Mexico Food Safety Testing Market Size, Share, Trends and Forecast by Type, Food Tested, Technology, and Region, 2026-2034

Mexico Food Safety Testing Market Summary:

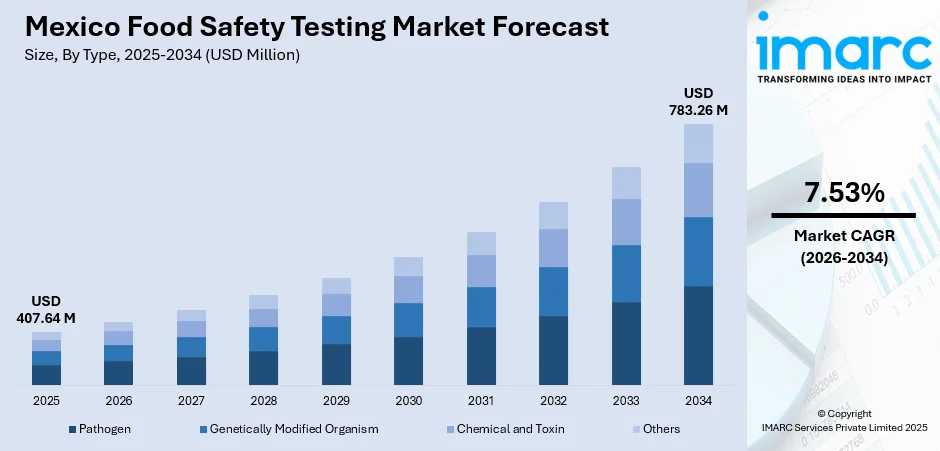

The Mexico food safety testing market size was valued at USD 407.64 Million in 2025 and is projected to reach USD 783.26 Million by 2034, growing at a compound annual growth rate of 7.53% from 2026-2034.

The Mexico food safety testing market is expanding as the country's agricultural export industry demands compliance with international safety standards. Growing consumer awareness about foodborne illnesses and food quality is strengthening demand for comprehensive testing services. Government initiatives through COFEPRIS and partnerships with international regulatory bodies are reinforcing safety practices, while advanced testing technologies and rapid detection methods are enhancing laboratory capabilities across the Mexico food safety testing market share.

Key Takeaways and Insights:

- By Type: Pathogen dominates the market with a share of 44.07% in 2025, driven by stringent regulatory requirements for detecting harmful microorganisms such as Salmonella, E. coli, and Listeria in food products destined for domestic consumption and international export markets.

- By Food Tested: Processed food leads the market with a share of 36.12% in 2025, reflecting the substantial growth of Mexico's food processing industry and the need for comprehensive safety testing across packaged goods, ready-to-eat meals, and convenience food products.

- By Technology: PCR-based assay holds the largest share at 48.06% in 2025, owing to its superior sensitivity, specificity, and rapid detection capabilities that enable efficient pathogen identification within shorter turnaround times.

- Key Players: The Mexico food safety testing market exhibits moderate competitive intensity, with multinational testing corporations and regional laboratories competing across service segments. Market participants are investing in advanced analytical technologies and expanding certification capabilities to serve growing export requirements.

To get more information on this market Request Sample

The Mexico food safety testing market is advancing as regulatory bodies strengthen enforcement mechanisms and international partnerships enhance laboratory capabilities. The country's position as a leading agricultural exporter necessitates rigorous testing protocols to meet stringent requirements from destination markets, particularly the United States and European Union. Growing emphasis on modernized testing approaches and cross-border regulatory alignment is driving collaboration between Mexican and international health authorities. Technological advancements in molecular diagnostics, automation systems, and real-time monitoring solutions are expanding analytical throughput while improving detection accuracy across diverse food matrices.

Mexico Food Safety Testing Market Trends:

Adoption of Advanced Molecular and Digital Testing Technologies

The Mexico food safety testing market is experiencing transformation through implementation of cutting-edge analytical technologies including high-performance liquid chromatography, mass spectrometry, and real-time polymerase chain reaction systems. These technologies offer enhanced sensitivity and specificity for detecting contaminants, pathogens, and chemical residues. In February 2025, bioMérieux launched GENE-UP TYPER, a real-time PCR solution for rapid strain characterization of Listeria monocytogenes, combining assay technology with web applications to trace contamination sources and accelerate corrective actions. Integration of artificial intelligence and Internet of Things capabilities is further enabling predictive analytics and real-time supply chain monitoring.

