Mexico Forklift Market Size, Share, Trends and Forecast by Class, Power Source, Load Capacity, Electric Battery, End User, and Region, 2025-2033

Mexico Forklift Market Overview:

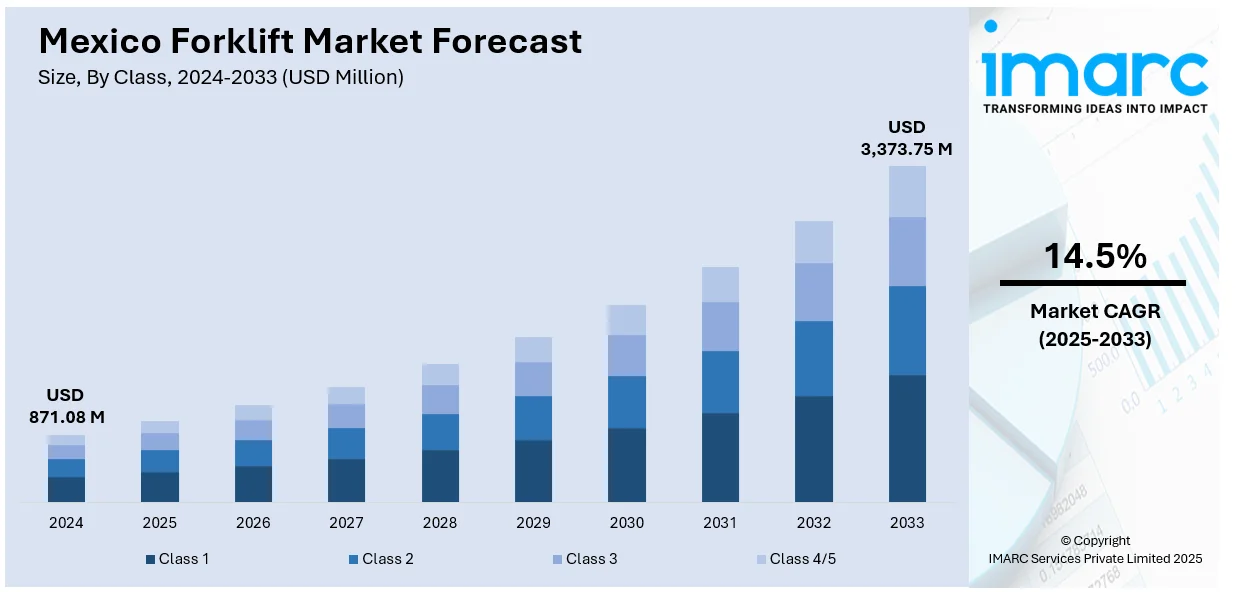

The Mexico forklift market size reached USD 871.08 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,373.75 Million by 2033, exhibiting a growth rate (CAGR) of 14.5% during 2025-2033. Expanding logistics and warehousing sectors, growing e-commerce, rising industrialization, infrastructure development, and increased adoption of electric forklifts due to environmental regulations are some of the factors contributing to Mexico forklift market share. Demand from manufacturing, automotive, and food industries further boosts market growth across urban and industrial zones.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 871.08 Million |

| Market Forecast in 2033 | USD 3,373.75 Million |

| Market Growth Rate 2025-2033 | 14.5% |

Mexico Forklift Market Trends:

Expansion of Cross-Border Freight Services Driving Equipment Needs

The recent scaling up of less-than-truckload (LTL) logistics coverage across nearly all Mexican postal codes is reshaping freight movement in the country. With nearshoring on the rise and stronger trade linkages being established with the US, warehouse operators are under pressure to boost efficiency and throughput. Real-time tracking capabilities and greater freight volume capacity are prompting storage and distribution hubs to upgrade their infrastructure. As a result, there is a growing requirement for forklifts and other material handling machinery to manage heavier cargo flow, streamline operations, and meet faster turnaround expectations. This shift is especially prominent in regions close to industrial corridors and border transit points, where demand for agile and high-capacity handling solutions is gaining momentum. These factors are intensifying the Mexico forklift market growth. For example, in July 2024, XPO launched "XPO Mexico+," expanding LTL services to boost cross-border trade amid rising nearshoring. Covering 99% of Mexico's postal codes with real-time tracking and enhanced freight capacity, the initiative is set to intensify warehouse activity. This expansion is likely to fuel forklift demand across Mexico, as logistics hubs upgrade equipment to handle increased shipment volumes efficiently.

Rising Demand for Material Handling Equipment in Border Logistics

Warehousing capacity is expanding rapidly near major Mexican border crossings, especially in strategic hubs like Tijuana. With logistics hubs scaling operations to support growing cross-border movement in technology, automotive, retail, and lifestyle sectors, facilities are seeing a surge in cargo volumes. This has intensified the need for efficient load management, leading to increased deployment of forklifts and related equipment. The warehousing boost is closely tied to Mexico's evolving role as a transshipment and manufacturing gateway to the US. The proximity to ports and border points further supports the operational push for quicker turnaround and higher throughput, directly influencing the uptake of advanced and high-capacity forklift models across regional storage and distribution centers. For instance, in April 2024, Maersk opened a 30,000-square-meter warehouse in Tijuana, Mexico, to enhance cross-border trade for sectors like technology, automotive, retail, and lifestyle. Situated near key ports and border crossings, the facility is expected to boost warehousing activity, increasing demand for forklifts and material handling equipment to manage higher cargo volumes efficiently.

