Mexico Forging Market Size, Share, Trends and Forecast by Technique, Material, Industry, and Region, 2025-2033

Mexico Forging Market Overview:

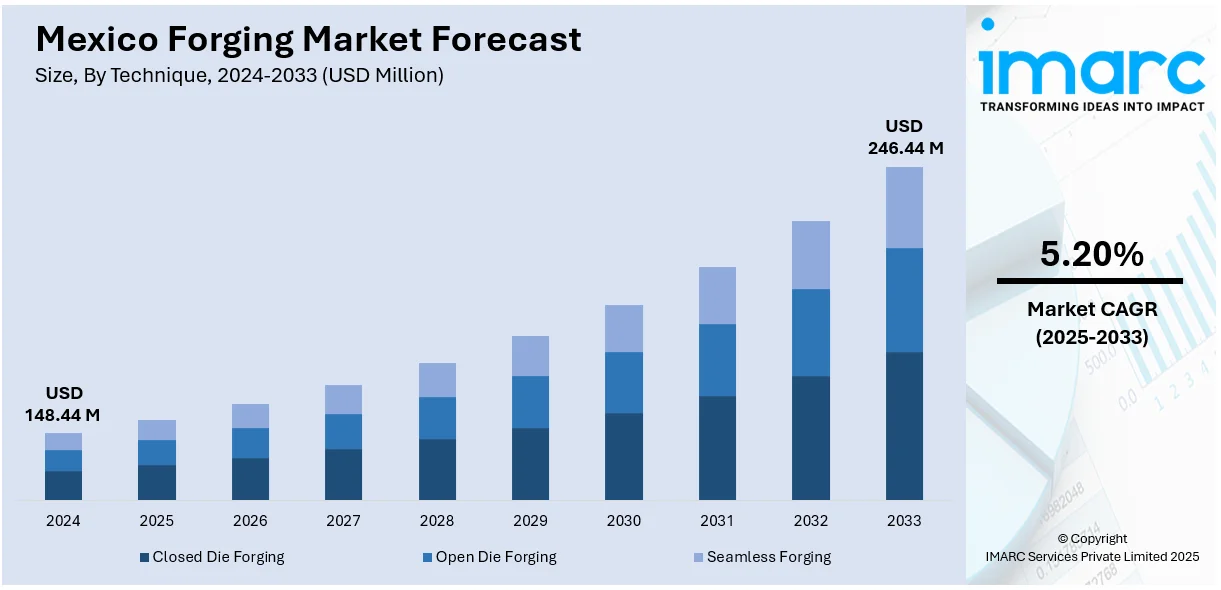

The Mexico forging market size reached USD 148.44 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 246.44 Million by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033. The market is driven by rising demand in automotive, aerospace, and construction industries. Technological advancements, increased automotive production, and the need for durable components are fueling market growth. Additionally, the shift to advanced materials and government infrastructure projects is boosting demand, expanding Mexico forging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 148.44 Million |

| Market Forecast in 2033 | USD 246.44 Million |

| Market Growth Rate 2025-2033 | 5.20% |

Mexico Forging Market Trends:

Increasing Automotive Demand

The automotive sector is a key driver of Mexico’s forging market growth. With Mexico being a prominent hub for automotive manufacturing, the demand for forged components has surged in recent years. For instance, as per industry reports, in 2024, Mexico's automotive industry accounted for 3.6% of the country's total GDP and 17.6% of its manufacturing output. As a leading vehicle producer, Mexico plays a central role in global automotive supply chains, particularly in North America. Notably, around 18% of all cars sold in the U.S. were manufactured in Mexico, underscoring its importance as a production hub for the region. Automakers need high-quality forged components for such crucial parts as engine blocks, crankshafts, and suspension components. The increase in vehicle manufacturing, particularly by multinational players within the country, has increased the demand for the components. The transition towards electric vehicles (EVs) is further defining new forging requirements, with EVs needing special components for batteries, motors, and body frames. As the automobile industry keeps on booming, it will play a major role in Mexico forging market development, inspiring competition and innovation in forging technology.

Rising Demand from Aerospace and Industrial Sectors

The aerospace and industrial segments in Mexico are demonstrating a strong demand for forged parts, fueling the Mexico forging market. With the increase in Mexico's aerospace industry, particularly with big aerospace players like Airbus, Bombardier, and Boeing opening manufacturing plants, a growing demand for precision forging parts to be utilized in airframes, engines, and turbines is being witnessed. Furthermore, the heavy machinery parts and equipment components requirement of the industrial sector is driving the demand for forgings. As Mexico further expands its industrial base, the demand for quality forged components will grow, further solidifying the direction of the market. For instance, in October 2024, ArcelorMittal Mexico announced plans to resume operations at its blast furnace in Lázaro Cárdenas, Michoacán, after nearly five months of inactivity due to a labor dispute. The restart will enable the production of long steel products, including rod and wire rod, with an annual capacity of 1.5 million metric tons. This move brings the plant's total production capacity back to 5.3 million metric tons per year. Consequently, this sector is expected to play an important role in the Mexico forging market growth in the coming years.

Mexico Forging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on technique, material, and industry.