Strengthening Regulatory Compliance and Export-Driven Testing Requirements

Regulatory pressures from both domestic and international bodies are significantly influencing the Mexico food safety testing market growth. Compliance with COFEPRIS standards and adherence to international protocols, including Hazard Analysis and Critical Control Points guidelines, are essential for exporters targeting foreign markets. Bilateral cooperation between Mexican and international regulatory authorities continues strengthening through joint training programs focused on produce safety requirements. Since Mexico ranked as the Top 10 exporting country in the world, food producers are investing in comprehensive testing services to achieve regulatory compliance and maintain competitiveness in international trade, particularly for high-value export commodities.

Growing Consumer Demand for Clean Label and Organic Product Verification

Consumer preferences in Mexico are increasingly shifting toward organic, sustainably produced, and transparently labeled food products, driving expanded testing requirements for pesticide residues, GMO content, and contaminant verification. Mexico's organic sector continues growing substantially, with organic-certified area totaling 571,608 hectares in 2023 and over 2,600 USDA-certified organic operations within the country. Food producers are adopting comprehensive testing protocols to address consumer demands for product authenticity and distinguish their offerings in competitive markets. This trend is expanding testing demand beyond traditional pathogen detection toward broader quality verification services emphasizing traceability and transparency throughout the supply chain.

Market Outlook 2026-2034:

The Mexico food safety testing market outlook remains positive as export-driven demand, regulatory enforcement, and consumer awareness converge to drive sustained growth. The market generated a revenue of USD 407.64 Million in 2025 and is projected to reach a revenue of USD 783.26 Million by 2034, growing at a compound annual growth rate of 7.53% from 2026-2034. Continued expansion of laboratory infrastructure, technology modernization, and enhanced regulatory partnerships will strengthen market foundations, positioning Mexico as a regional leader in food safety assurance and quality verification services.

Mexico Food Safety Testing Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Pathogen | 44.07% |

| Food Tested | Processed Food | 36.12% |

| Technology | PCR-based Assay | 48.06% |

Type Insights:

- Pathogen

- Genetically Modified Organism

- Chemical and Toxin

- Others

Pathogen dominates with 44.07% share of the total Mexico food safety testing market in 2025.

Pathogen maintains its leadership position due to the critical importance of detecting disease-causing microorganisms in food products. Common pathogens including Salmonella, E. coli, Listeria monocytogenes, and Campylobacter represent significant public health concerns and are primary targets for regulatory compliance testing. Mexico's substantial agricultural export industry requires comprehensive pathogen screening to meet stringent international standards, particularly for fresh produce, meat products, and seafood destined for the United States market. The segment benefits from technological advancements enabling faster and more accurate detection methods. Real-time PCR and molecular diagnostic systems have reduced testing turnaround times while improving sensitivity for detecting pathogens at lower concentrations.

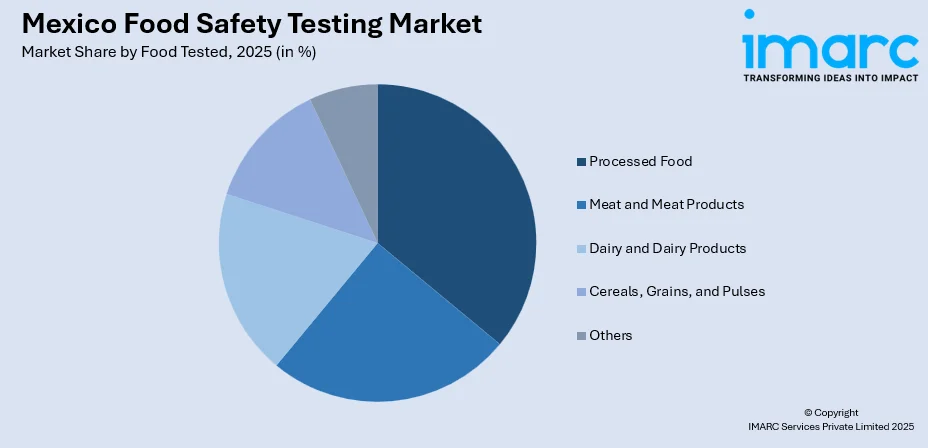

Food Tested Insights:

Access the comprehensive market breakdown Request Sample

- Meat and Meat Products

- Dairy and Dairy Products

- Cereals, Grains, and Pulses

- Processed Food

- Others

Processed food leads with 36.12% share of the total Mexico food safety testing market in 2025.