Mexico Forklift Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on class, power source, load capacity, electric battery, and end user.

Class Insights:

- Class 1

- Class 2

- Class 3

- Class 4/5

The report has provided a detailed breakup and analysis of the market based on the class. This includes Class 1, Class 2, Class 3, and Class 4/5.

Power Source Insights:

- ICE

- Electric

A detailed breakup and analysis of the market based on the power source have also been provided in the report. This includes ICE and electric.

Load Capacity Insights:

- Below 5 Ton

- 5-15 Ton

- Above 16 Ton

The report has provided a detailed breakup and analysis of the market based on the load capacity. This includes below 5 ton, 5-15 ton, and above 16 ton.

Electric Battery Insights:

- Li-ion

- Lead Acid

A detailed breakup and analysis of the market based on the electric battery have also been provided in the report. This includes Li-ion and lead acid.

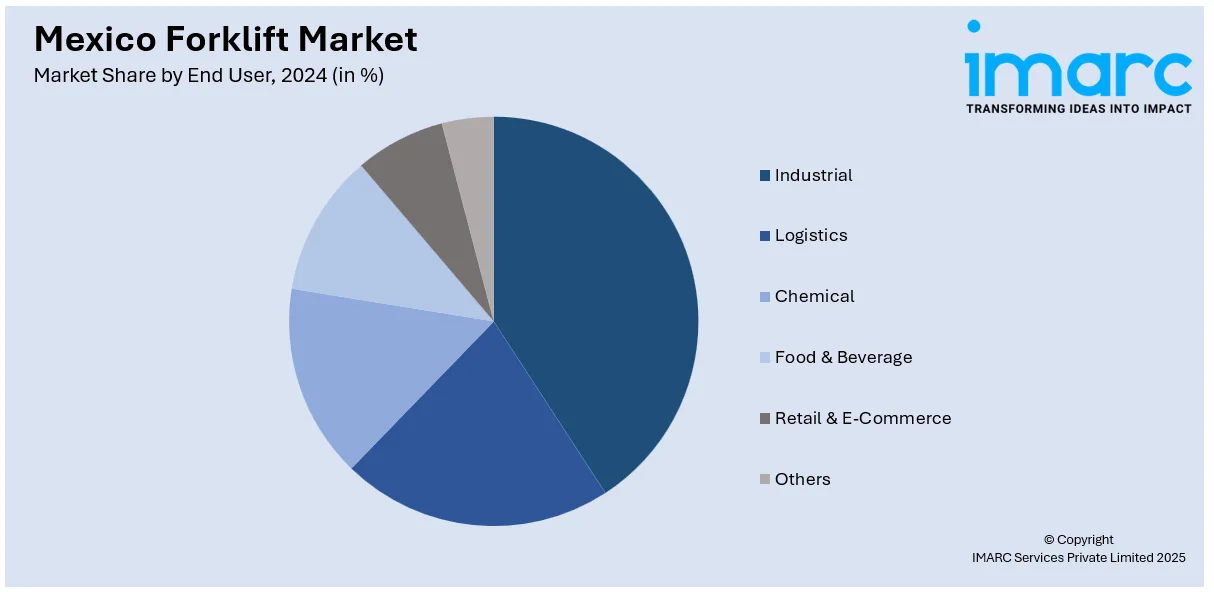

End User Insights:

- Industrial

- Logistics

- Chemical

- Food and Beverage

- Retail and E-Commerce

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes industrial, logistics, chemical, food and beverage, retail and e-commerce, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Forklift Market News:

- In February 2024, ArcBest introduced Vaux Smart Autonomy, a suite of autonomous and remote-controlled forklifts and reach trucks designed to enhance warehouse efficiency. Equipped with sensors and cameras, these forklifts can navigate warehouse floors, load and stack pallets, and move goods autonomously or via remote control. This technology aligns with Mexico's growing demand for automation in logistics and warehousing, potentially accelerating the adoption of autonomous forklifts in the region.

Mexico Forklift Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Classes Covered | Class 1, Class 2, Class 3, Class 4/5 |

| Power Sources Covered | ICE, Electric |

| Load Capacities Covered | Below 5 Ton, 5-15 Ton, Above 16 Ton |

| Electric Batteries Covered | Li-ion, Lead Acid |

| End Users Covered | Industrial, Logistics, Chemical, Food and Beverage, Retail and E-Commerce, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, and Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico forklift market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico forklift market on the basis of class?

- What is the breakup of the Mexico forklift market on the basis of power source?

- What is the breakup of the Mexico forklift market on the basis of load capacity?

- What is the breakup of the Mexico forklift market on the basis of electric battery?

- What is the breakup of the Mexico forklift market on the basis of end user?

- What is the breakup of the Mexico forklift market on the basis of region?

- What are the various stages in the value chain of the Mexico forklift market?

- What are the key driving factors and challenges in the Mexico forklift market?

- What is the structure of the Mexico forklift market and who are the key players?

- What is the degree of competition in the Mexico forklift market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico forklift market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico forklift market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico forklift industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)