Technique Insights:

- Closed Die Forging

- Open Die Forging

- Seamless Forging

The report has provided a detailed breakup and analysis of the market based on the technique. This includes closed die forging, open die forging, and seamless forging.

Material Insights:

- Nickel-based Alloys

- Titanium Alloys

- Aluminum Alloys

- Steel Alloys

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes nickel-based alloys, titanium alloys, aluminum alloys, and steel alloys.

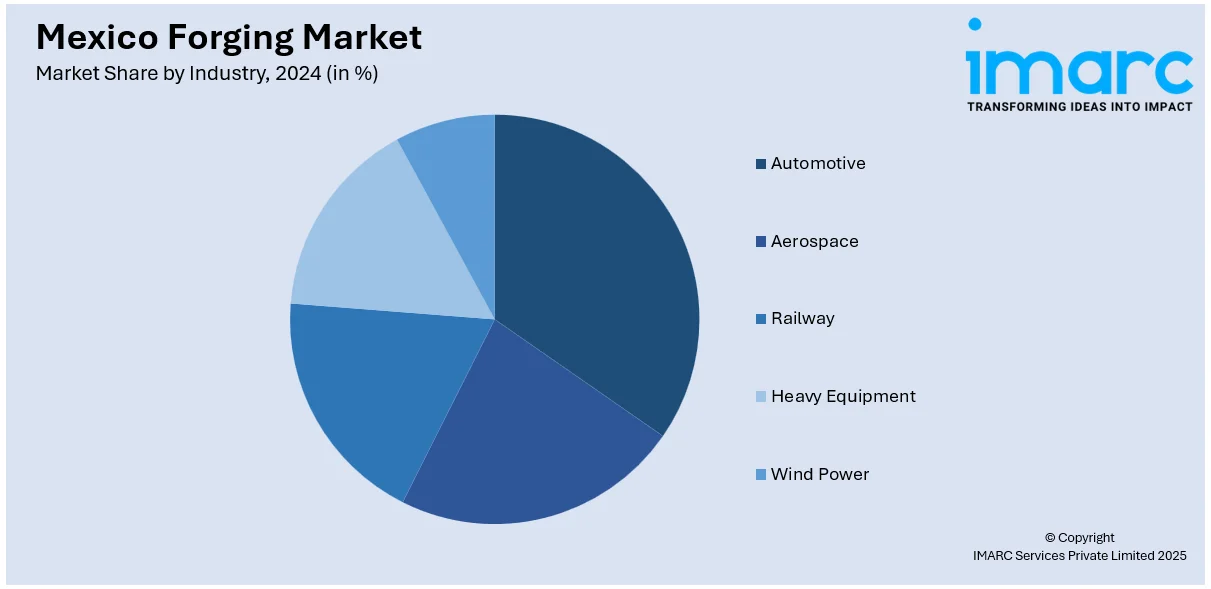

Industry Insights:

- Automotive

- Aerospace

- Railway

- Heavy Equipment

- Wind Power

The report has provided a detailed breakup and analysis of the market based on the industry. This includes automotive, aerospace, railway, heavy equipment, and wind power.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Forging Market News:

- In September 2024, Ramkrishna Forgings announced its goal of achieving over 20% growth in exports for FY25, fueled by its new manufacturing facility in Mexico. The company projected its revenue to increase from Rs 1,400 crore in FY24 to Rs 1,700 crore, with the Mexico unit initially focusing on machining services before adding a railway coach unit.

- In September 2024, Frisa Steel invested $250 million in its Monterrey, Mexico mill to enhance its electric arc furnace (EAF) capacity and produce hot rolled SBQ for the North American market. The company aims to increase its annual melt capacity to 350,000 tons and expand its product range. Frisa plans to commission new equipment by late 2024, including rolling mills, to produce bars from 3.5 to 16 inches.

- In January 2024, as a subsidiary of PETROFER, a global leader in industrial lubricants and specialty chemicals, PETROFER Latinoamericana S.A. de C.V. expanded its production plant in Mexico to meet growing demand. The facility's floor space has doubled, significantly boosting production capacity. The upgrade also includes new training rooms, a canteen, and modern sales offices. The expansion enhances the company’s ability to serve customers efficiently and supports its role in delivering specialized solutions for metalworking processes, including forging.

Mexico Forging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Techniques Covered | Closed Die Forging, Open Die Forging, Seamless Forging |

| Materials Covered | Nickel-Based Alloys, Titanium Alloys, Aluminum Alloys, Steel Alloys |

| Industries Covered | Automotive, Aerospace, Railway, Heavy Equipment, Wind Power |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico Forging market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico Forging market on the basis of technique?

- What is the breakup of the Mexico Forging market on the basis of material?

- What is the breakup of the Mexico Forging market on the basis of industry?

- What is the breakup of the Mexico Forging market on the basis of region?

- What are the various stages in the value chain of the Mexico Forging market?

- What are the key driving factors and challenges in the Mexico Forging market?

- What is the structure of the Mexico Forging market and who are the key players?

- What is the degree of competition in the Mexico Forging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico Forging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico Forging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico Forging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)