Mexico Food Sweetener Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, and Region, 2025-2033

Mexico Food Sweetener Market Overview:

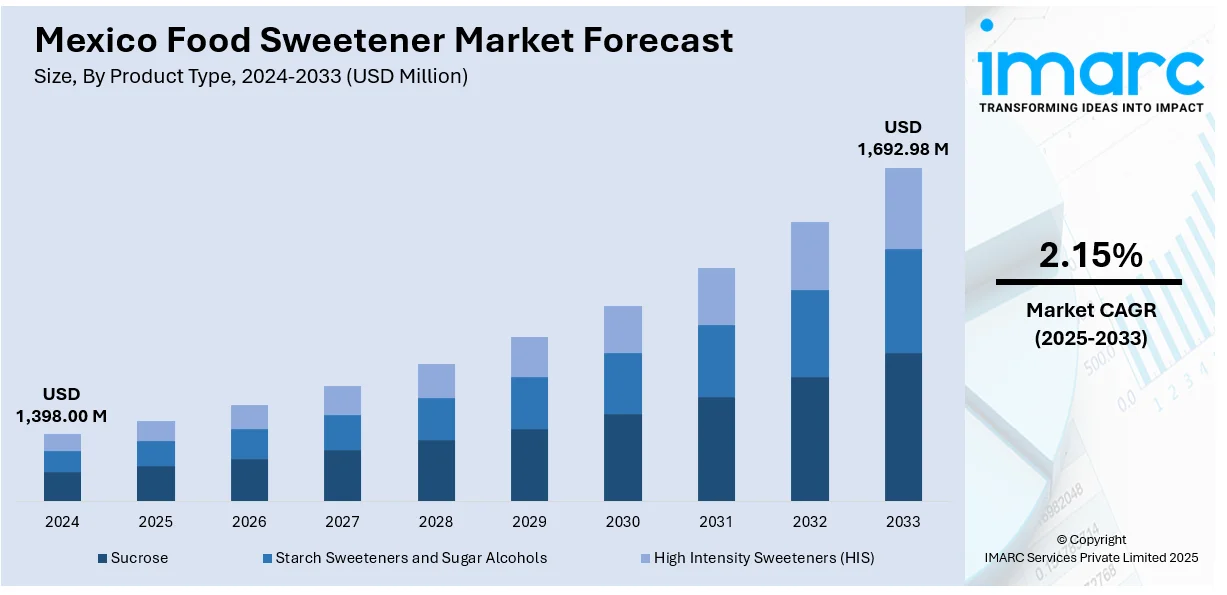

The Mexico food sweetener market size reached USD 1,398.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,692.98 Million by 2033, exhibiting a growth rate (CAGR) of 2.15% during 2025-2033. The market is experiencing steady growth mainly driven by increasing demand for low-calorie and natural alternatives. Consumers are becoming more health-conscious, leading to a shift toward plant-based sweeteners like stevia and monk fruit. Innovation and regulatory support for healthier ingredients are also expected to significantly increase the Mexico food sweetener market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,398.00 Million |

| Market Forecast in 2033 | USD 1,692.98 Million |

| Market Growth Rate 2025-2033 | 2.15% |

Mexico Food Sweetener Market Trends:

Growing Demand for Natural Sweeteners

In Mexico, there has been a noticeable shift toward natural sweeteners such as stevia and monk fruit as consumers become more health conscious. Health concerns related to the intake of too much sugar, including obesity, diabetes, and other metabolic disorders are pushing this shift. Natural sweeteners are seen as healthier options because they have a lower glycemic index and fewer calories than conventional sugar. Stevia, for instance, is a sweetener that comes from plants with a natural zero-calorie sweetening solution without an impact on blood sugars and it is thus favored by those looking for weight control answers. Similarly, monk fruit another plant-based sweetener is picking up steam for its natural sweetness and antioxidant properties. This trend fits a wider global preference for clean-label and organic products as consumers seek transparency and healthier food alternatives, thus powering demand for natural sweeteners in Mexico's food and beverage industries.

Rising Health Consciousness

In Mexico, the increasing awareness of obesity and diabetes is significantly influencing consumer preferences towards healthier alternatives in food and beverages. As these health conditions continue to rise, consumers are becoming more cautious about their sugar intake and its impact on their overall health. The demand for low-calorie and sugar-free sweeteners has grown as a result, with individuals seeking ways to indulge in sweet flavors without the associated health risks. Sweeteners like stevia, erythritol, and aspartame are gaining popularity due to their ability to provide sweetness without the calories and negative effects of traditional sugar. This trend is particularly evident in the beverage sector, where sugar-free sodas and health drinks are becoming increasingly common. As consumers embrace healthier lifestyles, the demand for sweeteners that support weight management and blood sugar control is expected to keep rising.

Innovation in Product Development

Mexican companies are now shifting their emphasis on innovation to come up with healthier sweetening options for food in different categories. With consumers leaning towards low-calorie and natural sweeteners food companies are launching new sweeteners that provide the same level of taste as sugar but pose fewer health concerns. Innovations range from mixtures of natural sweeteners such as stevia and monk fruit to creating sugar alcohols like erythritol which offer sweetness with little effect on blood sugar levels. These innovations are aimed at meeting specific consumer requirements including weight control, diabetes management and clean-label attitudes. Besides, product formulations are being enhanced to address the needs of various food segments such as beverages, dairy and bakery products. This growing focus on healthier, consumer-friendly products is contributing to the overall Mexico food sweetener market growth, with expectations for continued expansion in the coming years.