The processed food segment commands market leadership driven by the substantial growth of Mexico's food processing industry. Packaged snacks, ready-to-eat (RTE) meals, dairy products, and beverages require stringent safety testing to ensure product quality and compliance with regulatory standards. The complexity of processed food supply chains increases contamination risks at various processing stages, necessitating comprehensive testing protocols.

Rising consumer expectations for product safety and quality are driving food processing companies to invest substantially in testing services. Manufacturers implement testing protocols to monitor contaminants including pathogens, chemical residues, heavy metals, and allergens throughout production processes. The segment also benefits from growing demand for testing services that support clean label initiatives and verify ingredient authenticity for health-conscious consumers seeking transparency in food products.

Technology Insights:

- Agar Culturing

- PCR-based Assay

- Immunoassay-based

- Others

PCR-based assay holds 48.06% share of the total Mexico food safety testing market in 2025.

PCR-based assay maintains dominant market position due to its superior sensitivity, specificity, and rapid detection capabilities compared to traditional culturing methods. Real-time PCR systems enable simultaneous detection of multiple pathogens within a single test, improving laboratory efficiency and reducing overall testing costs. These molecular diagnostic approaches can identify pathogens at extremely low concentrations, providing earlier detection of potential contamination issues.

The technology segment continues advancing through innovations that enhance speed and accuracy. PCR-based methods typically deliver results within 24 hours compared to several days required for conventional culture-based approaches. This rapid turnaround enables faster product release decisions and more efficient supply chain management. In June 2024, Neogen Corporation launched the Petrifilm Automated Feeder to help high-volume food safety testing laboratories process quality indicator tests more efficiently, demonstrating ongoing technological innovation supporting market development.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The market in Northern Mexico is driven by its proximity to the United States border and concentration of agricultural export operations. The region's robust food processing industry and cross-border trade activities necessitate comprehensive testing services to meet stringent international export requirements and maintain efficient supply chain operations.

Central Mexico serves as a major hub for food safety testing activities, supported by substantial food processing industries and significant population centers driving domestic consumption. The region benefits from concentrated laboratory infrastructure and proximity to regulatory headquarters, facilitating compliance verification and quality assurance services for manufacturers across diverse food categories.

Southern Mexico contributes to food safety testing demand through its extensive agricultural production, particularly organic farming operations and tropical commodity cultivation. The region's growing emphasis on sustainable agriculture and organic certification requirements drives testing needs for pesticide residues, contaminant verification, and quality assurance throughout agricultural supply chains.

Market Dynamics:

Growth Drivers:

Why is the Mexico Food Safety Testing Market Growing?

Robust Agricultural Export Industry Driving Compliance Testing Demand

Mexico's position as a major agricultural exporter creates substantial demand for food safety testing services to meet international market requirements. The country ranks among the leading exporters of fresh produce, with agricultural exports representing a significant component of trade with the United States and other international markets. Export destinations impose stringent safety standards requiring comprehensive testing protocols for commodities including avocados, berries, tomatoes, and seafood products. Food producers and exporters invest in testing services to maintain market access and comply with destination country regulations, driving sustained growth in laboratory testing demand throughout the agricultural supply chain.

Stringent Government Regulations and Enhanced Regulatory Partnerships

Regulatory enforcement through COFEPRIS and enhanced international partnerships are strengthening food safety requirements throughout Mexico's food supply chain. The Federal Commission for Protection against Sanitary Risks implements strict standards governing food safety testing, sanitary licensing, and compliance verification across the food industry. The FDA-SENASICA-COFEPRIS Food Safety Partnership continues advancing bilateral cooperation on food safety matters, enabling joint training programs focused on produce safety requirements and reinforcing testing standards throughout agricultural supply chains. These collaborative efforts between Mexican and international regulatory authorities are establishing stronger frameworks for compliance verification and laboratory accreditation across the food industry.

