Mexico Foreign Exchange Market Size, Share, Trends and Forecast by Counterparty, Type, and Region, 2025-2033

Mexico Foreign Exchange Market Overview:

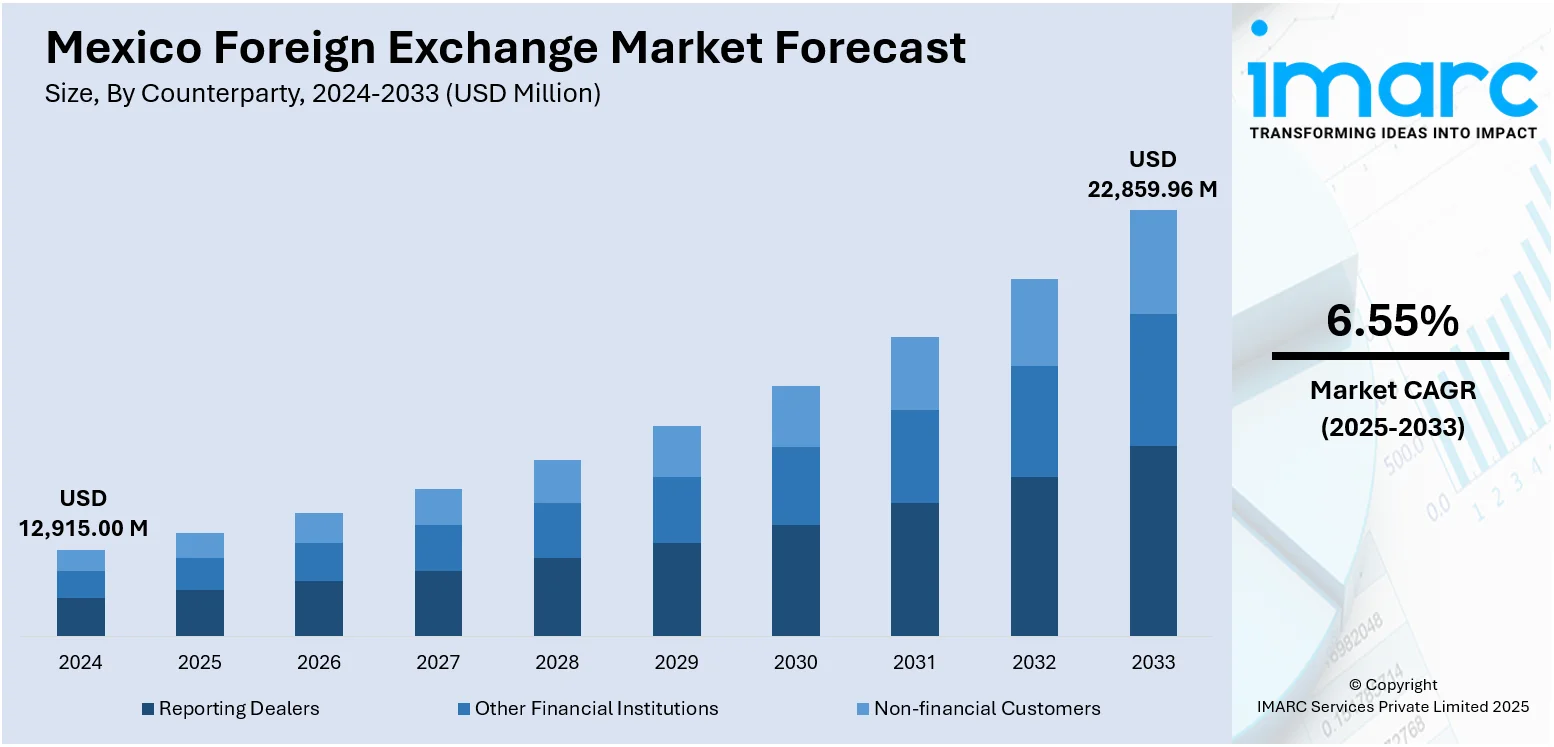

The Mexico foreign exchange market size reached USD 12,915.00 Million in 2024. The market is projected to reach USD 22,859.96 Million by 2033, exhibiting a growth rate (CAGR) of 6.55% during 2025-2033. The market is fueled by the country's robust trade relationships, particularly with the United States, which generate significant cross-border transactions and foreign currency inflows. Apart from that, growing remittance inflows further boost foreign exchange liquidity and strengthen the demand for conversion services and peso stability. Besides, active participation from institutional investors and ongoing efforts by the Bank of Mexico to maintain monetary stability are significant factors augmenting the Mexico foreign exchange market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 12,915.00 Million |

| Market Forecast in 2033 | USD 22,859.96 Million |

| Market Growth Rate 2025-2033 | 6.55% |

Mexico Foreign Exchange Market Trends:

Rise in Remittance-Driven Currency Flows

Mexico has consistently ranked among the top global recipients of remittances, primarily from the United States. As per industry reports, the remittance growth rate is anticipated to reach 5.8 percent in 2024, a substantial improvement over the 1.2 percent recorded in 2023. This is significantly contributing to the country's foreign exchange reserves. These remittances, largely channeled through digital platforms and formal banking systems, have improved liquidity in the market and enhanced the stability of the Mexican peso. Moreover, the surge in mobile and app-based transfer services has also fostered quicker and more cost-effective transactions, increasing the volume and frequency of remittance exchanges. Besides, remittances play a crucial role in offsetting current account deficits, thus strengthening investor confidence. The predictable and growing nature of these inflows has led currency traders and financial institutions to factor remittance seasonality into their hedging and trading strategies. This trend has also encouraged the central bank to adopt a more nuanced policy stance, considering the macroeconomic implications of remittance surges on the peso's valuation and domestic inflation expectations.

To get more information on this market, Request Sample

Trade-Driven Exchange Rate Volatility Amid USMCA Dynamics

The market remains highly sensitive to trade conditions under the United States–Mexico–Canada Agreement (USMCA), which governs a significant portion of its external commerce. As Mexico's largest trading partner, the U.S. exerts considerable influence on peso-dollar fluctuations, particularly through shifts in tariffs, trade regulations, and cross-border supply chain activity. Any uncertainty or reform within the USMCA framework tends to induce speculative behavior in the forex market, resulting in short-term volatility. For instance, delays in trade documentation, automotive content rules, or U.S. monetary policy adjustments often spark immediate reactions in the peso's value. Additionally, Mexico's export-driven sectors, such as automotive, electronics, and agriculture, require constant foreign exchange transactions, intensifying demand for forex services. Apart from this, edging practices among exporters and importers have become increasingly sophisticated, utilizing forwards and swaps to mitigate trade-linked currency risk. This ongoing interplay between trade policy and forex movements underscores the peso's status as a proxy currency for Latin American exposure among global investors.

Central Bank Interventions and Exchange Rate Management Policies

The Bank of Mexico (Banxico) plays an instrumental role in propelling the Mexico foreign exchange market growth through targeted interventions and interest rate policies. While Mexico maintains a floating exchange rate regime, Banxico occasionally intervenes to curb excessive volatility and maintain market order. These actions are often triggered by geopolitical shocks, inflationary pressures, or capital flight risks. In parallel, Banxico's inflation-targeting framework and proactive monetary tightening have made the peso attractive to foreign investors seeking real yield, especially amid global rate differentials. Transparency in policy communication, forward guidance, and consistent macroeconomic data reporting have further enhanced market confidence. Moreover, the central bank's coordination with other financial authorities ensures a well-regulated forex environment, with updated compliance protocols and reserve management strategies. Such systematic oversight contributes to predictable exchange rate dynamics and reduces systemic risk. The inclusion of the Mexican peso in major global currency indices and EMFX trading baskets reflects its growing integration and the credibility of Banxico's regulatory posture.

Mexico Foreign Exchange Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on counterparty and type.

Counterparty Insights:

- Reporting Dealers

- Other Financial Institutions

- Non-financial Customers

The report has provided a detailed breakup and analysis of the market based on the counterparty. This includes reporting dealers, other financial institutions, and non-financial customers.