Mexico Food Sweetener Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, application, and distribution channel.

Product Type Insights:

- Sucrose

- Starch Sweeteners and Sugar Alcohols

- Dextrose

- High Fructose Corn Syrup (HFCS)

- Maltodextrin

- Sorbitol

- Xylitol

- Others

- High Intensity Sweeteners (HIS)

- Sucralose

- Stevia

- Aspartame

- Saccharin

- Neotame

- Acesulfame Potassium (Ace-K)

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes sucrose, starch sweeteners and sugar alcohols (dextrose, high fructose corn syrup (HFCS), maltodextrin, sorbitol, xylitol, and others), and high intensity sweeteners (HIS) (sucralose, stevia, aspartame, saccharin, neotame, acesulfame potassium (Ace-K), and others).

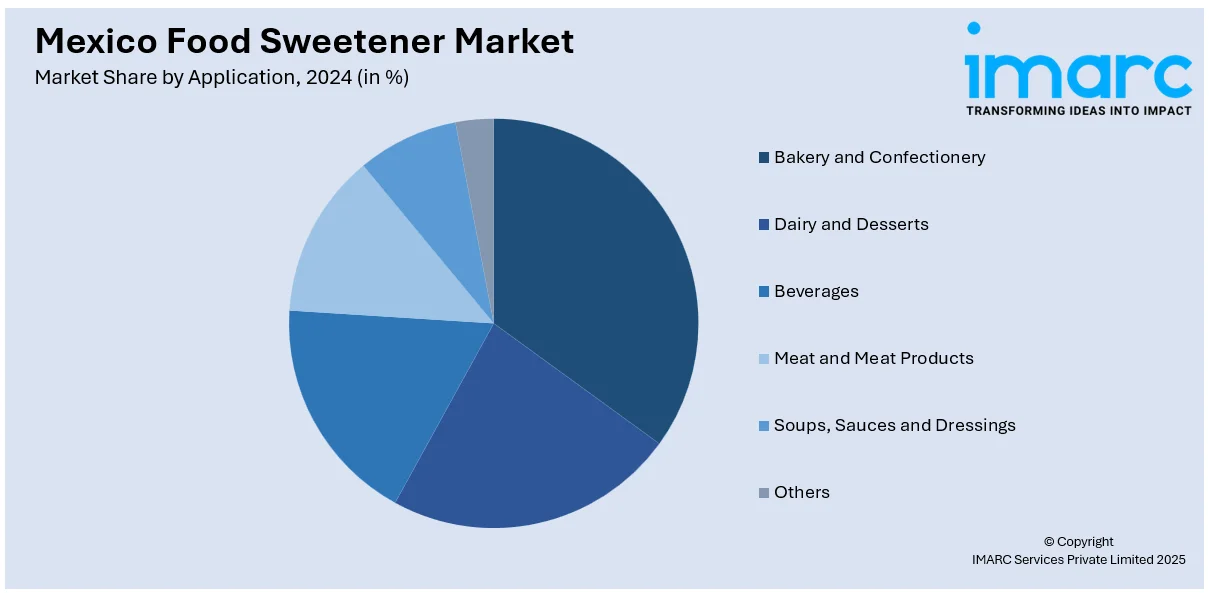

Application Insights:

- Bakery and Confectionery

- Dairy and Desserts

- Beverages

- Meat and Meat Products

- Soups, Sauces and Dressings

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes bakery and confectionery, dairy and desserts, beverages, meat and meat products, soups, sauces and dressings, and others.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Departmental Stores

- Convenience Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, departmental stores, convenience stores, online stores, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Food Sweetener Market News:

- In July 2024, Mexican sugar refiner Beta San Miguel (BSM) acquired 15.93% of Sucro Ltd.'s shares from SC Americas Corp. for $9 per share, totaling 3.75 million shares. BSM, a major player in the industry, has also established a supply agreement with Sucro, enhancing its presence in North American markets.

- In May 2024, Mexico and China announced their partnership to promote sustainable sugarcane farming across the Mexican states of Quintana Roo, Tabasco, and Campeche. This initiative, stemming from a recent bilateral meeting, will test innovative agricultural techniques on 40,000 to 50,000 hectares, aiming to enhance food security amid Mexico's low sugarcane harvest.

Mexico Food Sweetener Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Applications Covered | Bakery and Confectionery, Dairy and Desserts, Beverages, Meat and Meat Products, Soups, Sauces and Dressings, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Departmental Stores, Convenience Stores, Online Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico food sweetener market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico food sweetener market on the basis of product type?

- What is the breakup of the Mexico food sweetener market on the basis of application?

- What is the breakup of the Mexico food sweetener market on the basis of distribution channel?

- What is the breakup of the Mexico food sweetener market on the basis of region?

- What are the various stages in the value chain of the Mexico food sweetener market?

- What are the key driving factors and challenges in the Mexico food sweetener market?

- What is the structure of the Mexico food sweetener market and who are the key players?

- What is the degree of competition in the Mexico food sweetener market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico food sweetener market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico food sweetener market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico food sweetener industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)