Rising Foodborne Illness Awareness and Public Health Prioritization

Increasing awareness about foodborne illnesses and their health consequences is driving demand for comprehensive food safety testing services. Public health concerns regarding contamination incidents have heightened consumer and industry focus on preventive testing measures. Foodborne outbreaks affecting regional supply chains have reinforced the importance of rigorous testing protocols throughout food production and distribution networks. Such incidents drive food companies to implement more frequent testing programs, investing in rapid pathogen detection systems to prevent contamination and protect brand reputation. Growing consumer expectations for product safety are encouraging manufacturers to adopt proactive testing approaches that identify potential hazards before products reach the market.

Market Restraints:

What Challenges the Mexico Food Safety Testing Market is Facing?

High Costs of Advanced Testing Technologies and Infrastructure

Implementation of sophisticated testing technologies including molecular diagnostics, automated systems, and AI-driven analytics requires substantial capital investment. Smaller food producers and testing laboratories face challenges accessing advanced equipment and maintaining technical expertise necessary for operating complex analytical platforms. These cost barriers can limit adoption of modern testing methods among resource-constrained market participants.

Limited Testing Infrastructure in Rural and Agricultural Regions

Despite ongoing infrastructure development, many agricultural regions in Mexico face insufficient access to accredited testing laboratories. Rural and semi-urban areas where significant food production occurs may lack convenient testing facilities, creating logistical challenges for producers seeking timely sample analysis. Geographic gaps in laboratory coverage can delay testing results and increase costs associated with sample transportation.

Complexity of Regulatory Standards and Frequent Revisions

The regulatory landscape governing food safety testing involves multiple agencies and undergoes frequent modifications, creating compliance challenges for industry participants. Organic regulations, front-of-package labeling requirements, and import-export standards undergo periodic revisions that require testing laboratories and food producers to continuously adapt their processes. Navigating complex and evolving regulatory frameworks demands significant administrative resources.

Competitive Landscape:

The Mexico food safety testing market demonstrates moderate competitive intensity with multinational testing corporations and regional laboratories serving diverse customer segments. Industry leaders are actively expanding capabilities through laboratory investments, technology acquisitions, and enhanced certification services. Market participants differentiate through comprehensive testing portfolios, rapid turnaround times, and specialized expertise in high-growth sectors including export commodities and processed food products. Strategic partnerships between international testing organizations and Mexican regulatory bodies are strengthening market positioning while supporting compliance requirements. Competition is intensifying as food manufacturers increasingly seek testing partners capable of handling multiple contaminant categories through integrated service offerings.

Recent Developments:

- In October 2025, SGS’s laboratory in Naucalpan de Juárez, Mexico, added compliance with US Food and Drug Administration (US FDA) regulations to its accredited testing portfolio for food contact materials (FCMs). With this accomplishment, the location becomes Mexico's first accredited facility that can test in accordance with FDA regulations.

Mexico Food Safety Testing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Pathogen, Genetically Modified Organism, Chemical and Toxin, Others |

| Food Tested Covered | Meat and Meat Products, Dairy and Dairy Products, Cereals, Grains, and Pulses, Processed Food, Others |

| Technologies Covered | Agar Culturing, PCR-Based Assay, Immunoassay-based, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico food safety testing market size was valued at USD 407.64 Million in 2025.

The Mexico food safety testing market is expected to grow at a compound annual growth rate of 7.53% from 2026-2034 to reach USD 783.26 Million by 2034.

Pathogen testing, holding the largest revenue share of 44.07%, remains the dominant type in Mexico's food safety testing market, driven by stringent regulatory requirements for detecting harmful microorganisms in food products destined for domestic and international markets.

Key factors driving the Mexico food safety testing market include the robust agricultural export industry requiring compliance testing, stringent government regulations through COFEPRIS, enhanced international regulatory partnerships, rising consumer awareness about foodborne illnesses, and technological advancements in rapid detection methods.

Major challenges include high costs of advanced testing technologies, limited laboratory infrastructure in rural agricultural regions, complexity of regulatory standards with frequent revisions, and resource constraints among smaller food producers seeking comprehensive testing services.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)