Mexico Food Service Market Size, Share, Trends and Forecast by Sector, System, Type of Restaurant, and Region, 2025-2033

Mexico Food Service Market Overview:

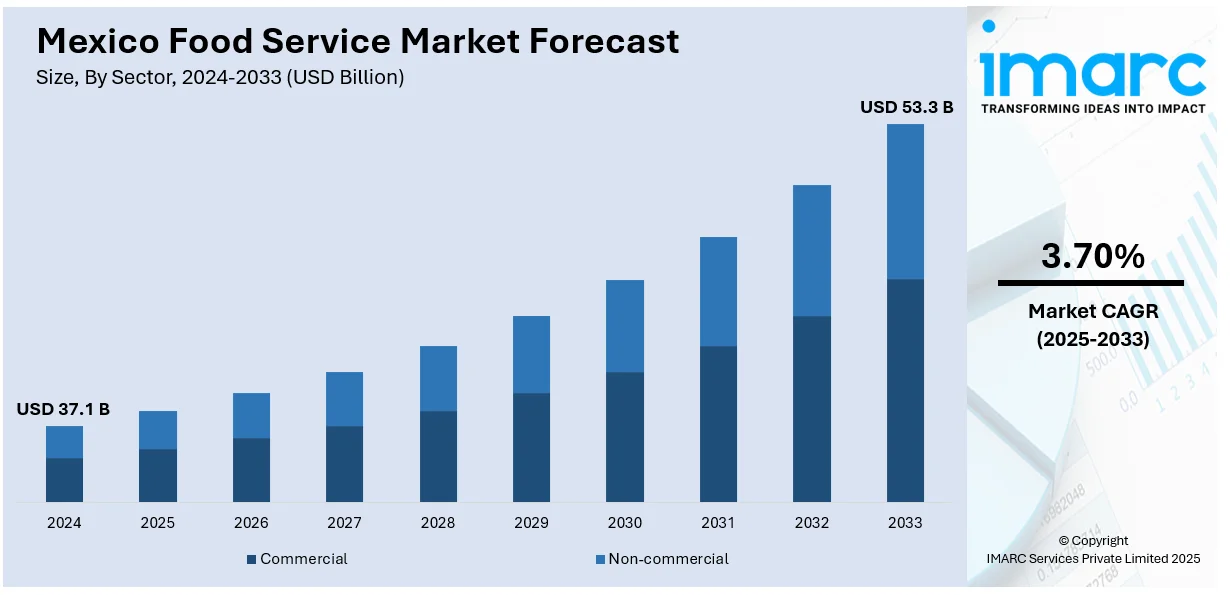

The Mexico food service market size reached USD 37.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 53.3 Billion by 2033, exhibiting a growth rate (CAGR) of 3.70% during 2025-2033. The market is growing steadily with urbanization, evolving consumer lifestyles, and boosting demand for convenient meals. Growing tourism, online ordering platforms, and an expanding middle class are also driving the sector's growth, with operators investing in improving customer experience and operational efficiency.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 37.1 Billion |

| Market Forecast in 2033 | USD 53.3 Billion |

| Market Growth Rate 2025-2033 | 3.70% |

Mexico Food Service Market Trends:

Adoption of Digital Ordering and Delivery Services

Mexico foodservice industry is experiencing a high migration towards ordering and delivery in digital formats based on growing customer demand for convenience. For instance, in March 2024, FEMSA opened andatti Drive in Nuevo León, Mexico—an app-enabled, dual-lane drive-thru coffee concept with CAFFENIO, aimed at fast, personalized service for on-the-go shoppers. Moreover, with escalating dependence on the smartphone and access to the internet, customers want simple means through which they can order food at their preferred eateries or food suppliers. Third-party delivery platforms, as well as digital websites, are rapidly growing, making the customer's experience smooth, with repeat sales boosted. This is in line with Mexico's wider digital evolution, which has enabled the expansion of online food services. Indeed, the Mexican food service market share in the online delivery sector has experienced significant growth, with a significant rise in the number of individuals ordering food online. As consumer tastes change, so too will this move towards a more tech-inspired strategy, providing a better, easier, and more affordable solution for consumers to be able to enjoy food, helping to support a general favorable future for the Mexico food service sector.

Growing Emphasis on Healthy Meals

With the rise of health and wellness trends in Mexico, food service providers are adapting by launching healthier alternatives to their menu that respond to the increasing trend of eating healthier and balanced foods. For example, in May 2024, Latin American "everything app" Rappi, with a user base of more than 30 million, is growing in Mexico, including its Rappi Turbo service for 10-minute food and pharmacy delivery. Furthermore, consumers are intensely becoming conscious of what they eat, driving restaurants and other food service chains to provide low-calorie, plant-based, and organic offerings. These typically feature low-sodium, gluten-free, and vegan meals targeting a health-oriented clientele. The rise in wellness-oriented food products is not only a boon for the consumer but is also driving the Mexico food service market growth by accelerating the diversity of consumers. As more people become aware of the significance of health and nutrition, food service outlets are increasingly adding these menu items to their offerings, indicating a shift in the broader society toward healthier consumption patterns. This trend will persist, promoting long-term market growth and changing the industry to address changing customer demands.