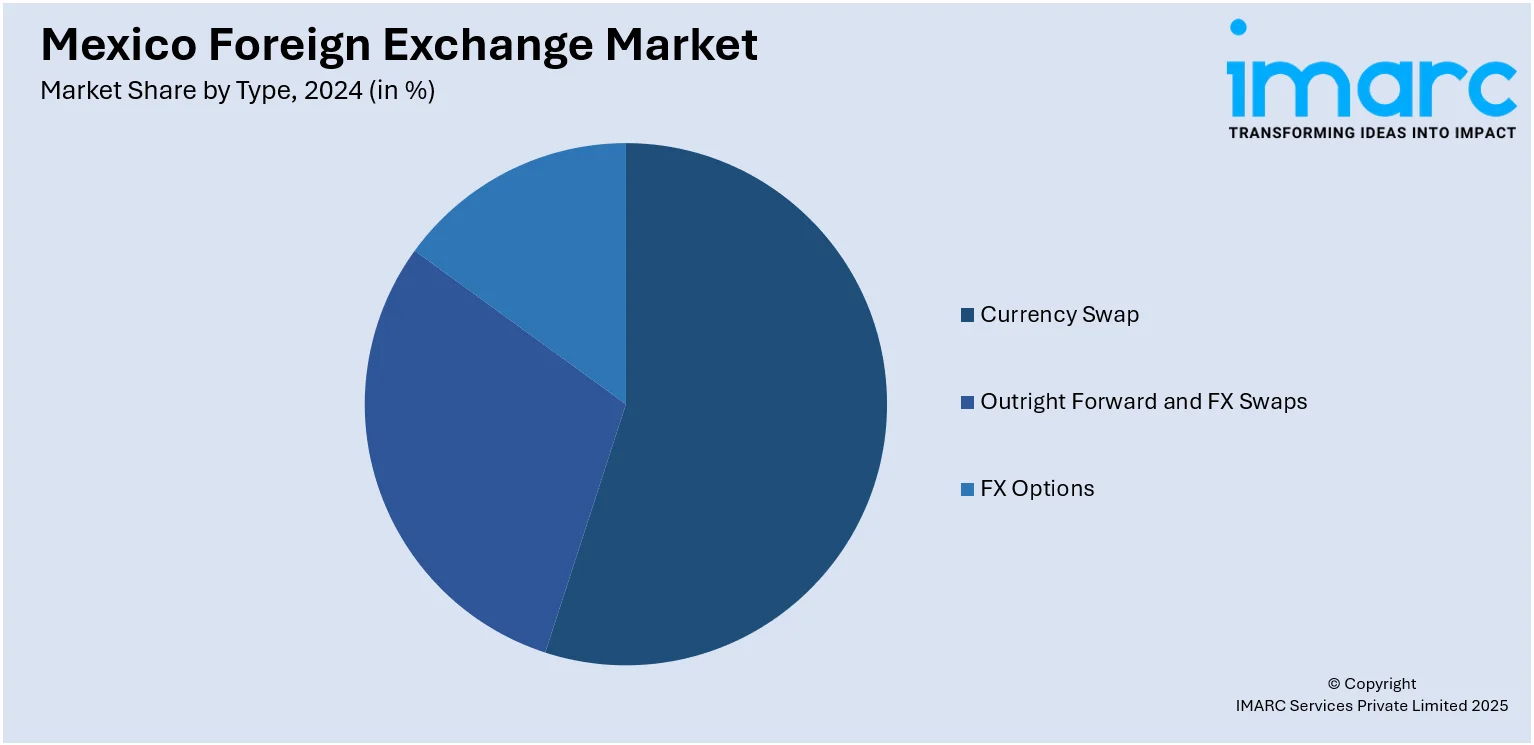

Type Insights:

- Currency Swap

- Outright Forward and FX Swaps

- FX Options

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes currency swap, outright forward and FX swaps, and FX options.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Foreign Exchange Market News:

- November 2024: ATFX officially inaugurated its new office in Mexico, marking a significant expansion in its Latin American presence. The opening ceremony featured an exclusive tour of the renovated facility and keynote remarks by senior leaders, who outlined the firm’s strategic ambitions for the Mexican and broader LATAM markets. As ATFX specializes in forex and CFD trading, this development is expected to enhance local access to global trading platforms and reinforce Mexico’s role in the regional forex ecosystem.

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Counterparties Covered | Reporting Dealers, Other Financial Institutions, Non-financial Customers |

| Types Covered | Currency Swap, Outright Forward and FX Swaps, FX Options |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico foreign exchange market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico foreign exchange market on the basis of counterparty?

- What is the breakup of the Mexico foreign exchange market on the basis of type?

- What is the breakup of the Mexico foreign exchange market on the basis of region?

- What are the various stages in the value chain of the Mexico foreign exchange market?

- What are the key driving factors and challenges in the Mexico foreign exchange market?

- What is the structure of the Mexico foreign exchange market and who are the key players?

- What is the degree of competition in the Mexico foreign exchange market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico foreign exchange market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico foreign exchange market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico foreign exchange industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)