.00 Million |

| Market Forecast in 2033 | USD 313.85 Million |

| Market Growth Rate 2025-2033 | 4.10% |

Mexico Food Flavors Market Trends:

Rising Demand for Authentic and Regional Mexican Flavors

The market is experiencing a rise in demand for authentic and regional flavors as consumers increasingly seek traditional and culturally rich culinary experiences. Mexico imports about 45% of its food intake, ranking it 7th globally. The nation imported USD 8.58 Billion in cereals and USD 1.62 Billion in fruit in 2023, representing a 7.5% rise. Vegetable imports have risen sharply by 50% and cheese imports by 18%, worth USD 887 Million, to signify a transition towards consumer choices away from classic foods towards healthy and global cuisine. As more demand is placed on organic, gourmet, and ready-to-eat food items, Mexico's food flavor industry is rapidly changing, due to high-end retail channels and shifting diet trends. Dishes and ingredients including mole, huitlacoche, chapulines (edible grasshoppers), and various chili-based sauces are gaining popularity not only in local markets but also internationally. Food manufacturers are responding by incorporating these unique flavors into snacks, sauces, and ready-to-eat meals to cater to both domestic and global consumers. Additionally, the trend is driven by younger generations who are rediscovering their heritage and preferring bold, genuine tastes over generic processed flavors. The rise of gourmet Mexican cuisine in restaurants and foodservice channels further amplifies this trend, encouraging innovation in flavor formulations. As a result, companies are investing in research to replicate traditional recipes while ensuring consistency and scalability for mass production, positioning regional Mexican flavors as a key growth driver in the market.

Growth of Health-Conscious and Natural Flavor Solutions

Health-conscious consumers are increasingly influencing the Mexico food flavors market growth, with a growing preference for natural, organic, and clean-label products. In 2023, Mexico authorized 571,608 hectares for organic agriculture, of which 60% are for wild harvesting, and 40% are for crops produced on farms. The top crop was coffee on 88,173 hectares, followed by oranges, mangoes, and lemons. 46,030 certified organic plant producers. This trend reflects a significant growth opportunity for the premium organic market in Mexico, especially for food flavors. Artificial additives and synthetic flavors are being replaced by natural extracts, spices, and herb-infused formulations to meet the demand for healthier options. Flavors derived from fruits, vegetables, and ancient grains such as amaranth and chia are gaining traction, particularly in snacks, beverages, and dairy products. The trend is further supported by rising awareness of lifestyle diseases, prompting food brands to reduce sugar, salt, and artificial ingredients while enhancing taste through natural means. Additionally, plant-based and functional flavors such as those with added probiotics or antioxidants are becoming popular among fitness enthusiasts and wellness-focused consumers. As regulatory bodies tighten labeling standards, manufacturers are compelled to adopt transparent sourcing and production practices, making natural flavors a dominant trend in Mexico’s changing food industry.

Mexico Food Flavors Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, form, and end user.

Type Insights:

- Natural

- Artificial

The report has provided a detailed breakup and analysis of the market based on the type. This includes natural and artificial.

Form Insights:

- Dry

- Liquid

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes dry and liquid.

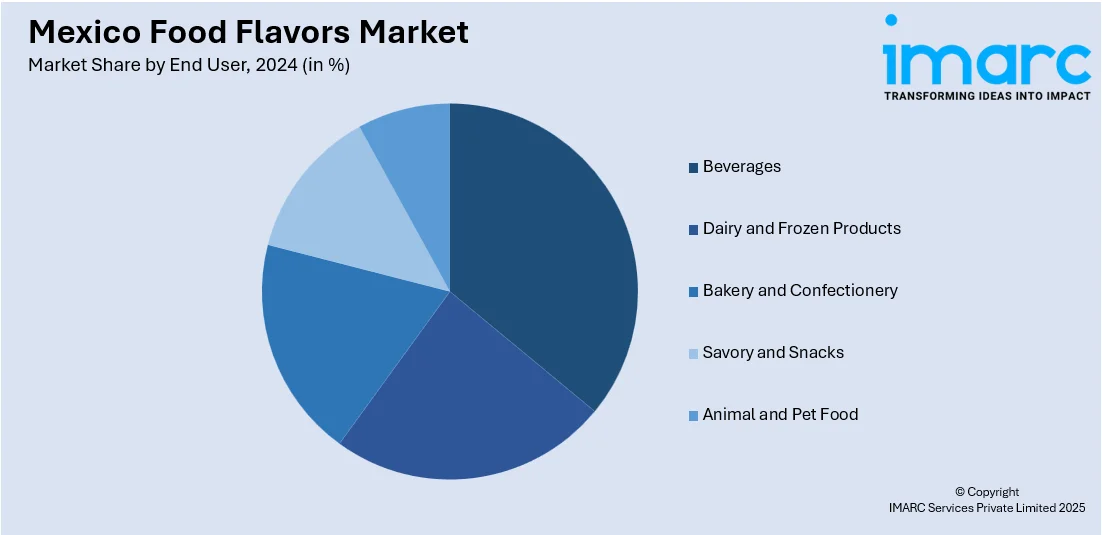

End User Insights:

- Beverages

- Dairy and Frozen Products

- Bakery and Confectionery

- Savory and Snacks

- Animal and Pet Food

The report has provided a detailed breakup and analysis of the market based on the end user. This includes beverages, dairy and frozen products, bakery and confectionery, savory and snacks, and animal and pet food.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Food Flavors Market News:

- October 04, 2024: SOMOS launched a new line of simmer sauces in taco, fajita, and al pastor varieties with traditional Mexican spices including chiles, tomatoes, cumin, and pineapple juice. The sauces are sold for USD 4.99 for a 12-oz jar and USD 2.99 for an 8-oz pouch and are already found on shelves at Whole Foods, Meijer, and Sprouts, with Target to follow later this spring. This new product launch increases the visibility of Mexican culinary flavors in the American marketplace with legitimate, ready-to-use sauces that pay respect to original flavors while delivering contemporary convenience.

- September 12, 2024: MegaMex Foods launched three new WHOLLY® GUACAMOLE flavors: Jalapeño Garlic, Serrano Lime, and Cilantro Lime, adding five varieties to its foodservice product. All three flavors are made from 100% genuine Hass avocados and feature no artificial additives, responding to the increased demand for authentic, ready-to-consume Mexican flavors. Available in 12/1 lb. cases, this introduction increases Mexican food flavors' presence in the North American foodservice market.

Mexico Food Flavors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Natural, Artificial |

| Forms Covered | Dry, Liquid |

| End Users Covered | Beverages, Dairy and Frozen Products, Bakery and Confectionery, Savory and Snacks, Animal and Pet Food |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico food flavors market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico food flavors market on the basis of type?

- What is the breakup of the Mexico food flavors market on the basis of form?

- What is the breakup of the Mexico food flavors market on the basis of end user?

- What is the breakup of the Mexico food flavors market on the basis of region?

- What are the various stages in the value chain of the Mexico food flavors market?

- What are the key driving factors and challenges in the Mexico food flavors market?

- What is the structure of the Mexico food flavors market and who are the key players?

- What is the degree of competition in the Mexico food flavors market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico food flavors market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico food flavors market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico food flavors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)