Incorporation of Sustainable Practices in Food Service Operations

Sustainability has emerged as a major area of concern within the Mexican food service sector, with operators becoming more and more inclined to employ practices that mitigate environmental footprint. This movement entails initiatives to eliminate food waste, minimize packaging waste, and procure ingredients sustainably. Most food service operators now include local and seasonal produce, sustainable seafood, and meats on their menus. In addition, environmentally friendly packaging and waste reduction initiatives are being implemented in restaurants, catering companies, and fast food chains. This dedication to sustainability not only aligns with international environmental targets but also is attractive to customers who are becoming increasingly aware of the environmental impact of their dining choices. Amplifying need for sustainable behaviors is fueling transformation throughout the entire foodservice industry, to the benefit the Mexico food service market outlook as it grows to satisfy the increasingly high expectations of ecofriendly consumers.

Mexico Food Service Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on sector, system, and type of restaurant.

Sector Insights:

- Commercial

- Non-commercial

The report has provided a detailed breakup and analysis of the market based on the sector. This includes commercial and non-commercial.

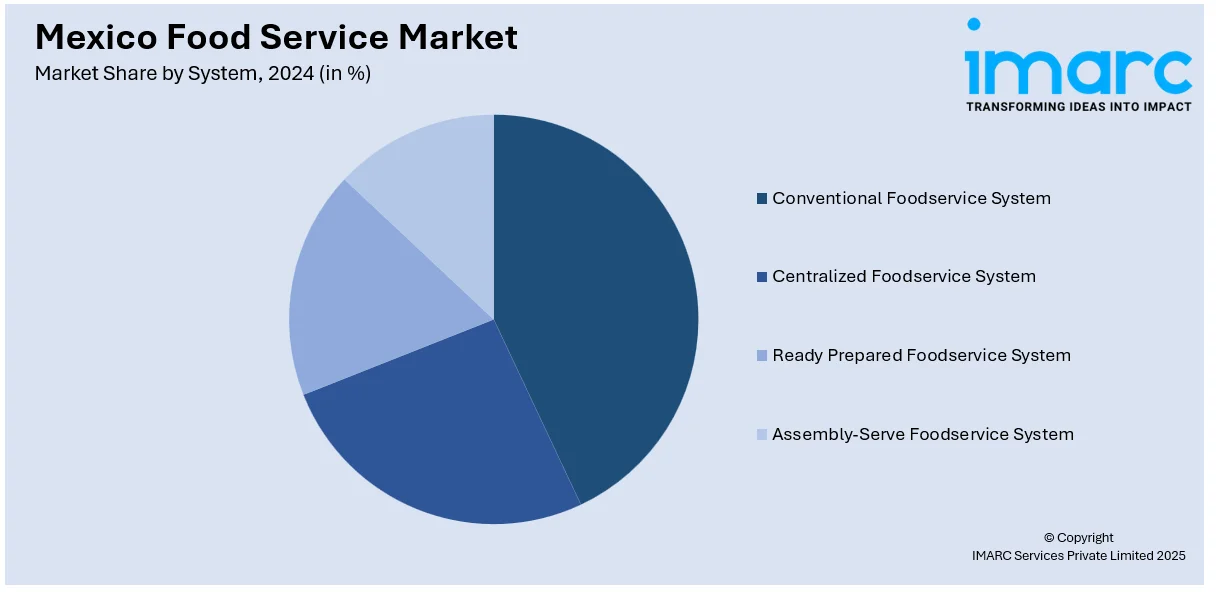

System Insights:

- Conventional Foodservice System

- Centralized Foodservice System

- Ready Prepared Foodservice System

- Assembly-Serve Foodservice System

The report has provided a detailed breakup and analysis of the market based on the system. This includes conventional foodservice system, centralized foodservice system, ready prepared foodservice system, and assembly-serve foodservice system.

Type of Restaurant Insights:

- Fast Food Restaurants

- Full-Service Restaurants

- Limited Service Restaurants

- Special Food Services Restaurants

A detailed breakup and analysis of the market based on the type of restaurant have also been provided in the report. This includes fast food restaurants, full-service restaurants, limited service restaurants, and special food services restaurants.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Food Service Market News:

- In May 2024, Uber Eats introduced a tie-up with Costco in Mexico that allows customers to order Costco products for delivery without a membership. This move meets the increasing demand for convenient food delivery services and strengthens Uber Eats' competitive edge in Mexico's fast-growing food service industry.

- In December 2023, Alsea announced investment plans to invest MX$550 million in 2024 to grow its Domino's Pizza chain in Mexico. The investment will increase digital services, such as the Domino's Cloud app, to a 50% share of sales via digital channels, increasing further e-commerce and delivery capabilities.

Mexico Food Service Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Commercial, Non-Commercial |

| Systems Covered | Conventional Food Service System, Centralized Food Service System, Ready Prepared Food Service System, Assembly-Serve Food Service System |

| Type of Restaurants Covered | Fast Food Restaurants, Full-Service Restaurants, Limited-Service Restaurants, Special Food Service Restaurants |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico food service market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico food service market on the basis of sector?

- What is the breakup of the Mexico food service market on the basis of system?

- What is the breakup of the Mexico food service market on the basis of type of restaurant?

- What is the breakup of the Mexico food service market on the basis of region?

- What are the various stages in the value chain of the Mexico food service market?

- What are the key driving factors and challenges in the Mexico food service?

- What is the structure of the Mexico food service market and who are the key players?

- What is the degree of competition in the Mexico food service market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico food service market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico food service market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico food service industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)