Mexico Forage Market Size, Share, Trends and Forecast by Crop Type, Product Type, Animal Type, and Region, 2025-2033

Mexico Forage Market Overview:

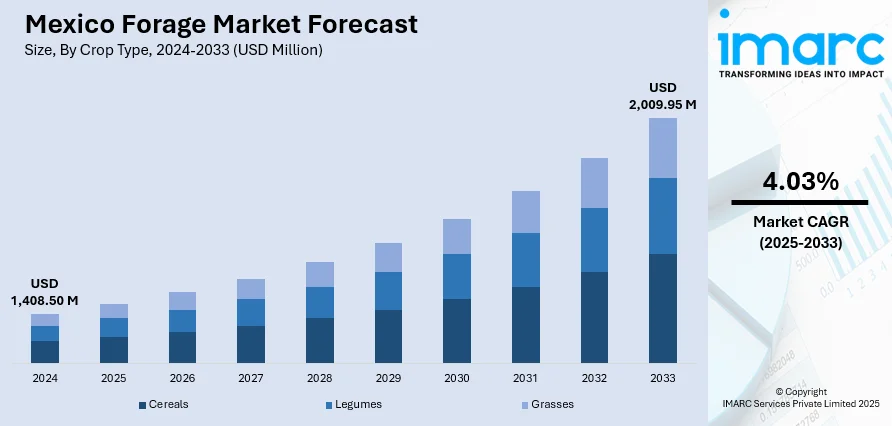

The Mexico forage market size reached USD 1,408.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,009.95 Million by 2033, exhibiting a growth rate (CAGR) of 4.03% during 2025-2033. The elevating demand for high-quality livestock feed due to the expanding dairy and meat industries and the increasing climate variability prompting farmers to adopt resilient forage crops are among the key factors driving the Mexico forage market, which is supported further by favorable government incentives and a shift toward sustainable agricultural practices.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,408.50 Million |

| Market Forecast in 2033 | USD 2,009.95 Million |

| Market Growth Rate 2025-2033 | 4.03% |

Mexico Forage Market Trends:

Growth in Livestock and Dairy Sectors

The consistent expansion of the livestock and dairy sectors is a key market driver. Mexico has been experiencing a growing demand for animal protein—particularly beef, milk, and dairy products. This demand has led to a growth in cattle and ruminant populations, especially in states such as Jalisco, Veracruz, and Chihuahua, which are key livestock centers. To support high productivity, ranchers need consistent, quality feed for their animals, especially in dry seasons when natural pastures weaken. Forage crops such as alfalfa, clover, and silage maize are a low-cost and nutritionally dense alternative. This growing reliance on organized feeding programs for higher milk production and meat quality is directly stimulating the demand for forage. Besides this, government-initiated schemes like feed subsidy to animals and incentive policies for introducing scientific animal husbandry practices have stimulated farmers even further to pursue forage-based farming systems.

Climate Variability and Drought Resilience Strategies

Another significant driver of Mexico's forage market is the growing risk of climate variability and prolonged droughts, especially in arid and semi-arid areas, such as Northern and Central Mexico. Water shortages and volatile rainfall patterns have severely stressed conventional crop agriculture and natural grazing systems, leading farmers to turn to more sustainable and resilient options. Drought-resistant crops like sorghum, Sudan grass, and legume varieties with drought resistance are extensively playing a key role in climate adjustment plans. They use less water compared to standard grains and can be grown even in degraded or low-fertility lands. Their resistance to extreme conditions makes them a favorite among livestock farmers who want to have a year-round availability of livestock feed even during adverse environmental conditions. In addition, efforts by local agricultural research centers and global partnerships are encouraging forage growth as a component of climate-smart agriculture initiatives. These programs tend to involve training in crop rotation, conservation tillage, and water-use efficiency—practices well-suited to forage production.

Mexico Forage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on crop type, product type, and animal type.

Crop Type Insights:

- Cereals

- Legumes

- Grasses

The report has provided a detailed breakup and analysis of the market based on the crop type. This includes cereals, legumes, and grasses.

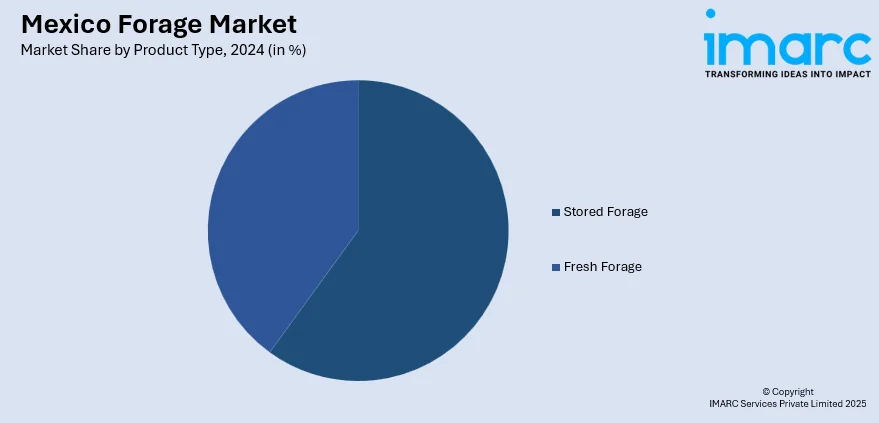

Product Type Insights:

- Stored Forage

- Silage

- Hay

- Fresh Forage

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes stored forage (silage and hay) and fresh forage.

Animal Type Insights:

- Ruminants

- Swine

- Poultry

- Others

The report has provided a detailed breakup and analysis of the market based on the animal type. This includes ruminants, swine, poultry, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Forage Market News:

- April 2025: The United States and Mexico reached an agreement to combat the New World screwworm, a parasitic fly threatening livestock by infesting open wounds. The US had previously suspended cattle imports from Mexico due to outbreaks, raising concerns over beef supply and prices. The new accord includes intensified eradication efforts, such as aerial spraying and the use of sterile insect techniques, to prevent the pest's spread and ensure the safety of livestock and forage resources.

- February 2025: Nigeria and Mexico agreed to deepen investment cooperation in livestock development, focusing on areas such as animal fattening, livestock health, and trade enhancement. A key focus was enhancing forage production and foraging practices to support pasture-based cattle systems, which Mexico had successfully implemented for high-quality meat and dairy output.

Mexico Forage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Crop Types Covered | Cereals, Legumes, Grasses |

| Product Types Covered |

|

| Animal Types Covered | Ruminants, Swine, Poultry, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico forage market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico forage market on the basis of crop type?

- What is the breakup of the Mexico forage market on the basis of product type?

- What is the breakup of the Mexico forage market on the basis of animal type?

- What are the various stages in the value chain of the Mexico forage market?

- What are the key driving factors and challenges in the Mexico forage?

- What is the structure of the Mexico forage market and who are the key players?

- What is the degree of competition in the Mexico forage market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico forage market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico forage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico forage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)